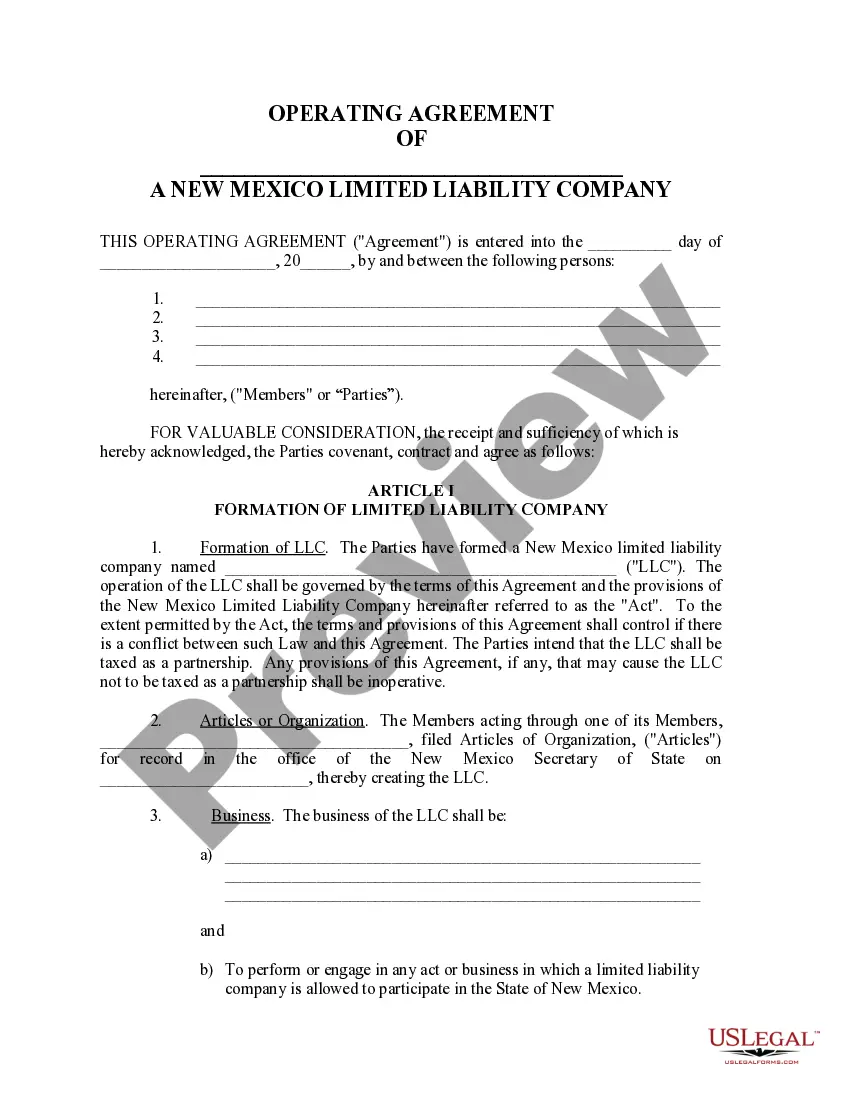

New Mexico Llc Operating Agreement Form With Llc

Description

How to fill out New Mexico Limited Liability Company LLC Operating Agreement?

Locating a reliable source for the latest and suitable legal templates is part of the challenge of navigating bureaucracy.

Selecting the appropriate legal documents requires precision and careful consideration, which is why it is essential to obtain samples of New Mexico Llc Operating Agreement Form With Llc solely from trustworthy providers, such as US Legal Forms. An incorrect template will squander your time and delay your situation. With US Legal Forms, you have very little to worry about. You can access and review all the information regarding the document’s application and significance for your circumstances and in your state or area.

Once you have the form on your device, you can modify it using the editor or print it and fill it out by hand. Eliminate the inconvenience that comes with your legal documentation. Discover the extensive US Legal Forms collection where you can find legal templates, assess their relevance to your situation, and download them immediately.

- Utilize the library navigation or search bar to locate your sample.

- Examine the form’s description to determine if it meets the criteria of your state and area.

- View the form preview, if available, to confirm that the template is indeed the one you need.

- Return to the search and find the suitable template if the New Mexico Llc Operating Agreement Form With Llc does not meet your needs.

- If you are confident about the form’s applicability, download it.

- As an authorized user, click Log in to verify and access your selected templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Select the pricing plan that fits your requirements.

- Proceed to registration to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading New Mexico Llc Operating Agreement Form With Llc.

