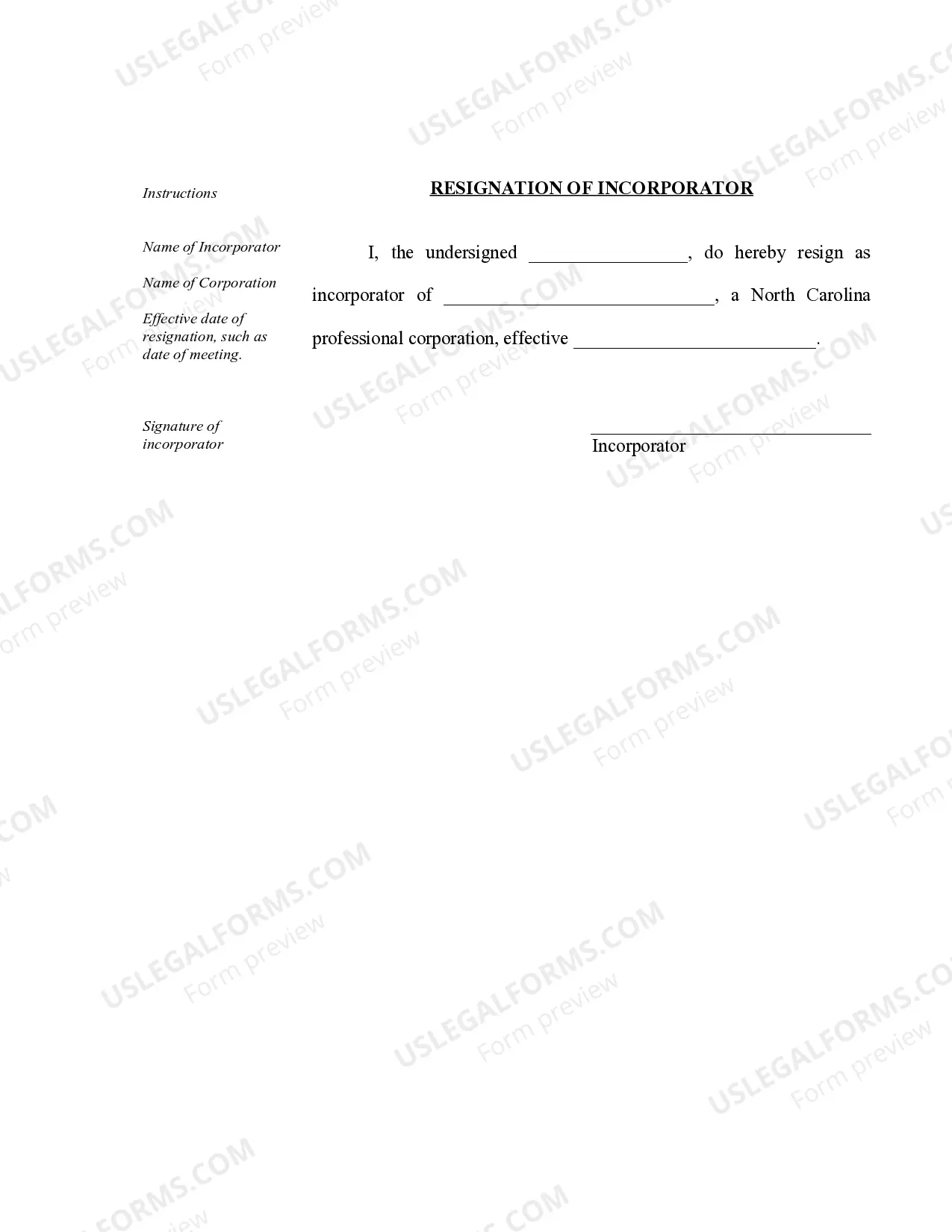

A Professional Corporation Without

Description

How to fill out A Professional Corporation Without?

Bureaucracy requires exactness and correctness.

