New Hampshire Trust Withholding Tax Registration

Description

How to fill out New Hampshire Living Trust For Husband And Wife With No Children?

Dealing with legal documents and operations might be a time-consuming addition to the day. New Hampshire Trust Withholding Tax Registration and forms like it typically need you to search for them and navigate the way to complete them appropriately. As a result, if you are taking care of economic, legal, or individual matters, using a extensive and practical online catalogue of forms when you need it will go a long way.

US Legal Forms is the top online platform of legal templates, boasting more than 85,000 state-specific forms and numerous tools to assist you complete your documents quickly. Check out the catalogue of appropriate documents accessible to you with just one click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Safeguard your document management processes using a high quality services that lets you put together any form within minutes without extra or hidden charges. Just log in in your account, locate New Hampshire Trust Withholding Tax Registration and download it straight away in the My Forms tab. You may also access formerly downloaded forms.

Would it be the first time making use of US Legal Forms? Register and set up up an account in a few minutes and you’ll have access to the form catalogue and New Hampshire Trust Withholding Tax Registration. Then, adhere to the steps below to complete your form:

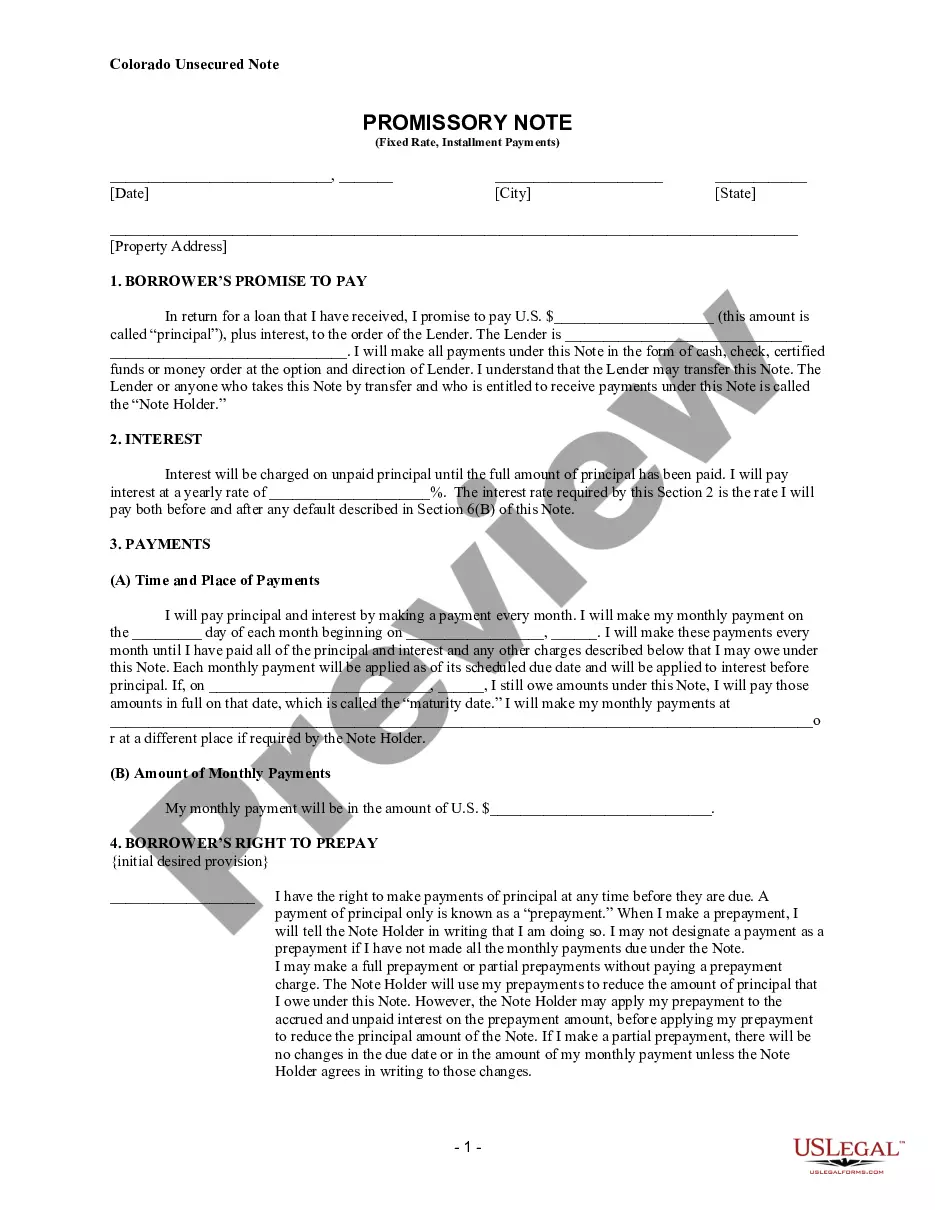

- Be sure you have the right form using the Review option and reading the form description.

- Select Buy Now once ready, and choose the subscription plan that meets your needs.

- Select Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience helping users deal with their legal documents. Obtain the form you need today and streamline any process without having to break a sweat.

Form popularity

FAQ

No Income or Capital Gains Tax One potential benefit to administering a trust in New Hampshire is income and capital gains tax savings. Generally, irrevocable trusts that are administered in New Hampshire (and which are not taxed to the grantor) are not subject to state income or capital gains tax.

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

What is it? A 5% tax is assessed on interest and dividend income. The State of New Hampshire does not have an income tax on an individual's reported W-2 wages.

Thus, the complete list of the federal payroll forms that you would need as an employer in New Hampshire are: W-4 Form: The W-4 Form will provide information on the employee withholdings so that you can properly calculate and withhold federal income taxes.

New Hampshire does not use a state withholding form because there is no personal income tax in New Hampshire.