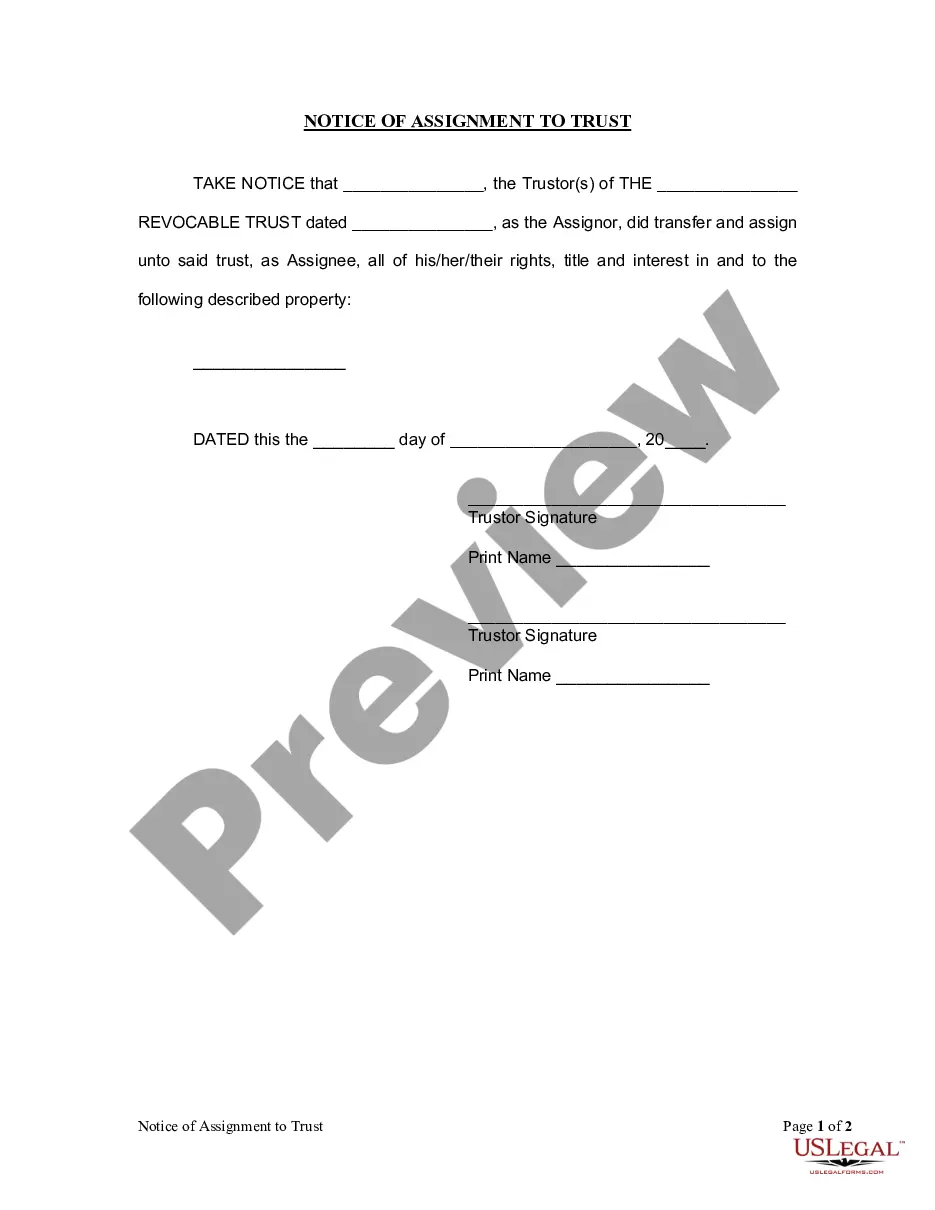

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

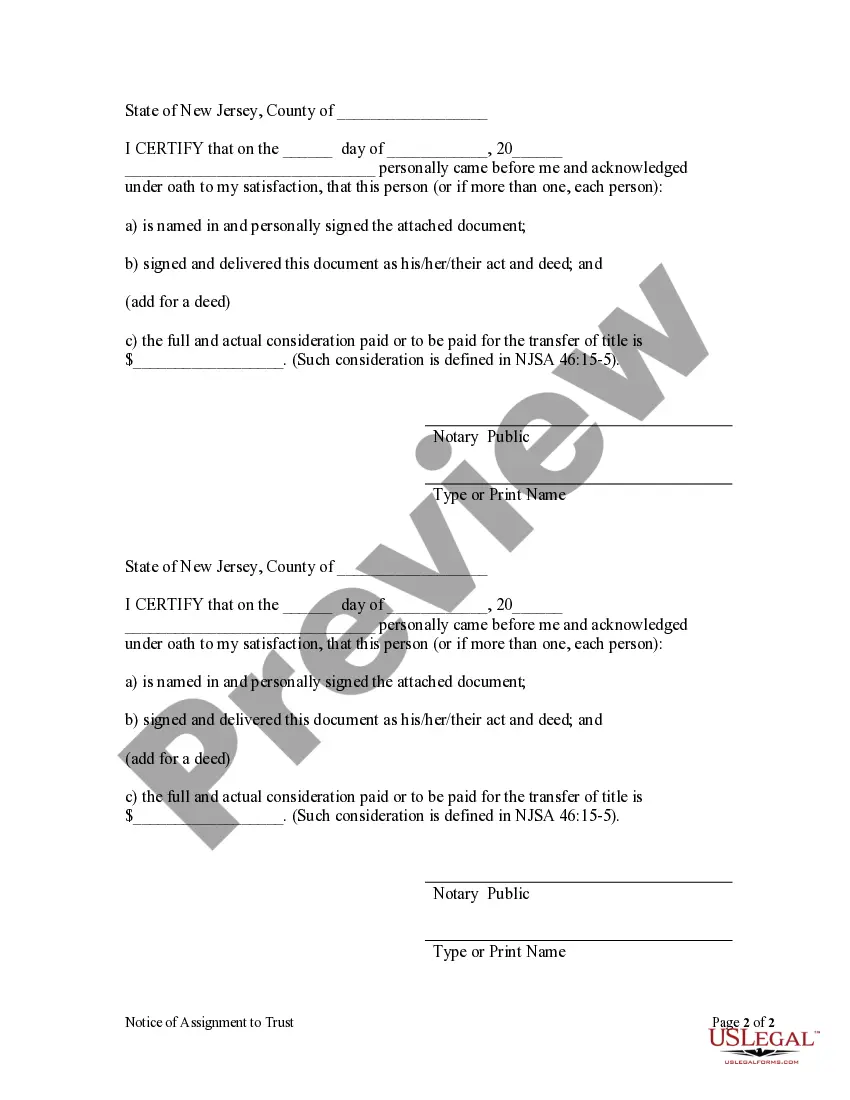

New Jersey Trust Withholding Registration

Description

Form popularity

FAQ

Avoiding inheritance tax in New Jersey typically requires strategic estate planning. Utilizing trusts, making lifetime gifts, and properly structuring your estate can all play a role in minimizing tax liabilities. Consulting professionals who specialize in estate planning can provide insights tailored to your goals. Engaging in New Jersey trust withholding registration can also simplify compliance and tax management.

Calculating your state withholding in New Jersey involves assessing your income, tax credits, and allowances. You can utilize the state’s withholding tax tables or online calculators to facilitate this process. By regularly reviewing your withholding estimates, you can adapt your strategy as needed throughout the year. Utilizing services related to New Jersey trust withholding registration can streamline this process.

While a trust can help manage the distribution of assets, it does not inherently protect assets from inheritance tax in New Jersey. The tax still applies based on the relationship of the beneficiaries and the type of trust established. Planning the structure of your trust carefully can potentially minimize tax impacts. Engaging with professionals can clarify how New Jersey trust withholding registration can aid your estate planning.

In New Jersey, certain individuals are exempt from inheritance tax, including spouses, civil union partners, and children. Additionally, charities and certain organizations may also qualify for exemptions. Understanding beneficiary classifications is vital for effective estate planning. Consult an expert in New Jersey trust withholding registration to explore options that can potentially minimize tax burdens.

The percentage for tax withholding in New Jersey can vary based on your income and personal tax situation. New Jersey typically provides guidelines that recommend specific withholding rates. You may want to adjust your withholding percentage based on your tax planning goals. Engaging with a service or professional familiar with New Jersey trust withholding registration can help ensure you select the correct rate.

