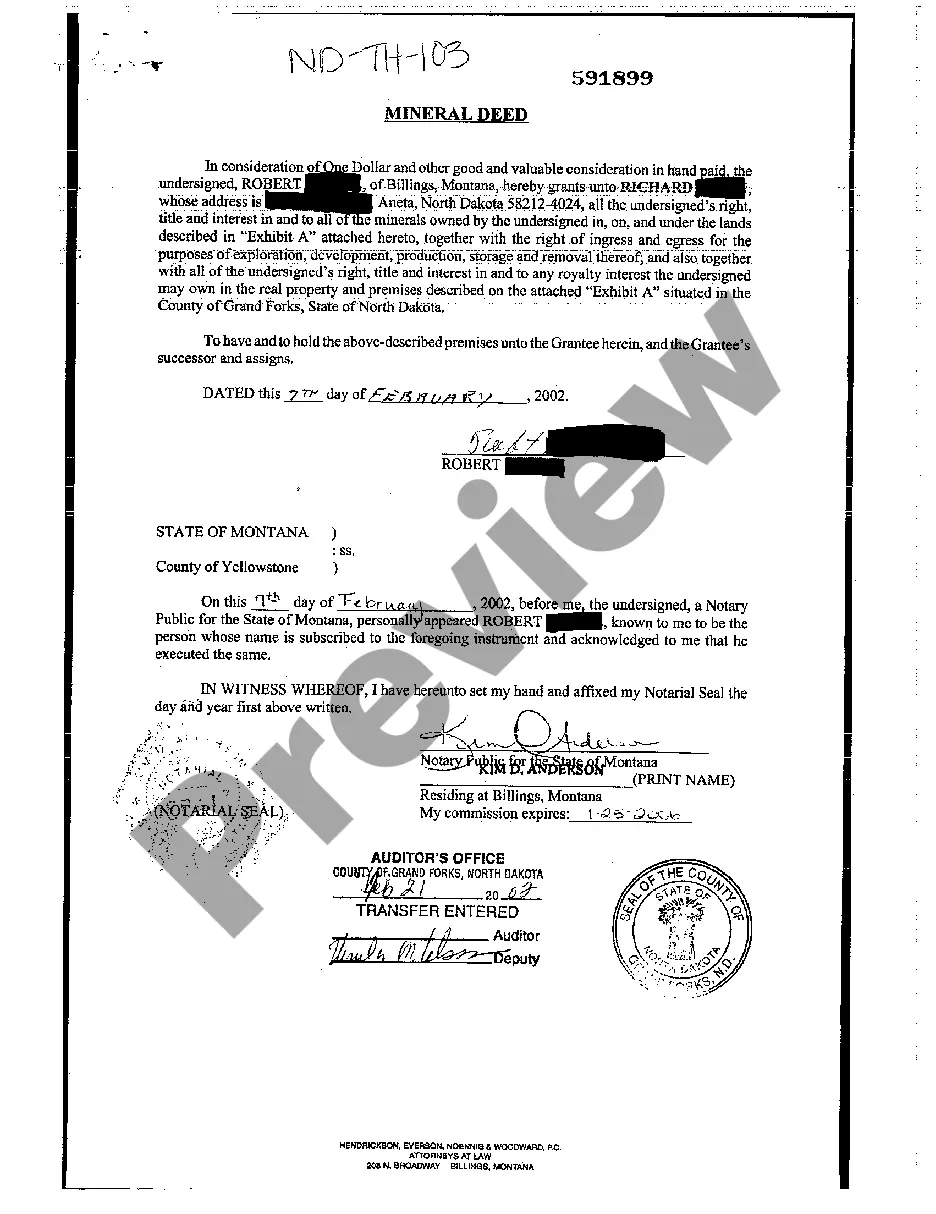

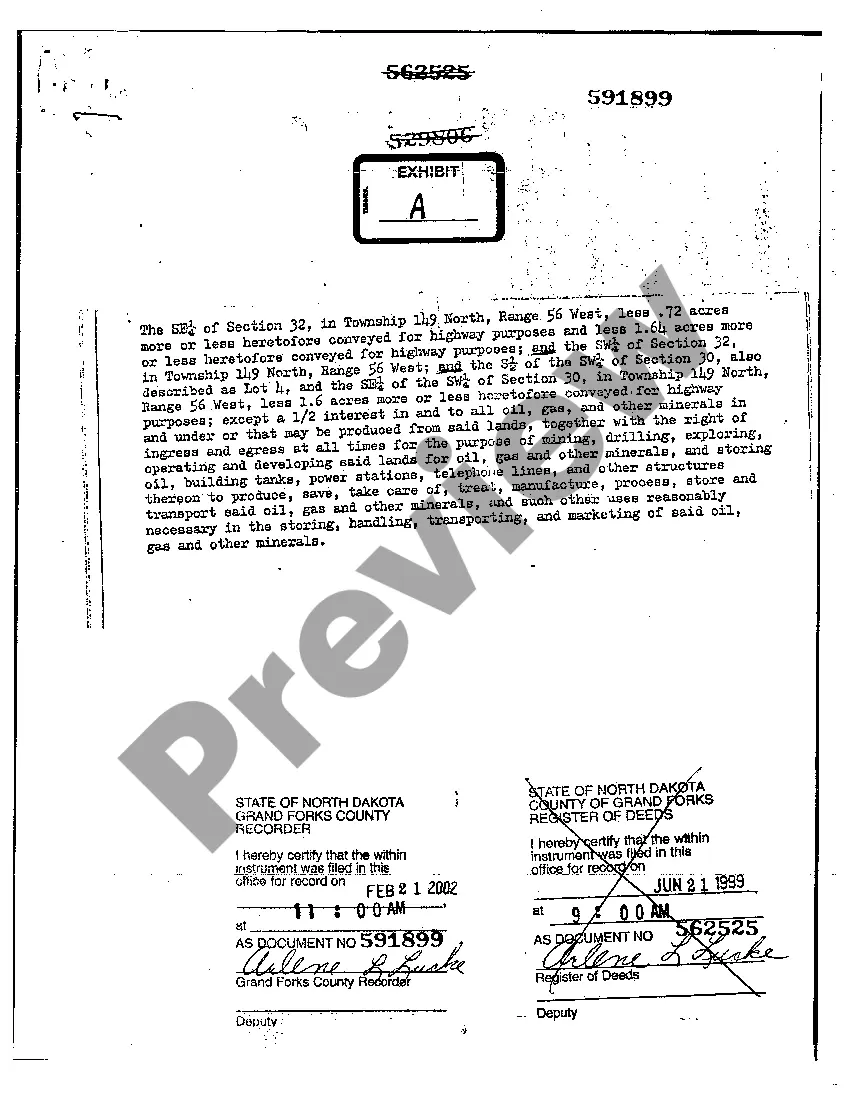

Mineral Rights Deed Form

Description

How to fill out North Dakota Mineral Deed Individual To Individual?

There's no longer a need to squander time searching for legal papers to meet your local state's mandates.

US Legal Forms has gathered all of them in a single location and streamlined their availability.

Our platform offers over 85,000 templates for any business and personal legal needs organized by state and area of application.

Employ the search bar above to look for another template if the previous one wasn’t suitable. Once you find the appropriate one, click Buy Now next to the template title. Select the most suitable subscription plan and either create an account or Log In. Proceed with payment for your subscription using a credit card or PayPal to continue. Choose the file format for your Mineral Rights Deed Form and download it to your device. You can print out the form to fill it out by hand or upload the sample if you prefer completing it in an online editor. Preparing legal documents under federal and state statutes is quick and easy with our library. Try US Legal Forms today to maintain your documentation organized!

- All documents are expertly prepared and confirmed for authenticity, ensuring you can confidently acquire an up-to-date Mineral Rights Deed Form.

- If you are acquainted with our service and already possess an account, please verify that your subscription is active before accessing any templates.

- To access your account, click Log In, choose the document, and press Download.

- You can also revisit all previously obtained documents at any time by navigating to the My documents tab in your profile.

- If you haven't utilized our service before, the procedure will involve a few additional steps to finalize.

- Here’s how new users can acquire the Mineral Rights Deed Form from our collection.

- Review the page carefully to ensure it includes the sample you need.

- Utilize the form description and preview options, if available.

Form popularity

FAQ

To transfer ownership of mineral rights in Texas, you must prepare a mineral rights deed form that outlines the specifics of the transfer. This form must include details like the names of the parties involved, a clear description of the mineral rights being transferred, and any considerations exchanged. Once completed, this deed should be filed with the county clerk's office. Engaging with a professional service can ensure accuracy and compliance with local laws.

Claiming mineral rights in Texas involves several steps, including researching existing ownership and potentially filing a claim. You start by obtaining a mineral rights deed form to establish your claim formally. This process usually requires proof of ownership and any supporting documentation. Using a reliable platform like US Legal Forms can streamline this process with easy-to-access templates.

