Amendment Flaw

Description

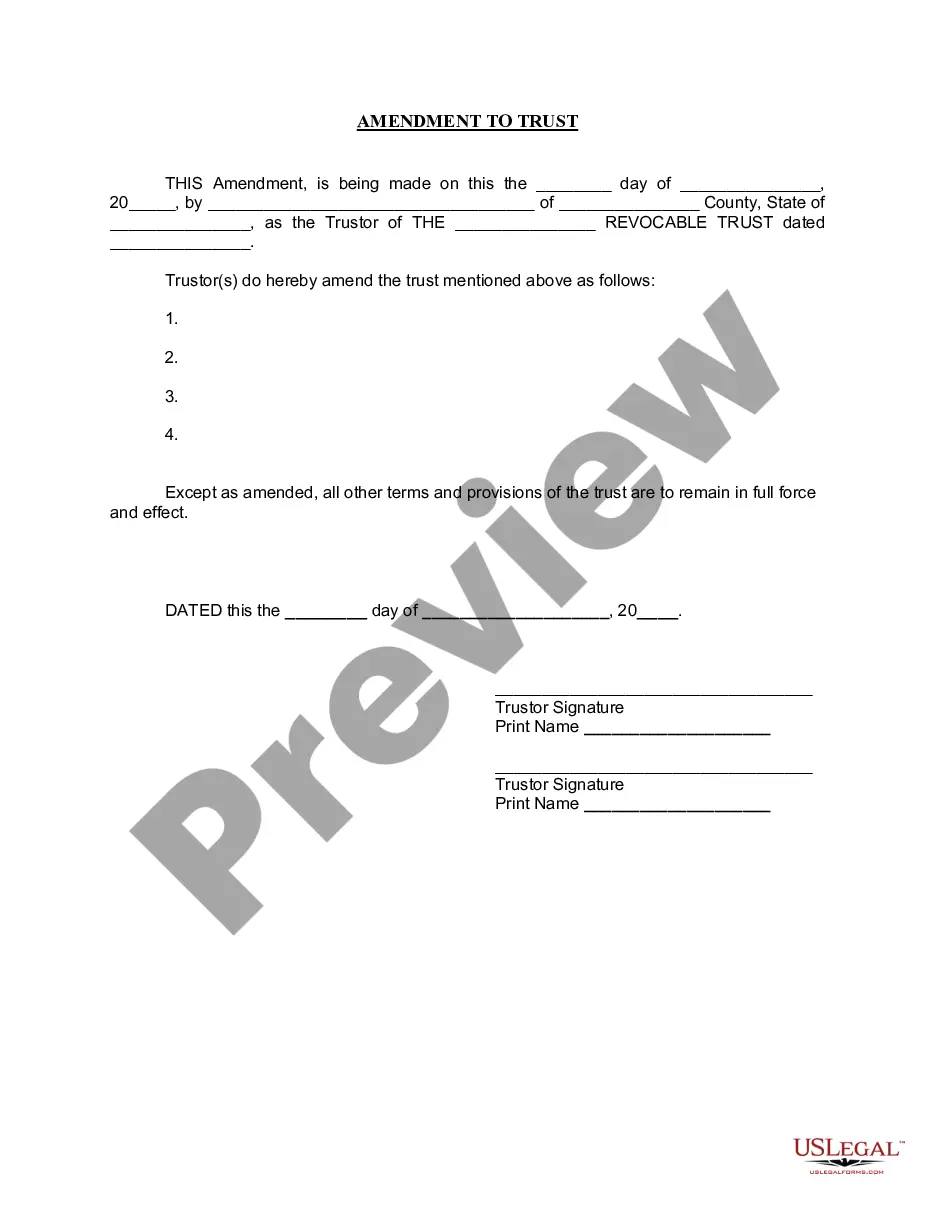

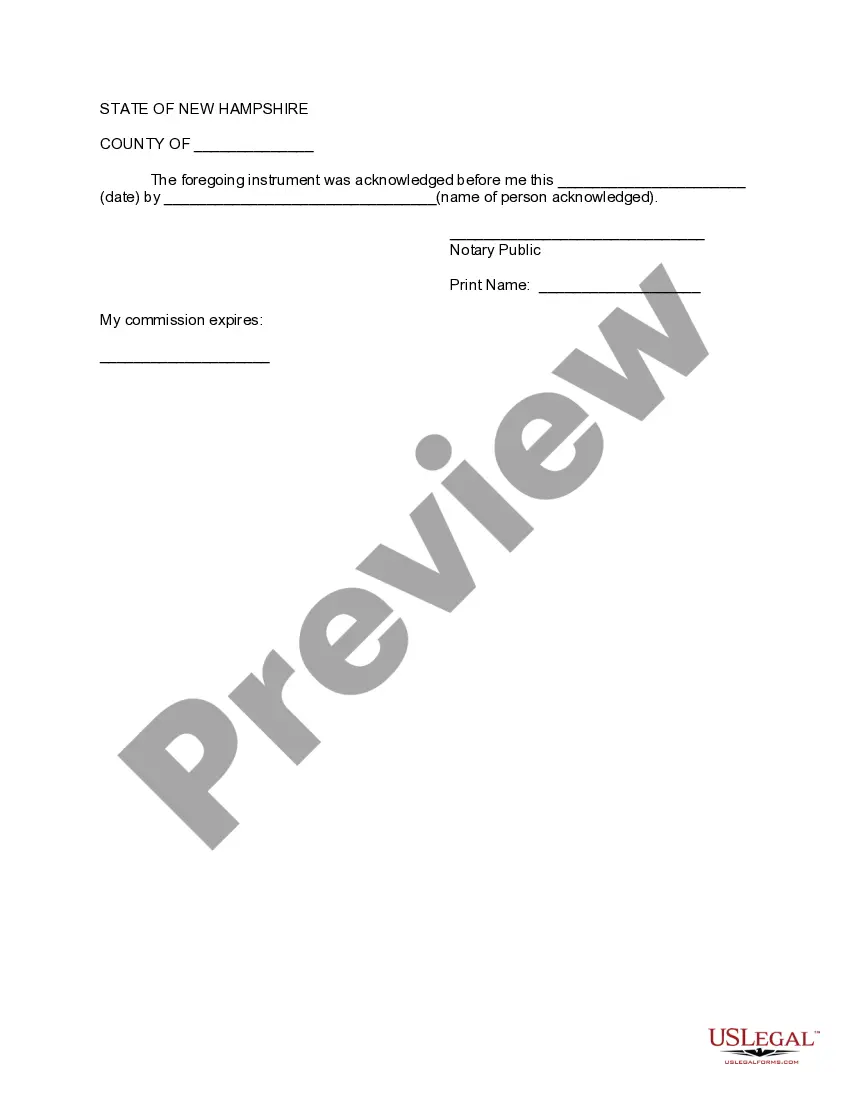

How to fill out New Hampshire Amendment To Living Trust?

- Log in to your existing US Legal Forms account or create a new one if this is your first time.

- Preview the desired documentation and check the description to ensure it fits your specific needs and adheres to your local jurisdiction’s regulations.

- If adjustments are needed, utilize the search function to find the correct template that minimizes any amendment flaws.

- Select your form and click the Buy Now button, choosing the subscription plan that best suits your needs.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download the completed document to your device, and access it anytime in the My Forms section of your account.

By following these steps, you can minimize amendment flaws and ensure your documents meet legal standards. US Legal Forms stands out with its extensive library, offering over 85,000 fillable forms and expert assistance for added confidence.

Ready to streamline your legal documentation process? Visit US Legal Forms today to start ensuring your legal documents are precise and compliant!

Form popularity

FAQ

Filing an amended tax return is generally straightforward, but you can encounter challenges, especially if there's an amendment flaw. It requires completing Form 1040-X and may involve gathering additional documentation to support your changes. While it can seem daunting at first, platforms like US Legal Forms streamline the process, making it easier to file the necessary paperwork and resolve issues effectively.

There are several reasons to file an amended return, especially if you discover an amendment flaw. You might find that you omitted income or deductions that affect your tax situation. Additionally, you may need to correct personal information, such as your filing status or dependents. By addressing these issues promptly, you can avoid complications and ensure accurate tax records.

Filling out articles of amendment involves providing specific information about your entity and the changes you are making. Start by gathering necessary details, then follow your state’s guidelines to ensure compliance. If you experience an amendment flaw, platforms like USLegalForms can provide templates and support to streamline the process.