Form popularity

FAQ

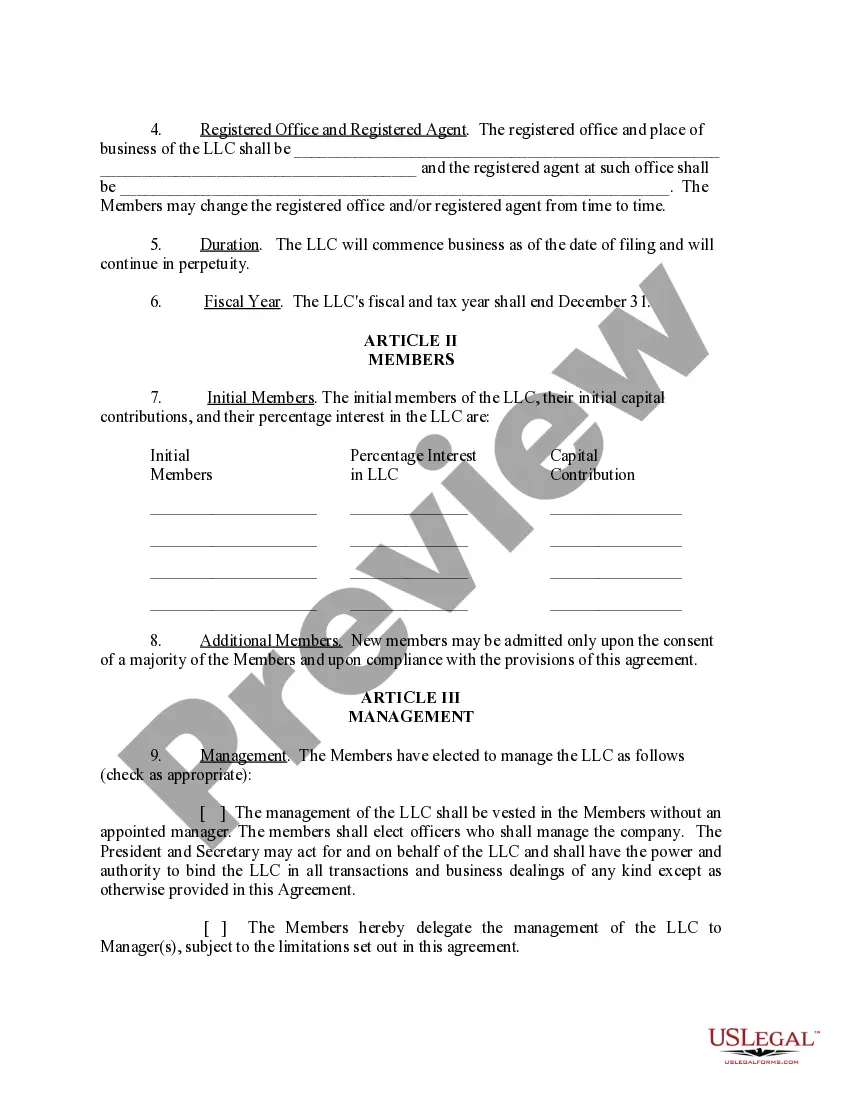

New Mexico statutes state that every corporation and LLC must maintain a registered agent, whether you formed your company in New Mexico or you're a foreign entity operating here.

All NM business entities are required to have a registered agent.

