Establishing Residency In New Mexico For Residency

Description

How to fill out New Mexico New Resident Guide?

The Establishing Residency In New Mexico For Residency you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Establishing Residency In New Mexico For Residency will take you only a few simple steps:

- Search for the document you need and review it. Look through the file you searched and preview it or check the form description to confirm it fits your requirements. If it does not, utilize the search option to get the appropriate one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Establishing Residency In New Mexico For Residency (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your papers again. Utilize the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

You will be presumed to be a California resident for any taxable year in which you spend more than nine months in this state. Although you may have connections with another state, if your stay in California is for other than a temporary or transitory purpose, you are a California resident.

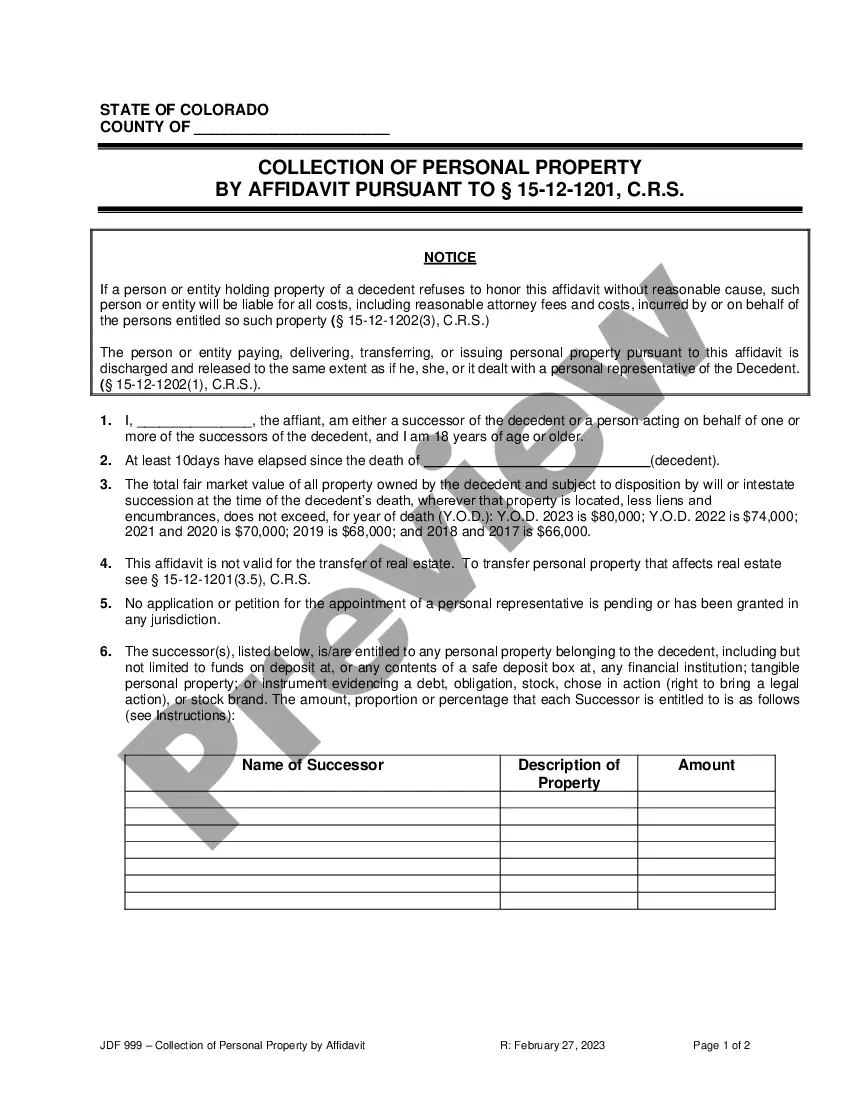

A person must physically reside in New Mexico for the twelve consecutive months immediately preceding the term for which the resident classification is requested.

Proof of residential property ownership in New Mexico; or. A rental agreement within New Mexico; or. Utility bills showing the applicant name and a New Mexico address; or. Other evidence which would reasonably support the individual's intent to establish and maintain New Mexico residency.

First-year resident: An individual is a first-year resident if they moved to New Mexico with the intent of making New Mexico your permanent place of residence and are still in New Mexico on December 31. Not meeting either of those tests they are considered either part-year residents or nonresidents.

When you want to prove that you are a New Mexico resident, you can bring in: A gas, electric, water, or phone bill that shows your current address. A rental property or purchase agreement. An auto, home, health insurance agreement or bill. A paycheck stub. A property tax statement or mortgage documents.