North Dakota Business Statement For 202

Description

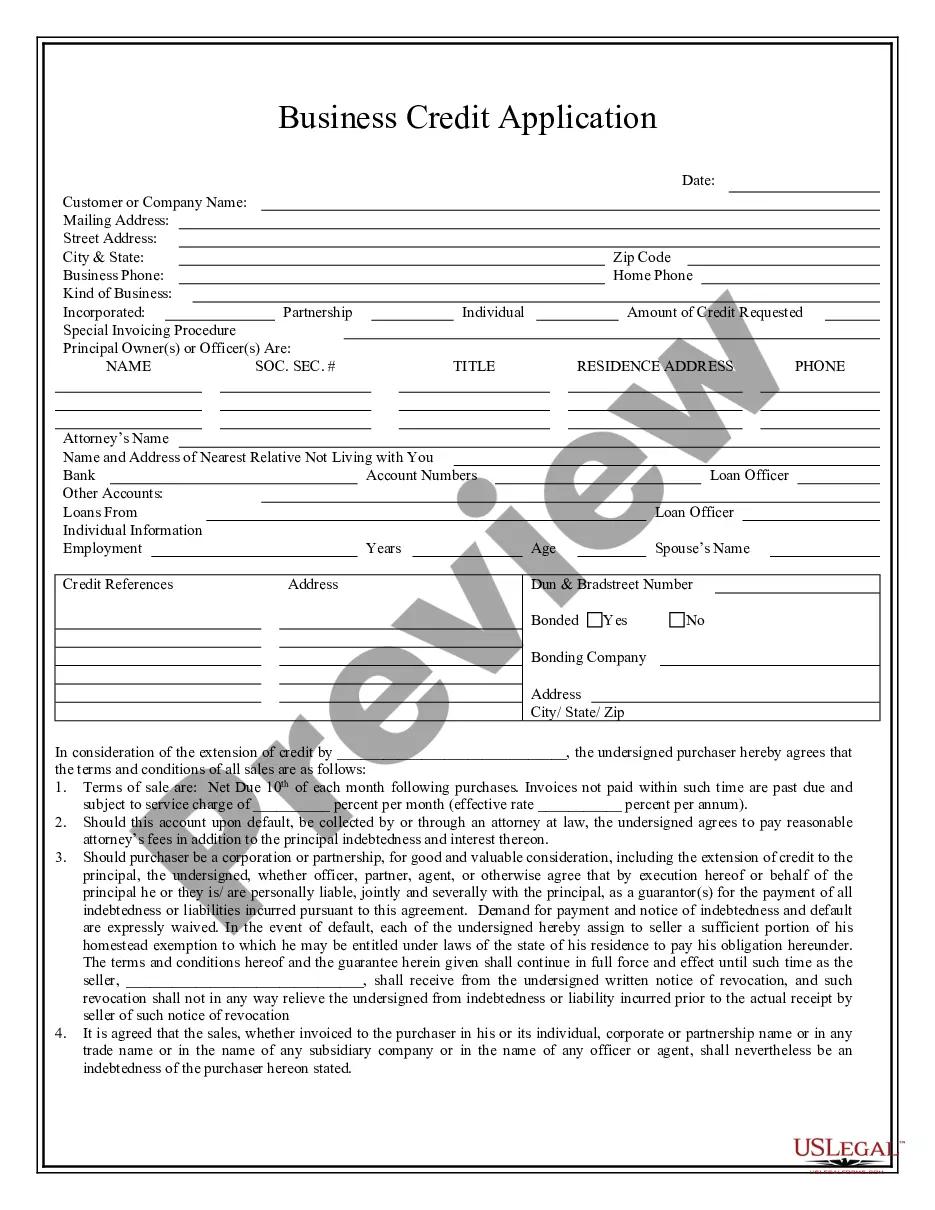

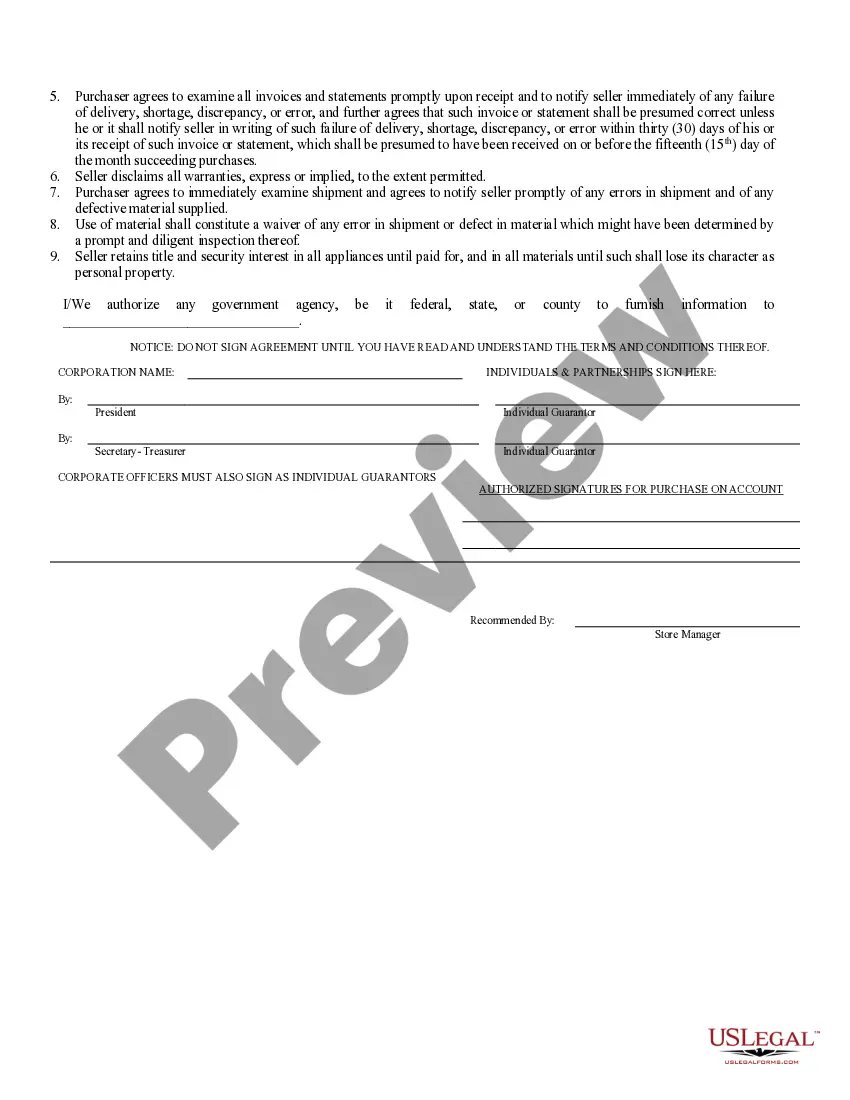

How to fill out North Dakota Business Credit Application?

- If you're a returning user, log in to your account and locate the necessary business statement. Ensure your subscription is active; renew if needed.

- For first-time users, start by reviewing the Preview mode and form description to confirm that it meets your specific requirements.

- If you need a different template, utilize the Search tab to find the correct form that aligns with your local jurisdiction.

- Once you've selected the right document, click the Buy Now button and select a subscription plan that suits you. You'll need to register for an account.

- Proceed to make your payment using a credit card or your PayPal account to complete the purchase.

- After your purchase, download the form to your device and access it anytime via the My Forms menu for future reference.

With US Legal Forms, not only do you gain access to a vast collection of legal forms, but you also have the added benefit of expert assistance to ensure your documents are completed accurately and are legally sound.

Start today to simplify your legal document needs and ensure that your North Dakota business statement for 202 is perfectly crafted!

Form popularity

FAQ

Yes, North Dakota has various state tax forms, including those for personal income tax and corporate taxes. When preparing your North Dakota business statement for 202, ensure you use the correct forms tailored to your business needs. Utilizing platforms like uslegalforms can help you access the right documents quickly and efficiently.

Filing sales tax in North Dakota involves registering with the Department of Revenue, collecting the appropriate sales tax, and submitting returns periodically. You can choose to file electronically, which is recommended for your North Dakota business statement for 202. Ensure that you keep detailed records of sales and taxes collected to support your filings.

In North Dakota, several tax forms can be filed electronically, including income tax returns, sales tax applications, and various business forms. Utilizing the e-file option can simplify your filing process for your North Dakota business statement for 202. Check the Department of Revenue website for a comprehensive list of eligible forms.

