North Dakota Release Lien Withdrawal

Description

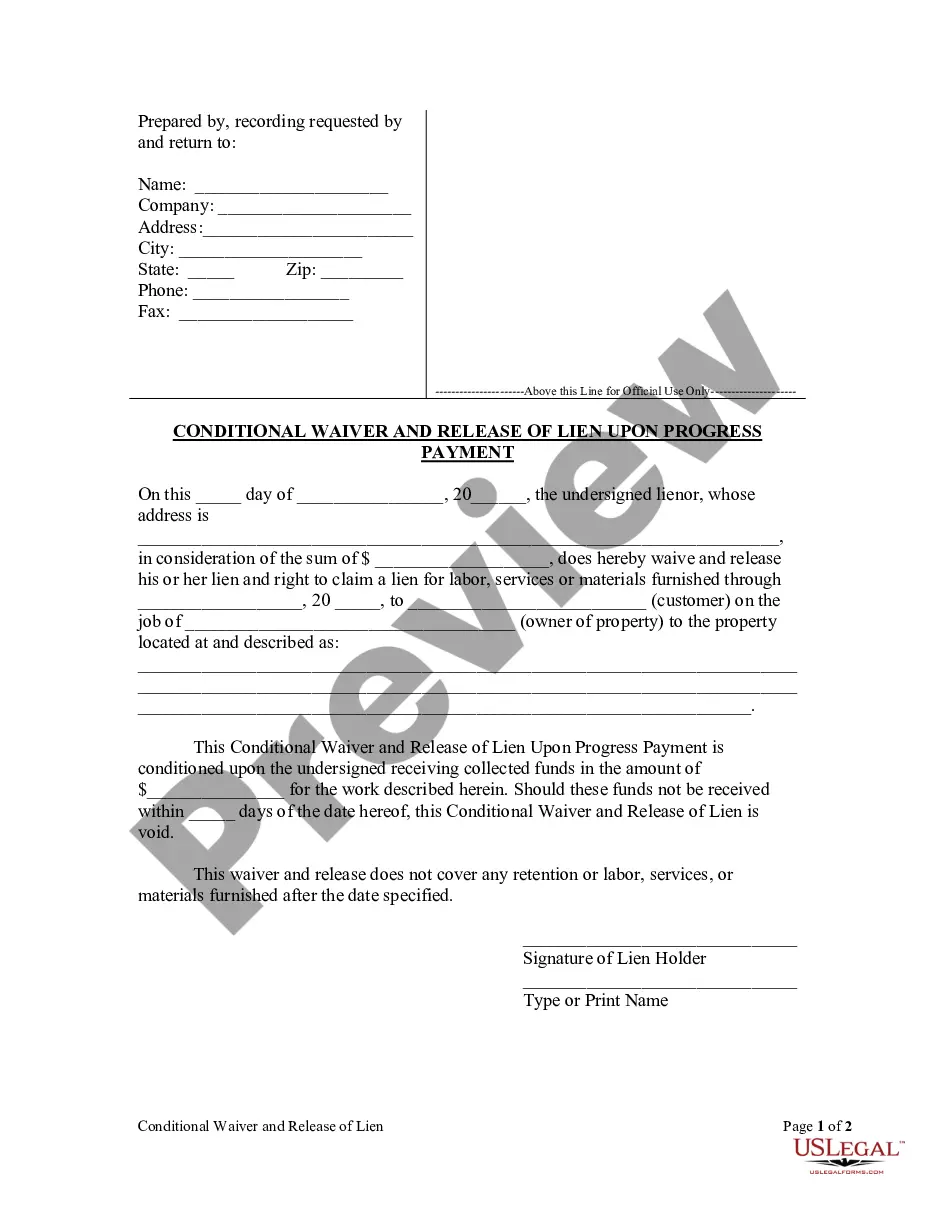

How to fill out North Dakota Conditional Waiver And Release Of Claim Of Lien Upon Progress Payment?

Navigating the intricacies of formal documents and templates can be daunting, particularly if one is not engaged in that profession. Even selecting the appropriate template for the North Dakota Release Lien Withdrawal can be labor-intensive, as it must be accurate and legitimate down to the final digit. Nonetheless, you will spend significantly less time acquiring a suitable template if it originates from a reliable source. US Legal Forms is a platform that streamlines the process of finding the correct forms online.

US Legal Forms is a singular source where you can locate the most recent examples of documents, consult their usage, and download these templates to complete them. This is a repository of over 85,000 forms that are applicable across various fields. When searching for a North Dakota Release Lien Withdrawal, you need not question its authenticity as all forms are confirmed.

Having an account at US Legal Forms guarantees you have all the essential templates within easy reach. Save them in your history or add them to the My documents archive. You can access your saved forms from any device by clicking Log In at the library's website. If you do not currently possess an account, you can always search for the template you need. Obtain the correct form in a few straightforward steps.

US Legal Forms will conserve your time and effort by verifying whether the form you discovered online suits your requirements. Create an account and gain limitless access to all the templates you need.

- Input the title of the document in the search box.

- Locate the appropriate North Dakota Release Lien Withdrawal from the results list.

- Review the description of the sample or open its preview.

