Nebraska Bill Of Sale Requirements

Description

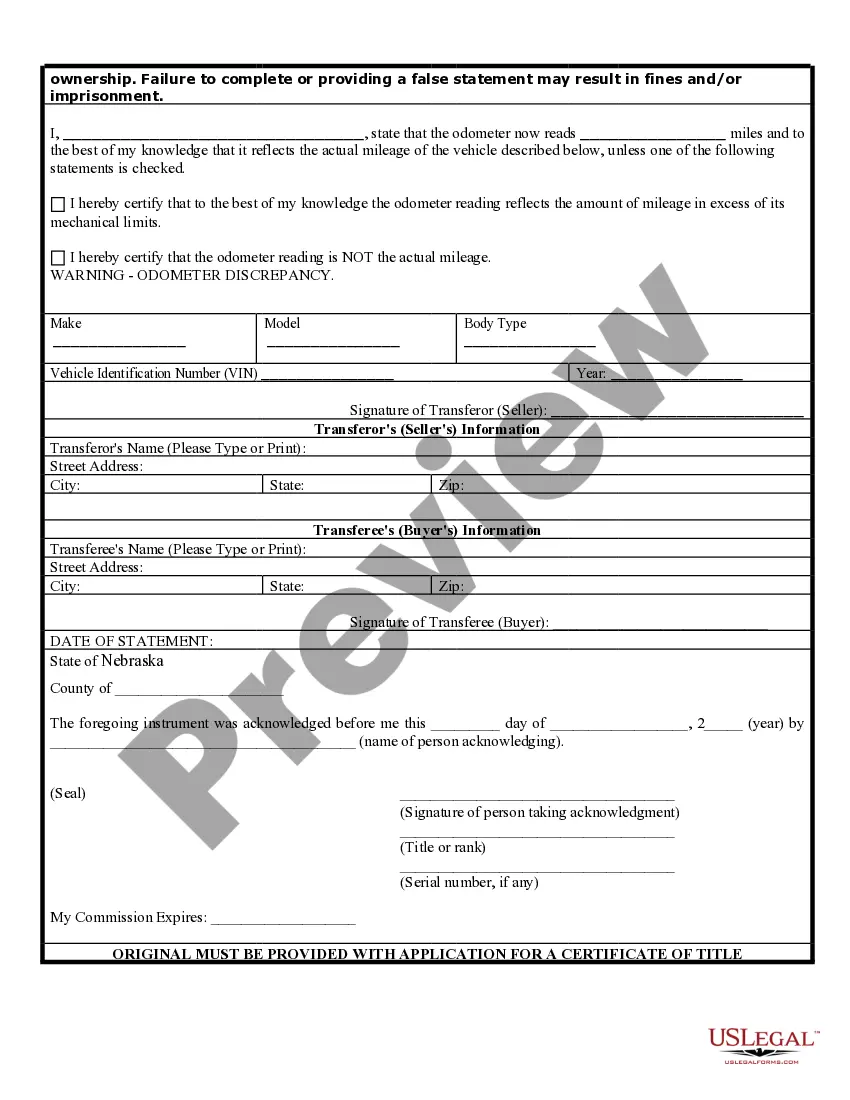

How to fill out Nebraska Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Legal administration may be overwhelming, even for the most proficient specialists.

When you are in search of Nebraska Bill Of Sale Requirements and lack the time to locate the accurate and current version, the tasks can be challenging.

Access a repository of articles, guides, handbooks, and materials pertinent to your circumstances and requirements.

Conserve time and effort in searching for the documents you need, and utilize US Legal Forms’ advanced search and Preview function to obtain Nebraska Bill Of Sale Requirements and secure it.

Experience the US Legal Forms online library, backed by 25 years of expertise and reliability. Transform your everyday document management into a seamless and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Visit the My documents tab to view the documents you have previously saved and manage your folders as needed.

- If it is your first time using US Legal Forms, create a free account for unlimited access to all the benefits of the library.

- After downloading the required form, ensure it is the correct one by previewing it and checking its details.

- Confirm that the sample is approved in your state or county.

- Select Buy Now when you are ready.

- Pick a subscription plan.

- Determine the file format you need, and Download, complete, sign, print, and forward your documents.

- Utilize state- or county-specific legal and business documents.

- US Legal Forms meets any requirements you may have, from personal to corporate paperwork, all in one place.

- Leverage cutting-edge tools to fulfill and manage your Nebraska Bill Of Sale Requirements.

Form popularity

FAQ

Yes, a bill of sale is required for private car sales in Nebraska. Form 6 needs to be completed and signed by both the buyer and the seller in the presence of a notary.

FAQ: About the Nebraska Bill of Sale Date of purchase. Contact information of buyer and seller. Purchase amount. Description of the sold item. Guarantee that the asset is cleared of any liens or claims. Ongoing terms, such as warranties. Signatures of buyer and seller. Signature of a notary public.

The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 ? Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle And Trailer Sales.

FAQ: About the Nebraska Bill of Sale Date of purchase. Contact information of buyer and seller. Purchase amount. Description of the sold item. Guarantee that the asset is cleared of any liens or claims. Ongoing terms, such as warranties. Signatures of buyer and seller. Signature of a notary public.

When a person purchases a vehicle from a private party, they need to have them write out a "Bill of Sale". It can be written or typed but it needs to include the purchaser and sellers names, the Vehicle Identification Number of the vehicle, sale date, and the sale price.