North Dakota Assignment Form 306

Description

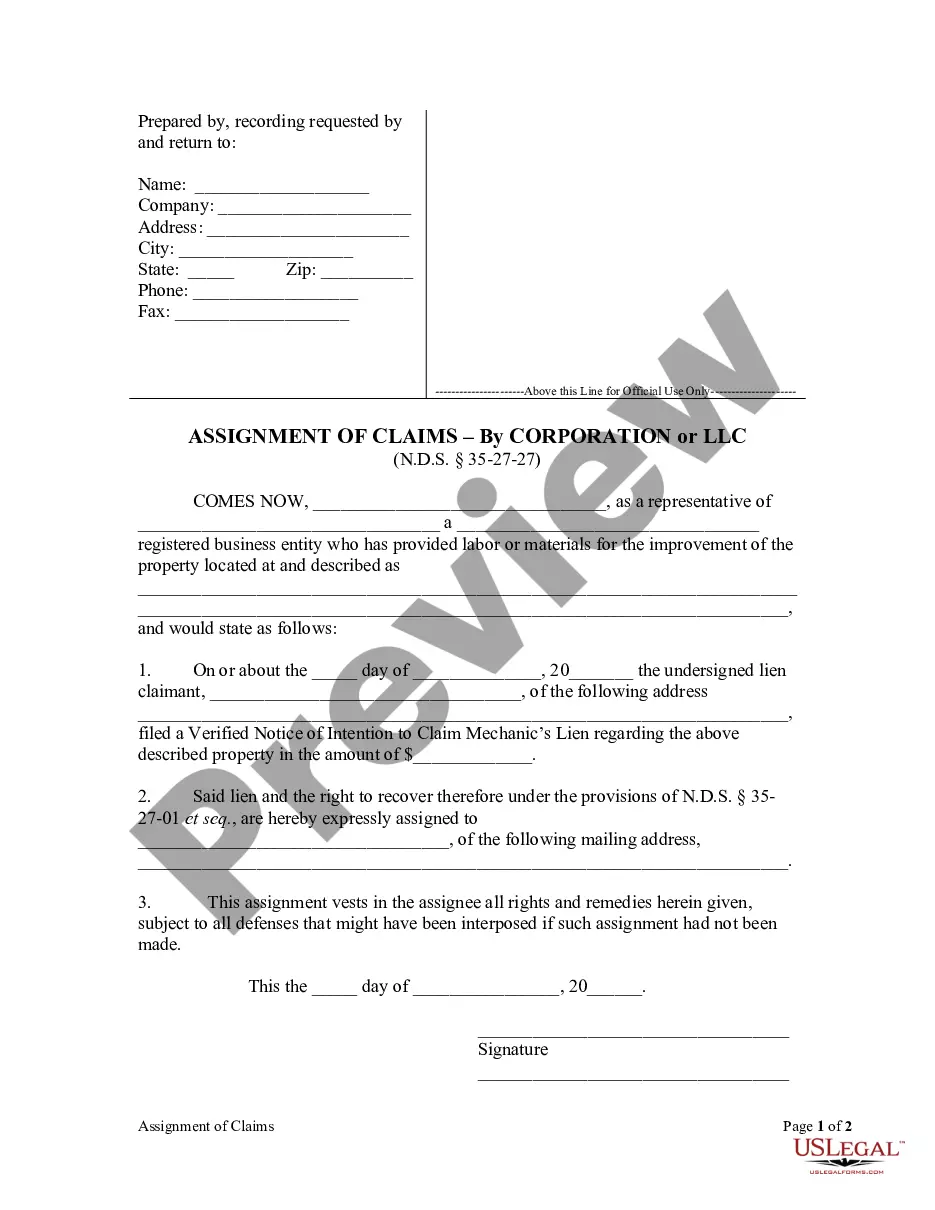

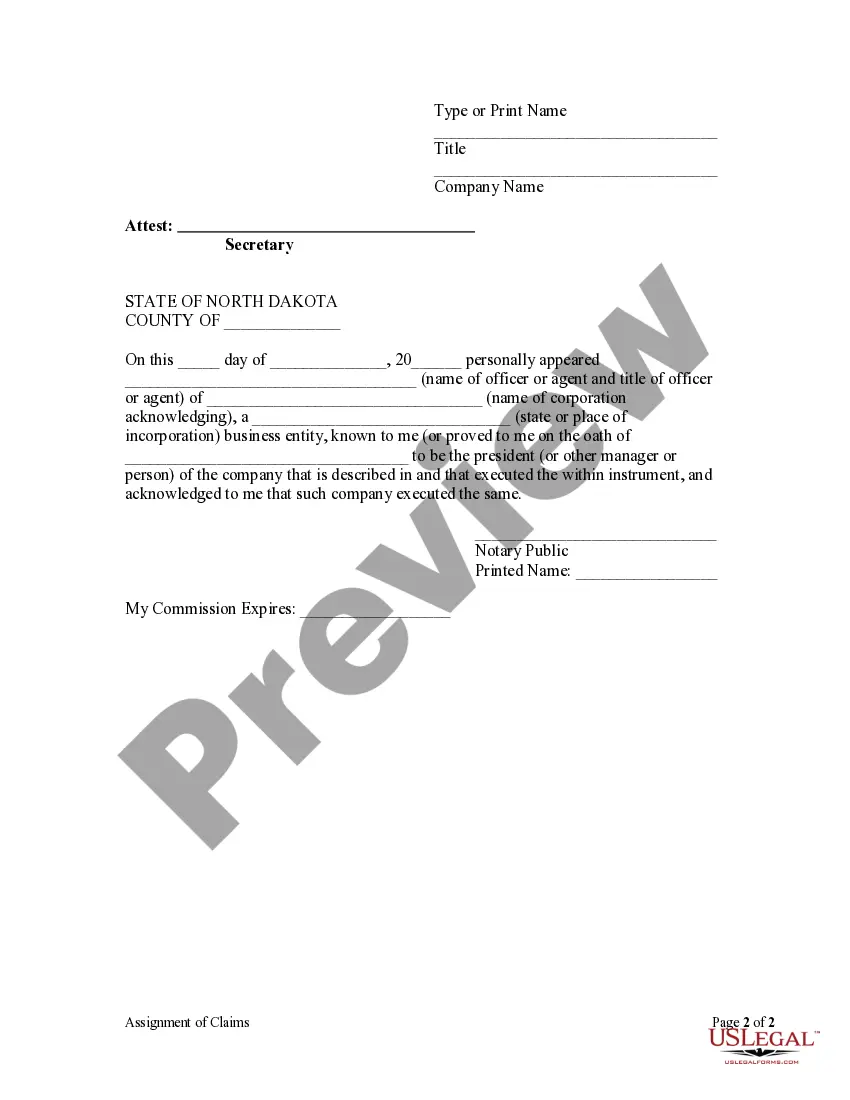

How to fill out North Dakota Assignment Of Claims - Corporation?

There's no further justification to squander hours searching for legal paperwork to adhere to your local state regulations.

US Legal Forms has consolidated all of these documents in a single location and streamlined their accessibility.

Our platform provides over 85k templates for any business and personal legal matters categorized by state and area of application. All forms are properly drafted and validated for authenticity, so you can be assured of obtaining an up-to-date North Dakota Assignment Form 306.

Select the desired subscription plan and either create an account or Log In. Make payment for your subscription using a credit card or PayPal to proceed. Choose the file format for your North Dakota Assignment Form 306 and download it to your device. Print your form to fill it out manually or upload the template if you wish to edit it in an online editor. Completing official documentation under federal and state regulations is quick and easy with our library. Try US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our service and already possess an account, you need to verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all previously obtained documents at any time by visiting the My documents section in your profile.

- If you haven't utilized our service before, the process will require additional steps to complete.

- Here’s how new users can acquire the North Dakota Assignment Form 306 from our catalog.

- Examine the page content thoroughly to confirm it contains the sample you need.

- To do this, utilize the form description and preview options, if available.

- Use the Search bar above to look for another template if the current one isn’t suitable.

- Click Buy Now next to the template title when you discover the correct one.

Form popularity

FAQ

Several states, including North Dakota, require state tax withholding forms for wage earners and contractors. Each state has its own rules and forms, so it's vital to check the requirements based on where you work or reside. Proper documentation is crucial to avoid penalties or issues with tax filings. Utilizing US Legal Forms can help you find the correct North Dakota assignment form 306 and ensure you meet all state requirements.

Yes, North Dakota has state withholding, which applies to income earned by residents and certain non-residents. Employers in North Dakota must withhold state income tax from employees' wages. If you are self-employed or an independent contractor, you may also need to submit your own state withholding payments. For all these financial processes, the North Dakota assignment form 306 can help ensure compliance.

When filling out an employee's withholding certificate, begin by gathering the necessary information, including the employee's full name and social security number. Next, have the employee indicate the total number of allowances they wish to claim. Make sure to verify their choices based on their unique financial circumstances. Utilizing the North Dakota assignment form 306 simplifies this process, and US Legal Forms offers helpful resources to guide you through.