If you do not manage document completion like A Professional Corporation Without regularly, it may lead to some misunderstandings.

Selecting the appropriate template from the outset will ensure that your document submission proceeds smoothly and avoid any hassles of resending a document or repeating the same task entirely from the beginning.

If you do not hold a subscription, finding the required template will involve a few more steps: Locate the template using the search box. Ensure the A Professional Corporation Without you’ve found is applicable to your state or locality. Open the preview or peruse the description containing the details regarding the usage of the template. If the result matches your search, click the Buy Now button. Choose the appropriate option from the suggested subscription plans. Log In to your account or establish a new one. Complete the transaction using a credit card or PayPal account. Download the document in your preferred format. Locating the correct and updated samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic worries and enhance your efficiency with paperwork.

- Discover the accurate template for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms that hosts over 85 thousand templates for various domains.

- You can easily find the most current and pertinent version of A Professional Corporation Without by simply searching on the site.

- Identify, save, and download templates in your profile or review the description to guarantee you have the correct one available.

- With an account on US Legal Forms, you can efficiently gather, store in one location, and navigate through the templates you save for quick access.

- While on the website, click the Log In button to authenticate.

- Then, proceed to the My documents page, where your document history is kept.

- Browse through the descriptions of the forms and download the necessary ones at any time.

