Pennsylvania Warranty Deed from Husband and Wife to an Individual

Description

How to fill out Pennsylvania Warranty Deed From Husband And Wife To An Individual?

Creating documents isn't the most easy process, especially for those who rarely deal with legal paperwork. That's why we recommend making use of accurate Pennsylvania Warranty Deed from Husband and Wife to an Individual samples made by skilled lawyers. It gives you the ability to prevent problems when in court or working with official organizations. Find the templates you want on our website for high-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will automatically appear on the template webpage. Soon after accessing the sample, it will be stored in the My Forms menu.

Users with no an active subscription can quickly create an account. Utilize this simple step-by-step help guide to get the Pennsylvania Warranty Deed from Husband and Wife to an Individual:

- Be sure that file you found is eligible for use in the state it is required in.

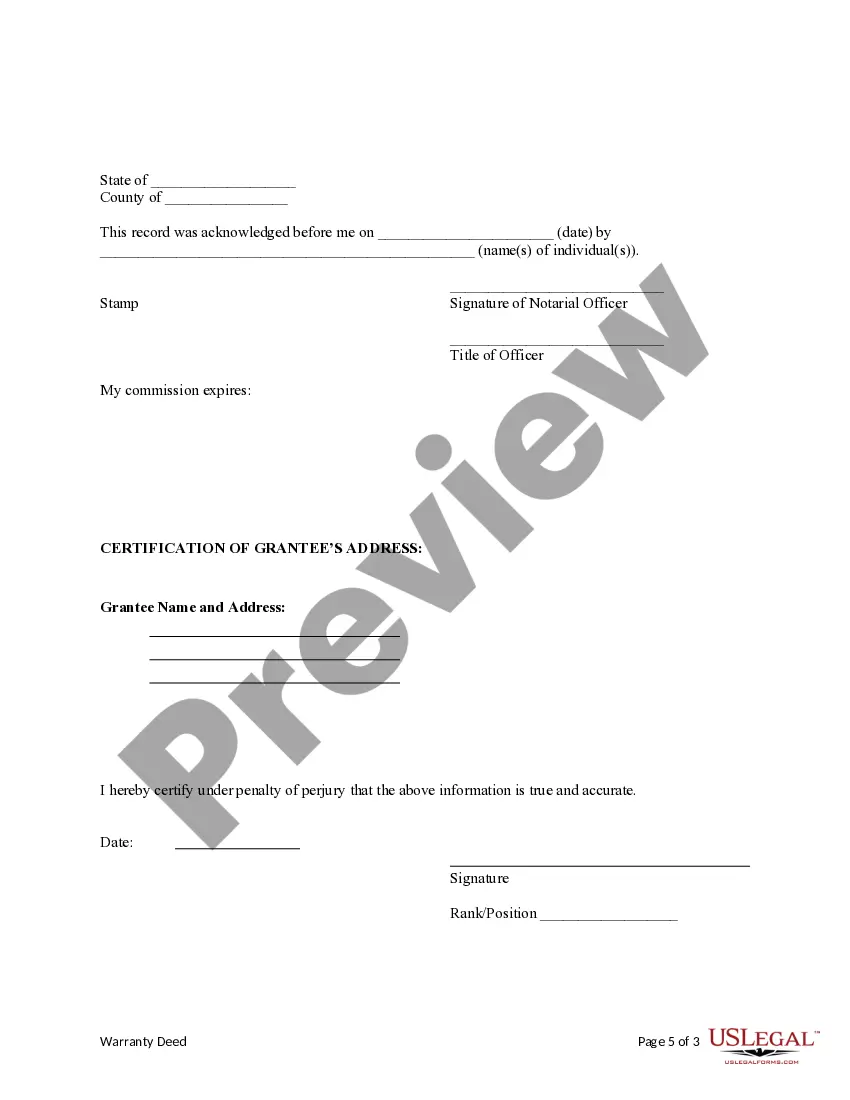

- Verify the document. Use the Preview option or read its description (if available).

- Click Buy Now if this form is what you need or return to the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after completing these straightforward steps, it is possible to complete the form in your favorite editor. Check the filled in data and consider requesting an attorney to examine your Pennsylvania Warranty Deed from Husband and Wife to an Individual for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