Yes, e-filing is still available in North Dakota for various tax forms, including income tax and sales tax returns. This option streamlines the process of submitting your North Dakota business statement for 202. It is highly recommended for its efficiency and ease of use.

To file an annual report in North Dakota, visit the Secretary of State's website and access the appropriate forms. Completing your North Dakota business statement for 202 is crucial for maintaining your business status. Make sure to keep track of the submission deadlines to avoid any potential penalties.

If you cannot file your North Dakota business statement for 202 by the deadline, you may need to request an extension. Filing an extension gives you additional time to prepare your documents without incurring late penalties. Be sure to file the extension form before the due date to stay compliant with state regulations.

Yes, North Dakota provides an e-file option for certain tax forms. E-filing is a convenient way to submit your tax documents, including your North Dakota business statement for 202. Using the e-file can save you time and reduces the chances of errors compared to paper filing.

Yes, North Dakota has a W-4 form, which is used by employees to determine the amount of state income tax withholding. This form is essential for accurate tax reporting. When completing your North Dakota business statement for 202, ensure you have the correct withholding details to avoid any tax surprises.

To register your business in North Dakota, you must complete a registration form through the Secretary of State’s office. You will need to provide essential details such as your business name, type, and structure. Registering online is a straightforward process that facilitates quicker approvals. Consider using US Legal Forms for step-by-step guidance in creating your North Dakota business statement for 202.

Creating an LLC in North Dakota typically takes about 2 to 3 business days if you file online. However, if you choose to submit your application by mail, it may take longer. Ensuring all required information is accurate can help speed up the process. If you need guidance, US Legal Forms offers resources to help you create your North Dakota business statement for 202 efficiently.