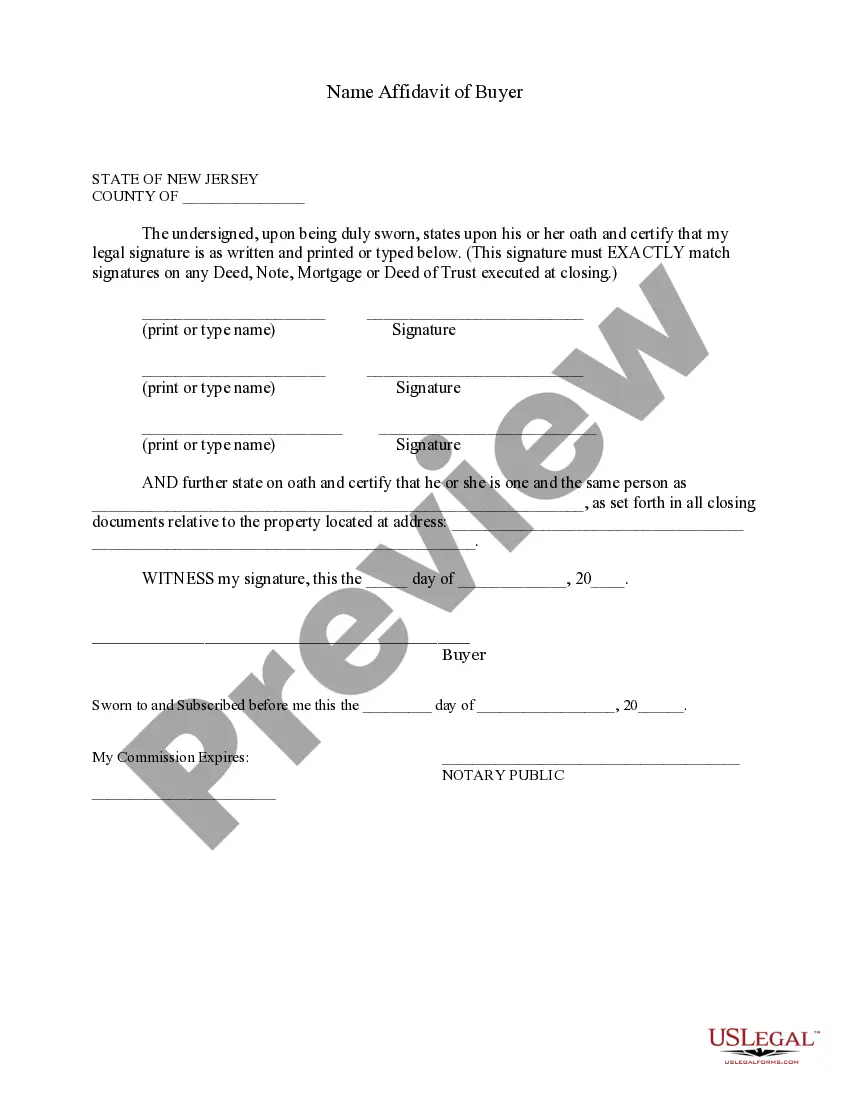

New Jersey Affidavit Of Consideration Buyer

Description

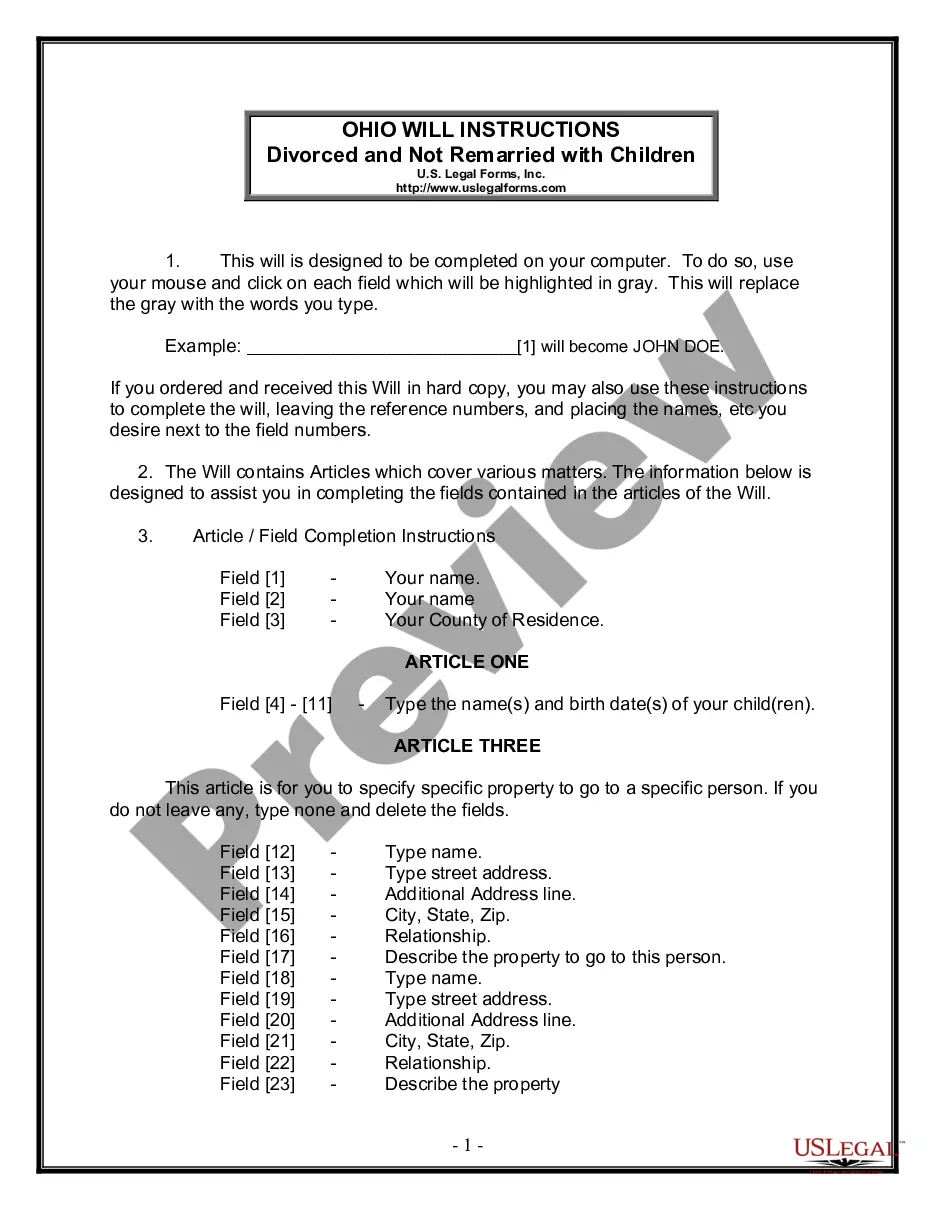

How to fill out New Jersey Name Affidavit Of Buyer?

When you need to finalize the New Jersey Affidavit Of Consideration Buyer that aligns with your local state's regulations, there can be numerous alternatives to select from.

There's no requirement to scrutinize every document to ensure it meets all the legal stipulations if you are a US Legal Forms subscriber.

It is a reliable resource that can assist you in obtaining a reusable and current template on any topic.

Utilize the Preview mode and examine the form description if available.

- US Legal Forms is the largest online catalog with a collection of over 85k ready-to-use documents for business and personal legal situations.

- All templates are confirmed to adhere to each state's regulations.

- Consequently, when downloading the New Jersey Affidavit Of Consideration Buyer from our platform, you can be assured that you possess a valid and up-to-date document.

- Retrieving the necessary sample from our platform is exceedingly straightforward.

- If you already have an account, simply Log In to the system, verify that your subscription is active, and save the chosen file.

- In the future, you can access the My documents section in your profile and retrieve the New Jersey Affidavit Of Consideration Buyer anytime.

- If this is your first experience with our site, please adhere to the instructions below.

- Review the proposed page and assess it for conformity with your criteria.

Form popularity

FAQ

An affidavit of title is a legal document provided by the seller of a piece of property that explicitly states the status of potential legal issues involving the property or the seller. The affidavit is a sworn statement of fact that specifies the seller of a property holds the title to it.

The mansion tax was introduced in 2004 when home values were considerably less than they are now and $1 million home prices were much less commonplace. Unless otherwise agreed upon by the buyer and seller, the mansion tax is typically paid by the seller at closing.

This is simply to prevent transactions that purposely avoid the NJ Realty Transfer Tax by selling property cheaply on paper (thus, paying less in fees) and compensating the seller at a later time. The director's ratio exists so that the realty transfer fee will always represent the true value of the transaction.

NJ Taxation An Affidavit of Consideration (RTF-1 ) must be filed with any deed in which a full or partial exemption is claimed from the Realty Transfer Fee.

Sales Tax: Sales Tax is not due on home sales. Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.