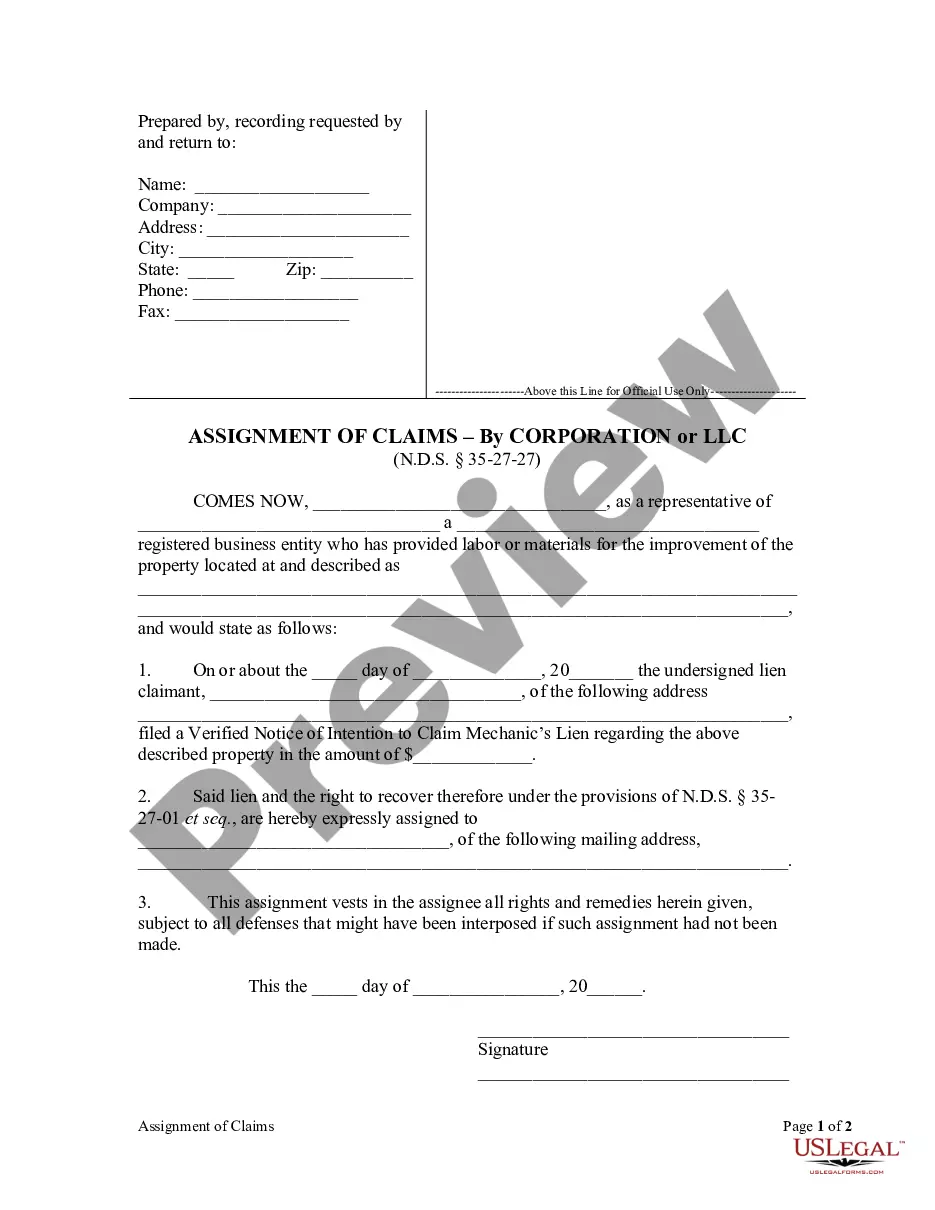

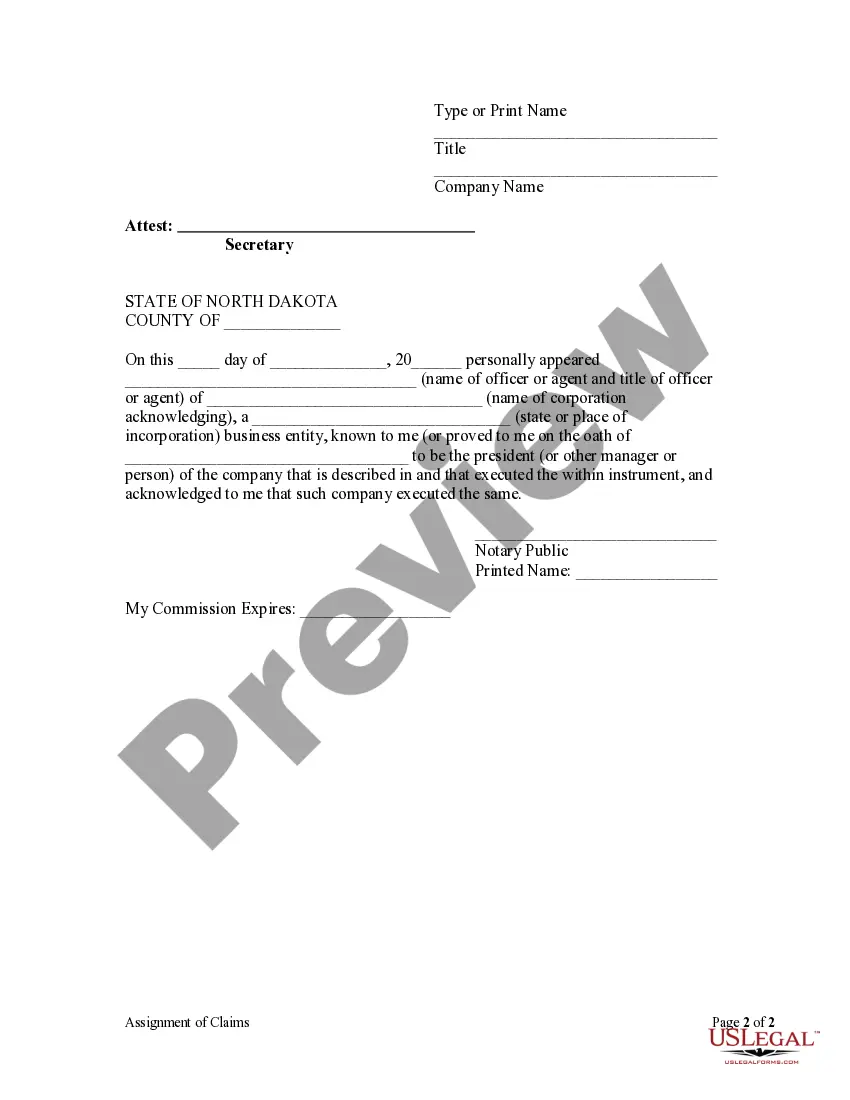

North Dakota Assignment Withholding Form 306

Description

How to fill out North Dakota Assignment Of Claims - Corporation?

When you need to complete the North Dakota Assignment Withholding Form 306 in line with your local state's requirements, there could be numerous options to choose from.

There's no need to verify every document to ensure it meets all the legal standards if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Navigating to the suggested page and verifying it for alignment with your needs is essential.

- US Legal Forms is the largest online library with a collection of over 85,000 ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's laws.

- Consequently, when downloading the North Dakota Assignment Withholding Form 306 from our platform, you can be assured that you have a valid and current document.

- Acquiring the necessary template from our site is exceptionally easy.

- If you already possess an account, simply Log In to the platform, verify your subscription is active, and save the desired file.

- Later, you can access the My documents tab in your profile and maintain access to the North Dakota Assignment Withholding Form 306 whenever needed.

- If this is your first time using our website, please follow the instructions below.

Form popularity

FAQ

To fill out an employee withholding certificate, start with your personal information, including your name and Social Security number. Then, specify your filing status and any additional allowances on the North Dakota assignment withholding form 306. If you have questions or need assistance, consider using the uslegalforms platform for user-friendly options and clear guidelines.

You can submit your withholding information by providing the completed North Dakota assignment withholding form 306 to your employer or payroll department. They will then include your withholding instructions in the payroll system. Ensure you keep a copy for your records and confirm that your employer processed it correctly.

A standard recommendation is to withhold 10% to 15% of your income for federal taxes, but the specific percentage can vary based on your overall income and tax situation. Utilizing the North Dakota assignment withholding form 306 allows you to customize your withholding based on your unique financial circumstances. It's wise to consult a tax professional to determine the most effective percentage for you.

