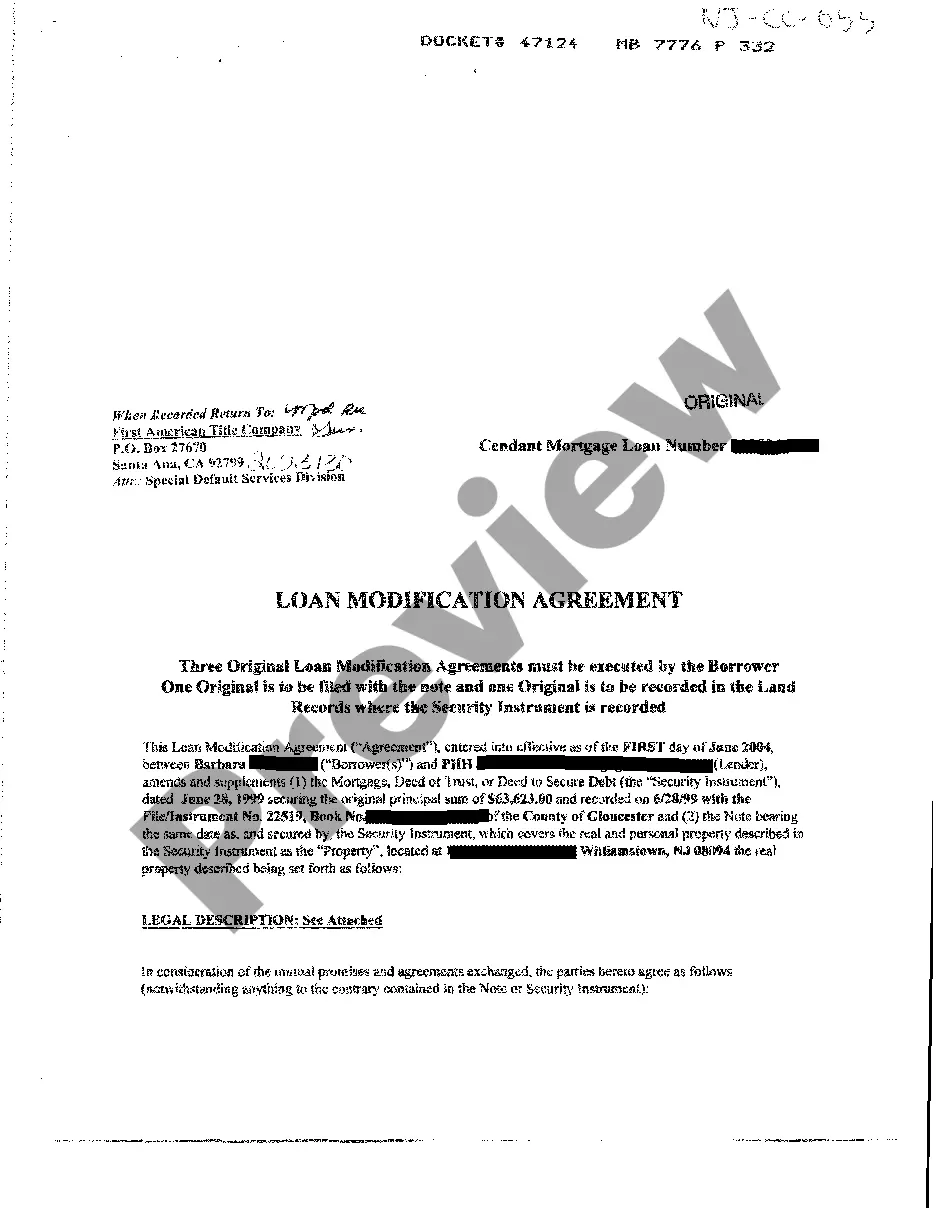

New Jersey Personal Loan Agreement Template Form

Description

How to fill out New Jersey Loan Modification Agreement?

How to obtain professional legal documents that comply with your state's laws and prepare the New Jersey Personal Loan Agreement Template Form without hiring an attorney.

Numerous services online offer templates to address various legal needs and formalities.

However, it may require time to determine which of the available samples meet both your specific use case and legal obligations.

