Transfer On Death Deed In Nebraska

Description

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

Identifying a reliable source to obtain the most up-to-date and pertinent legal templates is a significant portion of managing bureaucracy.

Securing the appropriate legal documentation necessitates precision and meticulousness, which is why acquiring samples of a Transfer On Death Deed in Nebraska solely from trustworthy providers, such as US Legal Forms, is crucial. An incorrect template can consume your time and prolong your circumstances.

Eliminate the inconvenience associated with your legal documentation. Explore the comprehensive US Legal Forms repository where you can locate legal templates, verify their applicability to your situation, and download them instantly.

- Use the catalog navigation or search bar to find your template.

- Review the form’s description to verify if it aligns with your state and county requirements.

- Access the form preview, if available, to confirm it’s the document you seek.

- Return to the search and identify the correct document if the Transfer On Death Deed in Nebraska does not meet your needs.

- When confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing plan that suits your needs.

- Proceed with registration to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Transfer On Death Deed in Nebraska.

- Once the form is on your device, you can edit it with the editor or print it and complete it manually.

Form popularity

FAQ

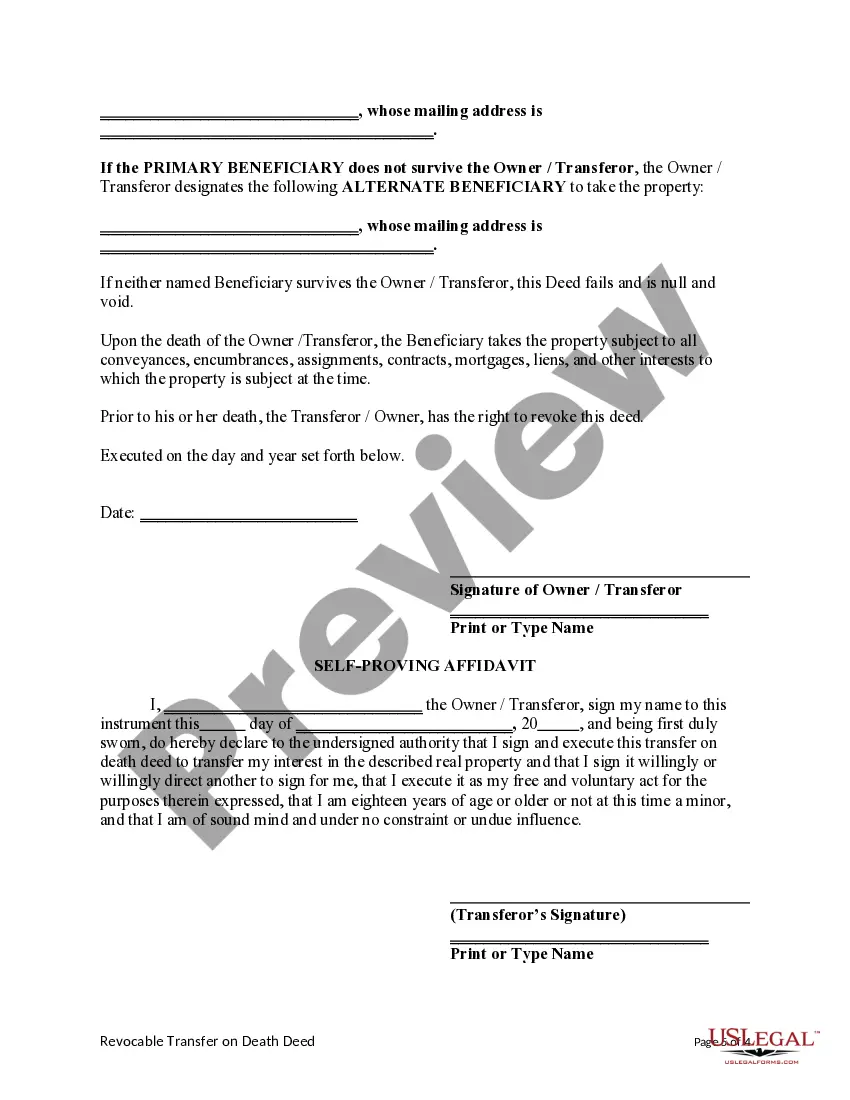

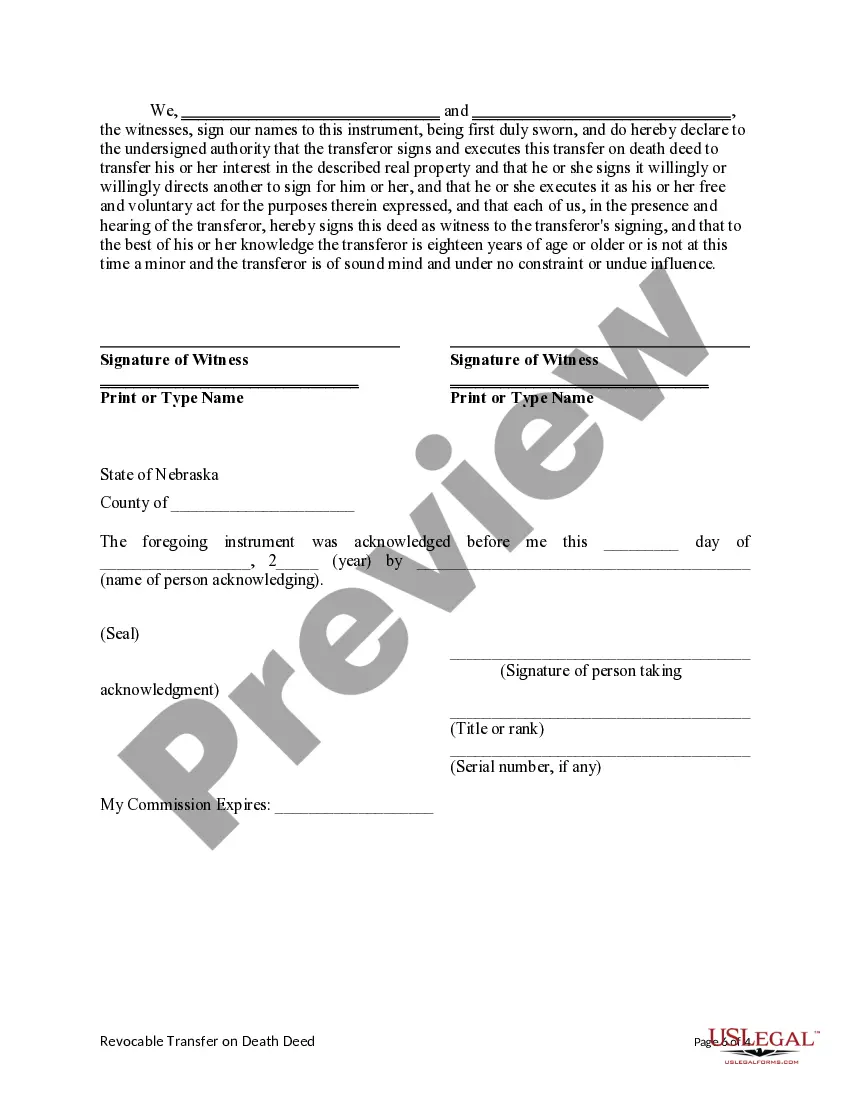

To create a valid transfer on death deed in Nebraska, you must be the sole owner or co-owner of the property. The deed must explicitly state that it will transfer the property upon your death and must be signed in front of a notary. Additionally, filing the deed with the county register of deeds is necessary to make it effective. Ensuring compliance with these requirements can prevent future legal issues, and platforms like uslegalforms can assist you in preparing the right documentation.

No, you do not need an attorney to create a transfer on death deed in Nebraska, but having legal assistance can be beneficial. Having a knowledgeable attorney can help you understand the implications of the deed. They will guide you through the necessary steps and help you avoid pitfalls that could arise during the inheritance process.

You do not necessarily need a lawyer for a transfer on death deed in Nebraska, but consulting one is highly recommended. A legal professional can help ensure the deed meets all requirements and reflect your intentions accurately. They also help navigate any potential complications regarding property ownership and beneficiary rights, making the process smoother for you and your loved ones.

