Guarantor Agreement Form For North Carolina Withholding

Description

How to fill out North Carolina Guaranty Or Guarantee Of Payment Of Rent?

Properly prepared formal documents are a crucial assurance for preventing issues and legal disputes, but acquiring them without a lawyer's help can be time-consuming.

If you need to swiftly locate a current Guarantor Agreement Form For North Carolina Withholding or any other employment, family, or business templates, US Legal Forms is always ready to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, all you need to do is Log In to your account and click the Download button next to the selected document. Furthermore, you can retrieve the Guarantor Agreement Form For North Carolina Withholding at any time since all documents previously acquired on the platform are accessible in the My documents tab of your profile. Save time and resources on preparing official paperwork. Experience US Legal Forms today!

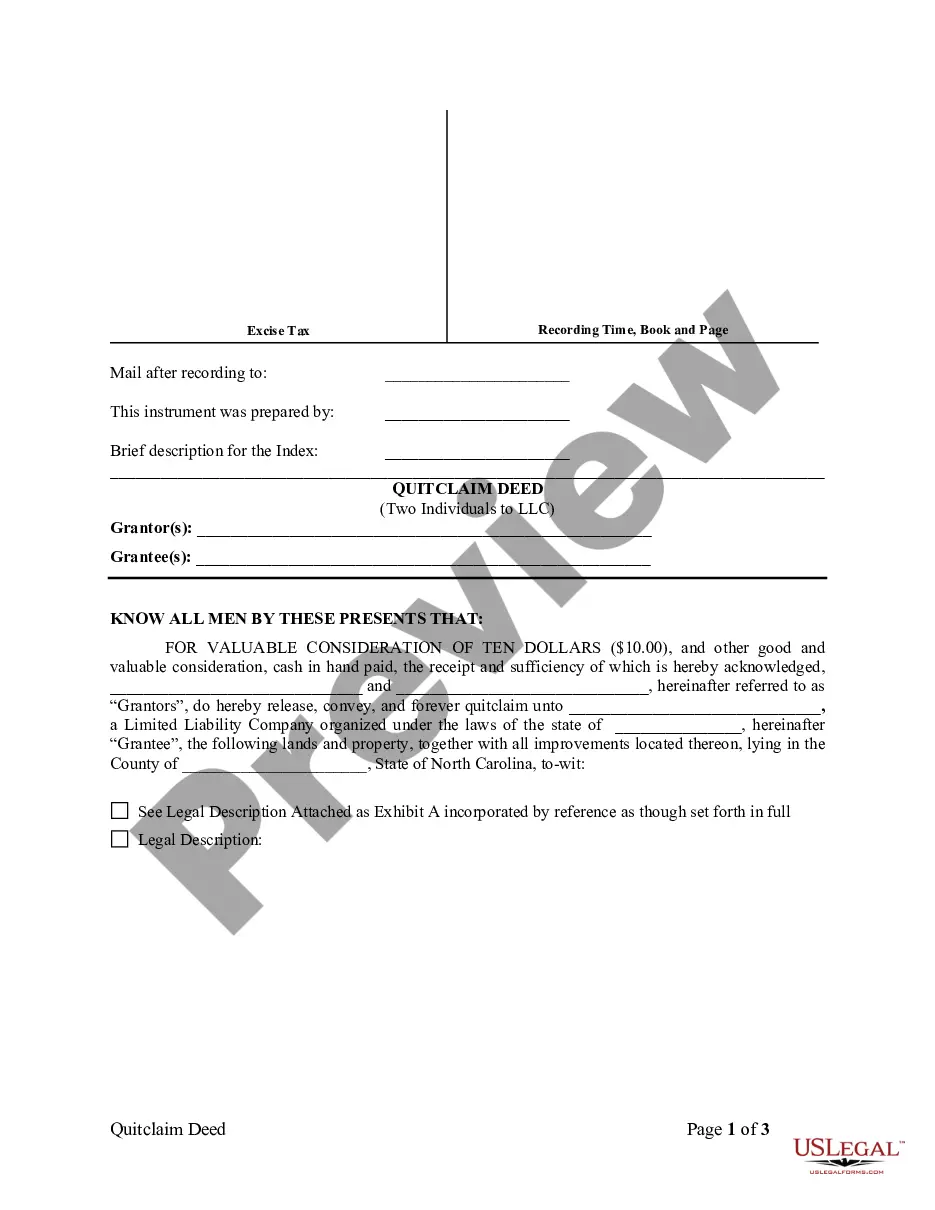

- Confirm that the form fits your situation and location by reviewing the description and preview.

- Search for an additional sample (if necessary) using the Search bar located in the page header.

- Hit Buy Now once you identify the right template.

- Select the pricing option, Log In to your account or create a new one.

- Choose your preferred payment option to buy the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX file format for your Guarantor Agreement Form For North Carolina Withholding.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

North Carolina Law Effective January 1, 2020 Effective January 1, 2020, a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. The amount of taxes to be withheld is four percent (4%) of the compensation paid to the payee.

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.

Employer, your employer is required to withhold based on single with zero allowances. FORM NC-4 EZ - You may use this form if you intend to claim either: exempt status, or the N.C. standard deduction and no tax credits or only the credit for children.

Yes. You must complete a new NC-4EZ or NC-4 for each employer.

An employee who is a resident of N. C. is subject to N. C. withholding on all of his wages, whether he works in N. C. or in another state. EXCEPTION: N. C. withholding is not required if the other state in which the employee works requires the employer to withhold income for that state.