Dissolve Limited Liability Company Without Operating Agreement

Definition and meaning

The term "dissolve limited liability company without operating agreement" refers to the legal process of formally terminating a limited liability company (LLC) that does not have an operating agreement in place. An operating agreement typically outlines the management and operational guidelines for an LLC. In the absence of this document, the default state laws govern the dissolution process.

How to complete a form

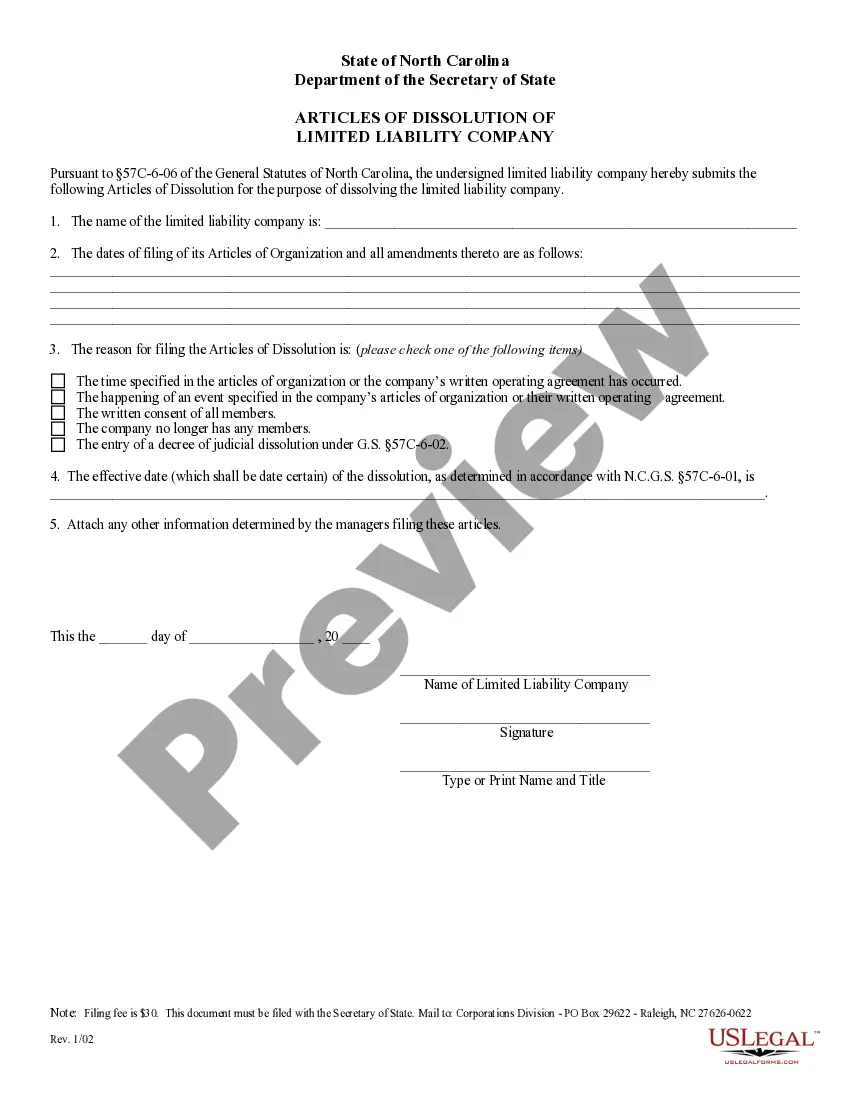

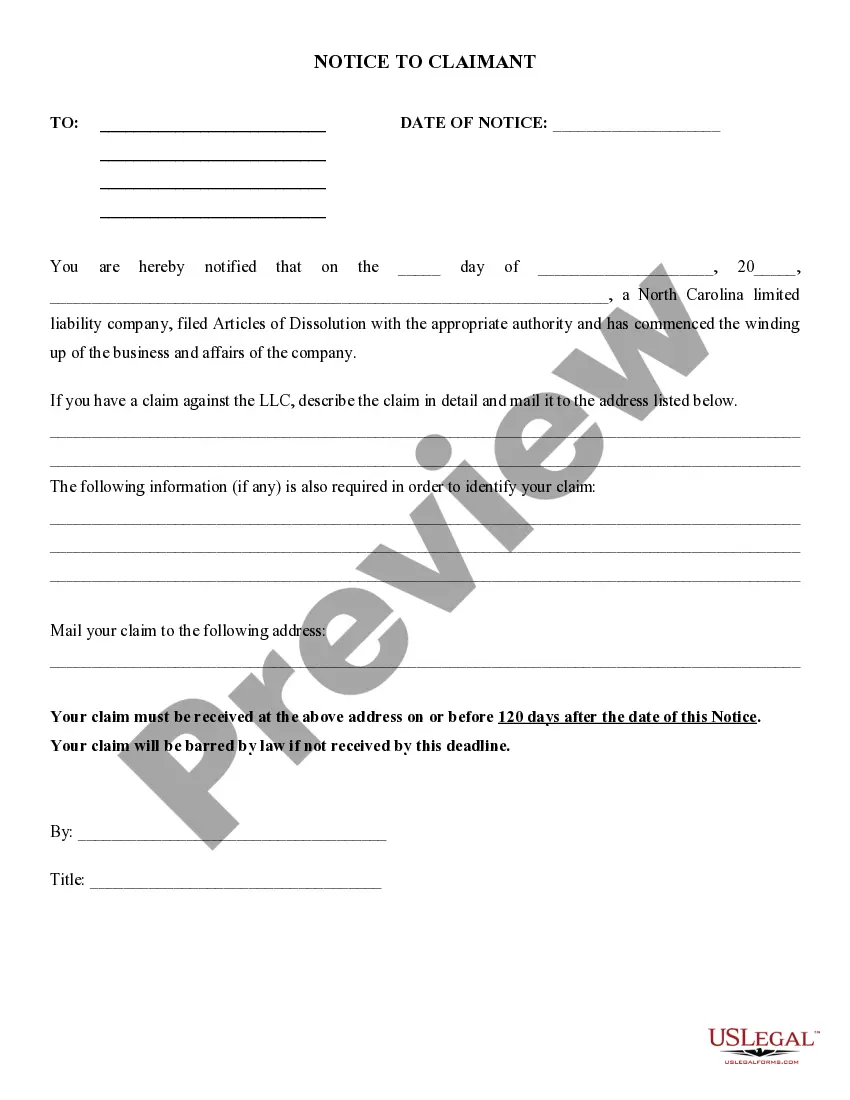

To dissolve your LLC without an operating agreement, you must fill out the Articles of Dissolution form required by your state. This process generally entails the following steps:

- Obtain the Articles of Dissolution form from your state’s Secretary of State website.

- Complete the form with accurate information, including the LLC’s name and the reason for dissolution.

- Provide details about the dissolution date and any outstanding liabilities.

- Sign and date the form before submitting it.

- Prepare to pay any required filing fees.

Key components of the form

The Articles of Dissolution form generally includes the following key components:

- Name of the LLC: The legal name under which the LLC was registered.

- Reason for dissolution: A brief explanation for closing the business.

- Dissolution date: The effective date of the dissolution.

- Signature: A signature from a member or manager of the LLC, if applicable.

Ensure that all information is accurate to avoid delays in processing your dissolution request.