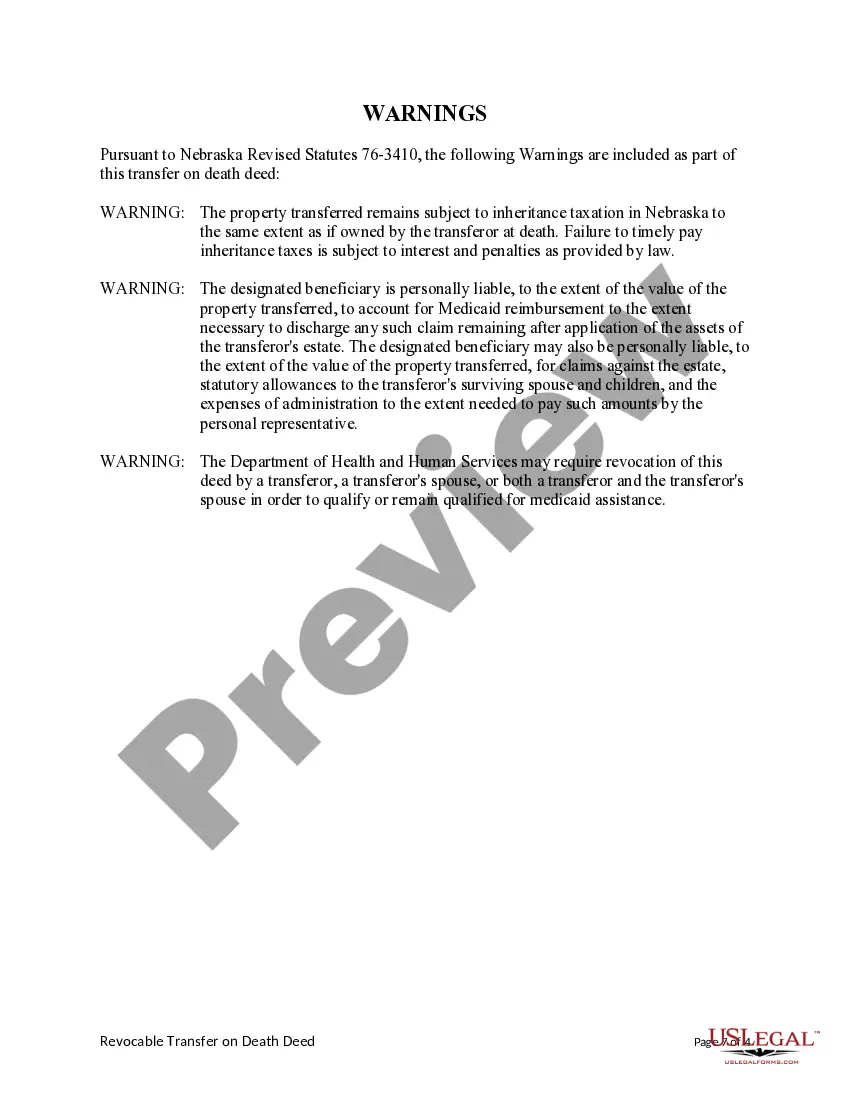

While a transfer on death deed in Nebraska simplifies the transfer process, it has some disadvantages. One major concern is that it doesn't protect beneficiaries from creditors that may pursue the deceased's estate. Additionally, if you change your mind, revoking the deed can be complicated. It’s also important to be aware that real estate transferred this way does not avoid probate unless the owners' estate includes only the property in the deed.

Choosing between a transfer on death deed in Nebraska and a designated beneficiary often depends on individual circumstances. A TOD deed generally avoids the probate process, providing a more streamlined transfer of property, while beneficiary designations can be more suitable for certain financial accounts. Always assess your specific needs and consult with a legal professional to ensure that your choice aligns with your estate planning goals.

One key issue with transfer on death accounts is the potential for family disputes after the account holder's passing. The transfer on death deed in Nebraska can complicate estate planning if other legal documents do not align with the designated beneficiaries. Moreover, if someone contests the transfer, it may lead to legal battles that could drain resources and create stress for loved ones left behind.

The transfer on death deed in Nebraska does not inherently avoid inheritance tax. However, it allows the designated beneficiary to take ownership of the property without probate, which can expedite the process and potentially minimize administrative costs. It's important to consult with a tax professional to understand the tax implications specific to your situation, as beneficiary designations can impact estate taxes.

While a transfer on death deed in Nebraska provides a straightforward way to transfer property, there are some potential drawbacks. First, this type of deed does not offer protection from creditors. Additionally, if the property owner has significant debts, the property might not be protected from claims during the owner's lifetime. Lastly, relying solely on a transfer on death deed can lead to confusion among heirs if not properly communicated.

You do not necessarily need a lawyer to execute a transfer on death deed in Nebraska, but it may be beneficial for your peace of mind. If you feel unsure about the process or the legal implications, consulting with a lawyer can provide clarity. However, many individuals successfully navigate this process independently, especially with helpful resources like USLegalForms available to guide you through. Ultimately, your comfort level will dictate whether you seek legal assistance.

To file a transfer on death deed in Nebraska, you first need to complete the deed form, including essential details such as your name, the property description, and the beneficiary's information. Afterward, you must sign the deed in the presence of a notary public. It is important to then file the completed deed with the local county register of deeds to ensure it becomes effective. Using USLegalForms can simplify this process by providing the right forms and guidance for transferring property smoothly.