Assignment Of Property To Trust Form

Description

Form popularity

FAQ

Putting assets in a trust comes with potential risks, such as loss of control if not structured correctly. If you fail to properly manage the trust or misunderstand the rules, it may lead to unintended tax implications or family disputes. Utilizing an Assignment of property to trust form accurately as part of your planning can mitigate these risks. Exploring resources from uslegalforms can provide you with the necessary guidance to avoid common pitfalls.

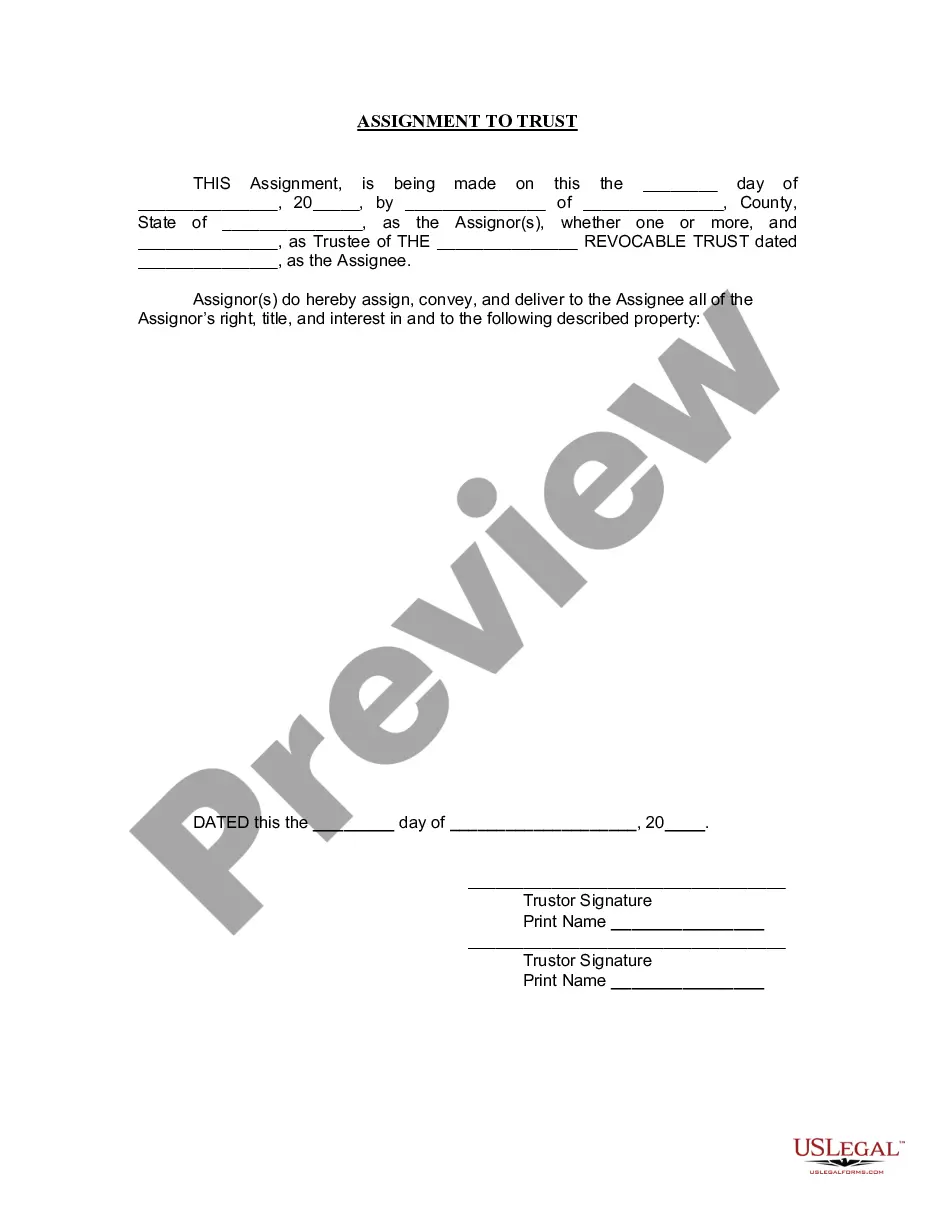

Transferring items to a trust involves drafting an Assignment of property to trust form for each item you wish to include. This process can include retitling real estate, changing the beneficiary of accounts, or designating other assets. It’s a structured approach that ensures everything is legally documented and protected. With platforms like uslegalforms available, you can manage these transfers with confidence.

To assign assets to a trust, you typically need to complete an Assignment of property to trust form for each asset. This involves legal documentation and possibly changing titles or deeds to reflect the trust as the owner. It's essential to ensure each asset is properly allocated to prevent legal complications later. Using online services like uslegalforms can simplify this process for you.

Certain assets cannot be held in a trust, including assets that require direct personal ownership for legal reasons. These can include some government benefits and certain types of jointly owned property. Knowing the limitations is vital, so using an Assignment of property to trust form appropriately can guide you through which assets to include. Consulting a legal platform can clarify common misconceptions.

Placing your bank accounts in a trust can provide various benefits, including ease of transfer upon your passing. However, it’s essential to evaluate your financial situation and long-term goals. Using an Assignment of property to trust form ensures your accounts are correctly transferred, allowing for more control over your assets. Consulting with experts or using reliable services like uslegalforms can help make the right decision.

Not all assets should be placed into a trust. For instance, retirement accounts like 401(k)s or IRAs often require special consideration due to tax implications. Similarly, certain types of insurance policies may not benefit from inclusion in a trust. It's wise to consult with experts or utilize an Assignment of property to trust form to identify which assets to keep out.

One of the biggest mistakes parents make is failing to properly assign their assets using an Assignment of property to trust form. Many assume that simply creating the trust is enough; however, without proper asset transfer, the trust will not function as intended. It’s crucial to ensure all intended assets are included to benefit the trust's purpose. Utilizing a legal platform like uslegalforms can help you navigate this process effectively.

One downside of placing assets in a trust is the potential for limited accessibility to those assets during your lifetime. Additionally, the trust may incur ongoing management fees, which can add to your overall expenses. It's important to weigh these factors against the benefits of asset protection and estate planning.

To assign assets to a trust, first, you need to complete an assignment of property to trust form that details the assets being transferred. After preparing the document, sign and date it in accordance with your state’s legal requirements. Finally, make sure to update titles, deeds, or registrations to reflect the trust as the new owner.

An assignment to a trust involves transferring ownership of property into the trust's name, using an assignment of property to trust form. This legal process ensures that assets are managed according to your specific wishes as outlined in the trust document. By doing this, you benefit from organized management and protection of your property.