North Dakota Agreement Withholding Form

Description

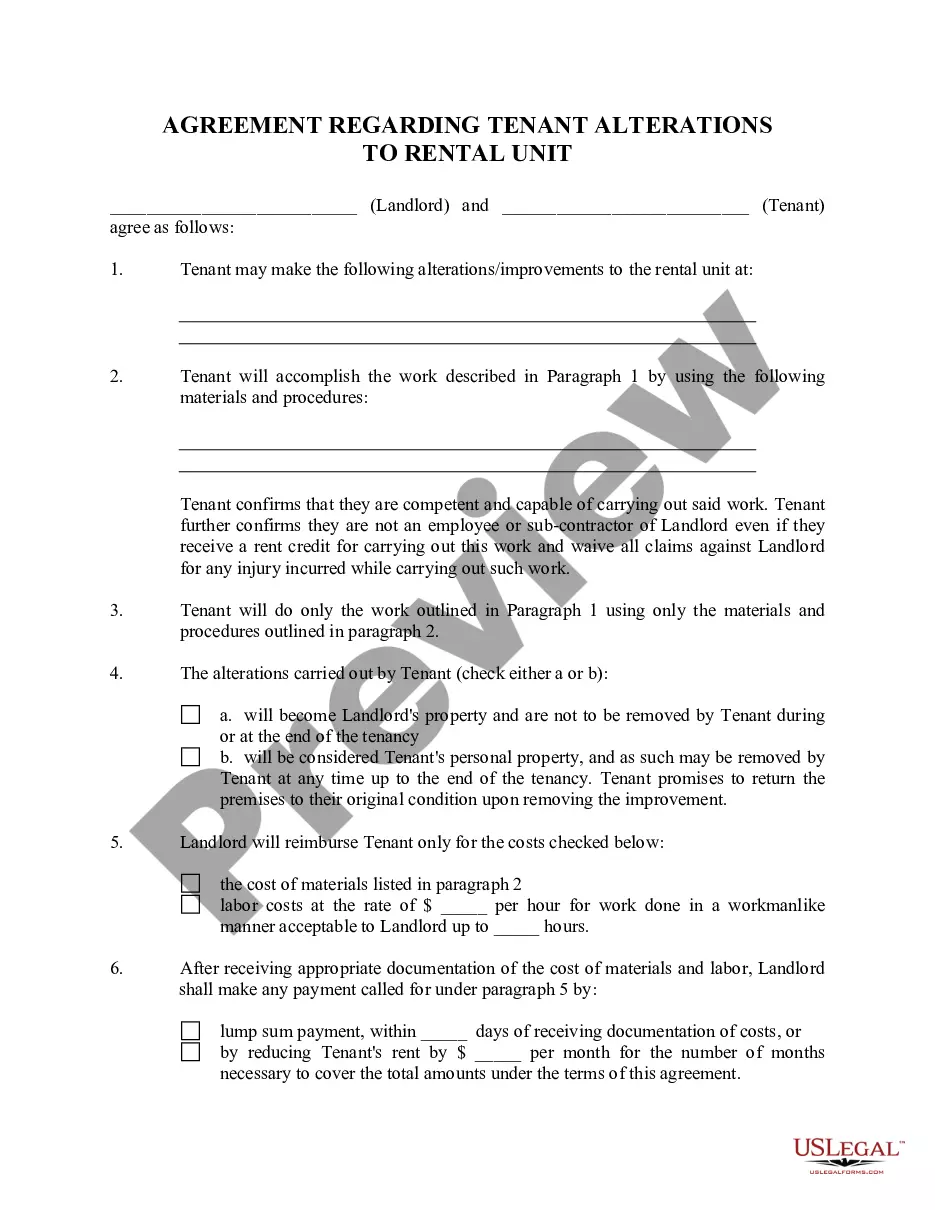

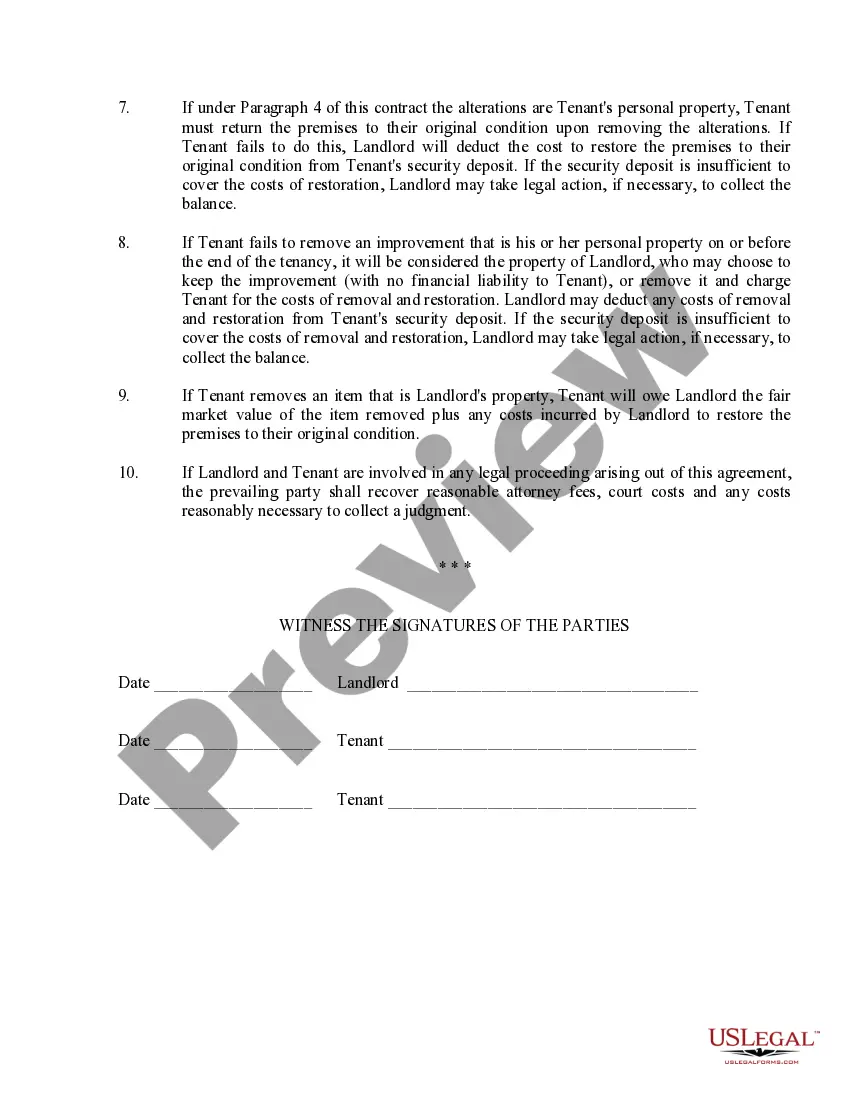

How to fill out North Dakota Landlord Agreement To Allow Tenant Alterations To Premises?

When you need to complete the North Dakota Agreement Withholding Form that adheres to your local state's requirements, there can be numerous options available.

There's no need to verify every form to ensure it satisfies all the legal stipulations if you're a US Legal Forms member.

It is a dependable resource that can assist you in acquiring a reusable and current template on any topic.

Navigating through professionally composed official documents becomes easy with US Legal Forms. Furthermore, Premium users can also benefit from the powerful integrated tools for online document editing and signing. Give it a shot today!

- US Legal Forms boasts the largest online repository with a compilation of over 85k ready-to-use documents for both business and personal legal situations.

- All templates are verified to comply with each state's regulations.

- Therefore, when you download the North Dakota Agreement Withholding Form from our platform, you can be confident that you have a valid and updated document.

- Acquiring the needed sample from our site is exceptionally simple.

- If you already possess an account, just Log In to the service, confirm that your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and retrieve the North Dakota Agreement Withholding Form anytime.

- If this is your initial experience with our repository, please follow the instructions below.

Form popularity

FAQ

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.18-Dec-2019

Employees use the federal Form W-4 for federal income tax withholding. Employees use their state's version of Form W-4 for state income tax withholding.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

For the highest paying job's W-4, fill out steps 2 to 4(b) of the W-4. Leave those steps blank on the W-4s for the other jobs. If you're married and filing jointly, and you both earn about the same amount, you can check a box indicating as much. The trick: Both spouses need to do that on each of their W-4s.

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold.