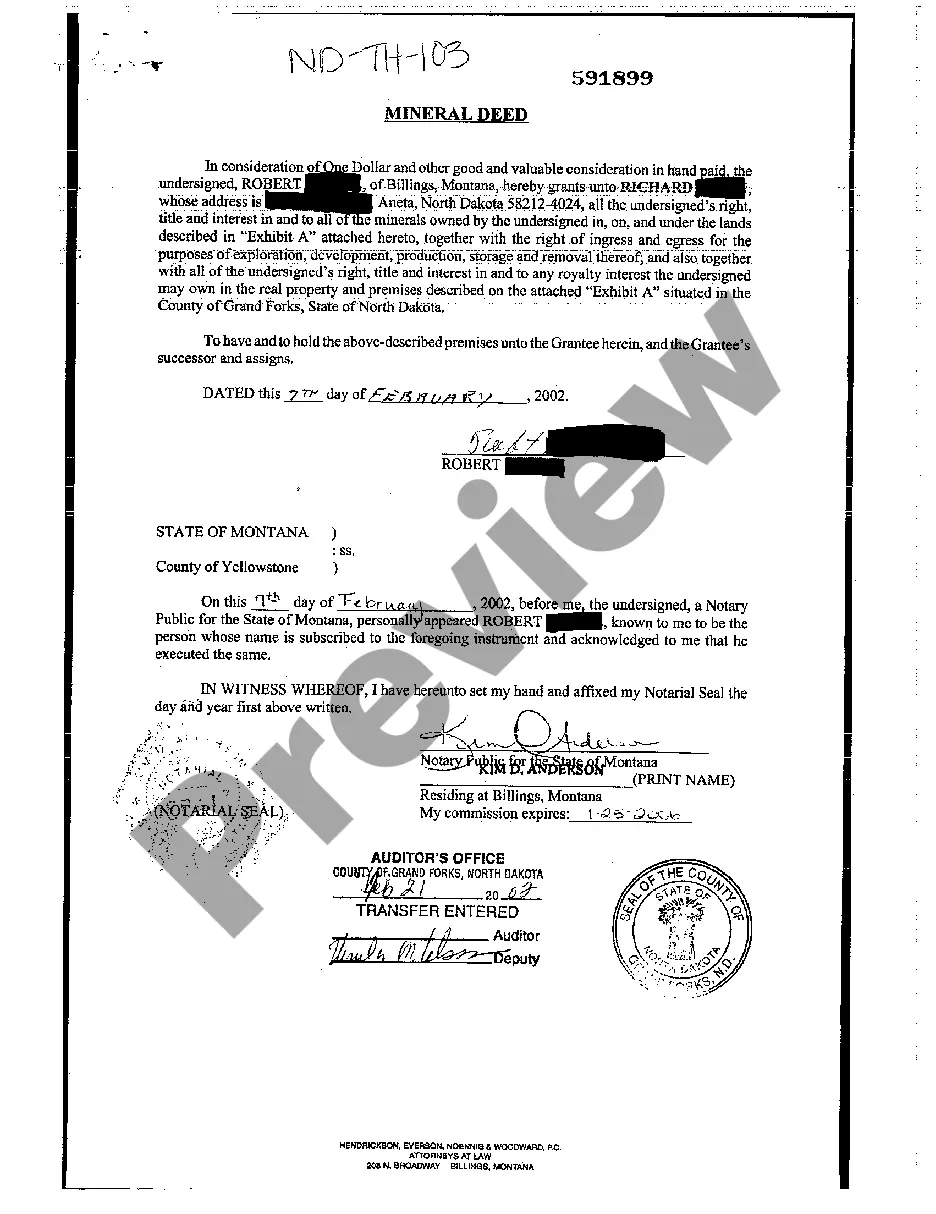

Inherited Mineral Rights North Dakota With Sale

Description

How to fill out North Dakota Mineral Deed Individual To Individual?

