North Carolina Landlord Tenants With Right Of Survivorship

Description

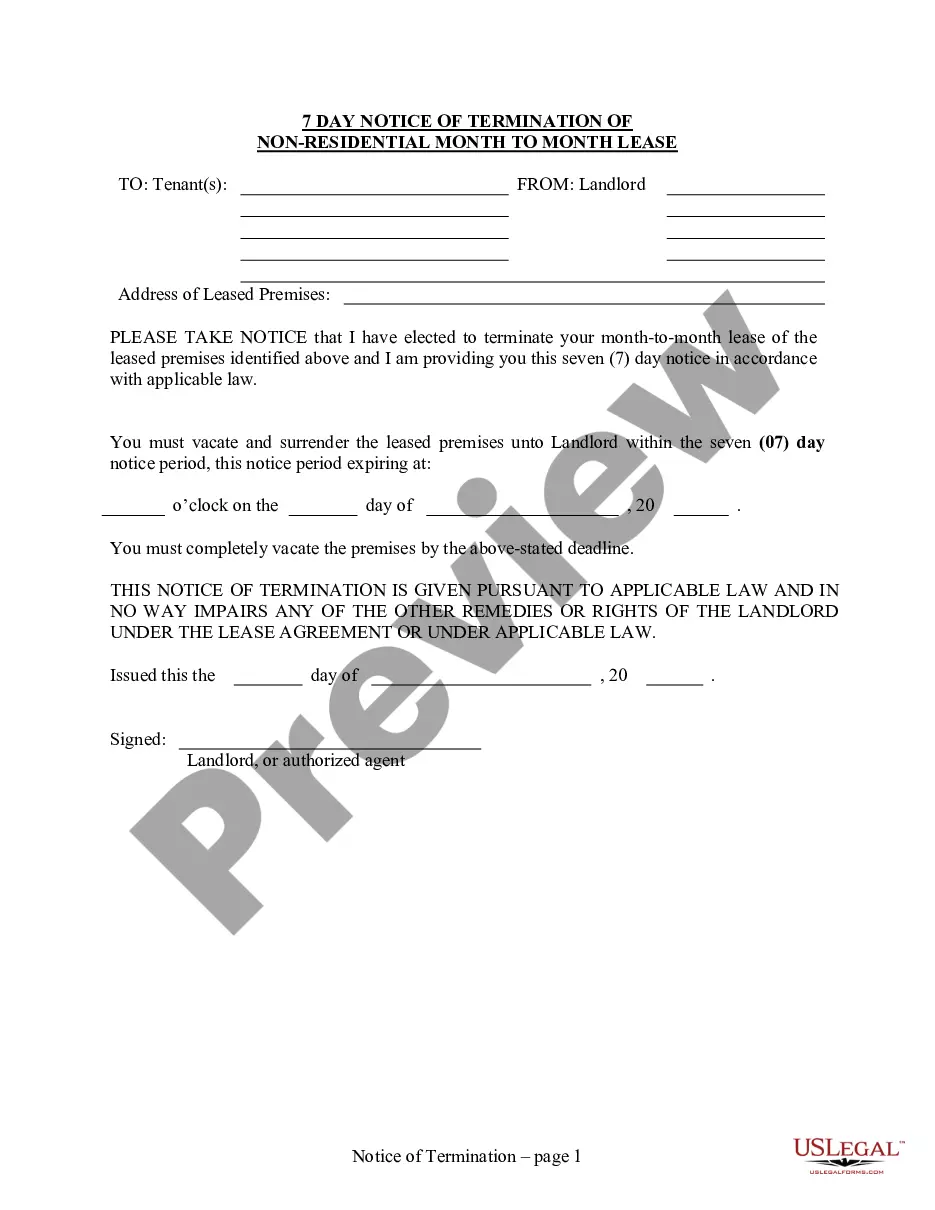

How to fill out North Carolina Landlord Tenant Eviction / Unlawful Detainer Forms Package?

Regardless of whether it is for corporate matters or personal issues, everyone inevitably has to deal with legal circumstances at some point in their lives.

Completing legal documents requires meticulous focus, starting with selecting the correct form template.

Select the document format you wish and download the North Carolina Landlord Tenants With Right Of Survivorship. After downloading, you can fill out the form using editing software or print it out and complete it by hand. With a comprehensive US Legal Forms catalog available, you don't need to waste time searching for the right template online. Utilize the library’s easy navigation to find the correct template for any occasion.

- For instance, if you choose an incorrect variant of the North Carolina Landlord Tenants With Right Of Survivorship, it will be rejected upon submission.

- Thus, it is vital to have a dependable source of legal documents like US Legal Forms.

- If you wish to obtain a North Carolina Landlord Tenants With Right Of Survivorship template, follow these simple steps.

- Utilize the search box or catalog navigation to locate the template you require.

- Review the form’s details to ensure it corresponds with your case, state, and county.

- Click on the form’s preview to inspect it.

- If it is the incorrect form, return to the search function to find the North Carolina Landlord Tenants With Right Of Survivorship template you need.

- Acquire the document if it meets your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you haven't created an account yet, you can purchase the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: you have the option to use a credit card or PayPal account.

Form popularity

FAQ

'With right of survivorship' means that when one co-owner of a property dies, their share automatically transfers to the surviving co-owner. This arrangement simplifies the transfer process and avoids the complexities of probate. Understanding this aspect is essential for North Carolina landlord tenants with right of survivorship to make informed decisions about property ownership.

For example, let's say that you and your two siblings inherit your grandfather's farm as joint-tenants with the right of survivorship. While more than one of you still lives, each co-tenant has an equal right to use the property. After two siblings die, the sole survivor becomes the sole owner of the property.

Disadvantages of joint tenants with right of survivorship JTWROS accounts involving real estate may require all owners to consent to selling the property. Frozen bank accounts. In some cases, the probate court can freeze bank accounts until the estate is settled.

§ 41-72. Determination of the interests of joint tenants in a joint tenancy with right of survivorship. (a) The interests of joint tenants in a joint tenancy with right of survivorship shall be deemed to be equal unless otherwise provided in the instrument of conveyance.

Entireties property can exist only between spouses and is recognized in North Carolina only in real property (real estate). In addition to the automatic, implicit right of survivorship feature, each spouse's interest in entireties property is protected from the creditors of the other spouse.

The surviving spouse automatically becomes the sole owner of property held as tenancy by the entirety, and is not disposed of by a will or otherwise disposed of by the intestate succession statute if there is no will.