North Carolina Release Withholding Form

Description

How to fill out North Carolina Release Withholding Form?

There's no longer any reason to spend hours searching for legal documents to fulfill your local state obligations. US Legal Forms has compiled all of them in a single location and enhanced their accessibility.

Our platform provides over 85k templates for various business and personal legal matters categorized by state and purpose. All forms are meticulously drafted and verified for legitimacy, so you can be confident in acquiring an up-to-date North Carolina Release Withholding Form.

If you are acquainted with our platform and already possess an account, make sure your subscription is valid before obtaining any templates. Log In to your account, select the document, and click Download. You can also revisit any saved documents anytime by accessing the My documents tab in your profile.

Print your form to fill it out by hand or upload the sample if you prefer to use an online editor. Preparing legal documents under federal and state laws and regulations is fast and straightforward with our library. Try US Legal Forms today to keep your paperwork organized!

- If you have never utilized our platform before, the process will require a few additional steps to complete.

- Here's how new users can locate the North Carolina Release Withholding Form in our catalog.

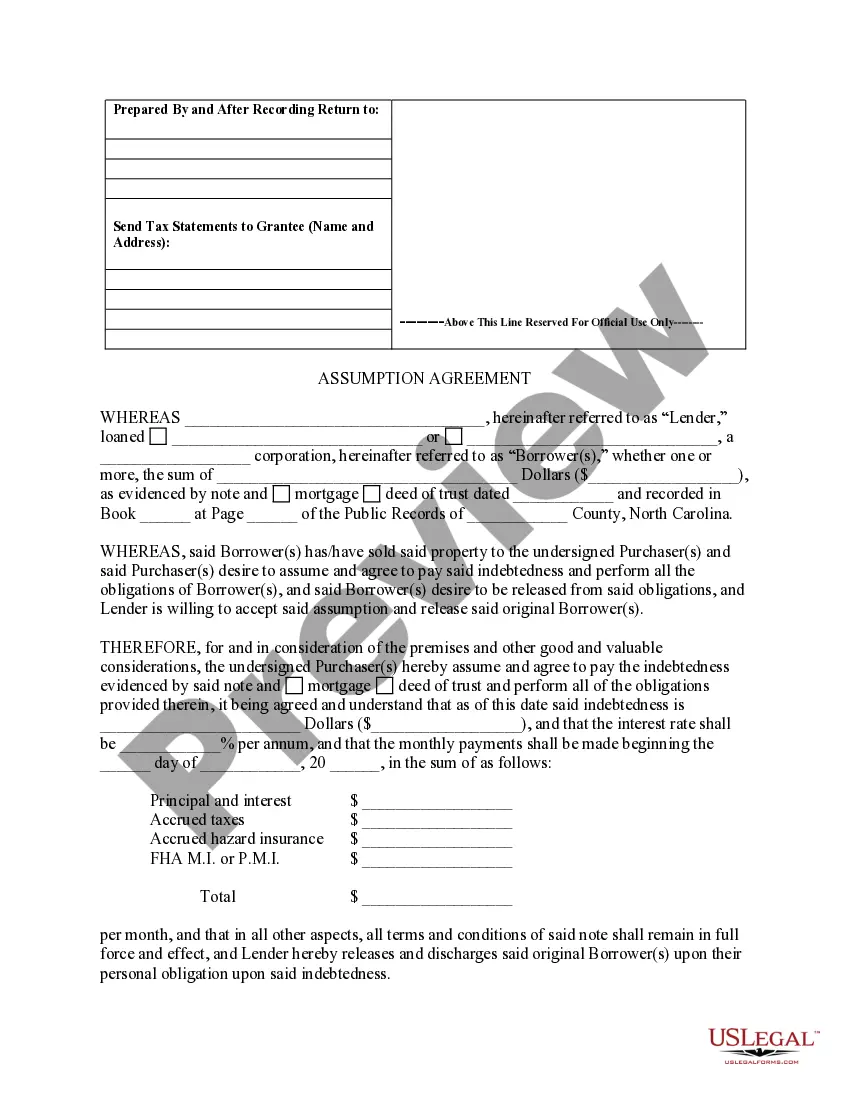

