Transfer On Death Property Deed Form Pennsylvania

Description

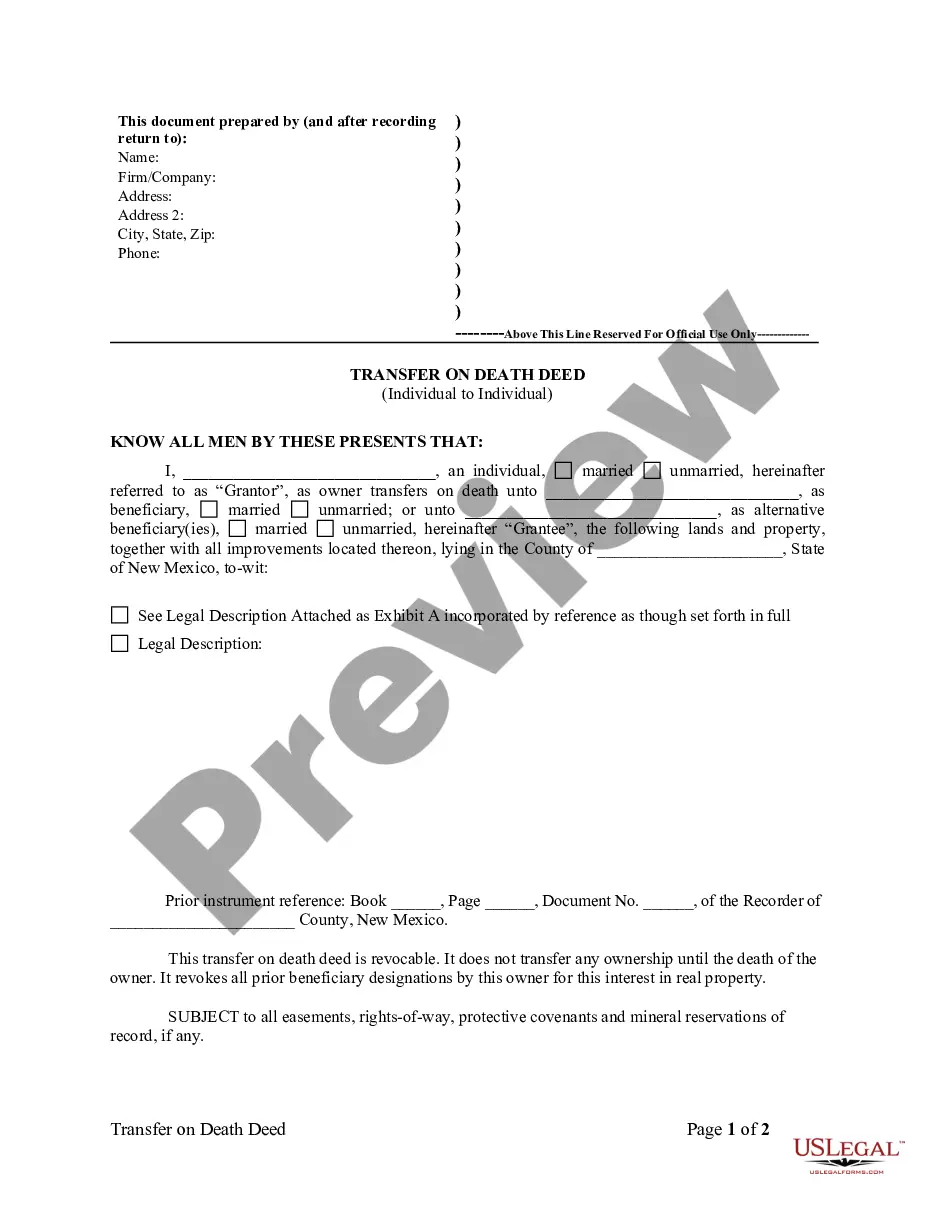

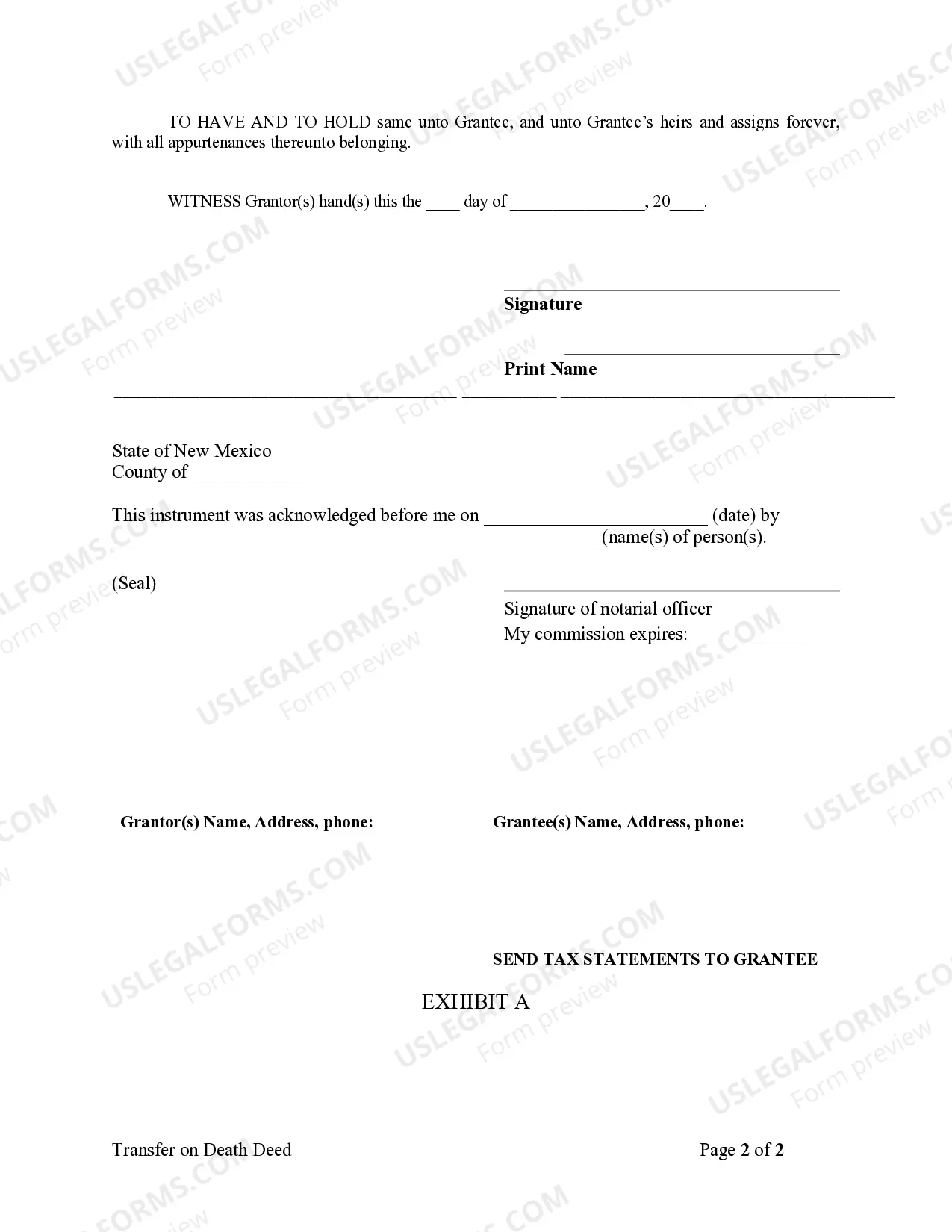

How to fill out Transfer On Death Property Deed Form Pennsylvania?

Obtaining legal templates that comply with federal and local laws is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the correctly drafted Transfer On Death Property Deed Form Pennsylvania sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life scenario. They are simple to browse with all files collected by state and purpose of use. Our professionals stay up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Transfer On Death Property Deed Form Pennsylvania from our website.

Getting a Transfer On Death Property Deed Form Pennsylvania is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, follow the instructions below:

- Take a look at the template using the Preview feature or through the text outline to make certain it meets your needs.

- Browse for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Transfer On Death Property Deed Form Pennsylvania and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

In Pennsylvania, real estate cannot be transferred via a TOD deed. Instead, the owner of the property can utilize a will, a living trust, or joint ownership to transfer property upon death. These methods should be discussed with an experienced estate planning attorney to understand their implications fully.

In Pennsylvania, the law allows you to register your bank accounts and certificates of deposit so that your named beneficiary automatically becomes the owner upon your death. To achieve such a result, you simply open the account in your name, but list the account as being ?in trust for? your beneficiary.

Transfer-on-Death deeds also do not allow for naming a contingent beneficiary on the deed like a trust document that owns the property does. Secondly, if the intended beneficiary is a minor, the minor would not be able to manage or transfer the property until they reach the age of 18.

Pennsylvania does not allow transfer-on-death deeds for real estate or vehicles. However, the state does allow registered stocks and bonds to be transferred on death.

Pennsylvania does not allow transfer-on-death deeds for real estate or vehicles. However, the state does allow registered stocks and bonds to be transferred on death.