North Dakota's tax withholding varies based on your income level and the number of allowances you claim on forms like the North Dakota assignment form 306. Generally, the state has a progressive income tax rate ranging from 1.1% to 2.9%. To get a precise figure, use the state's tax calculators or consult a tax professional. For more details on withholding, check out US Legal Forms.

After receiving the employee's withholding allowance certificate, ensure you review it for accuracy and completeness. Then, you should keep a copy for your records while submitting the original to your payroll department. It's important that the information contained assists in accurately calculating federal and state taxes. Resources from US Legal Forms can help guide you through managing this documentation effectively.

Your withholding form should include your full name, address, and social security number. It's crucial to accurately report the number of allowances you claim, which affects your tax withholding. You might also want to review the tax regulations to ensure that your withholding aligns with your financial goals. For assistance, explore the resources available on the US Legal Forms platform.

Filling out the North Dakota assignment form 306 involves providing accurate information regarding your withholding status. Start by entering your name and identifying your status, then include the number of allowances you are claiming. Additionally, calculate any additional withholding you wish to apply. Using the US Legal Forms platform can simplify the process by offering clear instructions and user-friendly templates.

Determining whether to claim 0 or 1 on your W4 depends on your specific financial situation. Claiming 0 means more tax will be withheld from your paycheck, which could result in a tax refund during filing. Conversely, claiming 1 allows for less withholding but may lead to owing taxes if you have insufficient payments. Consider using the North Dakota assignment form 306 and consult with a tax professional to make the best decision.

Begin by obtaining the Employee Withholding Certificate form, which is essential for tax purposes in North Dakota. Carefully enter your personal information, including your name, address, and social security number. Ensure you indicate the number of withholding allowances you are claiming, which directly affects your tax withholding amount. Resources like US Legal Forms can provide guidance and templates to streamline this process.

Yes, you can amend your tax return to change your filing status, but it requires careful attention to detail. Utilize the IRS Form 1040-X for federal purposes and the North Dakota assignment form 306 for state taxes. Changing your filing status can impact your tax liability significantly; therefore, it's wise to consult with a tax professional. This approach ensures you leverage the benefits of your new status effectively.