North Carolina Trust Form Withholding

Description

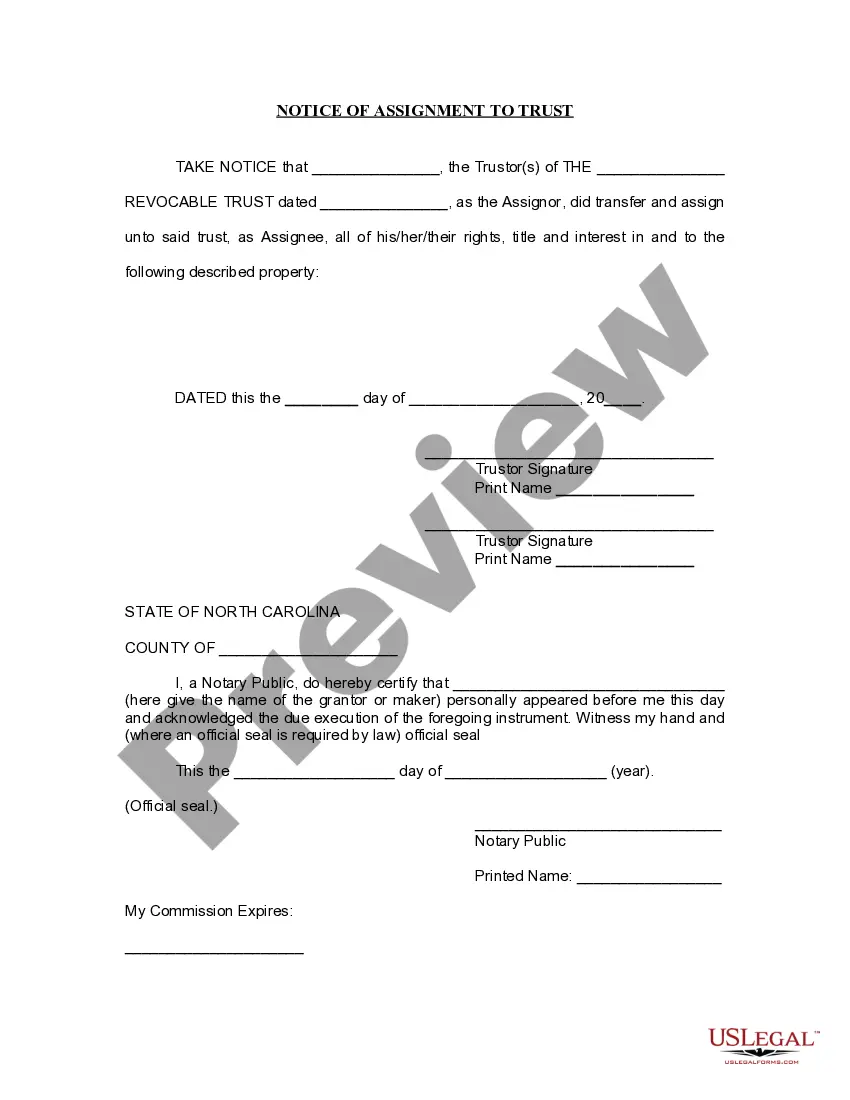

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Form popularity

FAQ

A good percentage to withhold varies based on individual circumstances, but 5.25% is the standard for North Carolina. It's important to keep your financial situation in mind, as under-withholding could lead to a tax bill at the end of the year. Tools addressing North carolina trust form withholding on platforms like uslegalforms can help you determine the best approach.

The standard withholding percentage for NC state taxes is currently set at 5.25%. This rate applies to most wages and salaries. For unique situations, check for instructions related to North carolina trust form withholding on state resources or consult an expert.

Most employees in North Carolina are subject to state withholding. However, specific exceptions apply to certain income types or individuals with particular eligibility. If you're unsure, review the North carolina trust form withholding guidelines or consult your employer's HR department.

To fill out a withholding exemption form in North Carolina, you will need to provide specific personal information, such as your name, address, and Social Security number. Make sure to indicate your eligibility for exemption clearly. Utilize resources on North carolina trust form withholding available on platforms like uslegalforms to make this process seamless.

In North Carolina, the withholding rate is typically a flat percentage. As of now, the rate is 5.25% for most taxpayers. It's crucial to stay updated with any changes in the law to ensure correct North carolina trust form withholding.

The amount of NC state tax to withhold depends on your total income and filing status. Generally, your employer calculates this based on information from your W-4 form. For precision, consider consulting the North Carolina Department of Revenue guidelines or using tools that provide insights on North carolina trust form withholding.

Trusts are taxed to beneficiaries based on the distributions they receive. Any income distributed is reported on the beneficiary's tax return, making them responsible for the corresponding tax. This taxation approach underscores the importance of effective planning and tax management. Utilizing North Carolina trust form withholding facilitates a transparent and compliant process for beneficiaries.

Yes, North Carolina has several state withholding forms for tax purposes, including the NC-4 form. These forms are essential for accurately reporting and withholding taxes on distributions. Trusts must ensure compliance with state requirements using the appropriate forms to facilitate withholding. Familiarity with North Carolina trust form withholding can help streamline this process.

The tax loophole for trusts often involves strategies that minimize taxable income. Some individuals may utilize certain distributions or deductions available to trusts, effectively reducing tax liability. However, it is critical to approach these strategies with caution and legal guidance. Understanding the implications of North Carolina trust form withholding is key to navigating these policies responsibly.

The NC-4 form is North Carolina's Employee’s Withholding Allowance Certificate. This form enables individuals to claim allowances to determine the correct amount of state tax withholding from their income. Trusts may require beneficiaries to complete an NC-4 form to adjust withholding relevant to trust distributions. Awareness of this form is essential for effective North Carolina trust form withholding management.