Establishing Residency In New Mexico For Taxes

Description

How to fill out New Mexico New Resident Guide?

It’s no secret that you can’t become a legal professional overnight, nor can you learn how to quickly prepare Establishing Residency In New Mexico For Taxes without having a specialized set of skills. Creating legal documents is a long process requiring a specific education and skills. So why not leave the creation of the Establishing Residency In New Mexico For Taxes to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court documents to templates for in-office communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and get the form you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether Establishing Residency In New Mexico For Taxes is what you’re looking for.

- Start your search over if you need any other template.

- Register for a free account and choose a subscription option to purchase the template.

- Pick Buy now. As soon as the transaction is complete, you can download the Establishing Residency In New Mexico For Taxes, complete it, print it, and send or mail it to the designated individuals or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

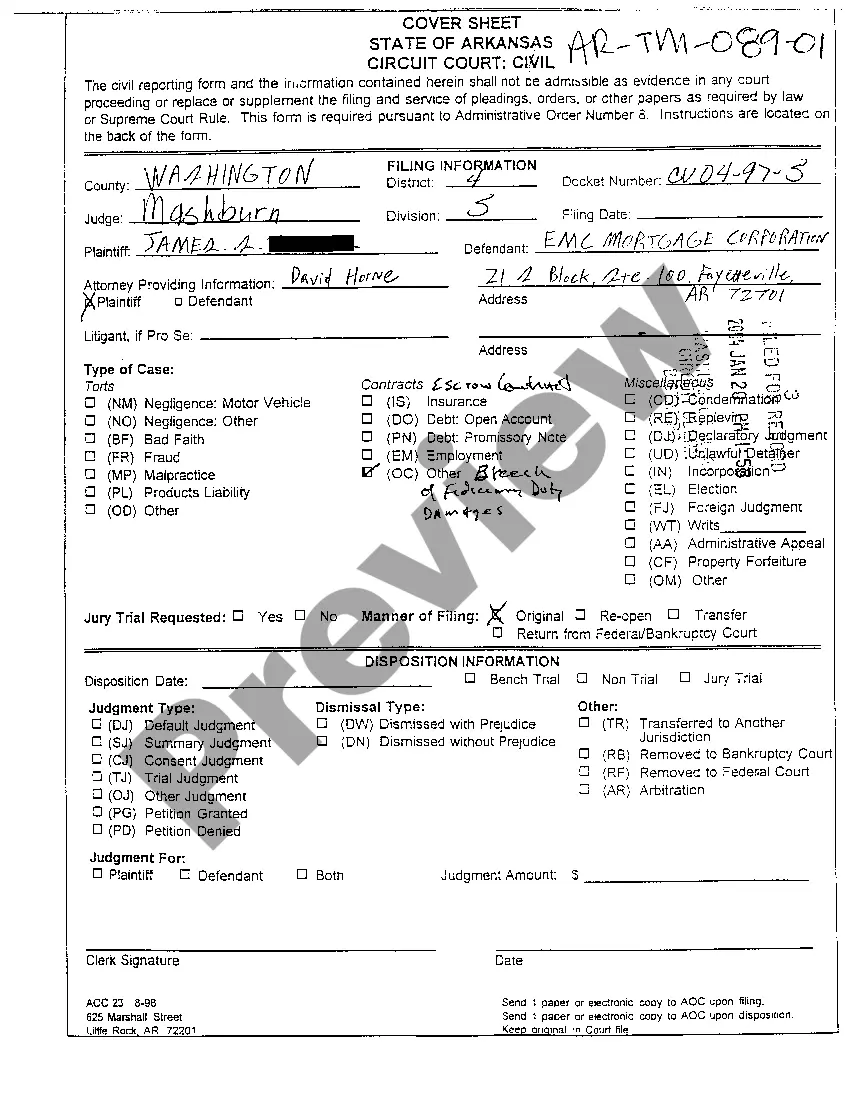

A person must physically reside in New Mexico for the twelve consecutive months immediately preceding the term for which the resident classification is requested. Only persons who are financially independent may establish residency apart from parents or guardians.

Acceptable Documents A rental property or purchase agreement. An auto, home, health insurance agreement or bill. A paycheck stub. A property tax statement or mortgage documents.

Proof of Residency Requirements Current real property rental or purchase agreement. Current Insurance bill, card, or binder. Local property tax statement. Original documents from a city, county, state, tribal or federal government organization attesting to the fact that the applicant is a New Mexico resident.

For New Mexico personal income tax purposes, a part-year resident is taxable upon all income that he or she received while a resident, plus any income received from New Mexico sources during the portion of the year that the individual taxpayer was a nonresident.

A New Mexico Resident is an individual who is domiciled in New Mexico or physically present in the state for 185 days or more (no matter where domiciled).