When completing the North Dakota assignment withholding form 306, you should include your full name, Social Security number, and address. You must also indicate your filing status and the number of allowances you wish to claim. Be accurate with this information to ensure the proper amount of taxes is withheld.

Non-resident partners in North Dakota must consider the state's withholding requirements when earning income from partnerships. Typically, the withholding is calculated based on the partner's share of income generated within the state. To manage this effectively, the North Dakota assignment withholding form 306 should be completed accurately. This ensures that all taxes are withheld properly and can help prevent any unexpected tax liabilities.

Yes, North Dakota has a state withholding form known as the North Dakota assignment withholding form 306. This form is essential for employers and employees to ensure the correct amount of state taxes are withheld from paychecks. If you are new to the state or adjusting your personal exemptions, this form is a necessary tool. For more details about completing the form, you can visit the USLegalForms platform, which provides guidance and resources.

North Dakota offers favorable tax conditions for retirees, primarily by not taxing Social Security benefits. This can provide financial relief for those who have retired in the state. However, retirees still need to consider sales tax and property tax implications. Utilizing resources like the North Dakota assignment withholding form 306 can help manage any additional income taxes that may arise.

Yes, North Dakota does tax non-residents on income earned within the state. This means if you work or have business activities in North Dakota, you need to file income taxes. Additionally, using the North Dakota assignment withholding form 306 simplifies the process for non-residents by ensuring proper tax withholding. It's essential to stay informed and compliant to avoid any issues.

To fill out additional federal withholdings, you need to specify the extra amount you want withheld from your paycheck. Include this information on your withholding form accurately. Referencing the North Dakota assignment withholding form 306 during this process will help clarify your state requirements alongside your federal obligations.

Filling out a withholding certificate requires you to provide your personal details and choose your withholding allowances. Be attentive to the specific sections of the North Dakota assignment withholding form 306, and complete it accurately to reflect your tax situation. This will help in calculating the correct tax withholdings for your income.