A trust may not automatically avoid inheritance tax in New Jersey. The tax status of a trust is influenced by its structure and the relationship of beneficiaries to the deceased. Specific types of trusts might offer some tax advantages, but it's crucial to navigate these options with a qualified advisor. To understand how New Jersey trust withholding registration affects your situation, seeking expert advice is a smart approach.

Yes, trusts can be subject to inheritance tax in New Jersey. However, the specific tax implications depend on various factors, including the type of trust and its beneficiaries. It's essential to consult with a tax professional who can provide guidance tailored to your situation. Effective New Jersey trust withholding registration can help manage these taxes more efficiently.

When determining how many allowances to claim in New Jersey, consider your personal situation, including your income level and family size. Generally, more allowances mean less tax withheld from your paycheck, while fewer allowances will result in more tax. It is advisable to review the New Jersey tax withholding guidelines to ensure you're meeting your requirements. Additionally, aligning your allowances with your overall financial strategy can help optimize your New Jersey trust withholding registration.

Your New Jersey corporate registration number can be found on your business registration documents or by checking with the New Jersey Division of Revenue and Enterprise Services. It is important to keep this number accessible as it relates to your ongoing compliance, especially with New Jersey trust withholding registration.

You can obtain a TIN number by applying directly through the IRS. This can be done online or by mailing in the required forms. Having a TIN number is crucial for navigating tax responsibilities, particularly in relation to New Jersey trust withholding registration.