New Jersey Business Nj Form Nj-cbt

Description

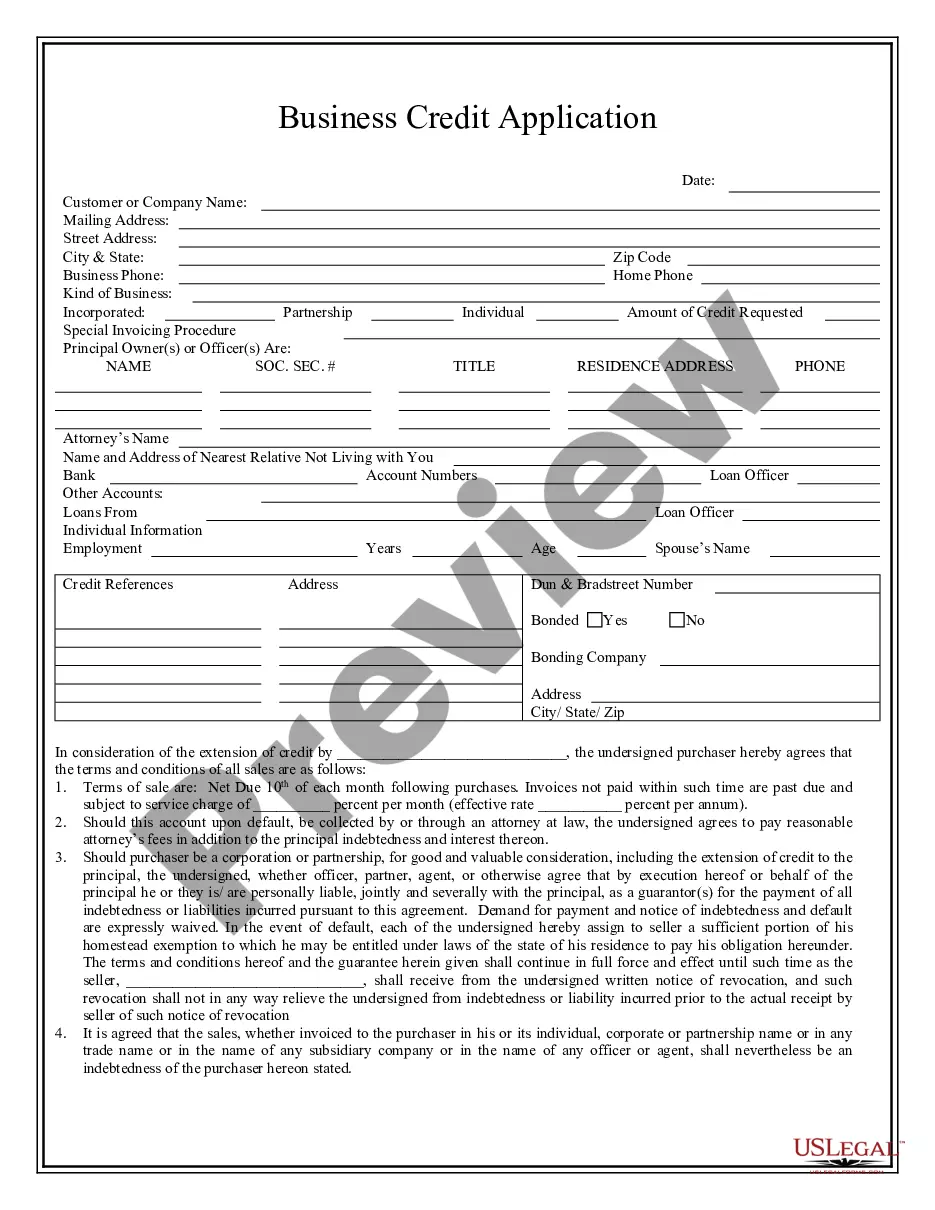

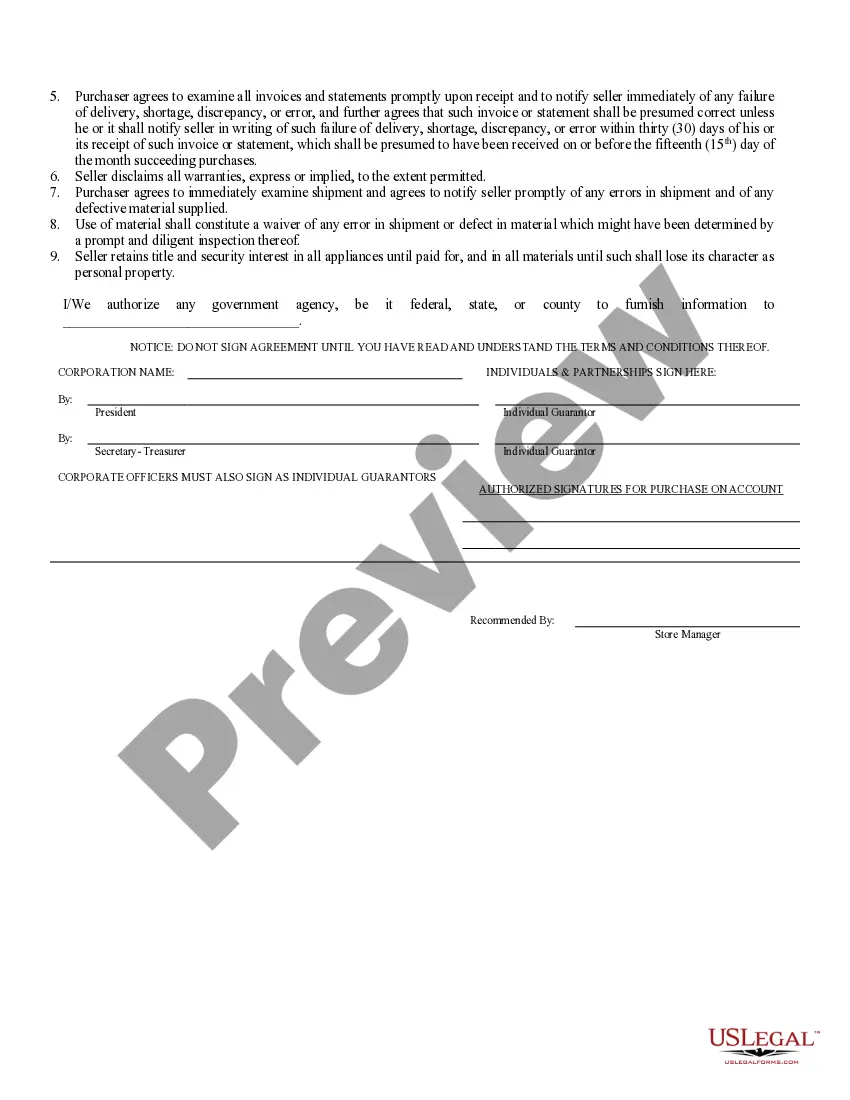

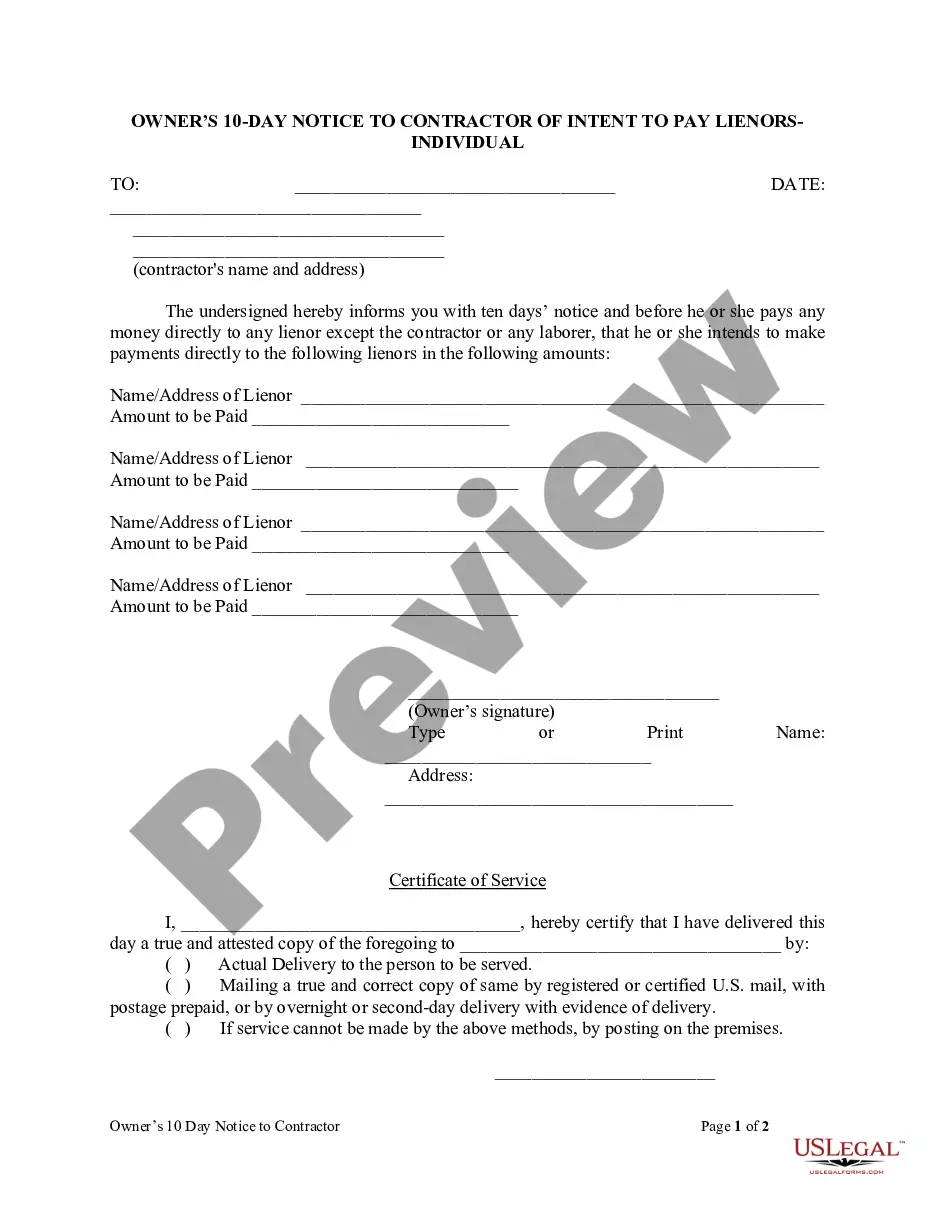

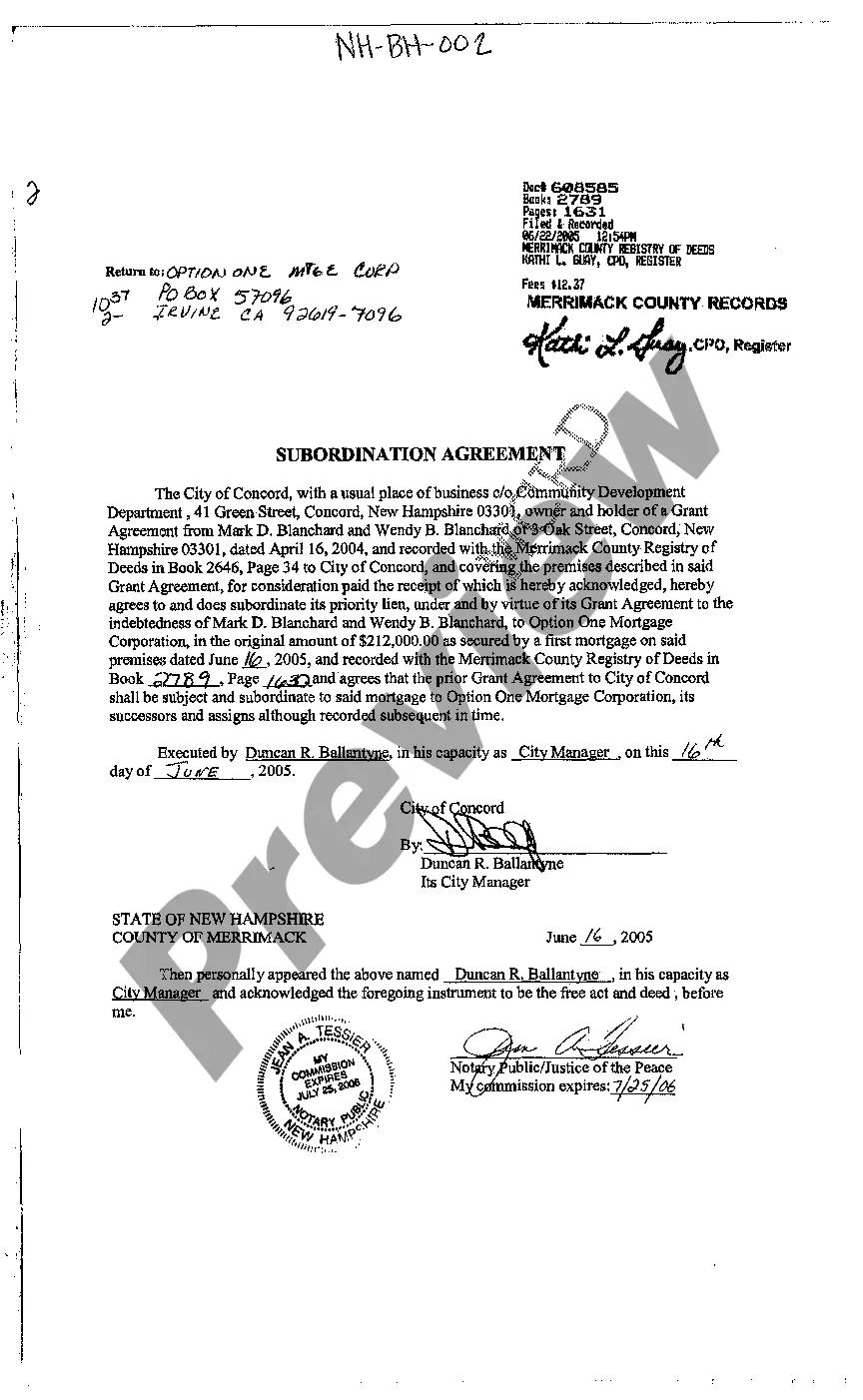

How to fill out New Jersey Business Credit Application?

It’s no secret that you can’t become a law professional immediately, nor can you learn how to quickly draft New Jersey Business Nj Form Nj-cbt without having a specialized set of skills. Putting together legal documents is a time-consuming process requiring a particular training and skills. So why not leave the creation of the New Jersey Business Nj Form