Deed Upon Death In Texas

Description

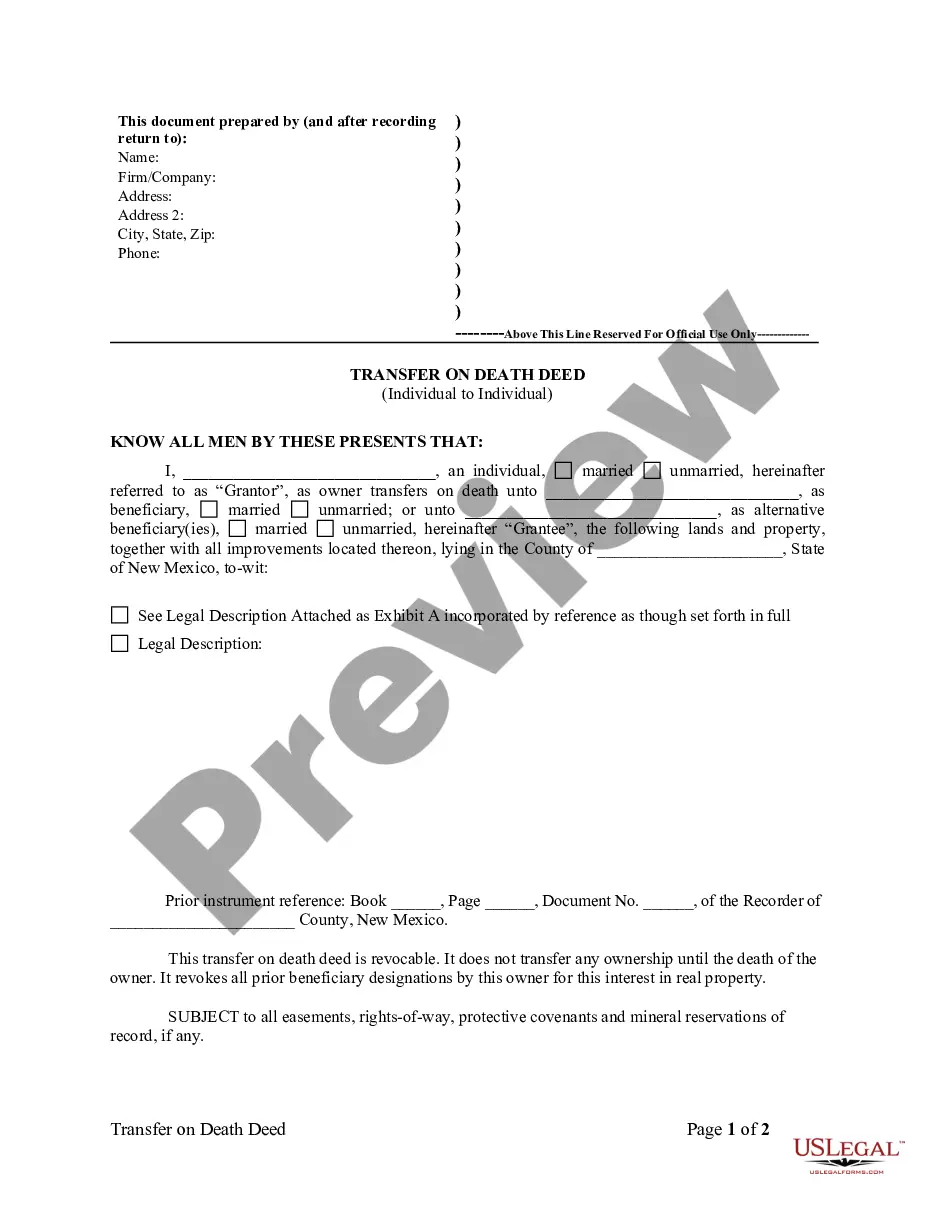

How to fill out New Mexico Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

Working with legal papers and operations can be a time-consuming addition to the day. Deed Upon Death In Texas and forms like it often need you to search for them and understand the best way to complete them effectively. Consequently, whether you are taking care of economic, legal, or personal matters, using a comprehensive and hassle-free web library of forms at your fingertips will help a lot.

US Legal Forms is the top web platform of legal templates, featuring more than 85,000 state-specific forms and numerous tools that will help you complete your papers easily. Explore the library of pertinent papers open to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered by any time for downloading. Protect your document management procedures having a high quality support that allows you to prepare any form within minutes without any extra or hidden cost. Simply log in to the profile, find Deed Upon Death In Texas and acquire it right away from the My Forms tab. You can also gain access to formerly downloaded forms.

Is it your first time making use of US Legal Forms? Sign up and set up up your account in a few minutes and you will get access to the form library and Deed Upon Death In Texas. Then, stick to the steps below to complete your form:

- Ensure you have discovered the proper form by using the Review feature and reading the form information.

