Corporation Contract Sample With Independent Contractor

Description

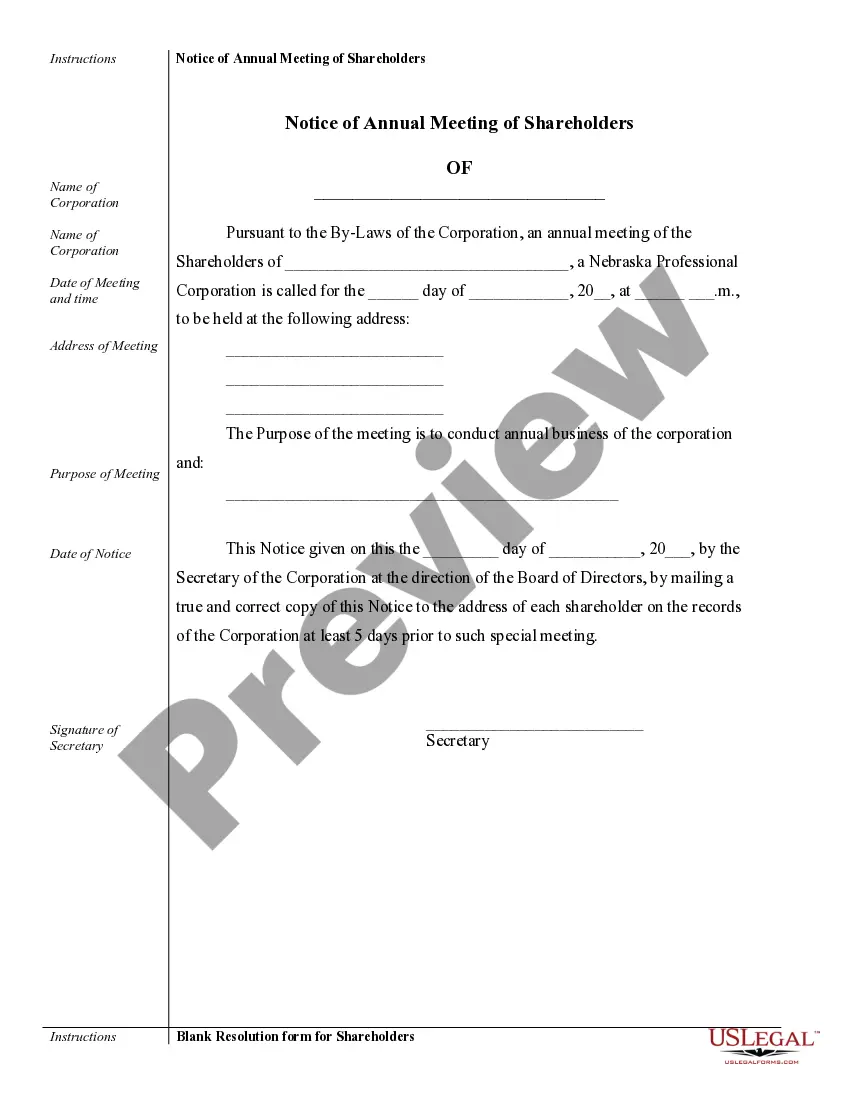

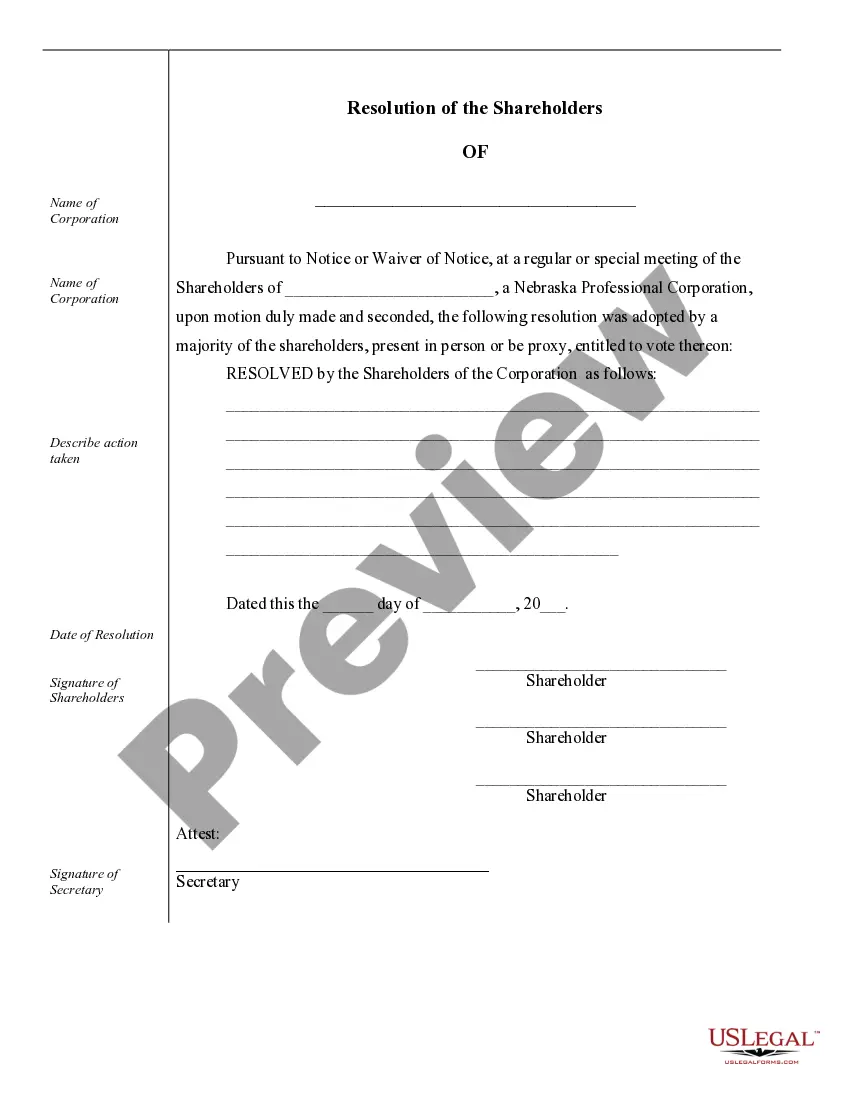

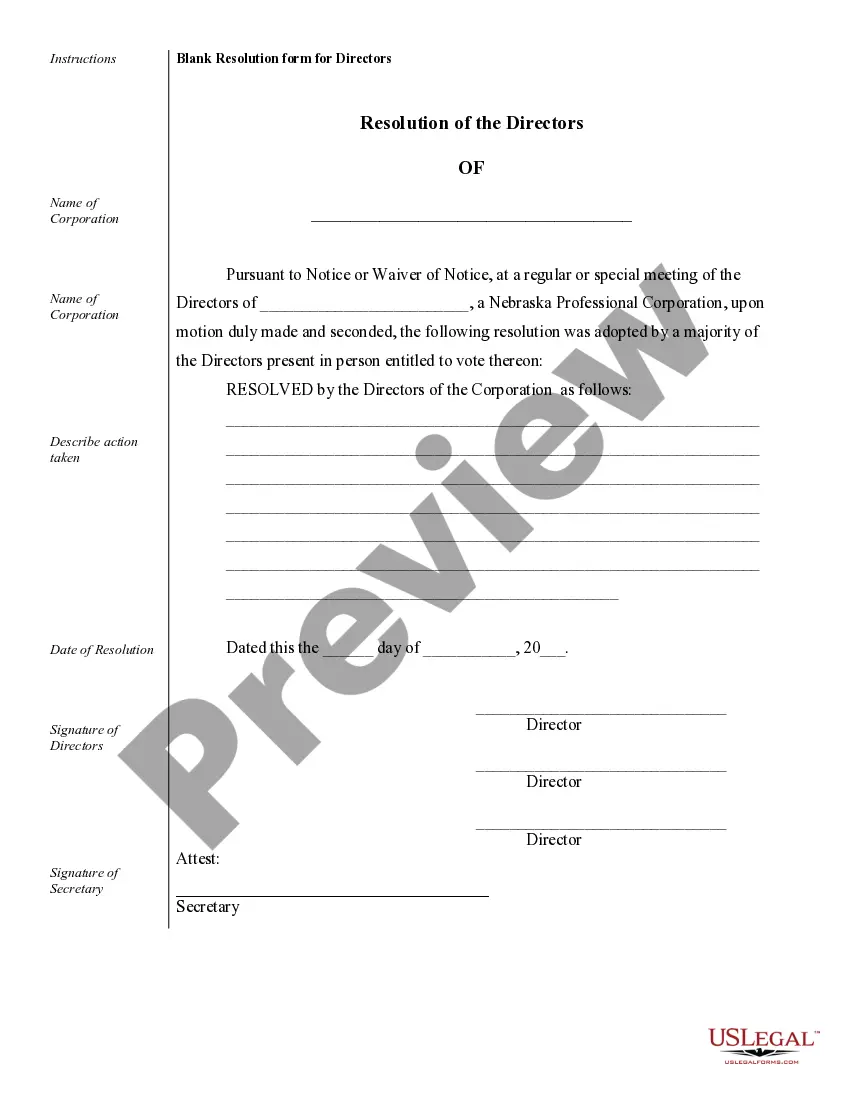

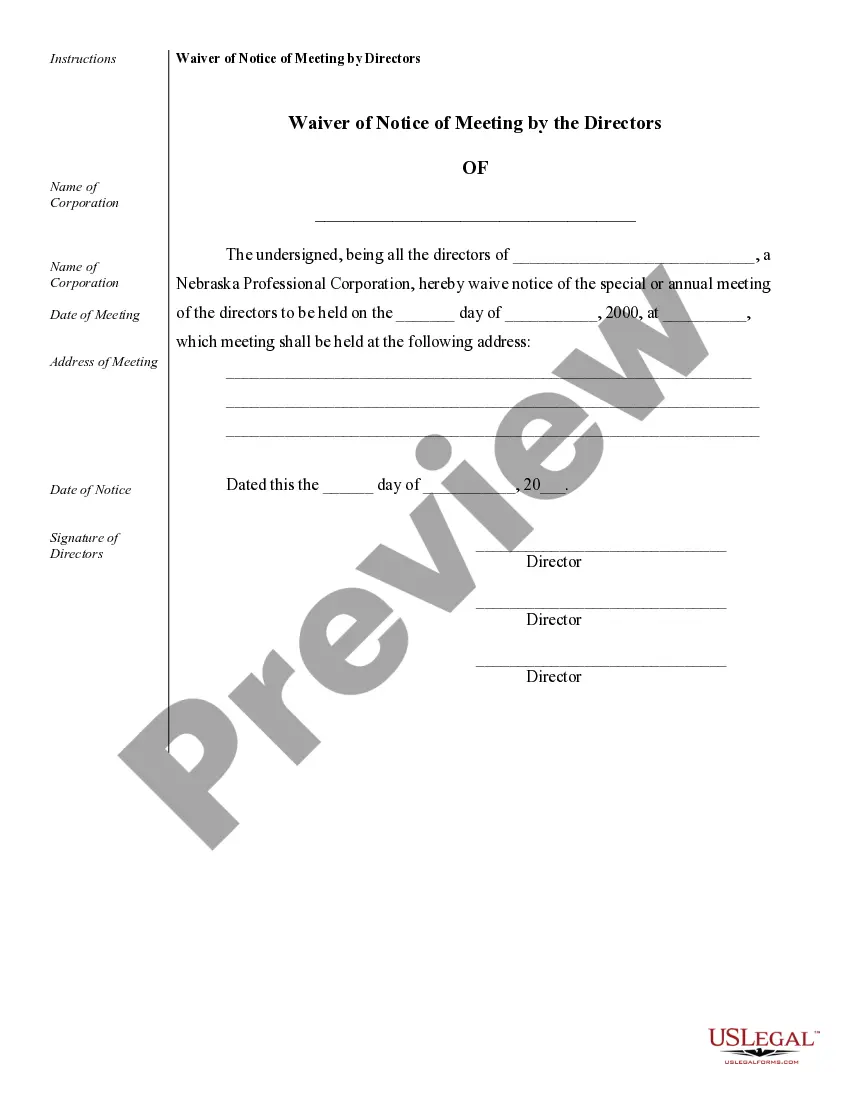

How to fill out Sample Corporate Records For A Nebraska Professional Corporation?

Administration demands exactness and precision.

If you do not regularly handle document completion like the Corporation Contract Sample With Independent Contractor, it may result in some misinterpretations.

Selecting the appropriate sample from the beginning will ensure that your document submission proceeds smoothly and avert any complications of resending a document or duplicating work from scratch.

Acquiring the correct and current samples for your documentation is a matter of a few minutes with an account at US Legal Forms. Eliminate any bureaucratic uncertainties and enhance your efficiency in handling paperwork.

- Locate the template using the search bar.

- Verify that the Corporation Contract Sample With Independent Contractor you discovered is valid for your state or county.

- Access the preview or review the description that outlines the details regarding the sample's application.

- If the result meets your requirements, click the Buy Now button.

- Choose the appropriate option from the available pricing plans.

- Log In to your existing account or establish a new one.

- Complete the transaction using a credit card or PayPal.

- Download the document in your preferred format.

Form popularity

FAQ

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

An independent contractor is a person, business, or corporation that provides goods or services under a written contract or a verbal agreement. Unlike employees, independent contractors do not work regularly for an employer but work as required, when they may be subject to law of agency.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.