Recorded Lien Individual For The Following

Description

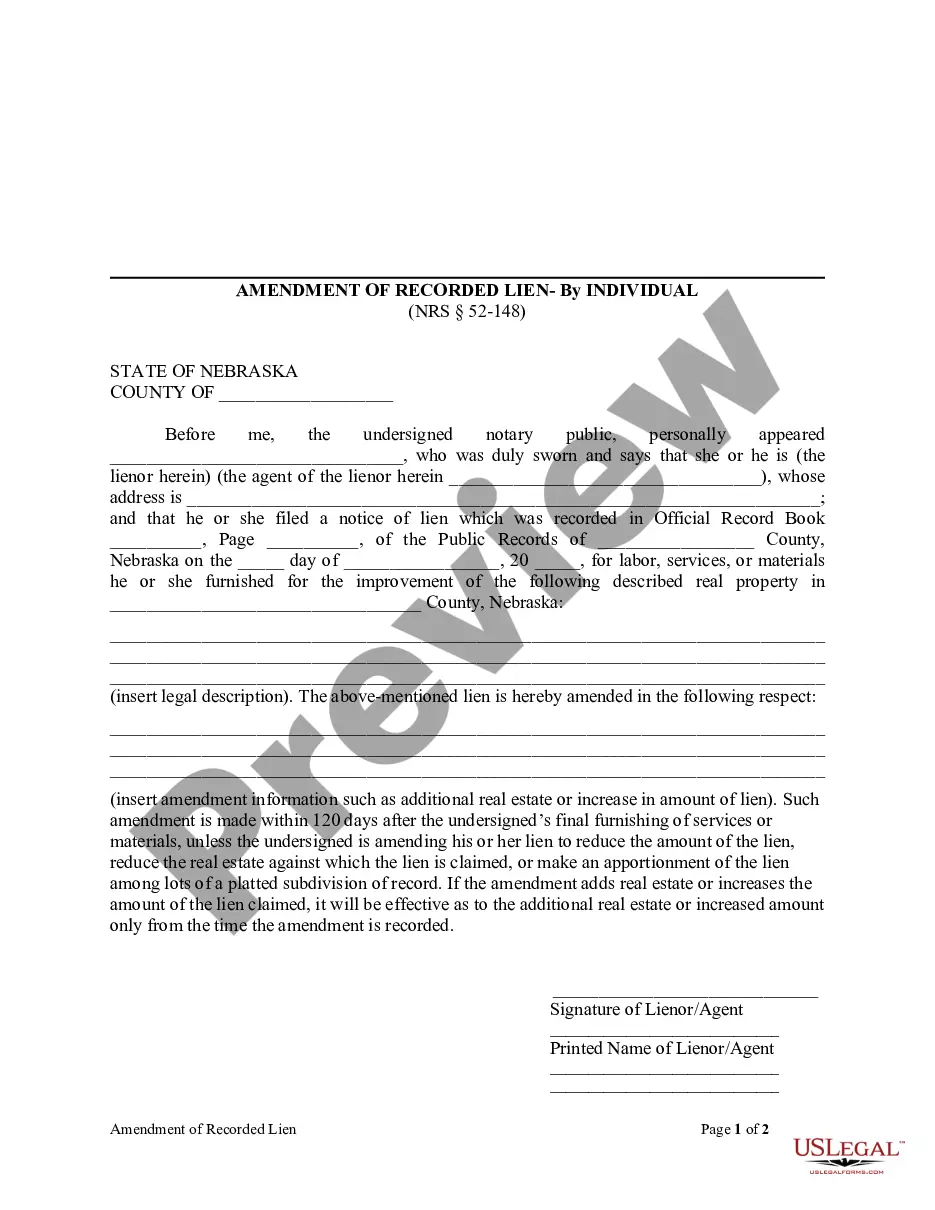

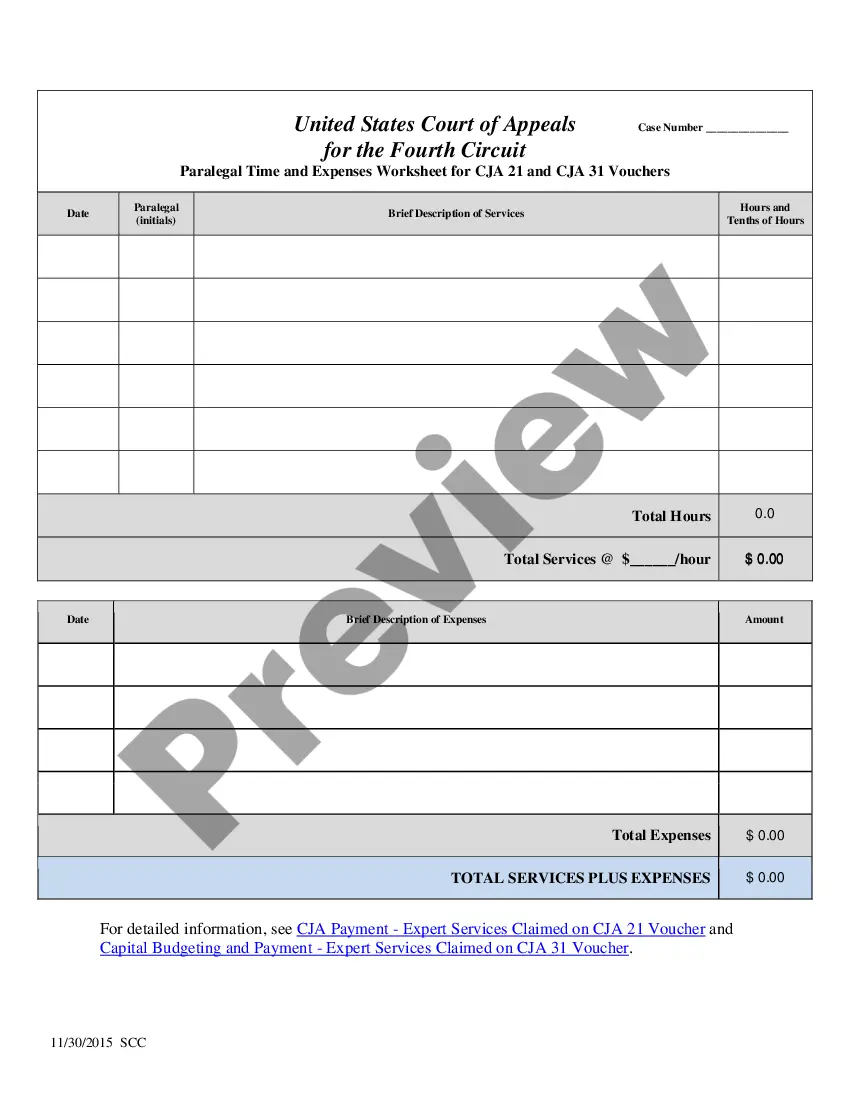

How to fill out Nebraska Amendment Of Recorded Lien - Individual?

- If you're a returning user, log in to your account and download the necessary form template by clicking the Download button, ensuring your subscription is up-to-date. If required, renew your account accordingly.

- For first-time users, begin by reviewing the Preview mode and description of your desired form. Ensure it aligns with your specific needs and local regulations.

- Should you need a different template, utilize the Search tab to locate a fitting option. Confirm it meets your criteria before proceeding.

- Complete your purchase by clicking on the Buy Now button and selecting your subscription plan. An account registration will grant you access to the comprehensive library.

- Finalize your transaction by entering your payment information through credit card or PayPal. Upon completion, download your form to save it for future use.

- Access your downloaded template anytime in the My Forms section of your profile.

Embracing US Legal Forms not only streamlines your legal documentation process but also ensures compliance with local laws through its robust collection of over 85,000 forms.

Start harnessing the power of professional legal documents today with US Legal Forms – your go-to source for simplicity and accuracy in legal documentation.

Form popularity

FAQ

Yes, someone can put a lien on your house without your knowledge. This typically occurs when a creditor files a claim due to an unpaid debt, which then becomes a recorded lien individual for the following. To protect yourself, it is wise to regularly check property records and be aware of any potential claims against your property.

To file a lien in Texas, you must gather specific information such as the debtor's details, property description, and the amount owed. You will need to complete a lien form and submit it to the appropriate county office. A recorded lien individual for the following has specific requirements, and using US Legal Forms can guide you through the process to ensure compliance.

In Virginia, you generally have six months to file a lien from the time the debt becomes due. However, this timeframe can vary based on the type of lien and the specific situation. Utilizing a reliable platform like US Legal Forms can help you navigate these timelines effectively and ensure your recorded lien individual for the following adheres to state regulations.