Download the New Jersey Personal Loan Agreement Template Form by clicking the appropriate button next to the file name. If you do not have an account with US Legal Forms, follow the instructions below: Browse the webpage you've accessed and confirm whether the form meets your requirements. Utilize the form description and preview features if they are provided. Search for another template in the header displaying your state if needed. Click the Buy Now button once you locate the correct document. Choose the most appropriate pricing option, then either sign in or create an account. Select your preferred payment method (credit card or PayPal). Choose the file format for your New Jersey Personal Loan Agreement Template Form and click Download. The templates you obtain remain yours: you can always access them in the My documents section of your profile. Join our library to prepare legal documents on your own like a seasoned legal professional!

- US Legal Forms is a reliable service that assists you in locating official documents created in accordance with the latest updates to state laws and helps you save on legal fees.

- US Legal Forms is not a typical online library.

- It's a compilation of over 85,000 verified templates for various business and personal situations.

- All documents are organized by category and state to streamline your search experience.

- It also offers compatibility with advanced solutions for PDF editing and electronic signatures, allowing Premium subscribers to easily complete their paperwork online.

- It requires minimal effort and time to acquire the necessary documents.

- If you already possess an account, Log In and verify your subscription status.

Form popularity

FAQ

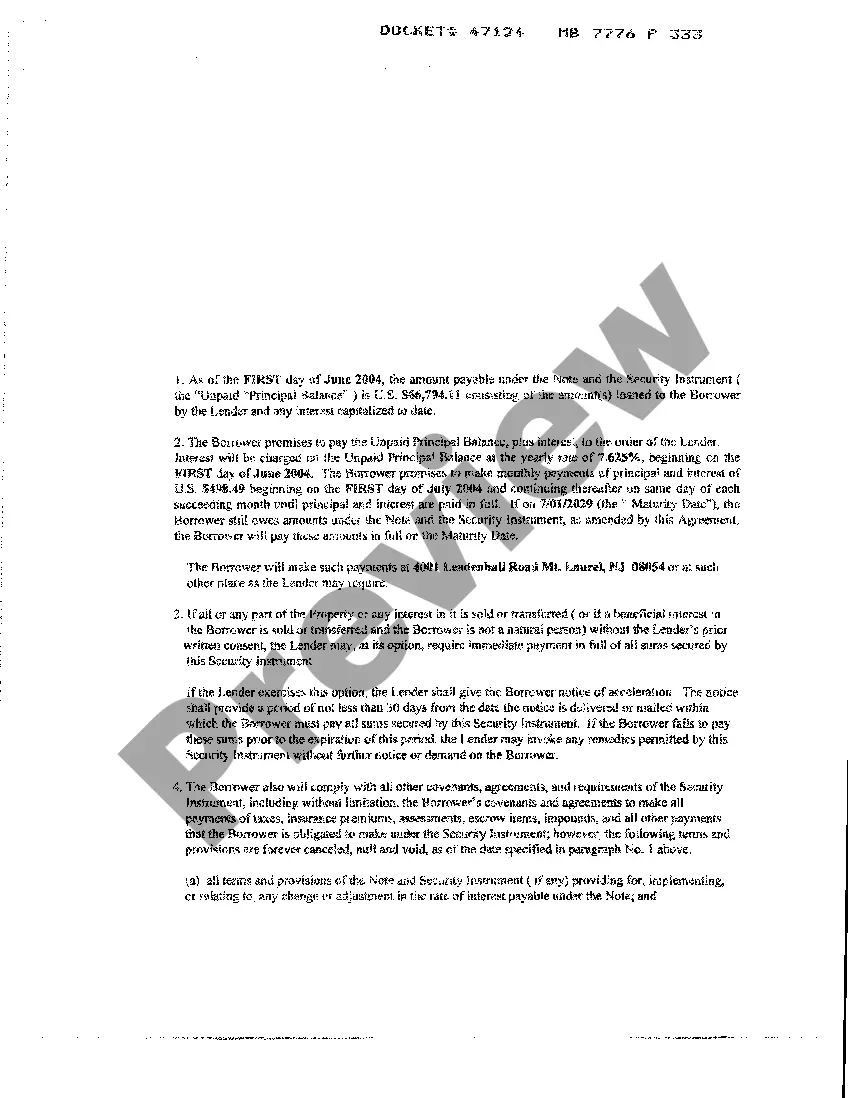

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

A simple loan agreement (1 page) is a written contract between one party borrowing money and another receiving it. The purpose of the document is to establish the legally binding conditions that will remain in place until the loan is repaid, for example the schedule. B of payment that the borrower must follow.