- Select Buy Now once ready, and choose the subscription plan that suits you.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has 25 years of experience assisting users handle their legal papers. Get the form you need today and improve any process without having to break a sweat.

Form popularity

FAQ

Disadvantages of a Transfer on Death Deed For example, your property will be subject to probate court if your beneficiary predeceases you and you lack an alternate estate plan. Another disadvantage is if you co-own property under a joint tenancy.

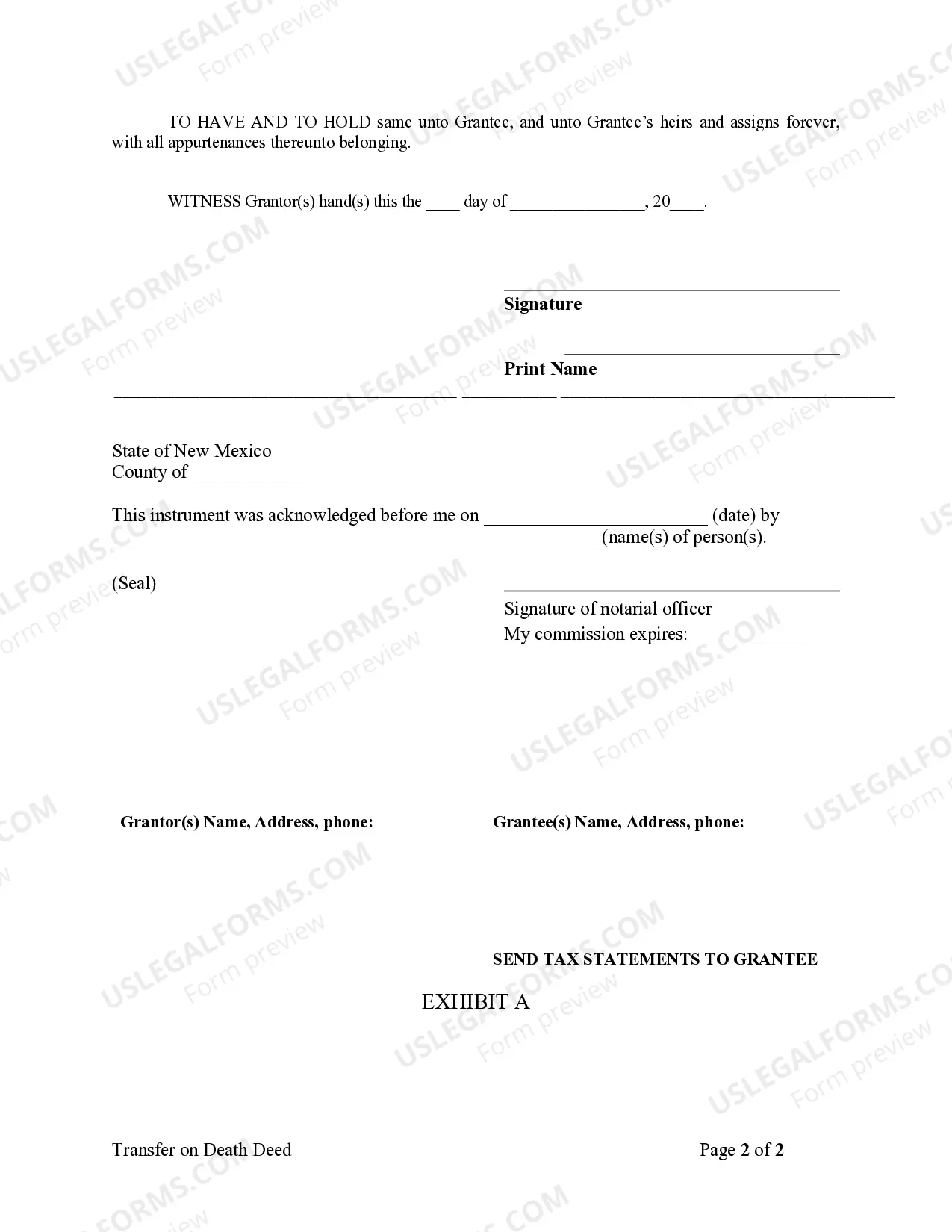

After the Grantor dies, an affidavit of death and a certified copy of the Grantor's death certificate should be filed in the county clerk's office of the county where the deed was recorded. This creates a link in the chain of title to show that the beneficiary is now the owner of the property.

In a joint tenancy, when one owner dies, their share of the property passes to the decedent's heirs or the persons named in the decedent's will. In a joint tenancy with right of survivorship, when an owner dies, their share of the property goes to the other owners.

You can use a Transfer on Death Deed to give your home to someone after you die. Although you make it before you die, it is not a will. Usually, a willed property must go through probate court before it goes to your heirs.

You do not need a TOD deed. Your spouse will automatically own the entire property at your death, and vice versa. You and your spouse can make a TOD deed together, but it would not have any effect until both you and your spouse have died.