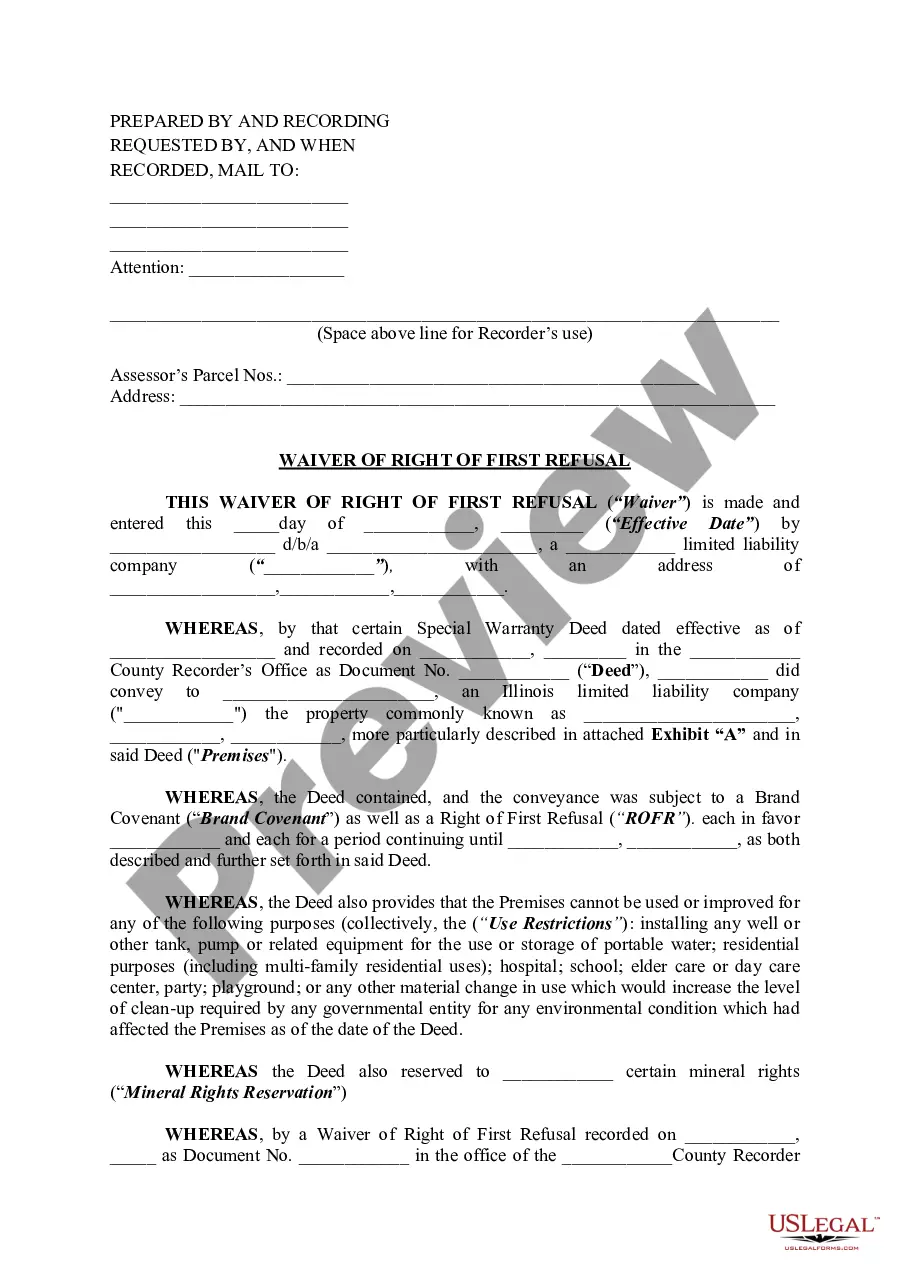

New Mexico Release Mortgage With Bad Credit

Description

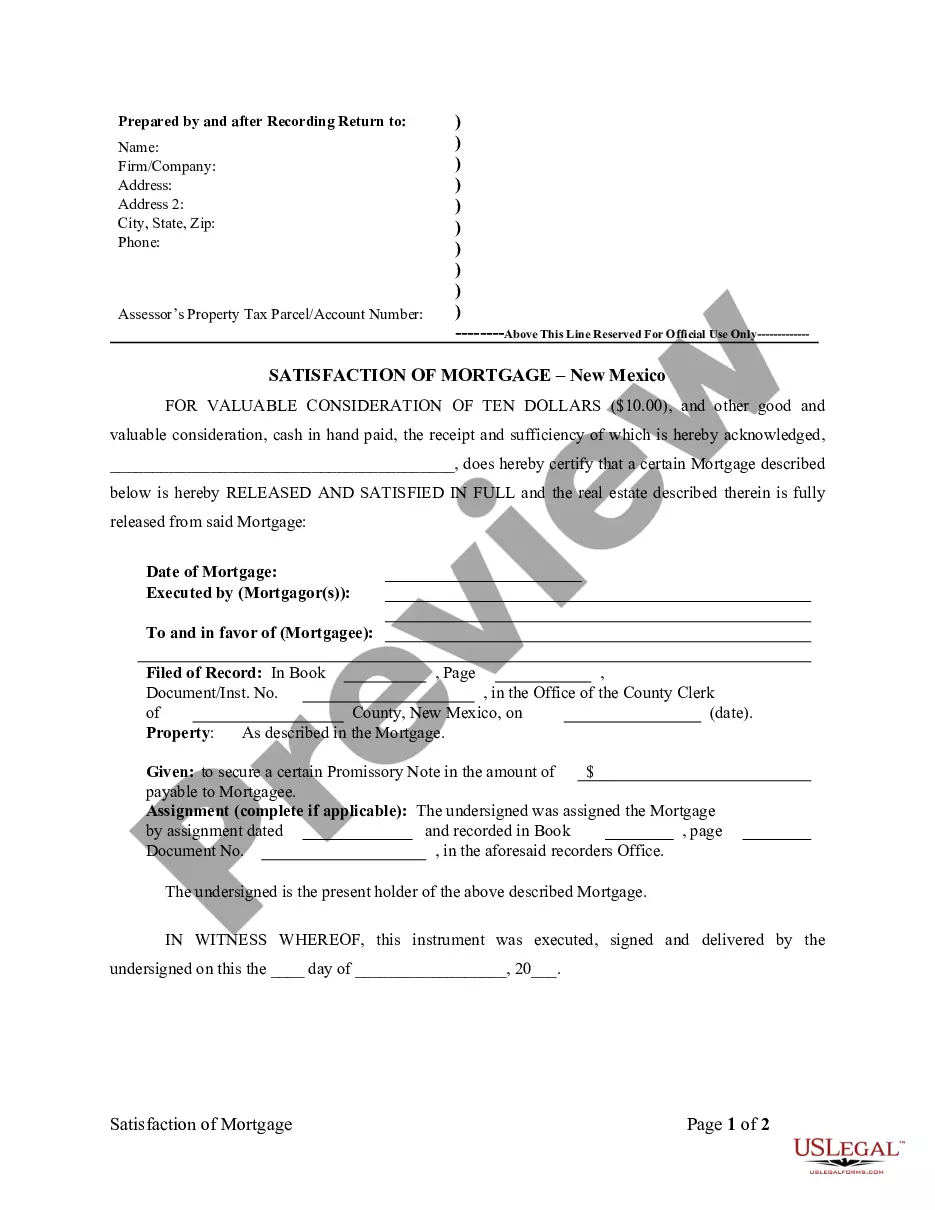

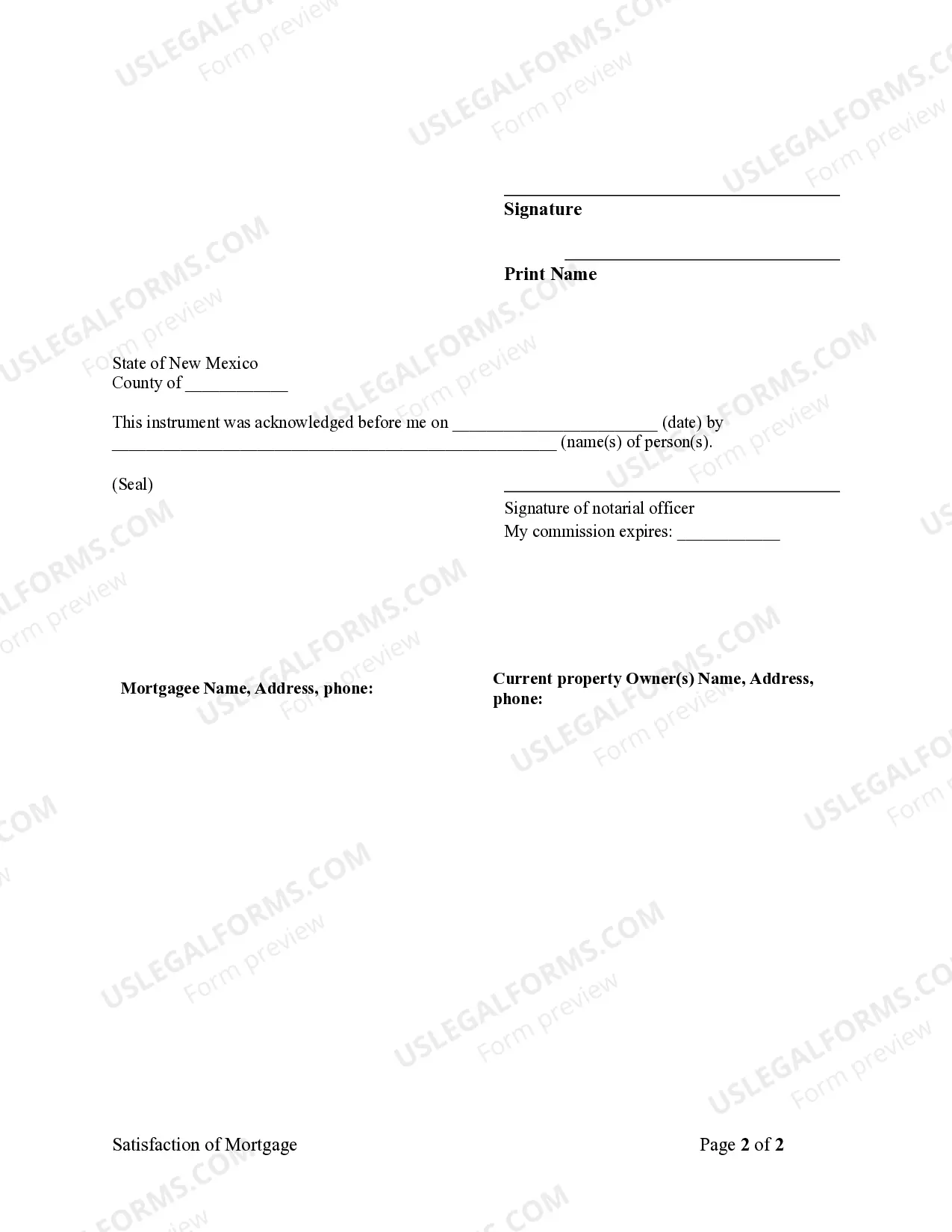

How to fill out New Mexico Satisfaction - Release Of Mortgage By Mortgagee - Individual Lender Or Holder?

Bureaucracy necessitates exactness and correctness.

If you do not manage completing documents like New Mexico Release Mortgage With Bad Credit regularly, it may result in some misunderstanding.

Choosing the appropriate sample from the start will guarantee that your document submission proceeds smoothly and avert any troubles of resubmitting a file or repeating the same task from the beginning.

Efficiently obtaining the correct and updated samples for your documentation is a matter of minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and enhance your paperwork efficiency.

- Obtain the latest and most suitable version of the New Mexico Release Mortgage With Bad Credit simply by searching it on the website.

- Locate, save, and download templates in your account or review the description to ensure you have the correct one available.

