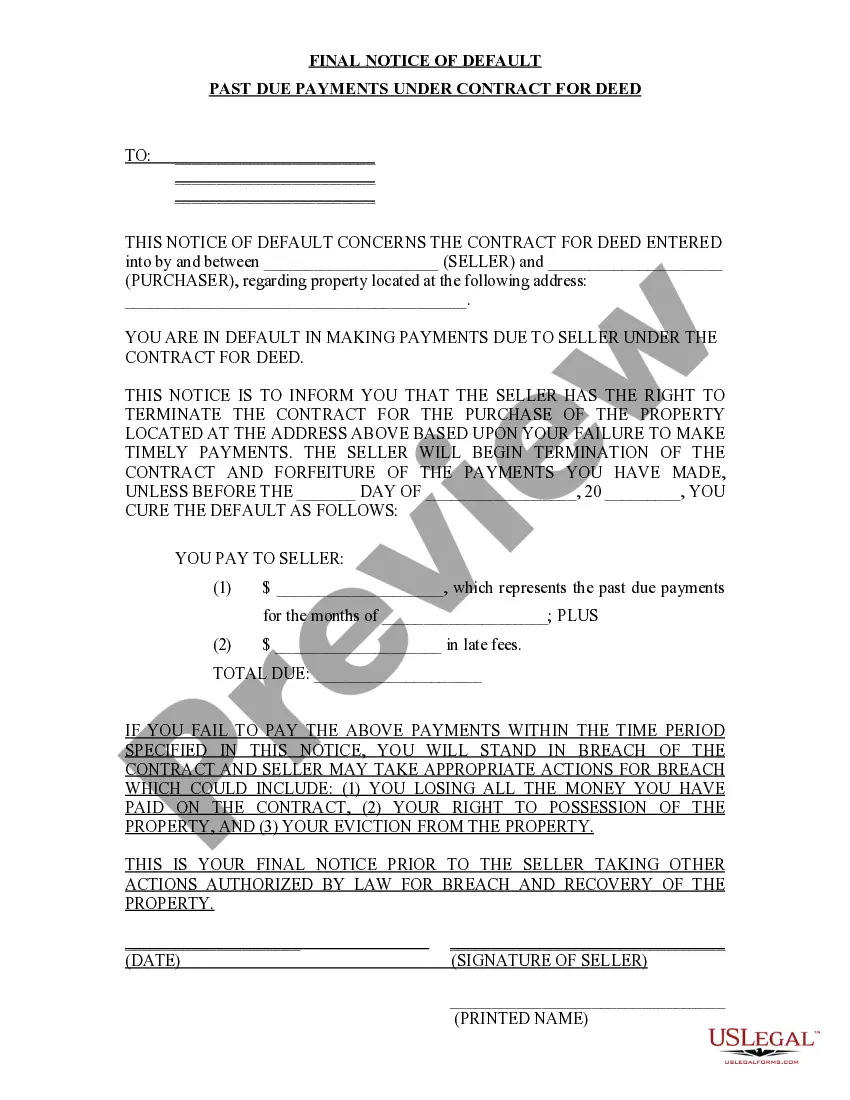

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

New Hampshire Notice Withdrawal Of Foreign Corporation

Description

How to fill out New Hampshire Notice Withdrawal Of Foreign Corporation?

Bureaucracy requires exactness and correctness.

If you do not handle filling out documents like New Hampshire Notice Withdrawal Of Foreign Corporation daily, it may lead to some misunderstanding.

Selecting the appropriate sample from the outset will guarantee that your document submission proceeds smoothly and avert any hassles of re-sending a document or undertaking the same tasks from scratch.

If you are not a registered user, locating the needed sample might require a few additional steps: Locate the template using the search bar. Ensure the New Hampshire Notice Withdrawal Of Foreign Corporation you’ve discovered is pertinent to your state or area. Review the preview or explore the description containing the details on the template's usage. If the result matches your search, click the Buy Now button. Choose the appropriate option among the recommended pricing plans. Log In to your account or sign up for a new one. Complete the purchase using a credit card or PayPal payment method. Save the form in your preferred file format. Finding the correct and up-to-date samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucracy worries and streamline your work with forms.

- You can consistently find the suitable sample for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms that provides over 85 thousand samples for diverse fields.

- You can find the most recent and most fitting version of the New Hampshire Notice Withdrawal Of Foreign Corporation by simply searching it on the platform.

- Identify, save, and download templates in your account or verify with the description to ensure you possess the correct one.

- With an account at US Legal Forms, it’s simple to obtain, organize in one location, and navigate through the templates you keep to access them in mere clicks.

- When on the site, click the Log In button to authenticate.

- Then, navigate to the My documents page, where your forms list is maintained.

- Examine the description of the forms and download those necessary at any moment.

Form popularity

FAQ

New Hampshire does not impose a traditional state income tax on wages or salaries. Instead, the state mainly taxes income from interest and dividends. If you are a foreign corporation operating in New Hampshire, you may need to file a New Hampshire notice withdrawal of foreign corporation to manage your tax obligations effectively. Consider using US Legal Forms to obtain the necessary documentation and ensure compliance.

A company becomes a foreign corporation when it incorporates in one state but operates in another. In the context of New Hampshire, if a corporation is registered in a different state and wants to conduct business there, it must file a New Hampshire notice withdrawal of foreign corporation to formally end its operations. This process ensures compliance with state laws and helps avoid penalties. By understanding the foreign corporation status, businesses can navigate legal requirements more effectively.

A letter of good standing is a document issued by the state that confirms your business's compliance with all legal requirements. It often contains information about your business status and is used in processing various applications or contracts. This letter serves as proof that your organization is in good standing in the state, allowing you to confidently engage in business activities.

When a business is said to be in good standing, it indicates that it has complied with all state requirements, including filing necessary documents and paying fees. This status is important for maintaining the legitimacy of your operations. To assure continual compliance, consider keeping track of important deadlines, including those related to the New Hampshire notice withdrawal of foreign corporation.

Another common term for a certificate of good standing is a certificate of existence. Both documents serve the same purpose, confirming that your business is compliant with state laws. When interacting with financial institutions and other entities, having either document can be essential.

A good standing certificate is an official document that verifies your business is compliant with state regulations. It shows that your company has no outstanding fees or penalties and is legally operating. This document is often required for various business transactions and represents the integrity of your business operations.

Failing to file an annual report for your LLC can lead to penalties, including fines and potential administrative dissolution. It is crucial to keep your business in Good Standing to avoid these issues. The New Hampshire notice withdrawal of foreign corporation may be affected, highlighting the importance of timely filings.

Foreign corporations must typically comply with state laws where they conduct business, which includes registering with the Secretary of State and obtaining necessary permits. They must also adhere to tax regulations and filing requirements specific to each state. In New Hampshire, this adds the importance of maintaining a New Hampshire notice withdrawal of foreign corporation for compliance.

To dissolve a corporation in New Hampshire, you must file a Certificate of Dissolution with the Secretary of State. Additionally, you should resolve all debts and obligations before officially dissolving to avoid complications. Filing a New Hampshire notice withdrawal of foreign corporation may be necessary to complete this process if your corporation was registered as a foreign entity.

To register a foreign corporation in New Hampshire, you must complete and file the appropriate application with the Secretary of State. This includes providing details about your corporation, its formation in another state, and other pertinent information. After filing, you will receive a New Hampshire notice withdrawal of foreign corporation which serves as an official acknowledgment of your registration.