North Carolina Affidavit Of Collection Disbursement And Distribution

Definition and meaning

The North Carolina Affidavit of Collection Disbursement and Distribution serves as a legal document that allows individuals to certify the collection and distribution of funds or property. This affidavit is particularly important in various legal contexts, such as estate planning, property transactions, or settling debts. By completing this form, individuals affirm that the specified disbursements have taken place according to the law, ensuring transparency and accountability.

How to complete a form

To accurately complete the North Carolina Affidavit of Collection Disbursement and Distribution, follow these steps:

- Begin by filling out your full name and the appropriate address at the top of the form.

- Clearly specify the nature of the collection and the total value of the disbursement.

- Include details regarding the recipient of the disbursement, ensuring that names and addresses are correct.

- Sign the affidavit in the designated area to confirm the information provided is truthful.

- Submit the form to the appropriate authority or retain it for your personal records.

Who should use this form

This affidavit is typically used by individuals involved in the collection or distribution of funds or property in North Carolina. Common users include:

- Executors of estates managing the distribution of assets.

- Property sellers confirming the disbursement of sale proceeds.

- Individuals settling debts who need to document the distribution.

Using this form can help to clarify the responsibilities and actions taken, minimizing potential disputes.

Key components of the form

The North Carolina Affidavit of Collection Disbursement and Distribution includes several essential components:

- Affiant Information: Personal details of the individual completing the affidavit.

- Collection Details: Description of what is being collected or disbursed, including amounts.

- Recipient Information: Names and addresses of parties receiving the disbursement.

- Signature: The legal affirmation that the information provided is accurate and truthful.

What documents you may need alongside this one

When completing the North Carolina Affidavit of Collection Disbursement and Distribution, it is important to prepare additional supporting documents, including:

- Proof of identity, such as a driver’s license or passport.

- Any contracts or agreements related to the collection and distribution.

- Financial statements supporting the amounts being disbursed.

- Documentation of prior communications regarding the fund or property transaction.

Benefits of using this form online

Utilizing the North Carolina Affidavit of Collection Disbursement and Distribution in an online format offers several advantages:

- Convenience: Access the form from anywhere at any time.

- Time-saving: Quickly fill in the necessary fields without needing to visit a physical location.

- Accuracy: Online forms often include prompts and checks to minimize errors during completion.

This streamlined process helps ensure the effective management of legal documents.