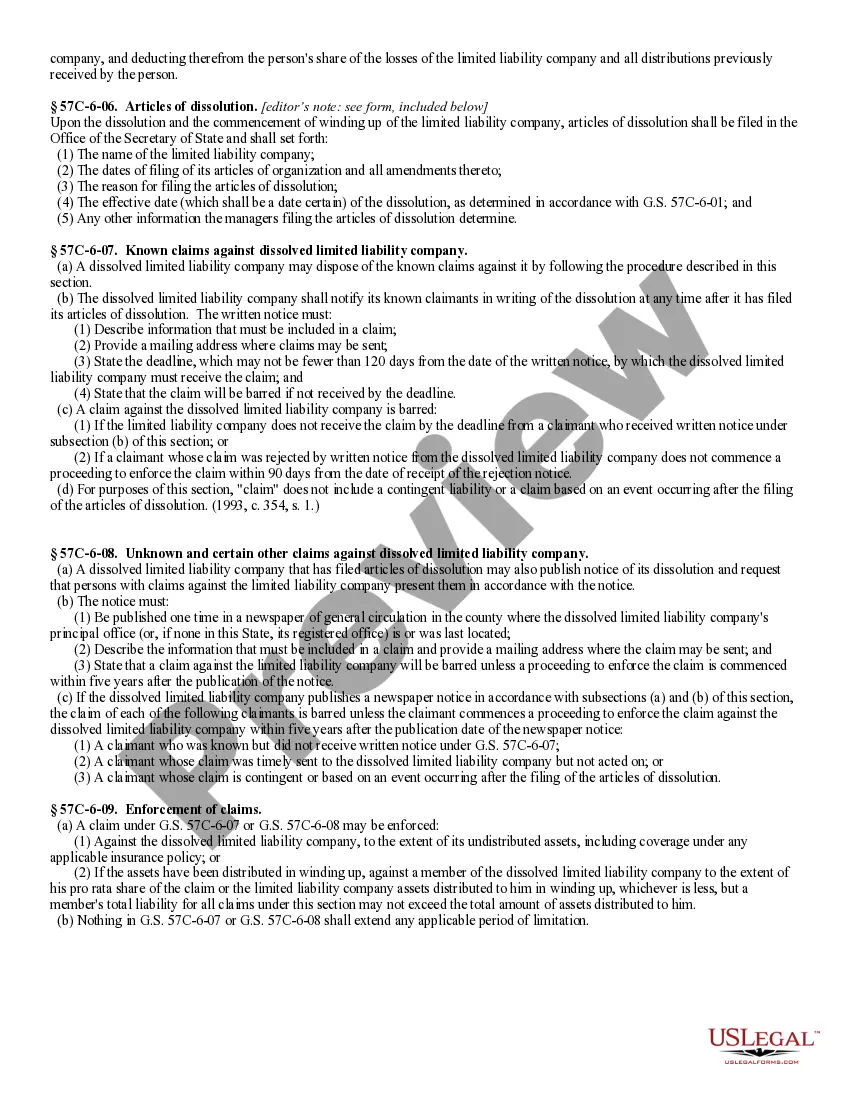

State-specific requirements

The requirements for dissolving an LLC may vary depending on the state where the company is registered. Some states have specific provisions regarding the notice to creditors and how to handle outstanding debts. It is important to familiarize yourself with local laws and procedures to ensure compliance. Consult your state's Secretary of State website for detailed information on the dissolution process in your area.

Common mistakes to avoid when using this form

When completing the Articles of Dissolution, avoid these common mistakes:

- Failing to include all required information.

- Not signing or dating the form.

- Submitting the form without the necessary filing fee.

- Not familiarizing yourself with state-specific requirements.

- Overlooking outstanding liabilities that need to be addressed before dissolution.

Review the form carefully before submission to lessen the chances of errors.

What documents you may need alongside this one

In addition to the Articles of Dissolution, you may need several documents, including:

- Final tax returns: To report any income generated by the LLC until the dissolution date.

- Proof of debt payments: To show that all outstanding obligations have been settled.

- Member consent documentation: In the case of members agreeing to the dissolution, if applicable.

Ensure all relevant paperwork is completed and included to facilitate a smooth dissolution process.

Key takeaways

Dissolving a limited liability company without an operating agreement requires adherence to state-specific laws and proper completion of the Articles of Dissolution. Key actions include:

- Gathering necessary documents.

- Completing the form with accurate details.

- Addressing outstanding liabilities.

- Paying the required filing fees.

By carefully following the recommended steps, you can navigate the dissolution process successfully.

