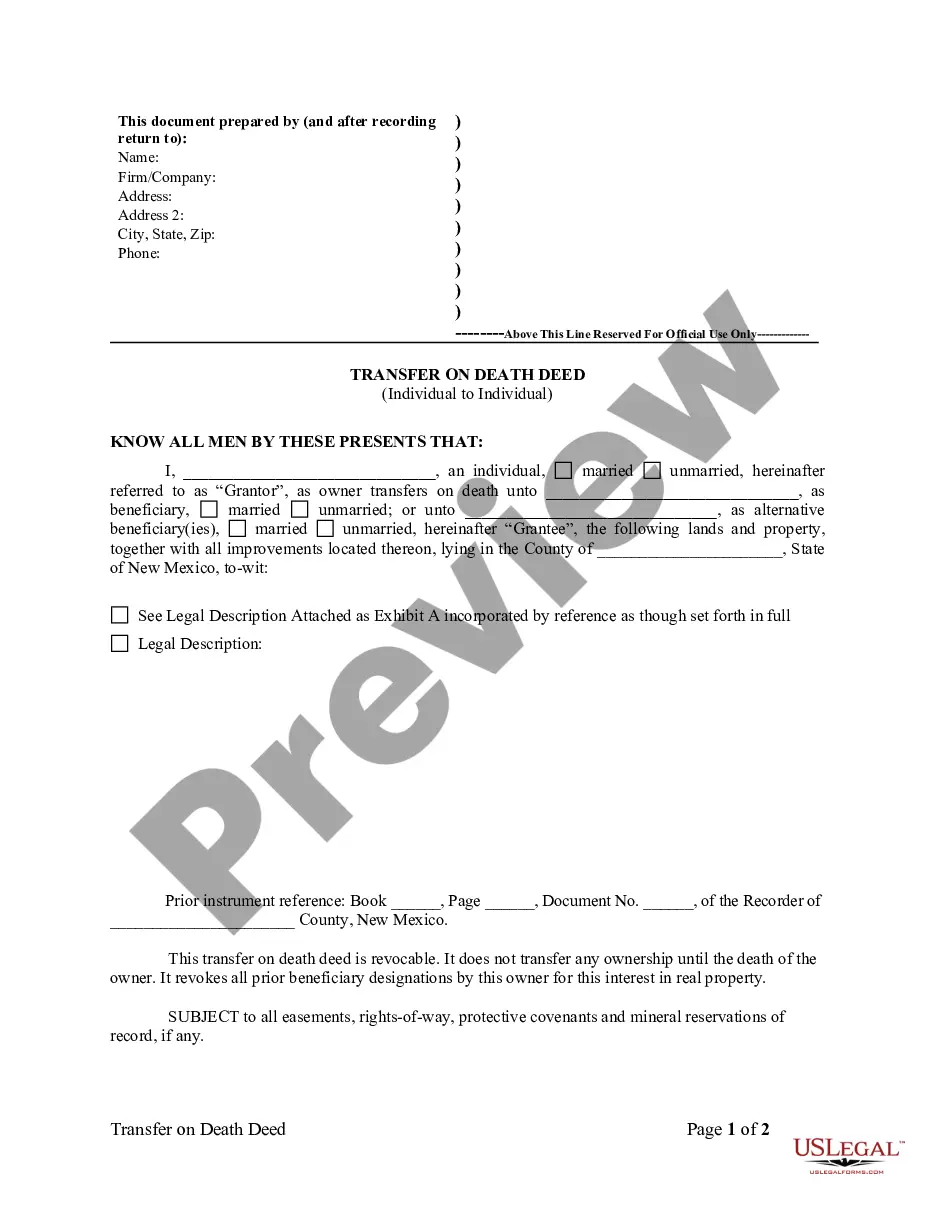

The Payable on Death (POD) form offered by the USA is a crucial financial tool designed to simplify and expedite the process of transferring assets to beneficiaries upon the death of the account holder. This form enables account owners to ensure the smooth and efficient distribution of their assets without undergoing the probate process. With the POD form, the account holder can designate one or more beneficiaries who will directly inherit the account balance after their passing, bypassing the need for a will or trust. USA provides different types of Payable on Death forms to cater to various financial accounts. These include: 1. Payable on Death (POD) Bank Account Form: This form is specifically designed for the USA bank accounts, allowing customers to designate beneficiaries who will directly receive the account balance upon their death. By completing this form, account holders can ensure that their loved ones promptly receive the funds without going through the probate process. 2. Payable on Death (POD) Investment Account Form: USA also offers a POD form for investment accounts. This allows individuals to designate beneficiaries who will inherit their investments such as stocks, bonds, mutual funds, and other securities. By completing this form, account owners can provide a seamless transition of their investment assets to their loved ones upon their passing. 3. Payable on Death (POD) Life Insurance Policy Form: USA provides a POD form specifically designed for life insurance policies. With this form, policyholders can designate beneficiaries who will receive the insurance proceeds upon their death. This streamlined approach allows for a quick and efficient transfer of funds to the intended beneficiaries, providing financial security during a challenging time. It is important