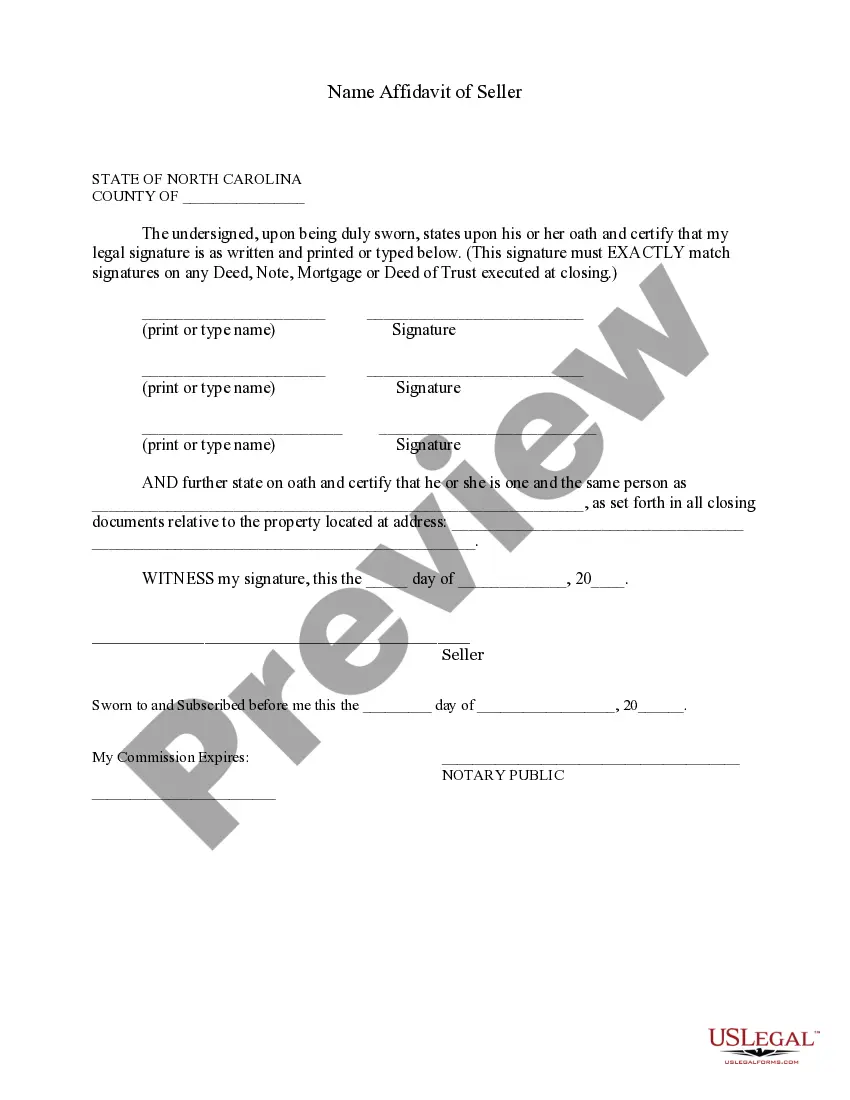

How to fill out North Carolina Name Affidavit Of Seller?

Individuals frequently link legal documentation with something intricate that only a professional can manage.

In some respects, this is accurate, as preparing the North Carolina Affidavit Of Collection Disbursement And Distribution demands considerable expertise in subject criteria, encompassing state and county regulations.

However, with US Legal Forms, the process has become simpler: accessible legal templates tailored to any personal and business scenario according to state laws are compiled in a single online repository and are now open to everyone.

Establish an account or Log In to advance to the payment page. Process your subscription payment through PayPal or with your credit card. Choose the format for your file and click Download. Print your document or transfer it to an online editor for expedited completion. All templates in our library are reusable: once obtained, they are stored in your profile. You can access them whenever necessary via the My documents tab. Explore all advantages of using the US Legal Forms platform. Join today!

- US Legal Forms offers over 85k current forms categorized by state and field of use, making it easy to find the North Carolina Affidavit Of Collection Disbursement And Distribution or any other specific template in mere minutes.

- Previously registered users with an active subscription must Log In to their account and select Download to obtain the form.

- New users on the platform will need to register for an account and subscribe prior to saving any documents.

- Here’s a step-by-step instruction on how to acquire the North Carolina Affidavit Of Collection Disbursement And Distribution.

- Review the content of the page carefully to ensure it meets your requirements.

- Examine the form description or review it through the Preview option.

- If the previous sample does not meet your needs, find another template using the Search bar in the header.

- Once you locate the appropriate North Carolina Affidavit Of Collection Disbursement And Distribution, click Buy Now.

- Select a subscription plan that aligns with your needs and budget.

Form popularity

FAQ

You can use an affidavit to claim personal property (that's anything but real estate) if the value of the deceased person's personal property, less liens and encumbrances, is $20,000 or less ($30,000, not counting spousal allowance, if the surviving spouse is the sole heir). There is a 30-day waiting period.

A North Carolina small estate affidavit is a document that allows an individual to petition for all or a portion of a deceased person's estate. The petitioner, or affiant, can only use this affidavit if they have a lawful claim to the estate.

A Collection by Affidavit is available for a small estate whether the decedent dies intestate (without a will) or testate (with a will). The affiant, or person who makes the affidavit, can be the public administrator or the decedent's heir, creditor, executor, or devisee.

North Carolina considers small estates to be any estate valued at less than $20,000.00 (or $30,000.00 if the only beneficiary is a surviving spouse). You do not have to count real property or certain retirement accounts and life insurance policies if they already include a named beneficiary.

Obtaining a Grant of Probate is needed in most cases where the total value of the deceased's estate is deemed small... Going through the process of probate is often required to deal with a person's estate after they've passed away.