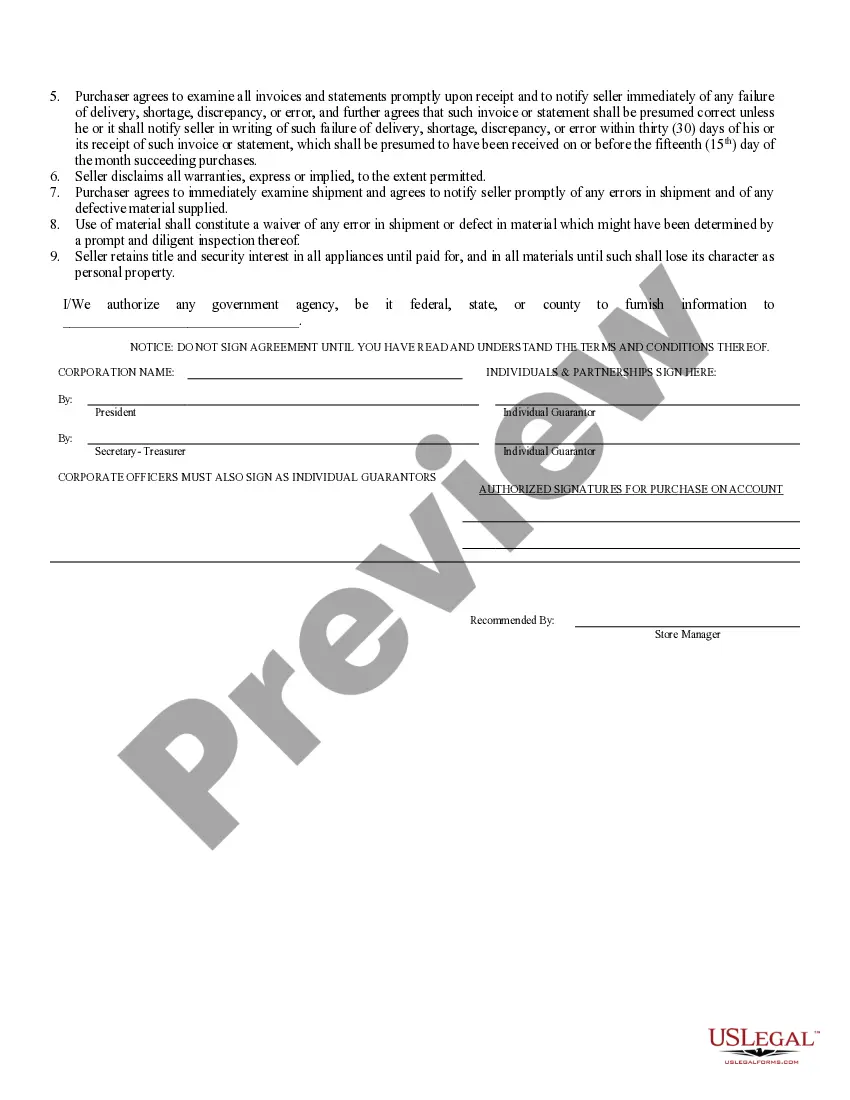

Credit Application Form With Personal Guarantee

Description

How to fill out Credit Application Form With Personal Guarantee?

There's no longer a need to invest time searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and simplified their availability.

Our website offers over 85k templates for any business and individual legal needs compiled by state and area of application.

Utilize the Search bar above to find another template if the previous one did not meet your needs. Click Buy Now next to the template title when you discover the right one. Choose your desired subscription plan and create an account or sign in. Complete your subscription payment with a credit card or through PayPal to proceed. Select the file format for your Credit Application Form With Personal Guarantee and download it to your device. Print your form to complete it manually or upload the sample if you prefer using an online editor. Preparing official documents under federal and state regulations is quick and straightforward with our platform. Try US Legal Forms today to maintain your documentation organized!

- All forms are professionally created and verified for accuracy, ensuring you receive a current Credit Application Form With Personal Guarantee.