to note that the process of completing a Payable on Death form with the USA Atypically requires providing the necessary personal information, account details, and beneficiary information. Consultation with a financial advisor or an estate planning attorney is recommended to ensure the appropriate completion and submission of the POD form for a specific account type. By utilizing the Payable on Death form provided by the USA, individuals can have peace of mind knowing that their assets will be transferred seamlessly to their chosen beneficiaries, without the need for probate or the potential delays and costs associated with it.

Payable On Death Form Usaa

Description

How to fill out Payable On Death Form Usaa?

Legal document management might be overpowering, even for the most experienced professionals. When you are interested in a Payable On Death Form Usaa and don’t get the time to commit trying to find the appropriate and updated version, the operations may be stress filled. A robust online form catalogue might be a gamechanger for everyone who wants to manage these situations successfully. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any needs you may have, from individual to enterprise papers, in one spot.

- Use advanced resources to finish and manage your Payable On Death Form Usaa

- Gain access to a resource base of articles, tutorials and handbooks and resources highly relevant to your situation and requirements

Help save effort and time trying to find the papers you need, and utilize US Legal Forms’ advanced search and Preview feature to locate Payable On Death Form Usaa and get it. For those who have a membership, log in to your US Legal Forms profile, search for the form, and get it. Review your My Forms tab to view the papers you previously downloaded as well as manage your folders as you see fit.

