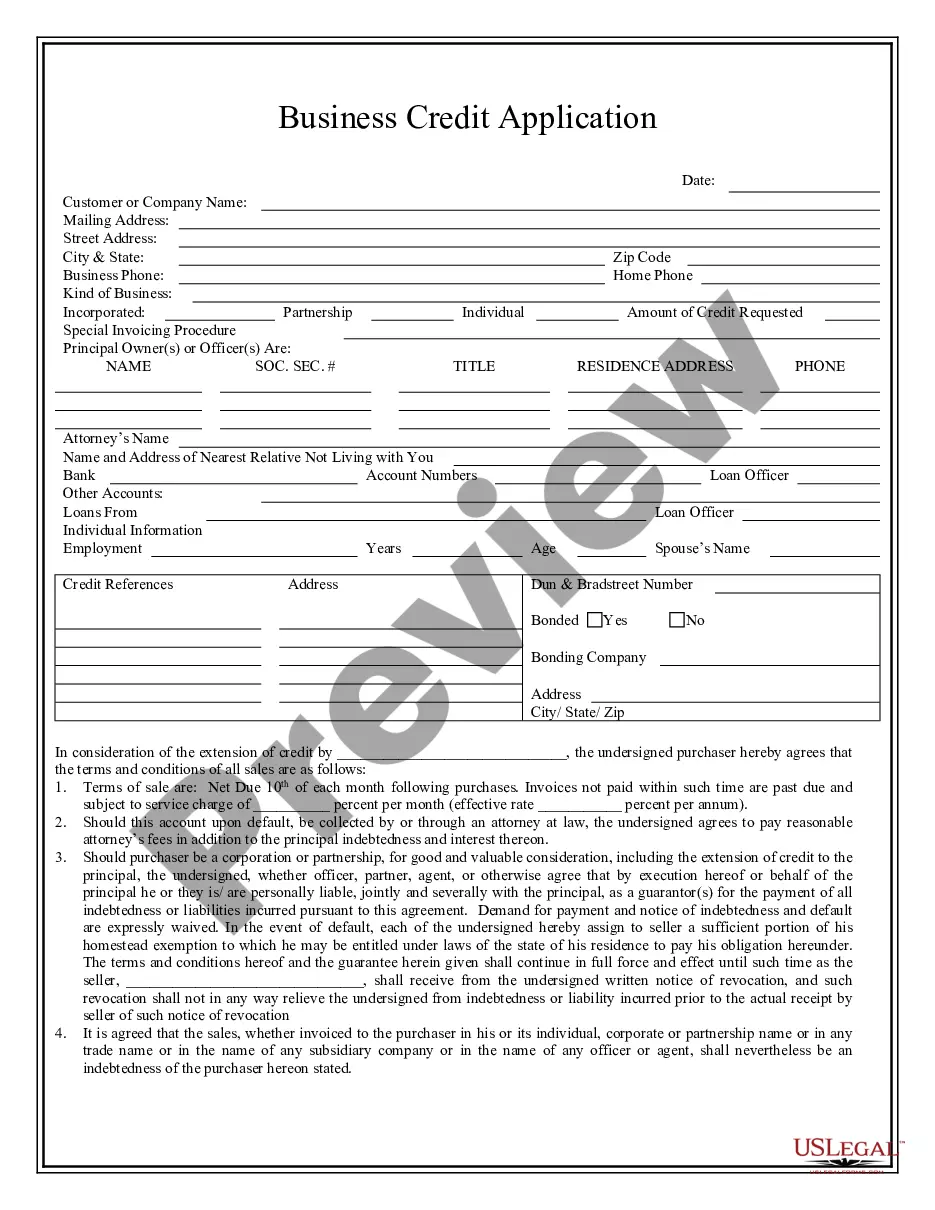

Credit Application Form For Rental Property

Description

How to fill out North Carolina Business Credit Application?

What is the most dependable service to obtain the Credit Application Form For Rental Property and other current versions of legal documents.

US Legal Forms is the answer! It's the biggest repository of legal forms for any situation.

If you haven't created an account with us yet, follow these steps to get one.