- With an account at US Legal Forms, you can gather, save in one place, and browse the templates you save to access them quickly.

- When on the website, click the Log In button to Log In.

- Then, visit the My documents page, where your form history is maintained.

- Examine the description of the forms and download those you require at any time.

- If you do not have a subscription, locating the desired sample will require a few extra steps.

- Search for the template using the search bar.

Form popularity

FAQ

The lender typically covers closing costs. This may be an option if a loan modification wasn't possible. You will take a major credit score hit from completing a short sale. This could drop your credit score by as much as 130 points, depending on your starting score before the sale and the model being used.

Having bad credit doesn't mean you can't enjoy the benefits of homeownership. Instead, it might just require additional research when looking for financing. With a loan backed by the government like an FHA loan, you can qualify for a mortgage even with a 500 credit score.

Although a minimum credit score of 620 is required, alternative credit qualification for homebuyers with no credit score is acceptable in certain cases. All homebuyers must receive pre-purchase homebuyer counseling through MFA's online program, eHome America, or a HUDapproved counseling agency.

If you have bad credit, you may still be able to get a home equity loan since the loan is backed by the home itself as collateral. A major downside, then, is that you will be putting your home at risk if you can't repay as you take on more debt with the loan.

Can I get a home equity loan with a 500 credit score? This is unlikely, as most lenders require a credit score in the 600s or higher for a home equity loan. You may find exceptions if you have a very low debt-to-income ratio (DTI) and lots of equity.

Your credit score is one of the key factors lenders consider when deciding if you qualify for a home equity loan or HELOC. A FICO® Score2609 of at least 680 is typically required to qualify for a home equity loan or HELOC.

If you have bad credit, you may still be able to get a home equity loan since the loan is backed by the home itself as collateral. A major downside, then, is that you will be putting your home at risk if you can't repay as you take on more debt with the loan.