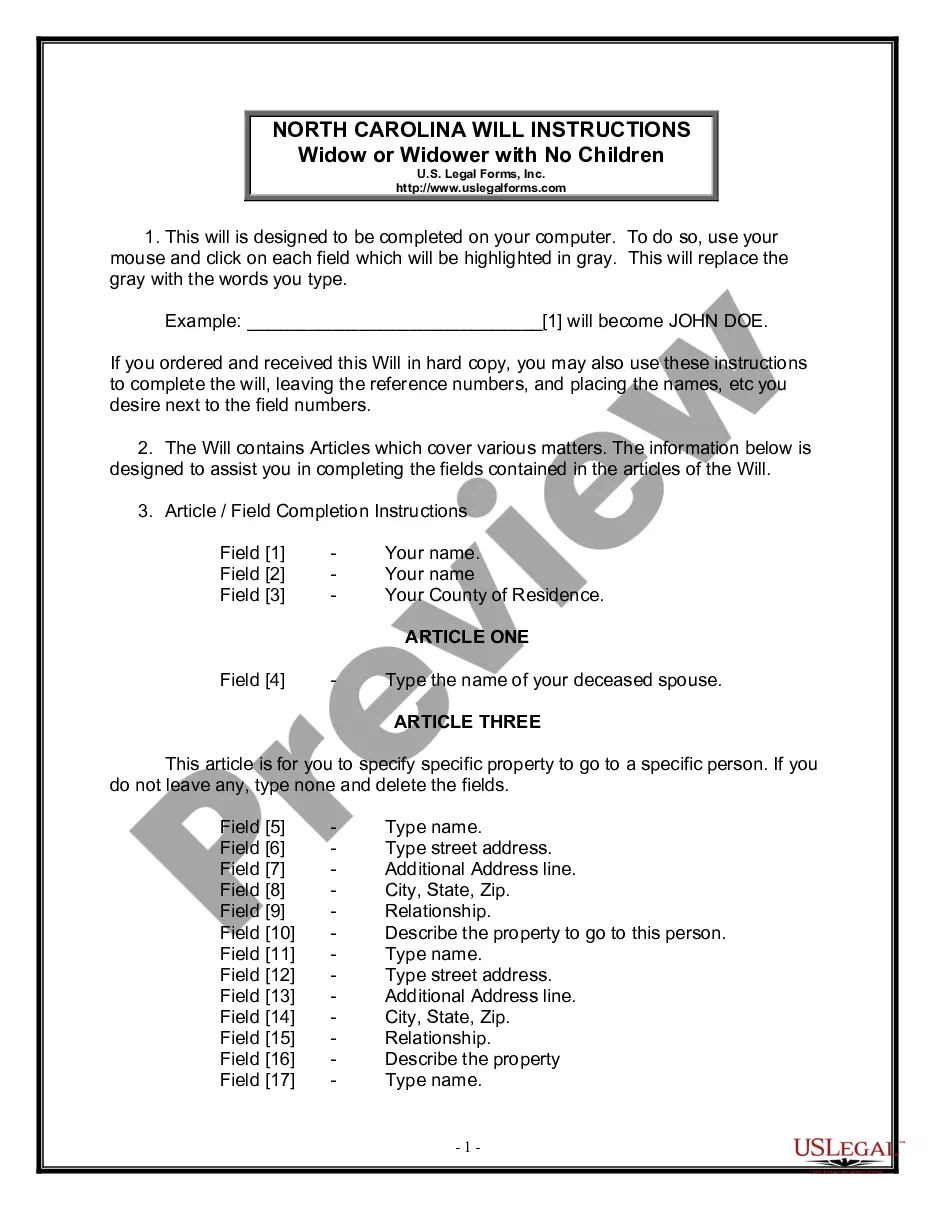

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Maneuvering through the red tape of official documents and forms can be challenging, particularly if one does not engage in that field professionally.

Moreover, locating the appropriate template to dissolve a Limited Liability Company without an Operating Agreement can be cumbersome, as it must be both valid and precise down to the last digit.

However, you will need to invest significantly less time selecting a fitting template from a trustworthy source.

Obtain the correct form in a few easy steps: Enter the title of the document into the search bar. Locate the precise Dissolve Limited Liability Company Without Operating Agreement in the list of results. Review the summary of the example or open its preview. If the template meets your requirements, click Buy Now. Proceed to select your subscription plan. Utilize your email and establish a password to register an account at US Legal Forms. Choose either a credit card or PayPal payment method. Save the template file on your device in your preferred format. US Legal Forms will save you considerable time determining whether the form you discovered online is appropriate for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the task of finding the correct forms online.

- US Legal Forms is a single destination where you can locate the latest examples of documents, verify their use, and download these examples to complete them.

- It boasts a collection of over 85,000 forms applicable in various professional fields.

- When searching for a Dissolve Limited Liability Company Without Operating Agreement, you won't have to doubt its validity since all forms are authenticated.

- Having an account at US Legal Forms guarantees that all the essential samples are readily accessible to you.

- You can save them in your history or add them to the My documents library.

- Retrieve your saved forms from any device by clicking Log In on the library website.

- If you have yet to create an account, you can always conduct a new search for the template you require.

Form popularity

FAQ

A corporation (or a farmer's cooperative) must file Form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Exempt organizations and qualified subchapter S subsidiaries should not file Form 966.

To close an LLC, the members need to surrender the authority of the company to do business. They can do this by sending a complete Articles of Dissolution to the secretary of state. However, filing these dissolution papers is one part of closing a limited liability company.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

How to Close an Inactive BusinessDissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved.Pay Any Outstanding Bills.Cancel Any Business Licenses or Permits.File Your Final Federal and State Tax Returns.

Does a Corporation Need to File Form 966? Technically, yes. The corporation must file IRS Form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock.