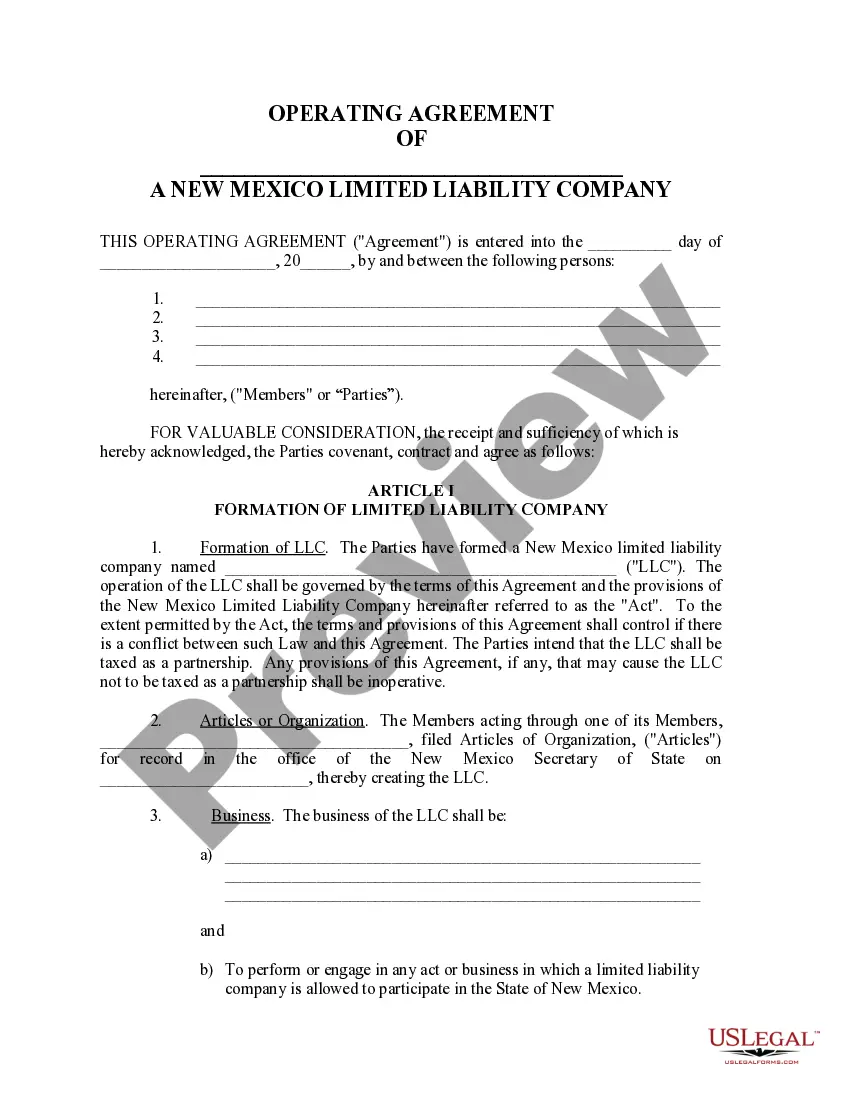

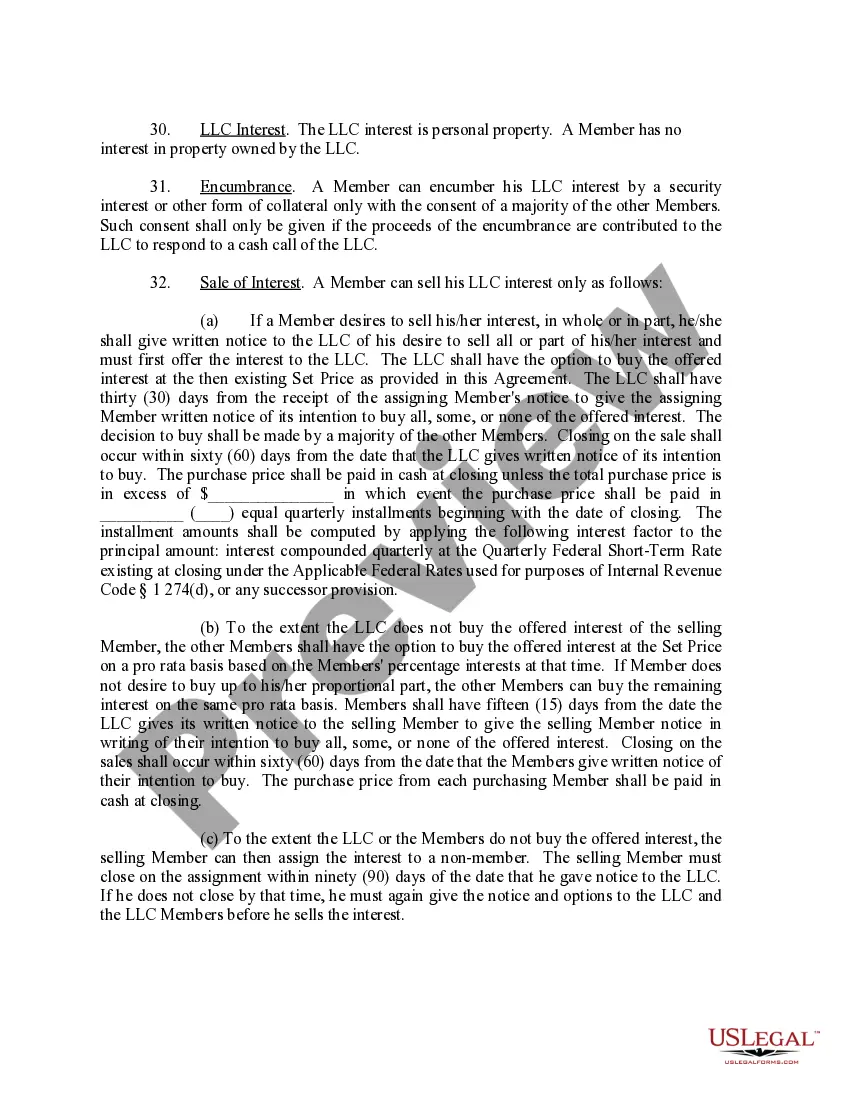

New Mexico Llc Operating Agreement With Multiple Members

Description

How to fill out New Mexico Limited Liability Company LLC Operating Agreement?

Whether for commercial reasons or for personal issues, everyone encounters legal circumstances at some point in their life.

Completing legal documents requires meticulous attention, starting from selecting the correct form template.

- For instance, if you select an incorrect version of a New Mexico LLC Operating Agreement with Multiple Members, it will be rejected when submitted.

- Thus, it is crucial to have a trustworthy source of legal documents like US Legal Forms.

- If you need to obtain a New Mexico LLC Operating Agreement with Multiple Members template, follow these simple steps.

- Locate the template you require by using the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your case, state, and locality.

- Click on the form’s preview to view it.

- If it is not the correct form, return to the search tool to find the New Mexico LLC Operating Agreement with Multiple Members example you need.

- Download the file when it meets your specifications.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable payment option.

- Complete the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you prefer and download the New Mexico LLC Operating Agreement with Multiple Members.

- After it is saved, you can fill out the form using editing software or print it and complete it by hand.

- With a comprehensive US Legal Forms library available, you do not need to waste time searching for the appropriate template online.

- Utilize the library’s user-friendly navigation to find the correct template for any circumstance.