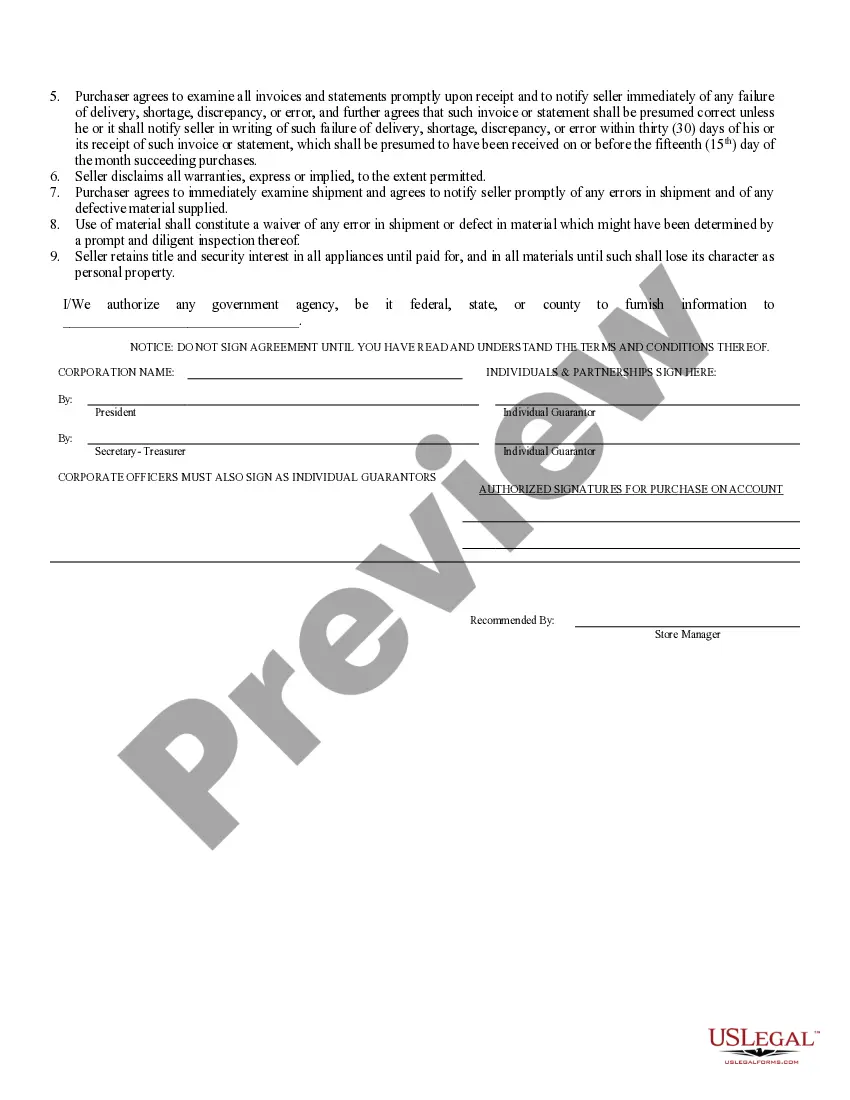

- Each template is professionally drafted and confirmed for adherence to federal and local statutes and guidelines.

- They are organized by field and state of application, making it simple to find the one you need.

- Experienced users of the site only need to Log In to the platform, verify if their subscription is active, and click the Download button next to the Credit Application Form For Rental Property to obtain it.

- Once saved, the template is available for future access in the My documents section of your account.

Form popularity

FAQ

Filling out an application for rental involves providing personal information, income details, and references. Ensure you understand each section, especially the financial parts where the credit application form for rental property requires accuracy. Take your time, as this application is essential for securing your new home.

You can obtain your credit score for a rental application from several reputable credit reporting agencies. It's wise to compare scores from different sources, as they can vary. When presenting this credit score with your credit application form for rental property, it will help landlords assess your financial standing.

Finding your rental credit score can be done through various online platforms that specialize in credit reporting. Some of these services offer insights specific to rental situations. This score can be vital when completing the credit application form for rental property, as it reflects your history as a renter.

When filling out the credit application form for rental property, choose a credit reference who knows your financial habits well. This could be a bank, credit union, or even a previous landlord. It’s important to select someone who can vouch for your reliability in paying bills and renting in the past.

A credit reference rental application is a crucial document that landlords use to assess a tenant's financial responsibility. This form helps property owners understand the reliability of a potential tenant by reviewing their credit history and references. When you fill out a credit application form for rental property, you provide essential information that enables landlords to make informed decisions. Using a platform like US Legal Forms can streamline this process, ensuring that both tenants and landlords have a user-friendly experience.

In your rental application, it’s best to include trustworthy and relevant references. Besides financial institutions, consider mentioning previous landlords, property managers, or even employers who can vouch for your stability and reliability as a tenant. Make sure to ask for their permission beforehand, ensuring they are available to provide feedback if contacted. This adds credibility to your credit application form for rental property.

For a credit reference in your rental application, you should provide current information about your financial obligations and history. Include details of any active loans, open credit lines, and their respective balances. You can also list individuals who can confirm your credit behavior, like previous landlords or financial advisors. This information helps landlords assess your suitability when reviewing your credit application form for rental property.

When filling out the credit application form for rental property, it’s essential to choose reliable credit references. You can use banks, credit unions, or other financial institutions where you have accounts. Additionally, if you have a good relationship with any lenders, including them can also strengthen your application. Ensure that you have their contact information ready, as landlords may reach out to verify your creditworthiness.

In Washington state, landlords are not legally obligated to accept the first application received. They have the discretion to review all applications to determine the best fit for their property. However, to ensure a robust selection process, consider submitting a comprehensive credit application form for rental property that reflects your qualifications as a tenant.

Creating an online rental application form can enhance the efficiency of your rental process. You can use various online platforms that offer customizable templates, including US Legal Forms, which provide an intuitive experience for both landlords and applicants. These platforms streamline the process, allowing you to easily collect and review applications in one central location.