North Dakota Corporation Withdrawal

Description

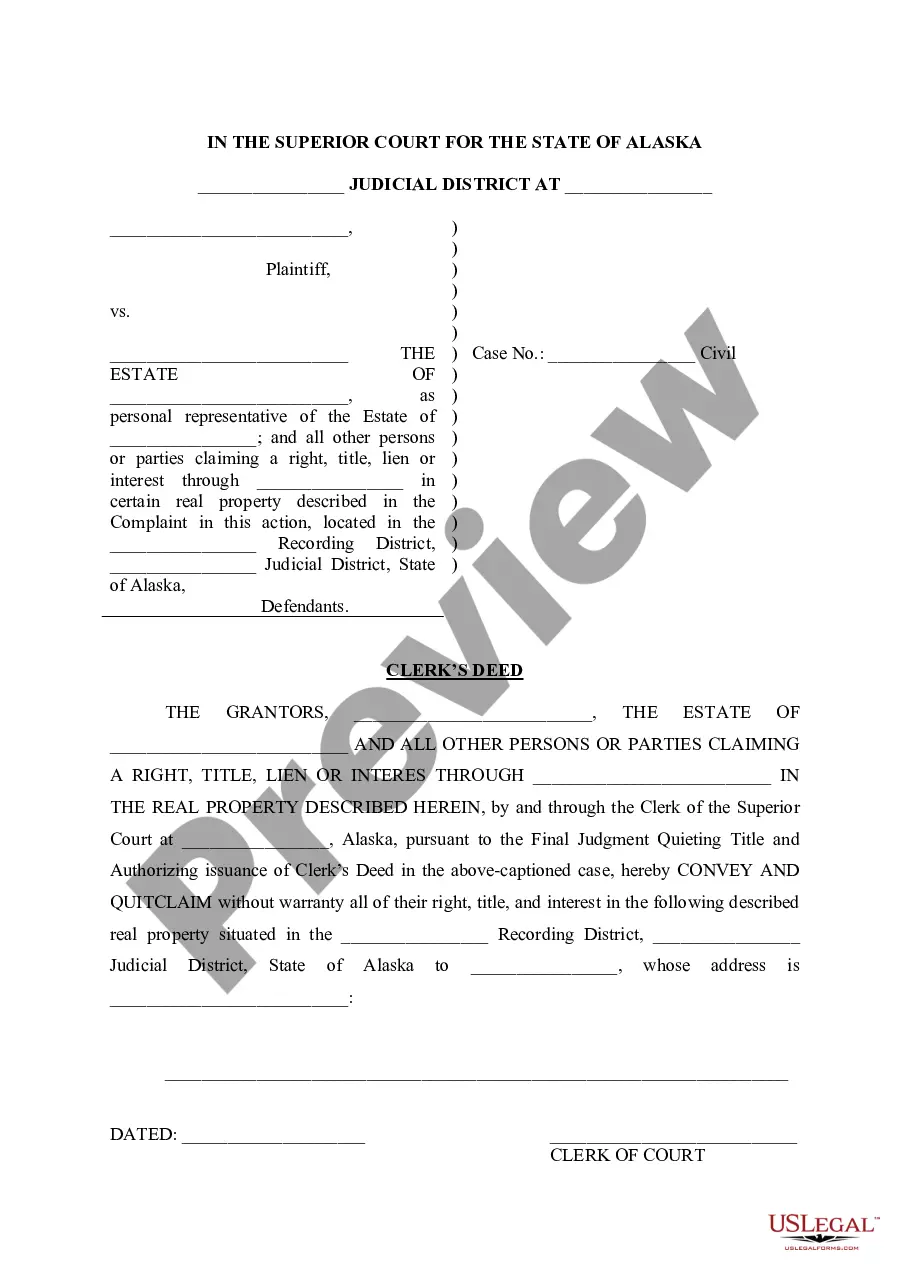

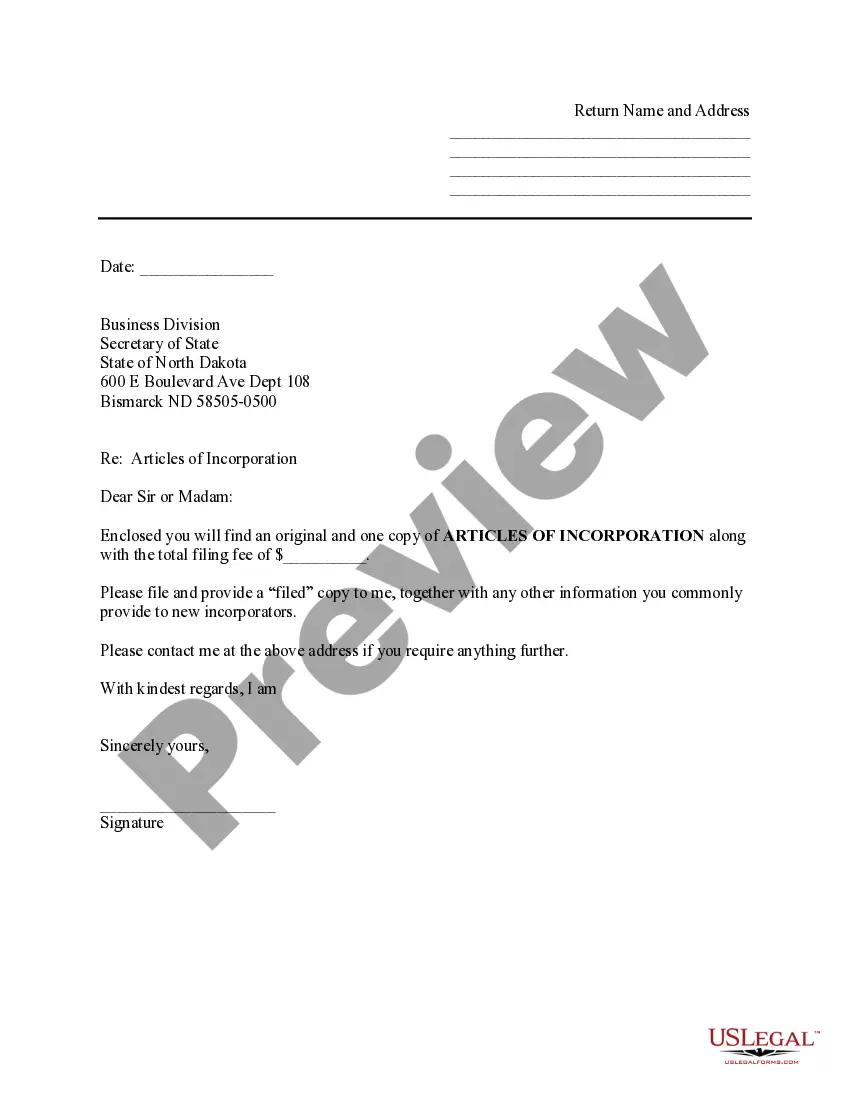

How to fill out North Dakota Sample Transmittal Letter For Articles Of Incorporation?

Bureaucracy requires exactness and correctness.

Unless you manage filling out forms like North Dakota Corporation Withdrawal daily, it might lead to some confusion.

Choosing the right template from the beginning will guarantee that your document submission is seamless and avoid any troubles of resubmitting a file or repeating the same task from the start.

Locating the correct and current templates for your paperwork takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic issues and enhance your document-related efficiency.

- Locate the template using the search function.

- Verify that the North Dakota Corporation Withdrawal you've located is suitable for your state or region.

- Review the preview or read the description that contains information on the utilization of the template.

- When the result matches your search, click the Buy Now button.

- Choose the appropriate option from the available pricing plans.

- Log In to your account or sign up for a new one.

- Complete the purchase using a credit card or PayPal account.

- Receive the form in the format of your preference.

Form popularity

FAQ

Starting a corporation in North Dakota involves choosing a unique name and filing Articles of Incorporation with the Secretary of State. You will also need to establish a registered agent and create bylaws for your corporation. Using platforms like USLegalForms can simplify the initial setup, helping you navigate through the paperwork, and lay a strong foundation before considering any future decisions like a North Dakota corporation withdrawal.

North Dakota has specific laws regarding corporate farming, limiting the types of businesses that can own and operate agricultural land. Generally, it restricts corporations from engaging in farming unless they meet certain criteria. Understanding these regulations can be crucial for corporations contemplating a North Dakota corporation withdrawal.

North Dakota corporate tax rates are based on the corporation's taxable income, with a minimum tax applicable. The state offers competitive rates for businesses, which can influence your decision to incorporate in North Dakota. For corporations looking to withdraw, it is essential to settle any outstanding tax obligations during the North Dakota corporation withdrawal process.

There are generally two methods for dissolving a corporation: voluntary and involuntary dissolution. Voluntary dissolution occurs when the corporation's board and shareholders agree to dissolve the business, while involuntary dissolution can happen due to legal issues or failure to comply with state requirements. Understanding these methods is key to navigating the North Dakota corporation withdrawal process effectively.

