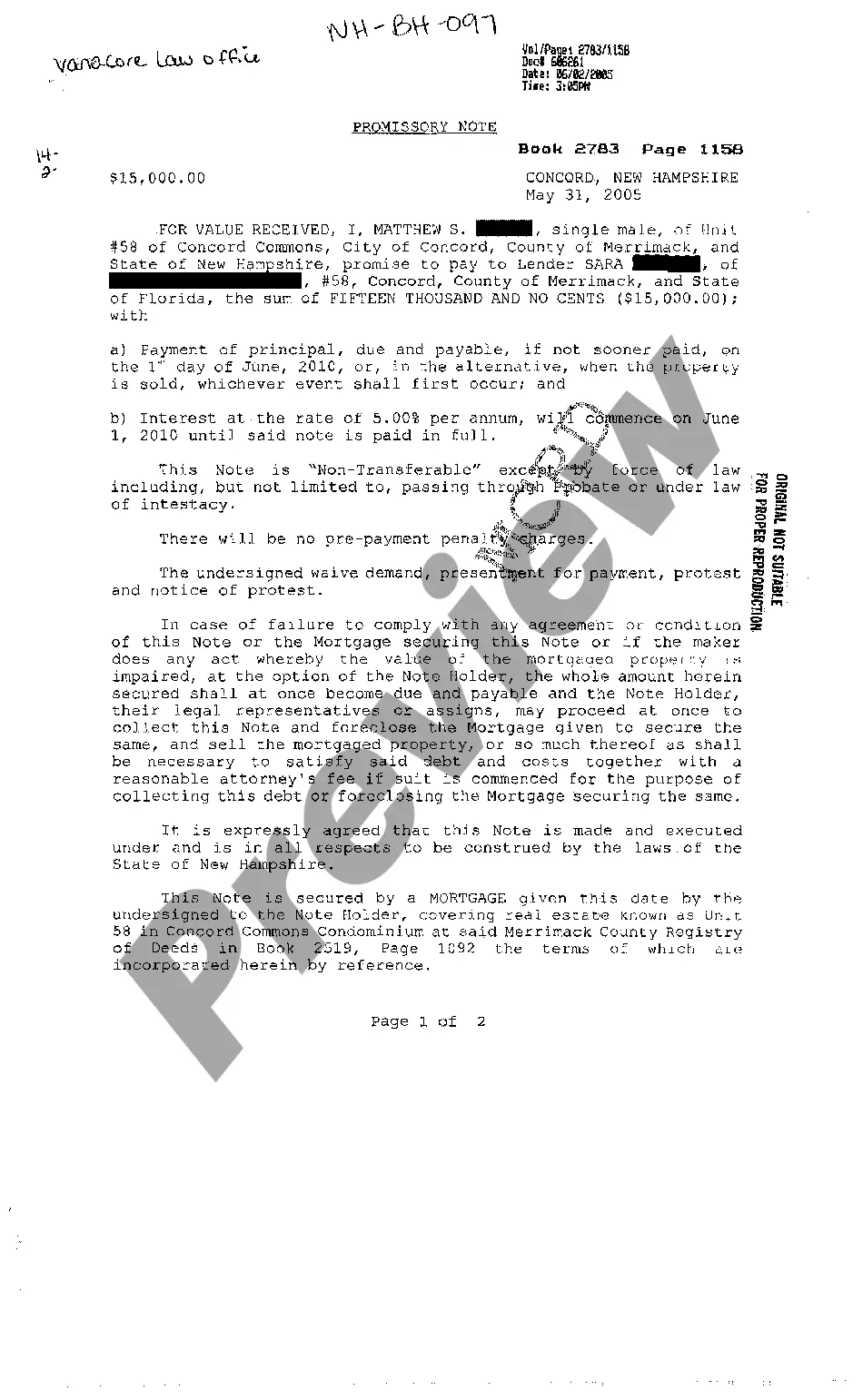

Promissory Note Secured By Mortgage Foreclosure

Description

How to fill out New Hampshire Promissory Note Secured By Mortgage?

Navigating through the red tape of official documents and formats can be challenging, particularly when one does not engage in such activities professionally.

Even locating the correct format for the Promissory Note Backed By Mortgage Foreclosure will consume a considerable amount of time, as it must be valid and precise to the last detail.

Nevertheless, you will invest significantly less time acquiring a suitable format if it originates from a trustworthy source.

Acquire the appropriate document in a few straightforward steps: Enter the document's name in the search section. Locate the suitable Promissory Note Backed By Mortgage Foreclosure among the results. Review the description of the example or view its preview. If the format meets your requirements, click Buy Now. Choose your subscription plan. Utilize your email and set a password to register an account at US Legal Forms. Select a credit card or PayPal payment method. Save the template document on your device in the format you prefer. US Legal Forms can save you considerable time investigating whether the document you discovered online is appropriate for your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the task of locating the appropriate documents online.

- US Legal Forms is a single destination you require to discover the latest examples of documents, understand their use, and download these examples to complete them.

- It is a collection with over 85K documents applicable in various fields.

- When searching for a Promissory Note Backed By Mortgage Foreclosure, you will not need to doubt its validity as all the documents are verified.

- Having an account at US Legal Forms will ensure you possess all the necessary examples at your disposal.

- Store them in your history or add those to the My documents collection.

- You can access your saved documents from any device by simply clicking Log In on the library website.

- If you still lack an account, you can always search again for the template you need.

Form popularity

FAQ

If a promissory note is not paid as agreed, the beneficiary has the right to foreclose upon the property, because the property is the security for the promissory note. If the borrower does not bring the payments current or pay off the existing loan(s) during the foreclosure period, the property goes to auction.

What describes a type of promissory note that is secured by a mortgage loan? A mortgage note. According to the terms of the deed of trust, a borrower must pay all of the following except which? Life insurance.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.

When a borrower loses their home to foreclosure and still owes their lender money after the sale, the remaining debt is usually referred to as a deficiency. Lenders can sue to recover this amount.

The Difference Between a Promissory Note & a Mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.