The Inherited Mineral Rights North Dakota With Sale you see on this page is a reusable formal template drafted by professional lawyers in line with federal and state laws. For more than 25 years, US Legal Forms has provided people, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, simplest and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Inherited Mineral Rights North Dakota With Sale will take you just a few simple steps:

- Browse for the document you need and check it. Look through the file you searched and preview it or check the form description to ensure it suits your requirements. If it does not, use the search option to get the correct one. Click Buy Now once you have located the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Inherited Mineral Rights North Dakota With Sale (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your paperwork one more time. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

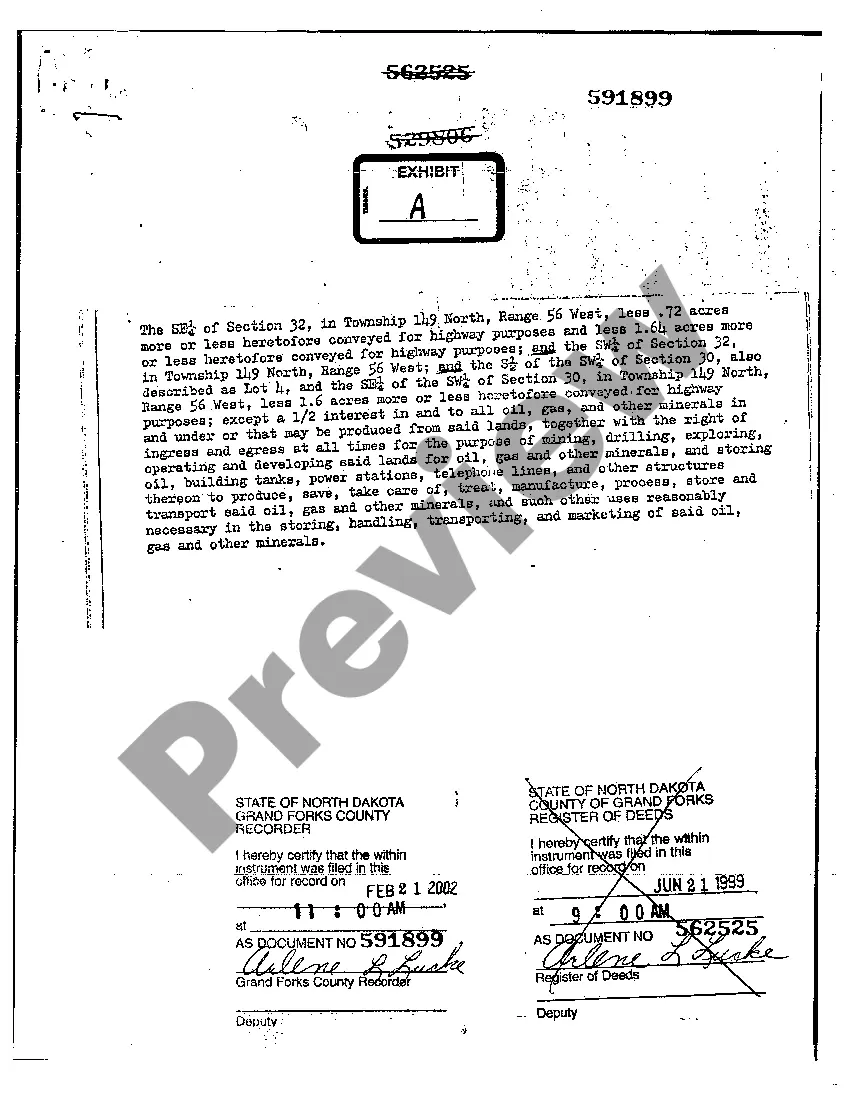

How can I find out who owns the oil rights on property in North Dakota? To determine mineral rights on a parcel of land, you need to go to the County Recorder's Office in the county of that parcel and request any recorded deed documents for the parcel.

A mineral rights owner does not necessarily have to own the land property itself but must have a legal agreement with the property owner. In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action.

If you have non-producing mineral rights in North Dakota, unfortunately there will be little to no value. It's safe to assume that the value of mineral rights in North Dakota for non-producing properties will be lower than $1,000/acre with rare exceptions.

How do I transfer mineral rights in North Dakota? To convey or transfer ownership of mineral rights to a new owner, the current owner of the rights has to engage a title insurance company or an attorney at a district court to perform a search of the property title.