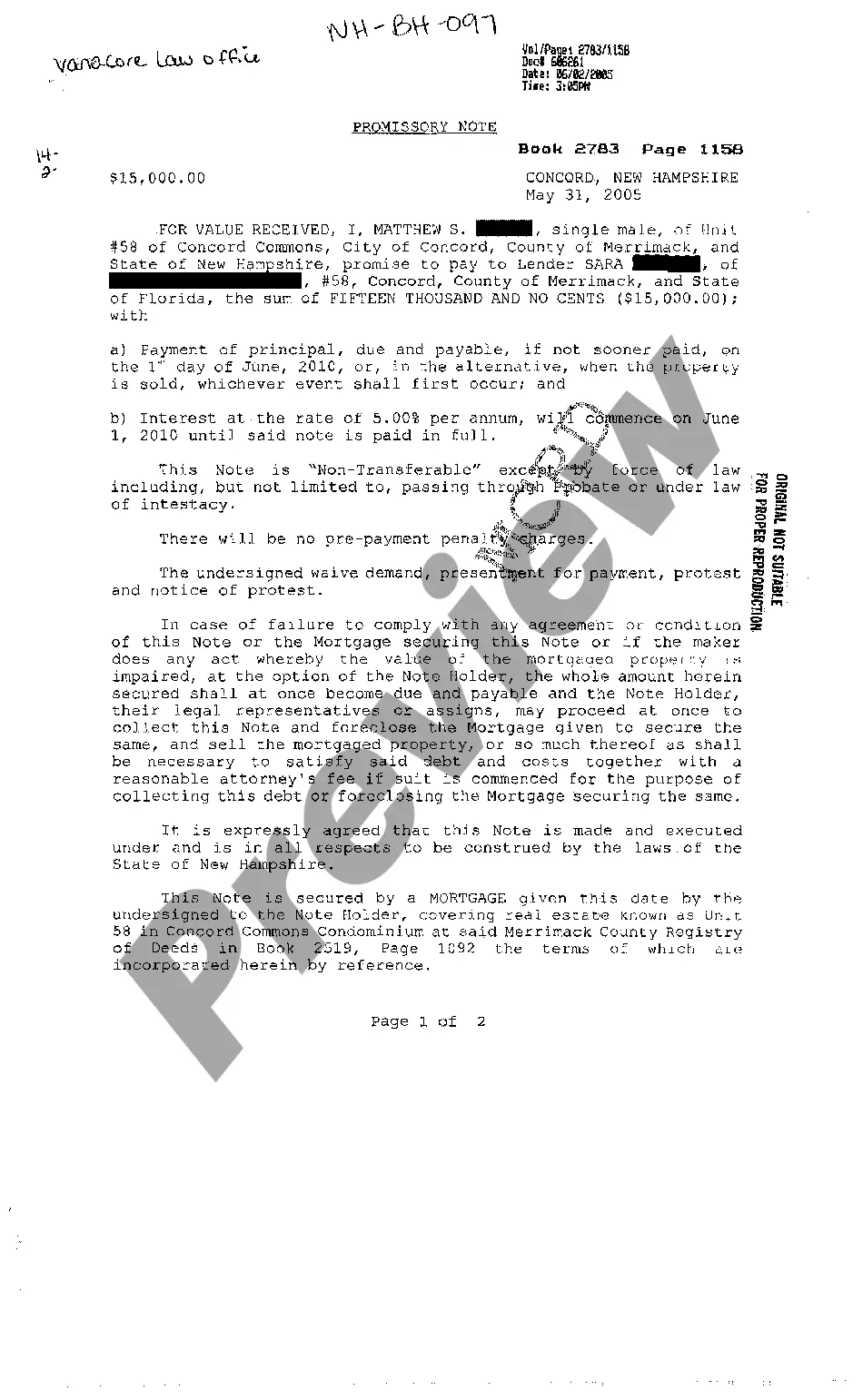

Promissory Note Secured By Mortgage Without

Description

How to fill out New Hampshire Promissory Note Secured By Mortgage?

Maneuvering through the red tape of standard forms and templates can be tough, particularly if one does not engage in such tasks professionally.

Even locating the appropriate template for the Promissory Note Secured By Mortgage Without will prove to be a lengthy process, as it needs to be valid and accurate down to the final digit.

However, you will spend considerably less time searching for a suitable template if it originates from a trustworthy source.

Obtain the correct form in a few simple steps: Enter the name of the document in the search box. Find the relevant Promissory Note Secured By Mortgage Without among the results. Review the description of the sample or view its preview. When the template aligns with your requirements, click Buy Now. Then choose your subscription option. Register for an account at US Legal Forms using your email and create a password. Select a credit card or PayPal payment method. Download the template file on your device in your preferred format. US Legal Forms will save you a significant amount of time ensuring that the form you discovered online is suitable for your requirements. Establish an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the procedure of finding the correct forms online.

- US Legal Forms serves as a centralized hub to discover the latest examples of forms, confirm their usage, and download these documents for completion.

- This is a repository housing over 85K forms that are relevant across multiple professions.

- When searching for a Promissory Note Secured By Mortgage Without, you won’t have to doubt its relevance since all forms are authenticated.

- Having an account at US Legal Forms ensures that all the essential samples are at your fingertips.

- You can store them in your history or add them to the My documents archive.

- Access your stored forms from any device by clicking Log In on the library site.

- If you don’t possess an account yet, you can always initiate a fresh search for the template you require.

Form popularity

FAQ

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

The Difference Between a Promissory Note & a Mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.