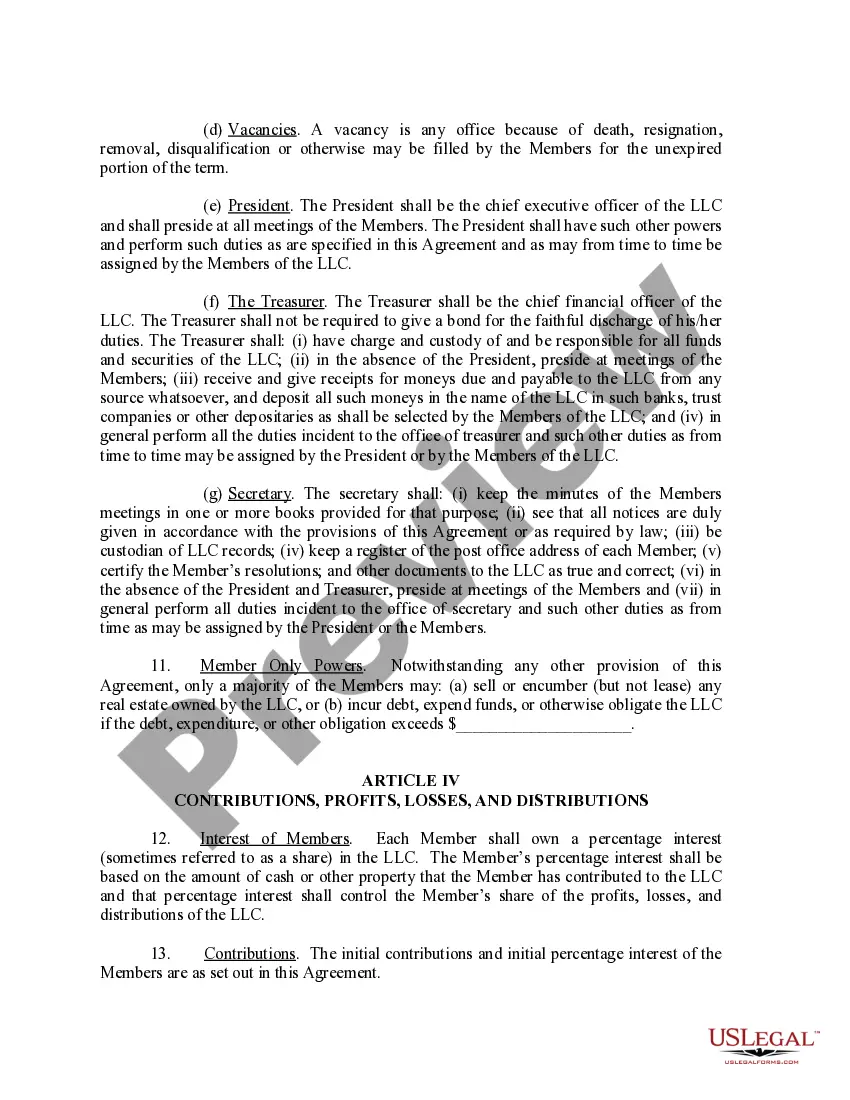

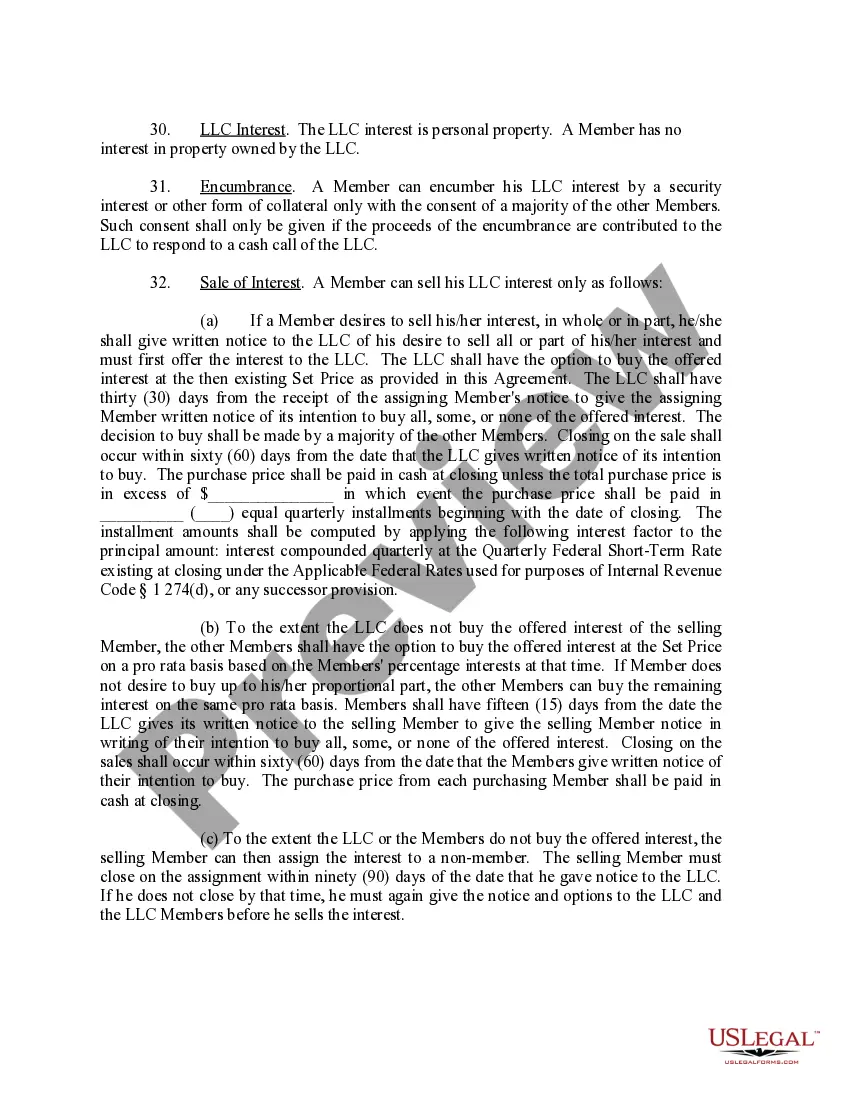

As per the New Mexico LLC Act, an Operating Agreement isn't required for an LLC in New Mexico. But while it's not required in New Mexico to conduct business, we strongly recommend having an Operating Agreement for your LLC.

As the owner of an LLC, you must pay self-employment tax and federal income tax, both of which are levied as ?pass-through taxation." Federal taxes can be complicated, so speak to your accountant or professional tax preparer to ensure that your New Mexico LLC is paying the correct amount.

Although fees vary by state when it comes to forming an LLC and keeping it in compliance, New Mexico is considered one of the best states to form an LLC in. This is because there is no annual fee.