Form popularity

FAQ

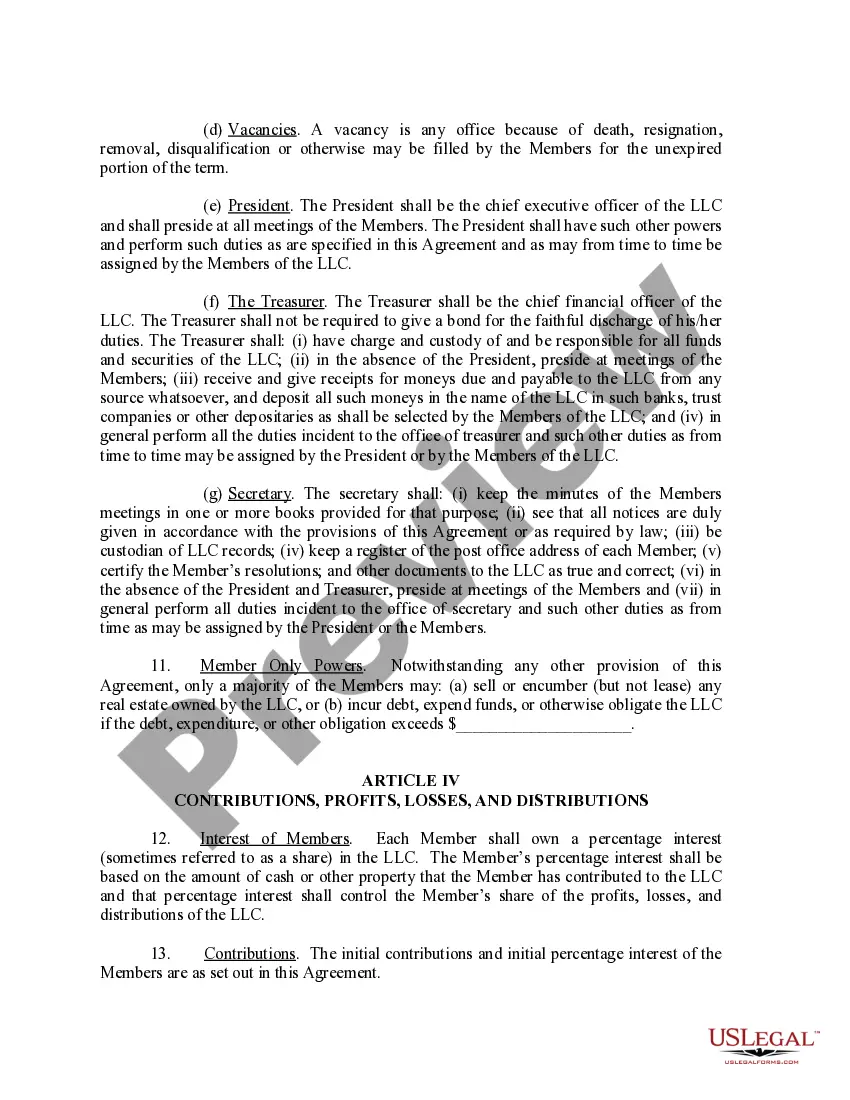

Yes, you can have multiple members in an LLC. In fact, a New Mexico LLC operating agreement with multiple members allows for shared ownership and management. This type of agreement clearly outlines each member's roles, responsibilities, and profit distribution. Additionally, using a service like US Legal Forms can help you create a comprehensive operating agreement tailored to your specific needs.

While multi-member LLCs offer many advantages, they also come with some disadvantages. For instance, potential conflicts among members can arise, particularly concerning decision-making and profit distribution. Additionally, the complex tax situation may require more detailed record-keeping. Understanding these drawbacks can help you navigate the challenges more effectively, especially when formalizing your New Mexico LLC operating agreement with multiple members.

In a multi-member LLC, the business itself requires an EIN for tax purposes, but individual members do not need separate EINs unless they have other businesses. The LLC will use its EIN when filing taxes and conducting business activities. Having an EIN streamlines tax processes and can help establish business credit. Make sure to obtain the EIN during the setup of your New Mexico LLC operating agreement with multiple members.

Yes, you can draft your own operating agreement for a New Mexico LLC with multiple members. However, it's essential to ensure that it covers all necessary aspects, such as member roles, profit distribution, and management structure. While creating your own document may save costs, using a template from platforms like USLegalForms can ensure you don’t overlook critical components and help you draft a comprehensive agreement.

