The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Co Signer Companies For Apartments With Bad Credit

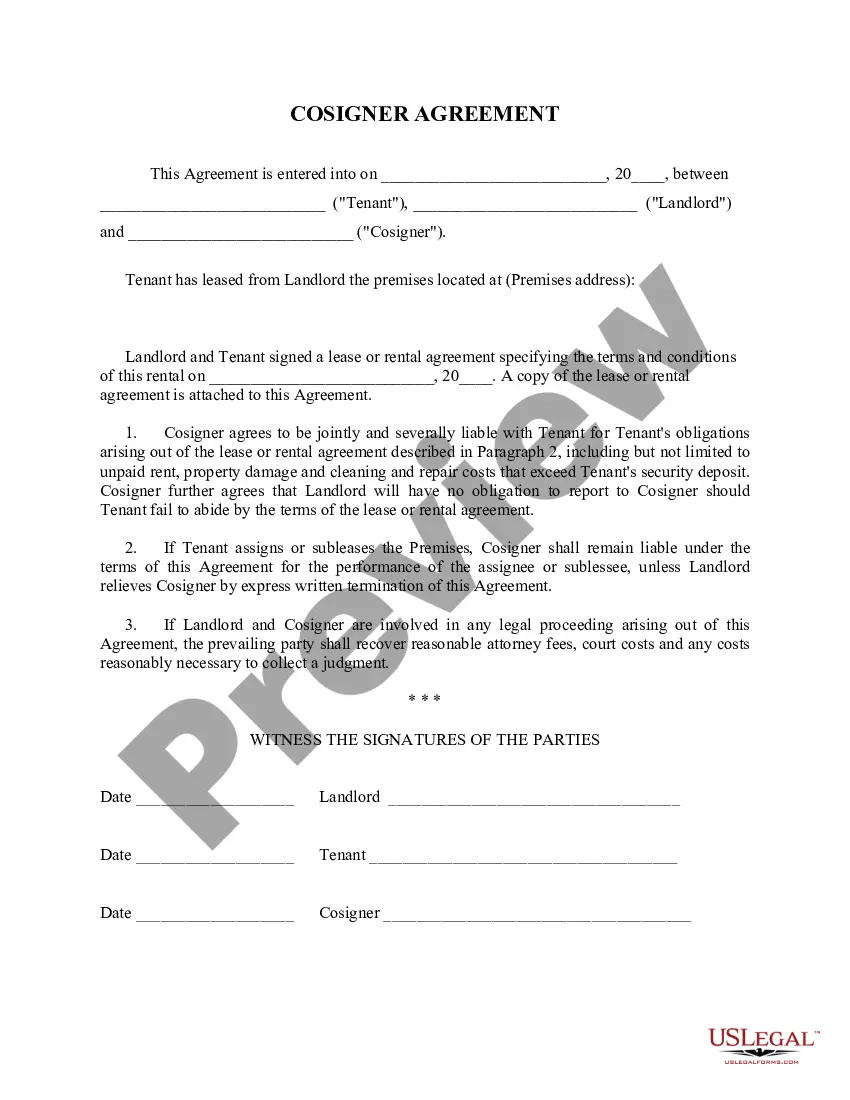

Description

How to fill out North Carolina Landlord Tenant Lease Co-Signer Agreement?

Drafting legal paperwork from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more affordable way of creating Co Signer Companies For Apartments With Bad Credit or any other paperwork without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of over 85,000 up-to-date legal documents covers virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific templates diligently put together for you by our legal professionals.

Use our website whenever you need a trusted and reliable services through which you can easily locate and download the Co Signer Companies For Apartments With Bad Credit. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes minutes to register it and navigate the library. But before jumping directly to downloading Co Signer Companies For Apartments With Bad Credit, follow these recommendations:

- Check the form preview and descriptions to ensure that you have found the form you are searching for.

- Make sure the template you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to get the Co Signer Companies For Apartments With Bad Credit.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and transform document execution into something easy and streamlined!

Form popularity

FAQ

To be a cosigner, your friend or family member must meet certain requirements. Although there might not be a required credit score, a cosigner typically will need credit in the very good or exceptional range?670 or better.

While each lender has its own credit requirements, most expect a cosigner to have good credit with at least a 670 credit score.

A cosigner can be a person who lives in the apartment, such as a roommate or partner, but they can also live elsewhere and simply step up financially if you fall short. A cosigner will need to meet a few general qualifications, including: A good credit score, usually a score of 720 or above.

While each lender has its own credit requirements, most expect a cosigner to have good credit with at least a 670 credit score.

Once they have found a co-signer, treat them as an additional tenant and have them fill out an online rental application, and run a screening report to ensure they are financially fit to be a co-signer.