Filing an amendment doesn't automatically trigger an audit, but it may attract additional attention from the IRS. If you correct significant errors, the agency might want to review the changes more closely. Therefore, it’s vital to ensure your filings are accurate and supported by relevant documentation to avoid potential issues.

Generally, you will not get in trouble for amending your taxes unless there is evidence of fraud or intentional misreporting. Correcting an amendment flaw can demonstrate your commitment to compliance. If you are unsure about how to proceed, using informative resources can help clarify your actions.

Filing an amended tax return is not inherently bad; it's an important tool to correct mistakes. However, it is crucial to ensure that you understand the reasons for any changes, as an amendment flaw can raise concerns. By using platforms like USLegalForms, you can navigate the amendment process confidently and accurately.

Amendments have the potential to trigger audits, particularly if they involve significant changes to your income or deductions. While an amendment flaw does not automatically lead to an audit, it can increase scrutiny. Therefore, it is essential to prepare your amended returns carefully to reduce any risks.

Several factors can trigger an IRS audit, including discrepancies in income reporting, excessive deductions, and having multiple amendments on your tax returns. An amendment flaw in your filings might also raise red flags. By ensuring accuracy and consistency, you can help minimize the chances of an audit.

Yes, you can track an amended return. The IRS provides a tool called 'Where's My Amended Return?' which allows you to check the status of your amendment. Often, tracking your amended return helps you stay informed about any changes made and ensures that any amendment flaw has been addressed promptly.

Changing an amendment requires a significant majority. Specifically, a constitutional amendment can be proposed with a two-thirds vote in each legislative chamber. Subsequently, it must be ratified by three-fourths of the state legislatures. Understanding these requirements helps address any potential amendment flaws in your proposals.