- If you are acquainted with our platform and already possess an account, you must verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents anytime by clicking the My documents tab in your profile.

- If you've never utilized our platform previously, the procedure will require a few more steps to finalize.

- Here’s how new users can acquire the Credit Application Form With Personal Guarantee from our library.

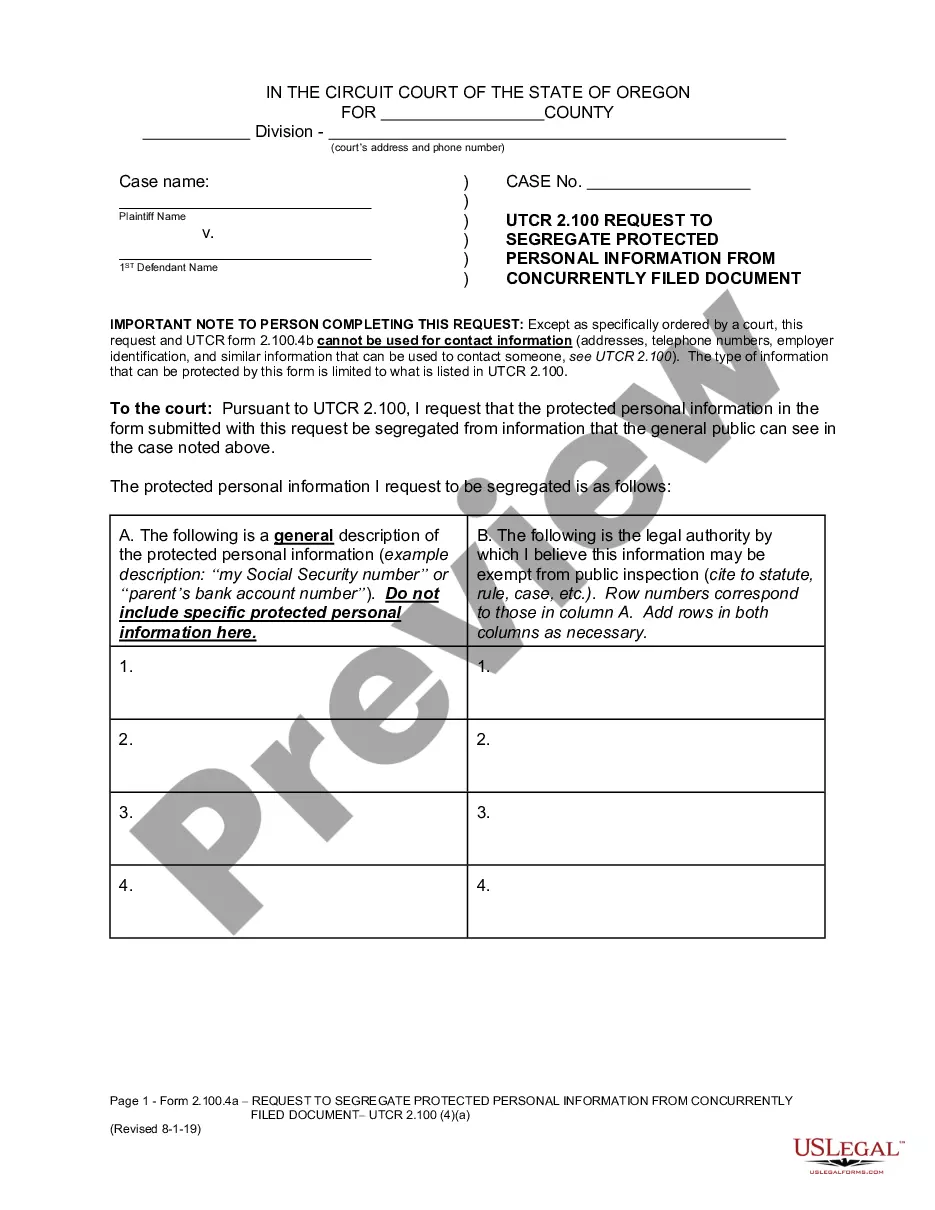

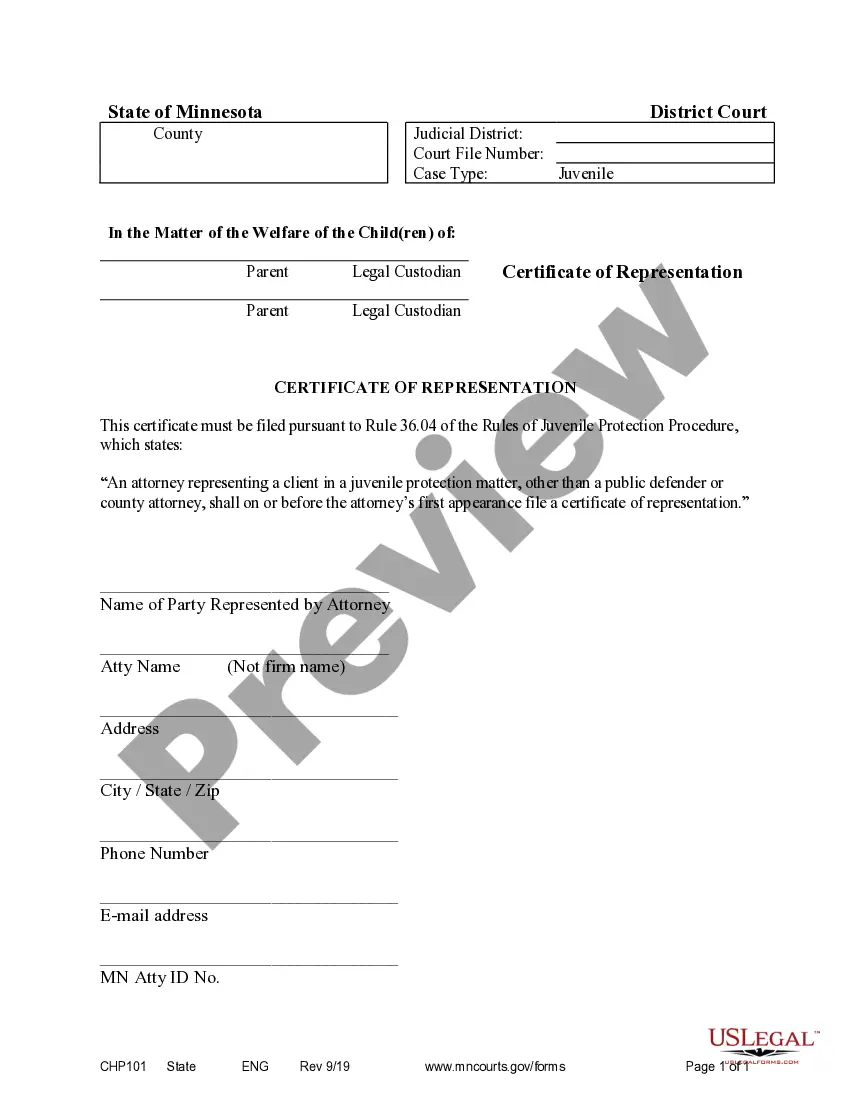

- Examine the page content closely to ensure it contains the sample you require.

- To do so, use the form description and preview options if available.

Form popularity

FAQ

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

In the credit application, you should request:bank details including account name, BSB and bank location;accountant's details;permission to do credit checks; and.trade references from at least three other suppliers, including full business name, ABN, mobile number and email address.17 Sept 2019

Commercial credit is any credit you've applied for that isn't for personal, household or family purposes. This includes business loans and goods or services that you've purchased while running a business and where payment has been deferred.

Corporate credit cards. Instead, by using a credit that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.

If the guarantee is enforceable based on the points described in this guide, unfortunately, there is no way to get out of a personal guarantee. However, there are some steps you can take to protect yourself from the potentially damaging consequences of the guarantee being called in.