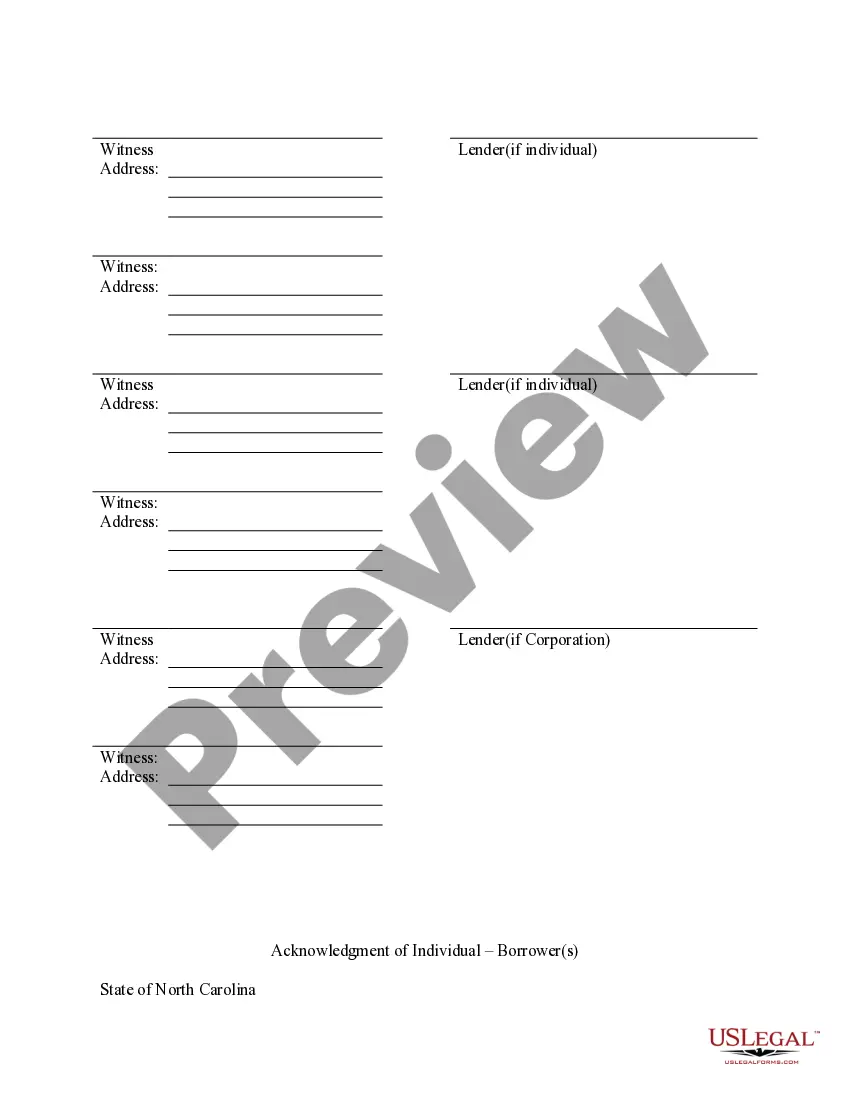

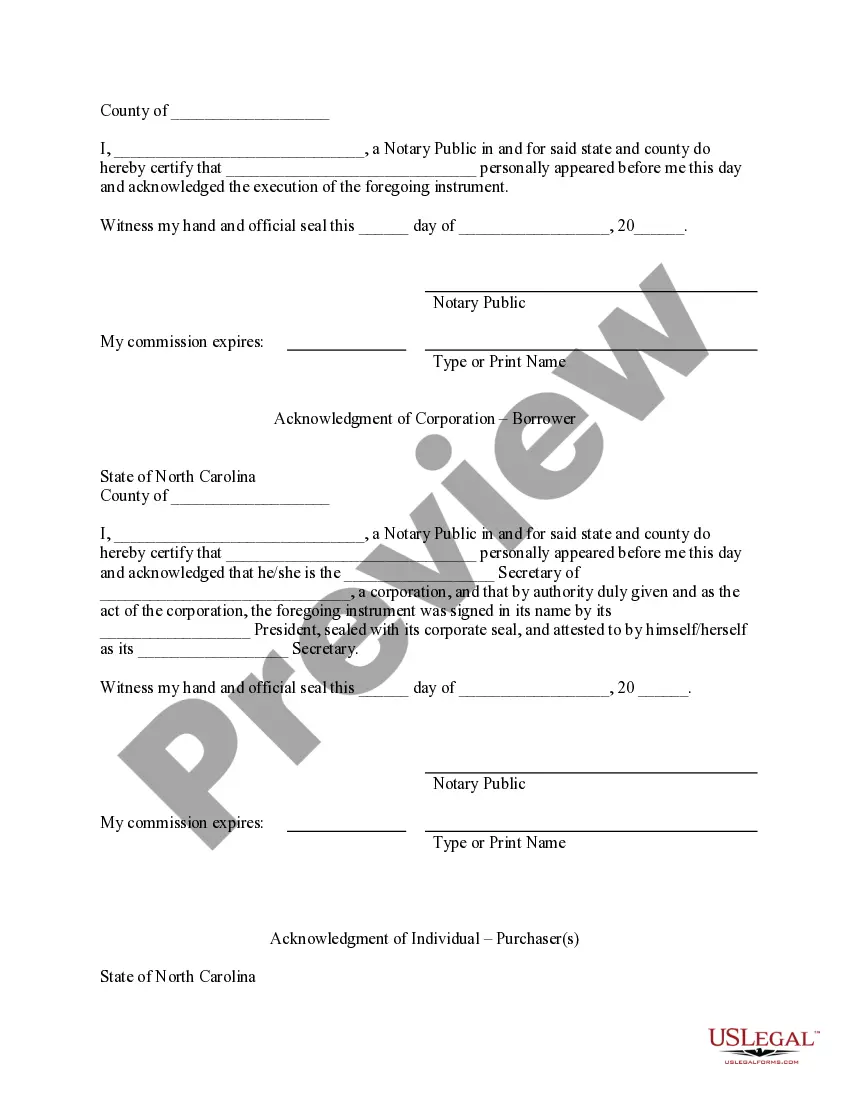

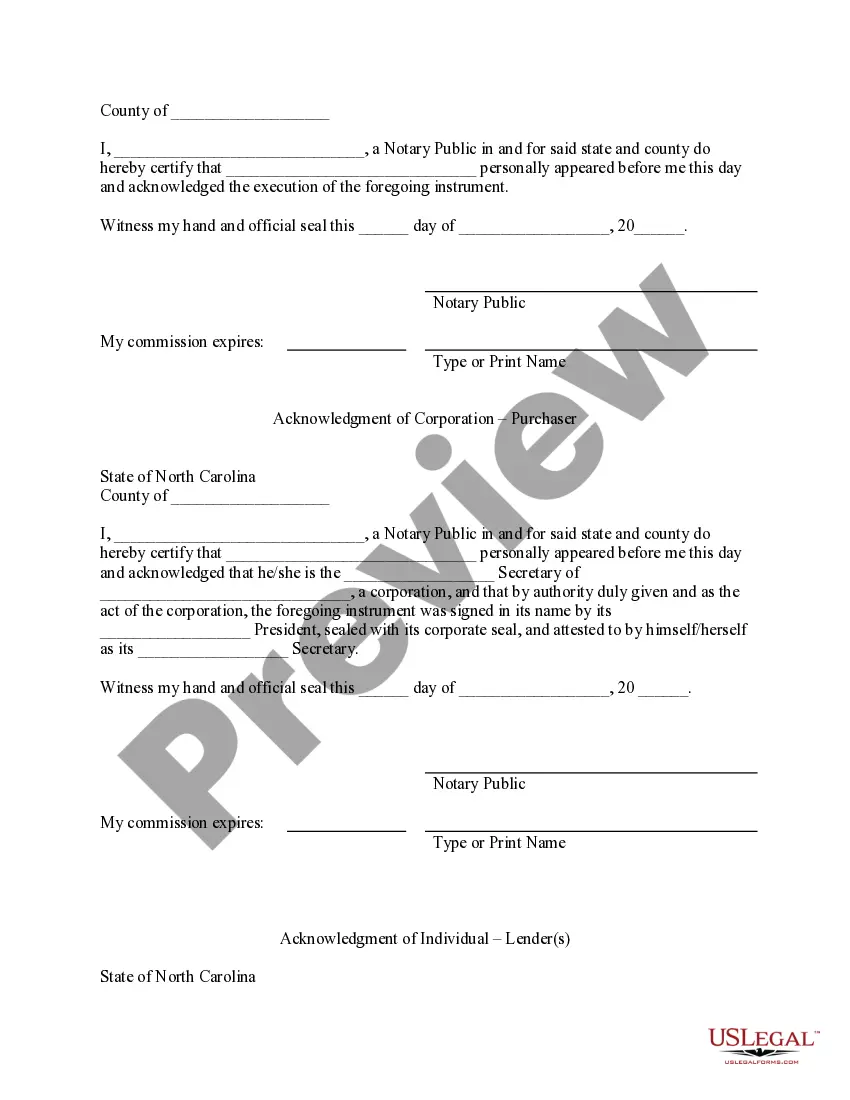

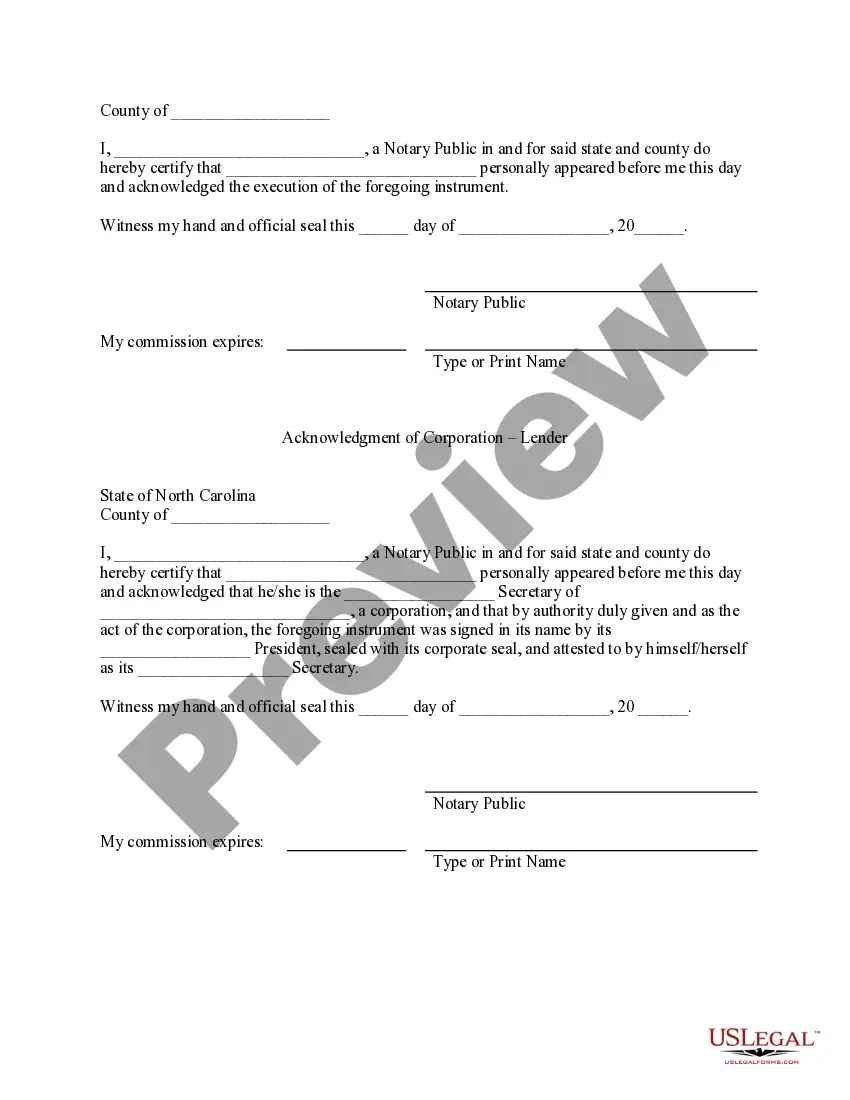

- Review the page content closely to ensure it contains the sample you require.

- To do so, use the form description and preview options if available.

- Employ the Search field above to find another sample if the current one does not meet your needs.

- Click Buy Now next to the template title once you discover the correct one.

- Choose the most appropriate subscription plan and sign up for an account or Log In.

- Process your subscription payment using a credit card or via PayPal to proceed.

- Select the file format for your North Carolina Release Withholding Form and download it to your device.

Form popularity

FAQ

FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits.

Yes. You must complete a new NC-4EZ or NC-4 for each employer.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

The NC-4EZ is a new, simplified form which should suffice for most taxpayers. The NC-4 is the complete form which may result in a more accurate withholding amount, but requires historical tax information and will involve estimates.

Employer, your employer is required to withhold based on single with zero allowances. FORM NC-4 EZ - You may use this form if you intend to claim either: exempt status, or the N.C. standard deduction and no tax credits or only the credit for children.