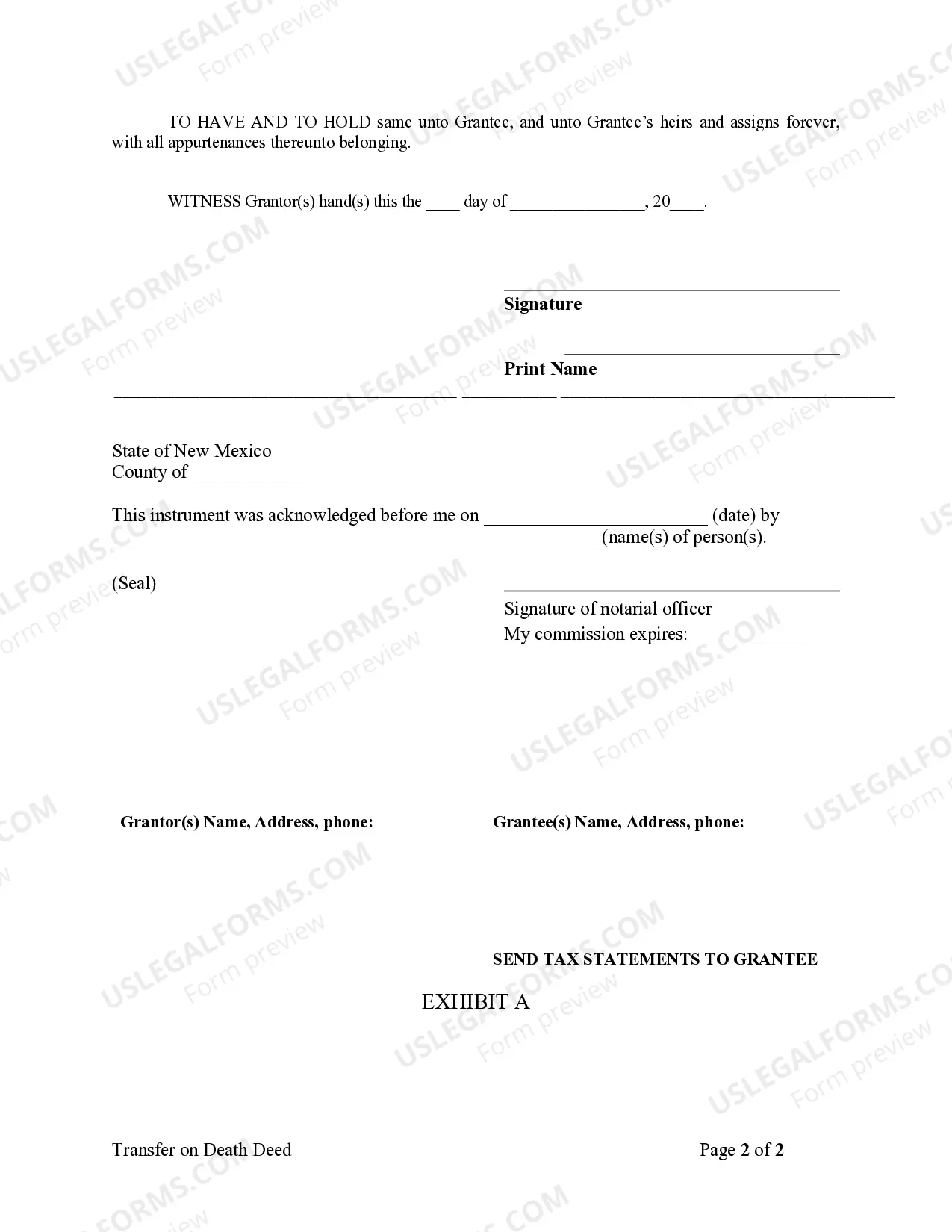

Should it be the first time with US Legal Forms, register a free account and have limitless access to all advantages of the library. Listed below are the steps to consider after downloading the form you need:

- Verify it is the right form by previewing it and reading through its description.

- Ensure that the sample is approved in your state or county.

- Pick Buy Now once you are all set.

- Choose a subscription plan.

- Pick the file format you need, and Download, complete, sign, print and send your papers.

Benefit from the US Legal Forms online catalogue, backed with 25 years of expertise and trustworthiness. Transform your day-to-day papers management in a easy and intuitive process right now.

Form popularity

FAQ

If you have any questions or need assistance in filing a Life/Annuity death claim, please call 800-531-8455. This claim form may have been provided before we determined whether a policy was in force at time of death and before we confirmed beneficiary (ies) of the policy.

Hear this out loud PauseYou can also call our Survivor Relations Team at 800-292-8294. We're available Monday to Friday, a.m. to 6 p.m. CT.

Make the steps below to fill out Usaa pod beneficiary form online easily and quickly: Sign in to your account. ... Import a form. ... Edit Usaa pod beneficiary form. ... Get the Usaa pod beneficiary form accomplished.

Get the up-to-date usaa payable on death form 2023 now. Step 2 Fax completed and signed form to 1-800-292-8177. This form cannot be used to add change or delete bene ciary information for an Individual Retirement Account IRA or other retirement account.

A Casualty Assistance Officer will be assigned to the family of the service member who died on active duty. Family members may be eligible for federal benefits, privileges or entitlements.