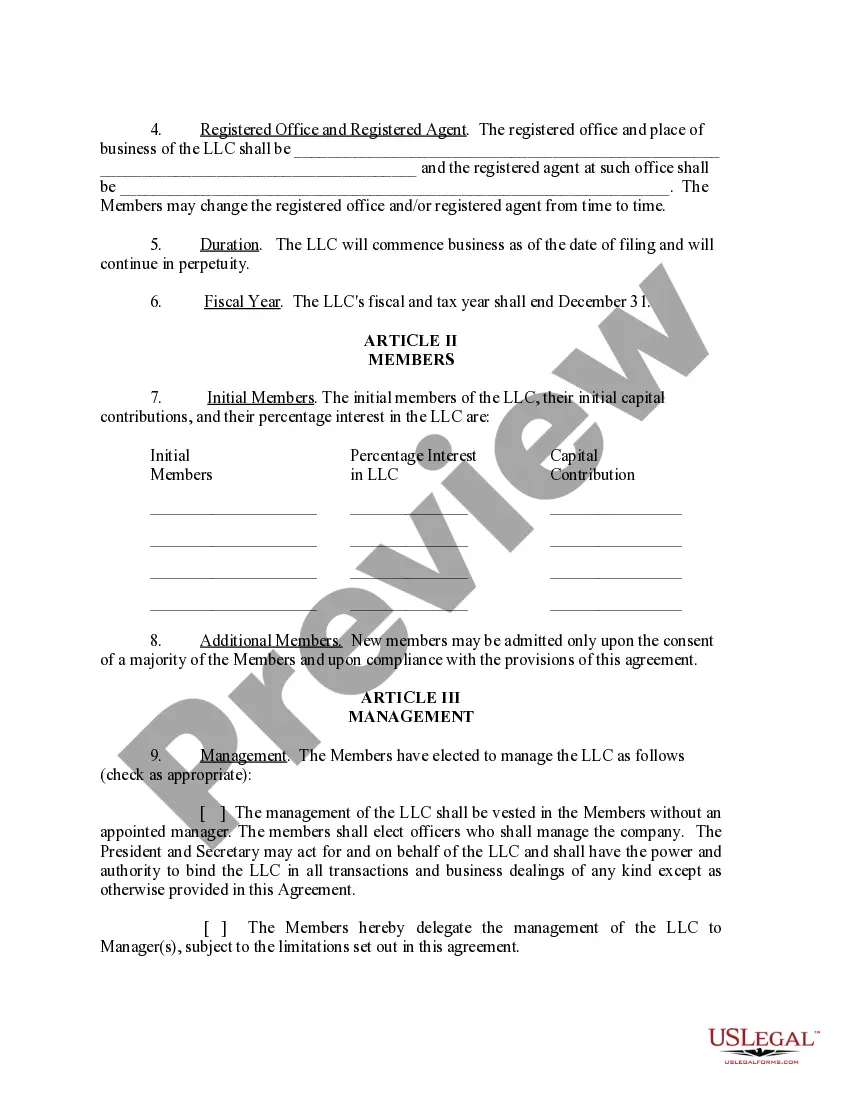

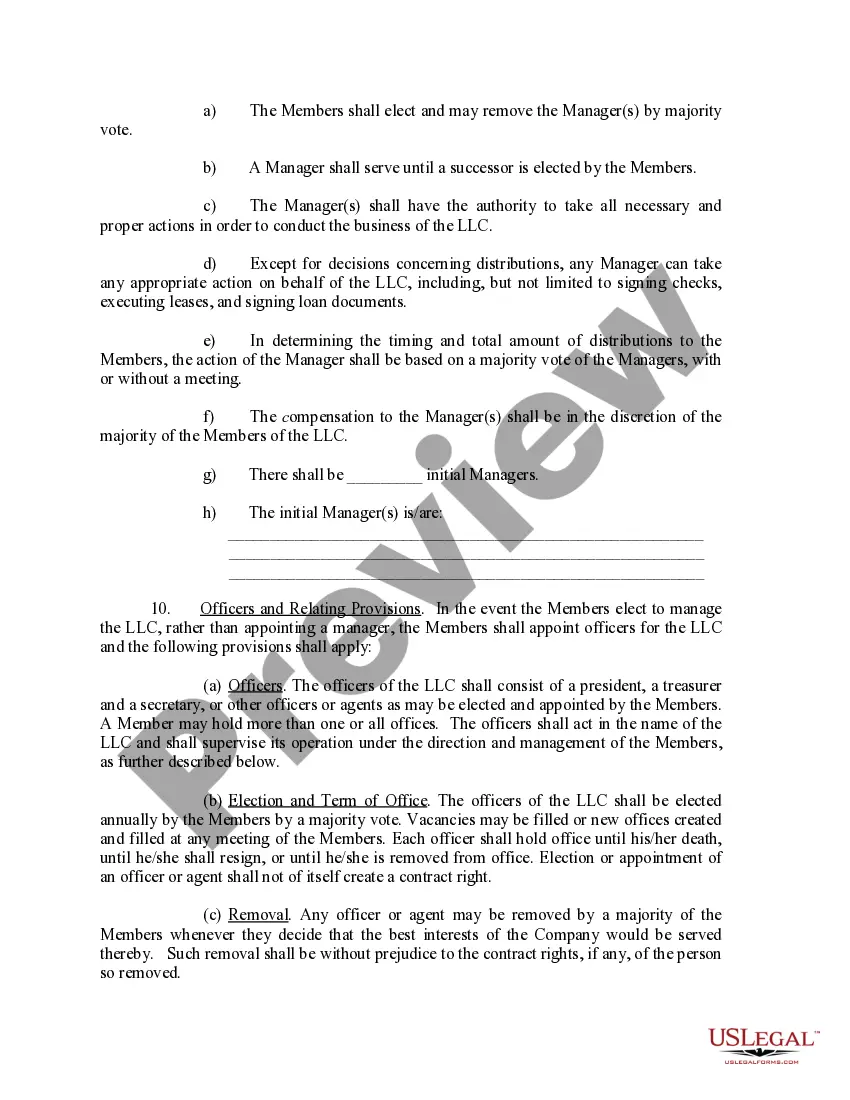

Structuring a multi-member LLC involves deciding how management will be handled and how profits will be distributed among members. You can choose between member-managed or manager-managed structures, depending on how you want to delegate authority. Additionally, your operating agreement should address contribution amounts and voting rights. Utilizing resources like USLegalForms can help you create a well-structured New Mexico LLC operating agreement with multiple members.

New Mexico does not require LLCs, including those with multiple members, to have an operating agreement. However, having one can provide significant benefits, such as defining member roles and establishing procedures for handling disputes. Without an operating agreement, state laws will dictate how the LLC is managed, which may not align with your intentions. Therefore, drafting a New Mexico LLC operating agreement with multiple members is advisable.

While New Mexico does not legally require a multi-member LLC to have an operating agreement, it is highly recommended. An operating agreement serves as an internal document that outlines how the LLC will operate and what each member's rights are. This can prevent misunderstandings and disputes among members. Opting for a comprehensive New Mexico LLC operating agreement with multiple members is a wise choice for clarity and organization.

To set up a multi-member LLC in New Mexico, you first need to choose a unique name and file the Articles of Organization with the state. After that, create an operating agreement to govern the LLC's operations and clarify the roles of each member. Lastly, obtain the necessary licenses and an EIN from the IRS for tax purposes. A well-structured operating agreement can help avoid future disputes among members.

Writing an operating agreement for a New Mexico LLC with multiple members involves outlining the management structure, member duties, and how profits and losses will be distributed. You should include sections on decision-making processes and procedures for adding or removing members. Using a template can simplify this process significantly. Consider using platforms like USLegalForms to access customizable operating agreement templates.