Foreclose Mortgage Foreclosure For Conventional Loan

Description

How to fill out New Jersey Complaint To Foreclose Residential Mortgage?

Getting a go-to place to access the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal papers calls for precision and attention to detail, which explains why it is crucial to take samples of Foreclose Mortgage Foreclosure For Conventional Loan only from reliable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the details regarding the document’s use and relevance for the circumstances and in your state or county.

Take the following steps to finish your Foreclose Mortgage Foreclosure For Conventional Loan:

- Utilize the library navigation or search field to find your sample.

- View the form’s information to ascertain if it matches the requirements of your state and area.

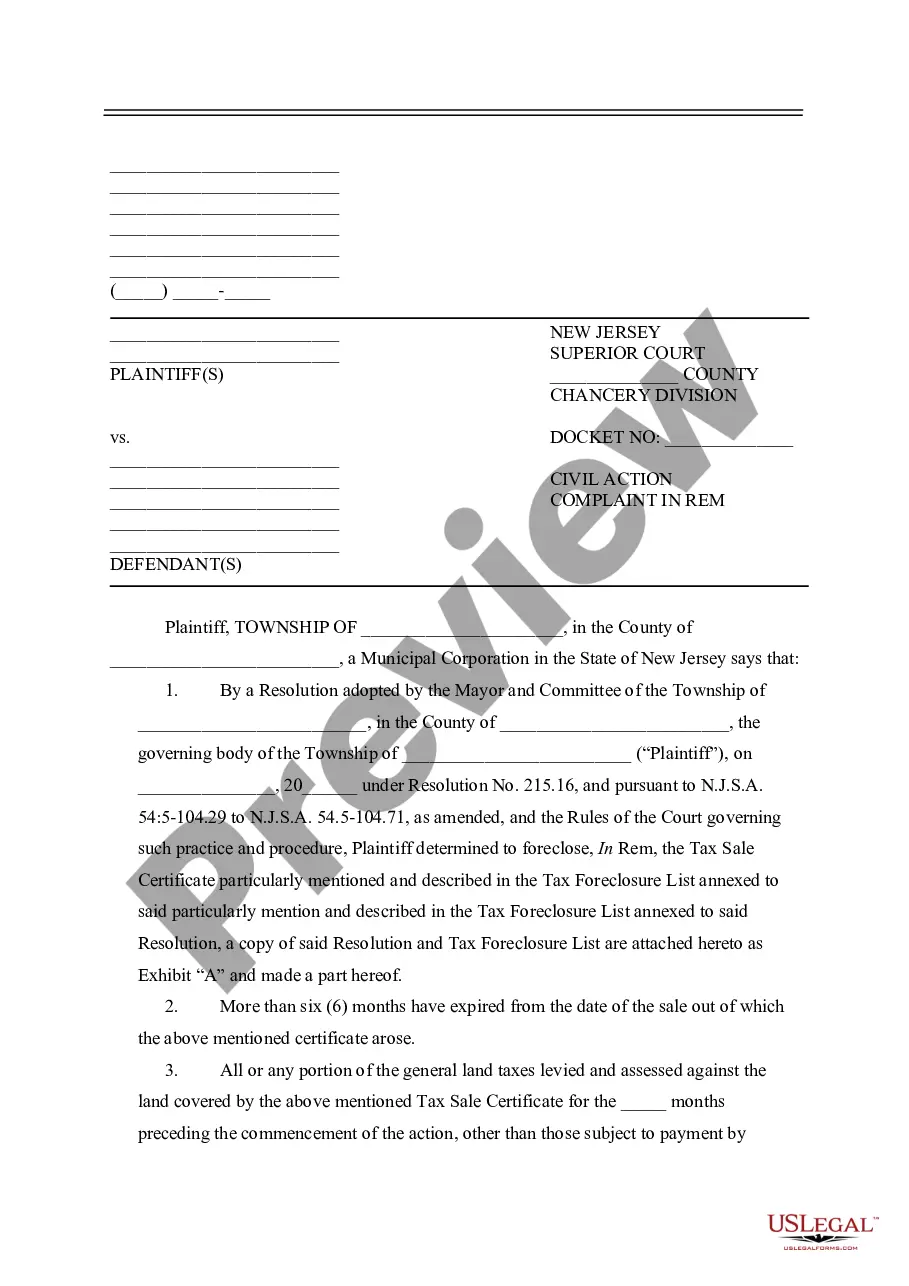

- View the form preview, if available, to make sure the template is the one you are searching for.

- Go back to the search and look for the correct template if the Foreclose Mortgage Foreclosure For Conventional Loan does not suit your requirements.

- When you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Choose the pricing plan that fits your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Choose the document format for downloading Foreclose Mortgage Foreclosure For Conventional Loan.

- Once you have the form on your device, you can alter it with the editor or print it and finish it manually.

Eliminate the hassle that accompanies your legal documentation. Discover the comprehensive US Legal Forms catalog where you can find legal templates, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Most mortgages have a power of sale clause, so lenders can foreclose without going to court (non-judicial). These are the most common type of foreclosures in California.

The conventional loan foreclosure waiting period is typically seven years, though it may be shortened to two to three years in extenuating circumstances.

Most mortgages have a power of sale clause, so lenders can foreclose without going to court (non-judicial). These are the most common type of foreclosures in California.

Fannie Mae mandates a seven-year waiting period after foreclosure. This span is calculated from the completion date of the foreclosure action. The seven-year period helps ensure that borrowers have ample time to recover financially and establish a more stable financial footing.

To be eligible for a mortgage loan, Fannie Mae requires borrowers to demonstrate that they have re-established credit following a significant derogatory credit event, such as a foreclosure, bankruptcy, preforeclosure sale (commonly known as a short sale), or deed-in-lieu (DIL) of foreclosure.