- When the template meets your requirements, click Buy Now.

- Continue to select your subscription option.

- Utilize your email and create a password to register an account at US Legal Forms.

- Select a credit card or PayPal payment method.

- Download the template file on your device in the format of your choosing.

Form popularity

FAQ

Step 1: Send a Notice of Intent to Lien Before you file your mechanics lien claim, North Dakota lien law says you must send a written Notice of Intent to Lien first. You should send this document to the owner of the property by registered or certified mail, at least 10 days before filing the lien claim.

It is the responsibility of the lienholder to execute a release within 20 days after final payment is received. The lienholder shall mail or deliver the release to the owner. The certificate of title and lien release shall be forwarded by the owner to any county treasurer. No fee is assessed for the release of a lien.

The seller must have a notarized paid receipt (lien release) from the lienholder describing the vehicle, the name of the seller and the date and amount of the lien. The seller must give you the original paid receipt along with the title.

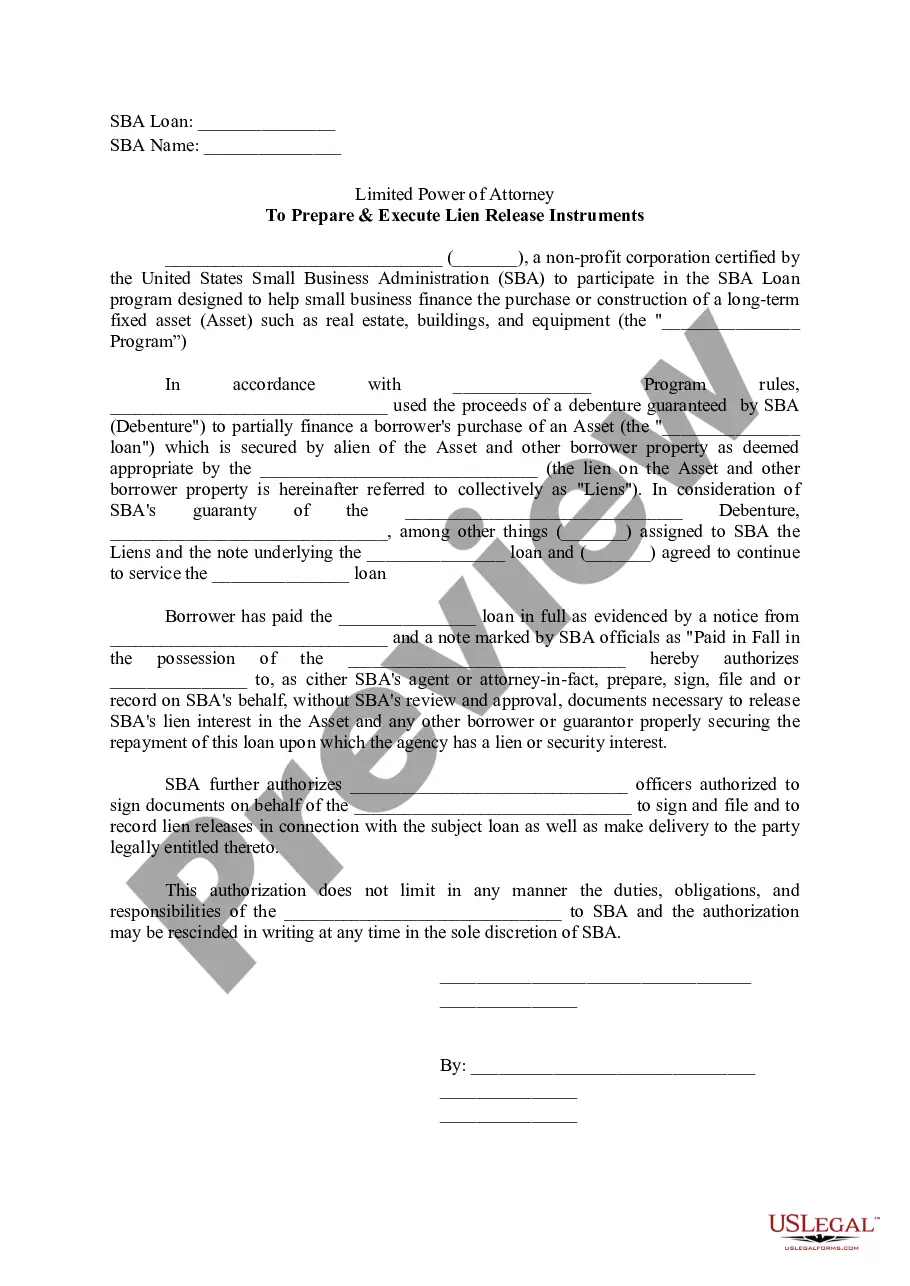

Once you have paid your loan in full, the lender can sign the title over to you to signify they have released the lien. Once this process is complete, you will receive your title in the mail or you can pick it up in person. You then have a free and clean title, according to TFC Title Loans.

The takeaway. It's perfectly legal to sell a car with a lien, as long as you pay off the loan first. To sell a car with a lien, you have the option to sell it to a car dealer as a trade-in, or sell the car to a private buyer.