To reserve mineral rights in Texas, you would typically use a mineral rights deed form. This document explicitly allows the landowner to retain ownership of minerals while transferring surface rights. By utilizing this form, you can clearly delineate which rights you intend to keep. Properly executed forms prevent misunderstandings and protect your interests.

In Texas, mineral rights do not automatically convey with the sale of land. Instead, a specific mineral rights deed form must be completed to ensure proper transfer. If the deed does not explicitly mention the mineral rights, they may remain with the seller. Hence, it is essential to clarify these rights during any land transaction.

A royalty interest in Texas is the right to receive a portion of the profits generated from minerals extracted from a property. It does not include ownership of the land but grants you a financial stake in the resources below. When establishing this interest, using a mineral rights deed form is vital for documenting your rights clearly. It ensures that all parties understand their entitlements, making the process smoother.

Royalty refers to the payment received by the mineral rights owner based on the production of minerals, while interest signifies ownership rights in a mineral estate. When you have a royalty interest, you own a portion of the revenue generated from the minerals extracted. Utilizing the mineral rights deed form will clarify these distinctions when transferring or assigning interests.

In Texas, you should use a mineral rights deed form to properly convey your mineral interests. This legal document outlines the specific rights being transferred and protects your interests. Additionally, ensure that the form complies with state laws for it to be valid. You can find templates for these forms through platforms like US Legal Forms, which simplify the process.

To transfer ownership of a property after death in Texas, you need to go through probate if the deceased left a will. If there’s no will, the Texas intestacy laws will dictate the distribution. Generally, a mineral rights deed form can facilitate the transfer of any mineral interests associated with the property. Consulting with an attorney can help ensure the transfer is done correctly.

Transferring royalty interest in Texas involves executing an assignment of interest document. This document details the specific rights you are transferring and should reference the mineral rights deed form to clarify the interests involved. It is important to record this assignment with the appropriate authorities. By doing this, you ensure that the new owner receives the benefits associated with those rights.

To transfer property to a family member in Texas, you can use a quitclaim deed. This document allows you to transfer any ownership rights you have over the property. Ensure you fill out the mineral rights deed form accurately to avoid future disputes. Once completed, you must file it with the county clerk's office to finalize the transfer.