When a lien is recorded, it means that a legal claim has been filed with a government authority against a property. This claim indicates that there is an outstanding debt associated with that property. Consequently, a recorded lien individual for the following can affect a property's sale and title transfer, making it essential to handle such claims carefully.

Yes, you can file a lien online. Many states offer electronic filing options that make the process quick and easy. By using platforms like US Legal Forms, you can simplify the filing of a recorded lien individual for the following. Online filing often speeds up the processing time and increases accessibility.

When a lien is placed on you, it signals that a creditor has a legal claim to your property due to unpaid debt. This recorded lien individual for the following can hinder your ability to obtain loans and may lead to challenges in selling your assets. Moreover, the lien often remains attached to your property until you address the debt. Knowing your options can help you resolve the situation and move forward.

A recorded lien is a legal claim against your property, indicating that a debt remains unpaid. When a recorded lien individual for the following is filed, it becomes part of public records, warning potential creditors about the existing obligation. This status can affect your creditworthiness and restrict your ability to sell or refinance your property. Understanding this term is essential for anyone navigating financial obligations.

A recorded lien individual for the following can have significant effects on your financial standing. When a lien is placed, it may limit your ability to secure loans or credit, as lenders view it as a risk. Additionally, the lien may appear on public records, potentially harming your credit score. Understanding how a lien impacts you is essential for managing your finances effectively.

No, a release of lien is not the same as a title. A release of lien indicates that the lien holder no longer has a claim on the property, while the title proves ownership. Understanding these distinctions is important for anyone dealing with property transactions. A clear title is essential for any recorded lien individual for the following situations.

You can obtain a lien release letter by directly contacting the lien holder, who is typically the creditor. Provide necessary details, such as the account number and proof of payment. It's crucial to ensure that all financial obligations are fulfilled before requesting this letter. Utilizing platforms like US Legal Forms can streamline the process for any recorded lien individual for the following requests.