Form popularity

FAQ

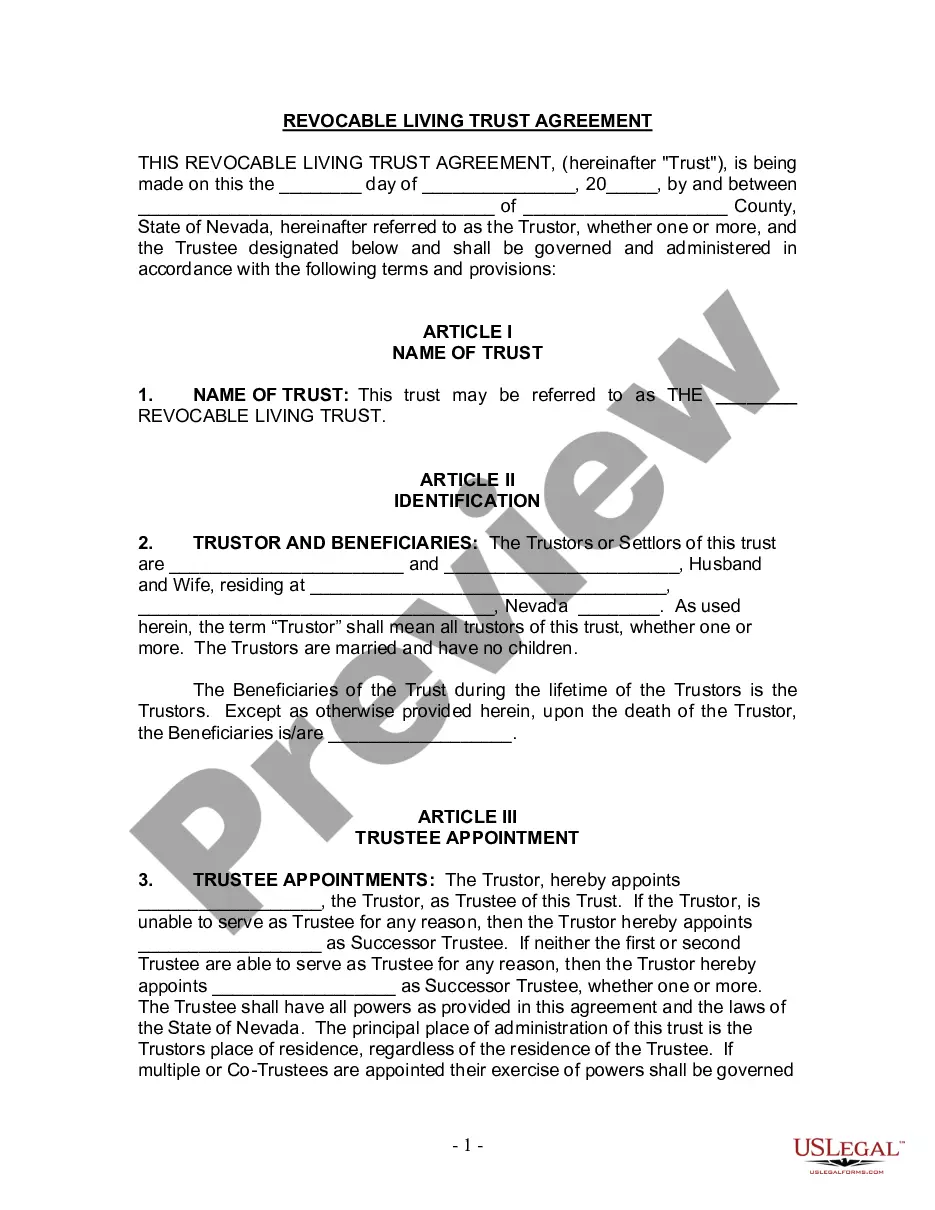

Choosing between a PC and an LLC largely depends on your business goals and the nature of your professional practice. A PC may offer specific liability protections and tax benefits tailored to licensed professionals, while an LLC provides flexibility in management and tax treatment. Evaluating your options for a professional corporation without the burdens of alternative structures can help you decide which is best for your needs.

The term 'professional' in a company context refers to employees who possess specialized skills or credentials and uphold industry standards. These individuals contribute to the organization's success by delivering expert services to clients and stakeholders. Forming a professional corporation without the usual pitfalls allows such talents to thrive while ensuring regulatory compliance.

In accounting, a professional corporation is an entity established by accountants to provide services while limiting personal liabilities associated with their professional practices. This structure allows accountants to protect their personal assets while maintaining a distinct separation between personal and business finances. Opting for a professional corporation without unnecessary complications can streamline your accounting services.

A corporate professional is someone who works in a corporate setting, often bringing specialized expertise to the organization. They may play critical roles in advising, managing, and driving business strategies. For a professional corporation without the distractions of other business arrangements, having corporate professionals ensures that you benefit from experienced individuals dedicated to your industry.

In business, PC stands for professional corporation, a structure that provides a framework for licensed professionals to operate while protecting their personal assets. This designation signifies a commitment to ethical practice and professionalism within the corporate environment. Establishing a professional corporation without the complexities of other business forms can help you focus on what matters most—serving your clients effectively.

Corporate professionalism embodies the standards and practices that define the behavior of professionals in the corporate world. It includes elements such as ethical decision-making, effective communication, and adherence to industry regulations. Creating a culture of corporate professionalism within a professional corporation without compromising values can greatly enhance your firm's reputation.

A PC, or professional corporation, is treated as an independent business entity for tax purposes. This means that it can file its own tax return and may qualify for certain tax benefits unavailable to sole proprietorships or partnerships. By forming a professional corporation without the typical challenges of other structures, you potentially enjoy favorable tax treatment, enhancing your financial efficiency.

The term 'professional corporate' often refers to businesses formed to provide professional services, similar to professional corporations. This designation emphasizes the focus on professional expertise within a corporate framework. When you consider a professional corporation without the added burdens of other business forms, this structure becomes appealing for licensed professionals seeking liability protections.

A professional corporation is a specific type of business entity designed for professional services provided by licensed individuals, such as doctors, lawyers, or accountants. It offers limited liability protection while allowing professionals to maintain control over their business operations. Therefore, choosing a professional corporation without additional complexities simplifies the legal and operational aspects of your practice.

A corporate professional refers to an individual who operates within a corporate structure, typically in roles that require specialized skills or knowledge. These professionals engage in a variety of functions such as management, finance, or accounting. Understanding this concept helps clarify the role of such individuals in a professional corporation without implying any specific limitations.