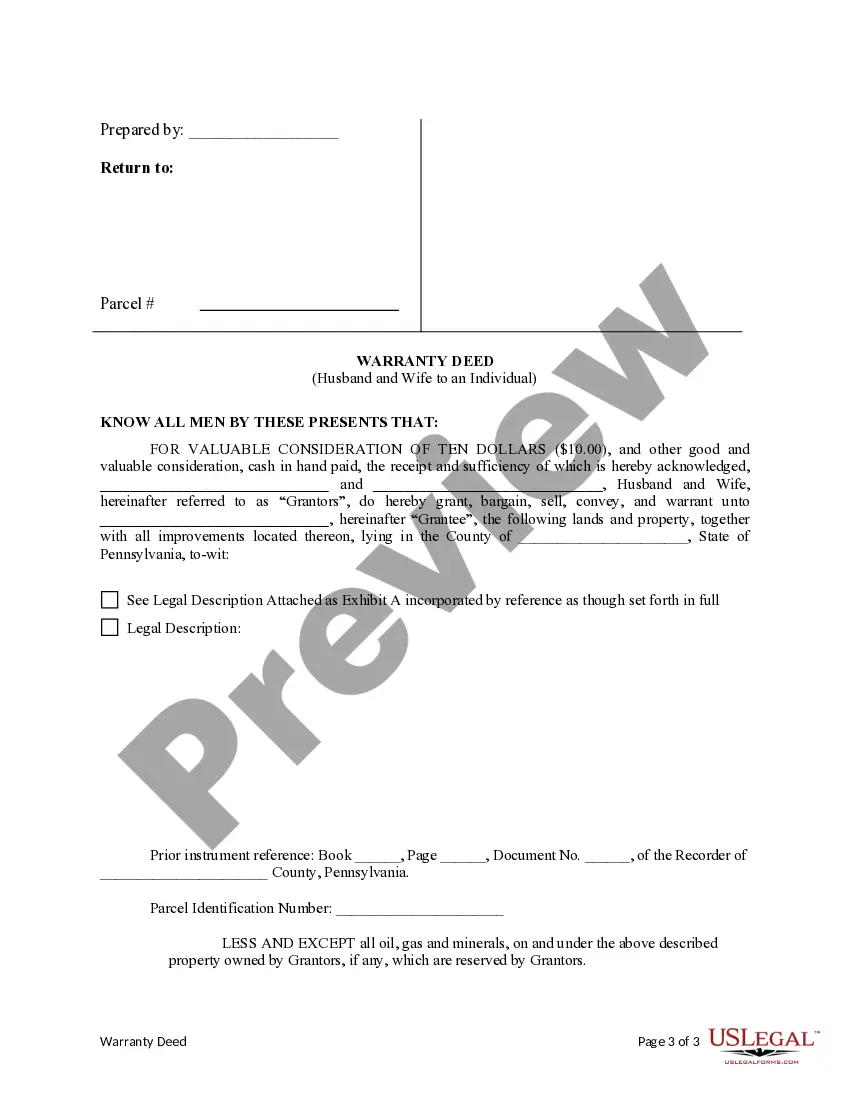

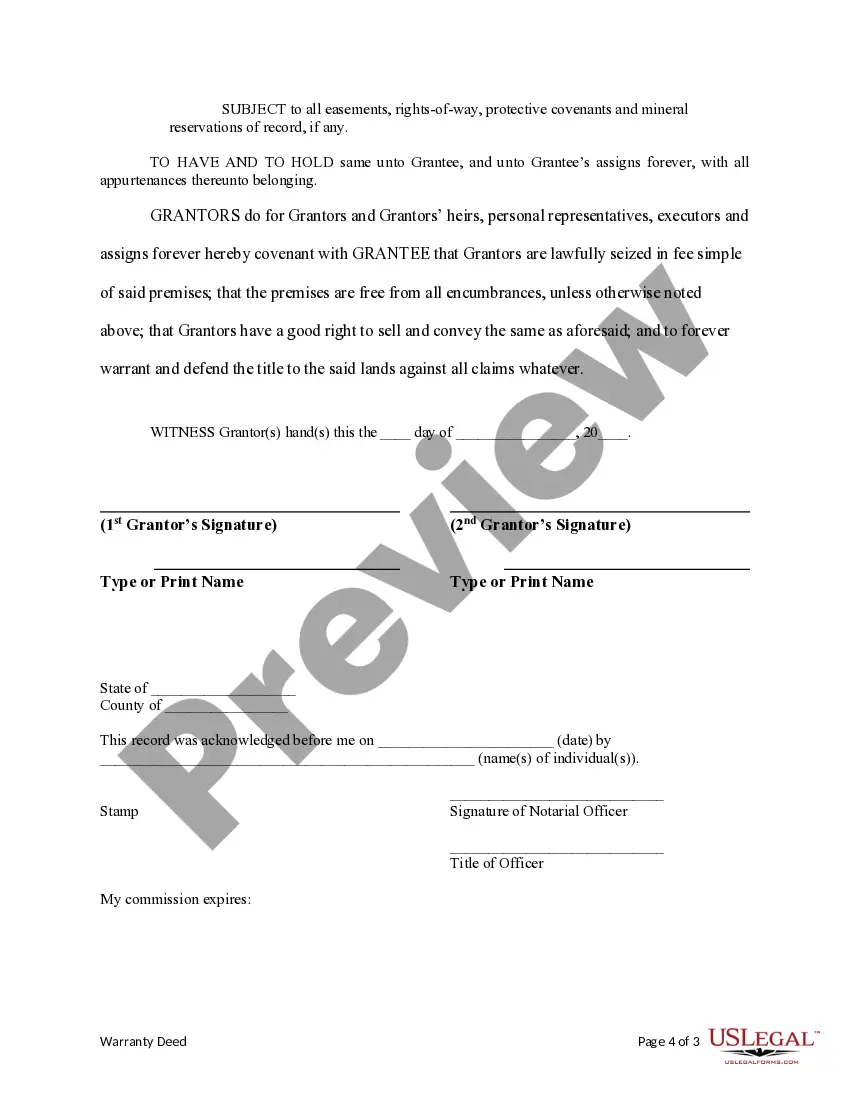

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

Signing over the interest in the property, whether land or house, can be done in several ways. However, the most common instruments of transfer of property between family members are the quitclaim deed, the gift deed or the transfer on death (TOD) deed.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

If you give your house to your children, the tax basis will be $150,000.PA INHERITANCE TAX ISSUES: In Pennsylvania, there is no gift tax. However, to avoid PA Inheritance Taxes (the rate is 4.5% for assets passed to children or grandchildren), you must live at least one year from the time the gift was made.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Think about IHT implications potentially exempt transfer Be aware of the rules on gifts with reservation of benefit You will no longer be the legal owner of the property. Risk from outside parties. Don't forget capital gains tax.