Lien Subordination Agreement Form For Second

Description

How to fill out Nebraska Lease Subordination Agreement?

Red tape necessitates exactness and precision.

Unless you engage with completing paperwork such as Lien Subordination Agreement Form For Second on a daily basis, it may lead to some confusions.

Selecting the correct template from the outset will ensure that your document submission proceeds without hitches and avert any issues of resubmitting a document or repeating the same task from the beginning.

Peruse the descriptions of the forms and download the ones you need at any time. If you are not a registered user, finding the desired template would require a few extra steps: Find the template using the search function. Ensure that the Lien Subordination Agreement Form For Second you’ve identified is valid for your state or locality. View the preview or consult the description that includes the guidelines for the template's use. If the result corresponds to your search, click the Buy Now button. Choose the suitable option from the available pricing plans. Sign in to your account or create a new one. Finalize the purchase using a credit card or PayPal payment method. Acquire the form in your preferred file format. Locating the correct and current samples for your paperwork can be accomplished in just a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and enhance your efficiency with documents.

- You can consistently locate the appropriate template for your documentation in US Legal Forms.

- US Legal Forms stands as the largest online forms repository featuring over 85 thousand templates across various domains.

- You can obtain the most recent and pertinent version of the Lien Subordination Agreement Form For Second by simply navigating the website.

- Identify, save, and download templates to your account or check the description to confirm you possess the correct one.

- With an account at US Legal Forms, you can conveniently gather, store together, and explore the templates you have saved for quick access.

- When on the site, click the Log In button to sign in.

- Next, go to the My documents page, where your forms are maintained.

Form popularity

FAQ

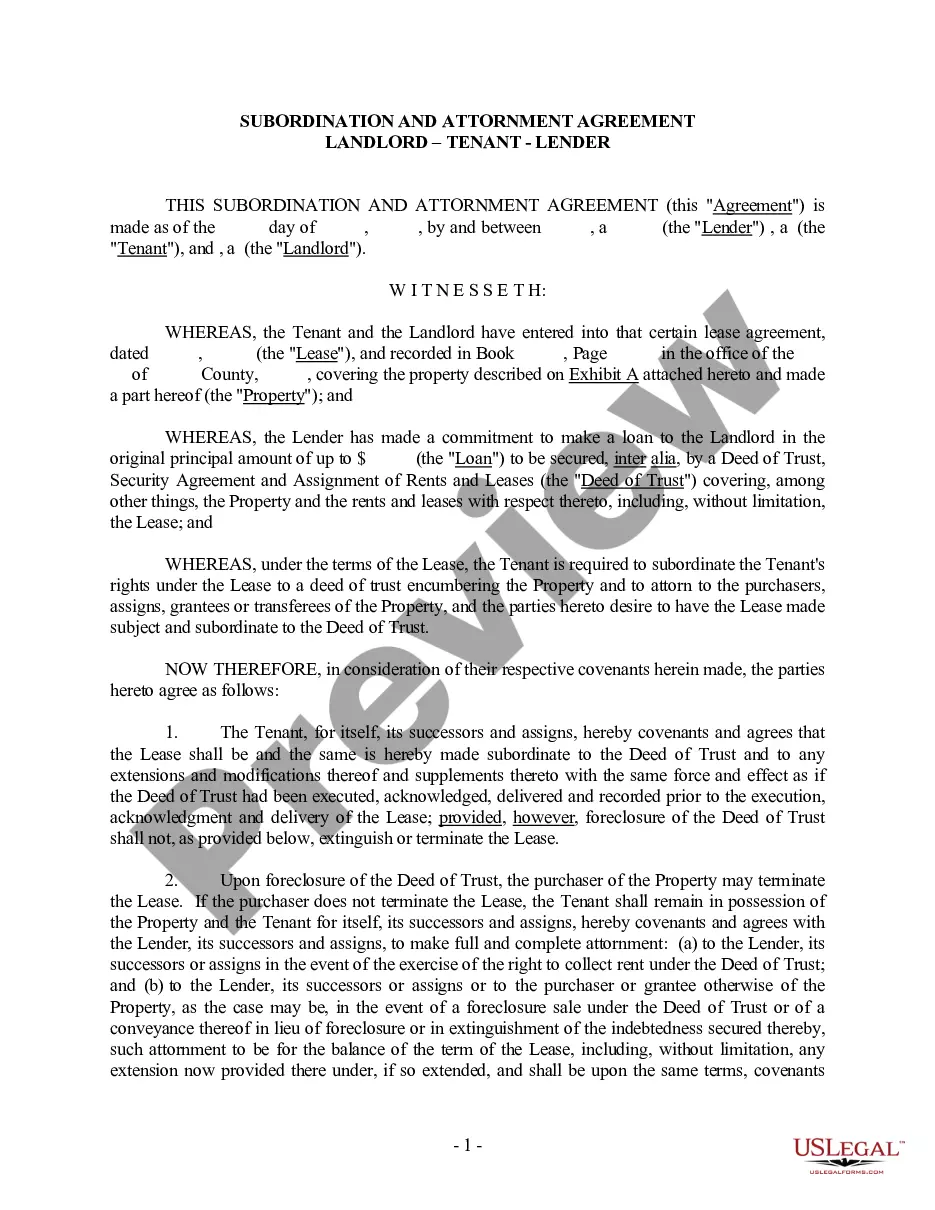

The most common type of subordinate lien is a second mortgage. When you get a second mortgage loan, the lender records the lien, representing its claim on the collateral: your real estate. Because your first mortgage provider has the first claim on the property, the second mortgage is considered a subordinate lien.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

The existing second loan moves up to become the first loan. The lender of the first mortgage refinancing will now require that a subordination agreement be signed by the second mortgage lender to reposition it in top priority for debt repayment.

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans your mortgage and HELOC. Both are secured by the collateral in your home at the same time.

Getting A Second MortgageA second mortgage will become a subordinate loan. If you repay the primary loan within the term of the second mortgage, then the second mortgage can take its place as the primary loan. As a second mortgage, the lender will be taking on more risk.