Nj-cbt to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court paperwork to templates for internal corporate communication. We understand how important compliance and adherence to federal and state laws are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the document you require in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether New Jersey Business Nj Form Nj-cbt is what you’re searching for.

- Begin your search over if you need any other template.

- Register for a free account and select a subscription plan to purchase the form.

- Choose Buy now. As soon as the payment is complete, you can download the New Jersey Business Nj Form Nj-cbt, complete it, print it, and send or mail it to the necessary individuals or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Electronic Filing Mandate Visit the Division's website or check with your software provider to see if they support any or all of these filings. To file and pay the annual report electronically, visit the Division of Revenue and Enterprise Services website.

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ-CBT-1065 must be filed when the entity is re- quired to calculate a tax on its nonresident partner(s).

Every corporate entity, including certain limited liability companies (LLCs) and partnerships, that operates in New Jersey is required to file a Corporate Tax Return (Form CBT 100).

Complete and submit your return online using this filing service. Pay your tax liability using an electronic check or credit card and receive immediate confirmation that your return has been received by the State of New Jersey.

New Jersey Partnership To apply for an extension for Form NJ-CBT-1065, file Form CBT-206 on or before the original deadline of the partnership tax return is due. Form Part-200-T & CBT-206 provides an automatic 5-month extension of time to file Forms NJ-CBT-1065 & NJ-1065.