For a corporation to be voluntarily dissolved, the board of directors must first pass a resolution to dissolve. Following this, the shareholders must approve the decision. Once this step is complete, you can initiate the North Dakota corporation withdrawal by filing the proper paperwork with the Secretary of State.

To dissolve a business in North Dakota, you begin by filing a resolution to dissolve with the Secretary of State. You must ensure that all debts and obligations of your corporation are settled before submitting your application. Additionally, the North Dakota corporation withdrawal process includes notifying any stakeholders and creditors about the decision to dissolve the business.

Failing to file an annual report for your LLC in North Dakota may lead to serious consequences such as fines or administrative dissolution of your company. If your business becomes inactive due to non-filing, reactivating it can be challenging and may involve complex procedures. To avoid such issues, it is important to stay diligent with your filing requirements, particularly if you're considering a North Dakota corporation withdrawal. Consider using resources like uslegalforms to simplify your compliance process.

To change your business address in North Dakota, begin by accessing the North Dakota Secretary of State's website. You will need to complete a form to update your business information, ensuring all details are precise and current. After submitting the form, confirm that the record reflects the updated address. This is vital for maintaining compliance and communication, especially if you are planning a North Dakota corporation withdrawal.

To fill out a North Dakota title, first, gather all necessary information, including the vehicle identification number, odometer reading, and buyer and seller details. Ensure that each field is filled accurately to avoid complications during the transfer process. After completing the title form, submit it to the North Dakota Department of Transportation. This step is crucial when considering a North Dakota corporation withdrawal, as proper documentation prevents future legal issues.

To file an annual report in North Dakota, you need your corporation's identification number, financial statements, and any changes to your business structure. Accurate and up-to-date information is essential for successful filing. Additionally, utilizing platforms like UsLegalForms can help ensure you have all the required documentation for your North Dakota corporation withdrawal, making the process seamless.