Credit Application Form For Car

Description

How to fill out North Carolina Business Credit Application?

There’s no longer a need to squander hours hunting for legal forms to fulfill your local state obligations. US Legal Forms has compiled all of them in a single location and simplified their access.

Our website offers over 85,000 templates for various business and personal legal situations categorized by state and area of application. All forms are properly drafted and validated for correctness, allowing you to feel confident in obtaining a current Credit Application Form For Car.

If you are acquainted with our platform and already possess an account, make sure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all previously acquired documents anytime necessary by navigating to the My documents section in your profile.

Print your form to fill it out manually or upload the sample if you prefer to complete it in an online editor. Preparing official documents according to federal and state regulations is fast and easy with our library. Explore US Legal Forms now to keep your paperwork organized!

- If you've never worked with our platform previously, the process will require a few additional steps to complete.

- Here’s how new users can find the Credit Application Form For Car in our collection.

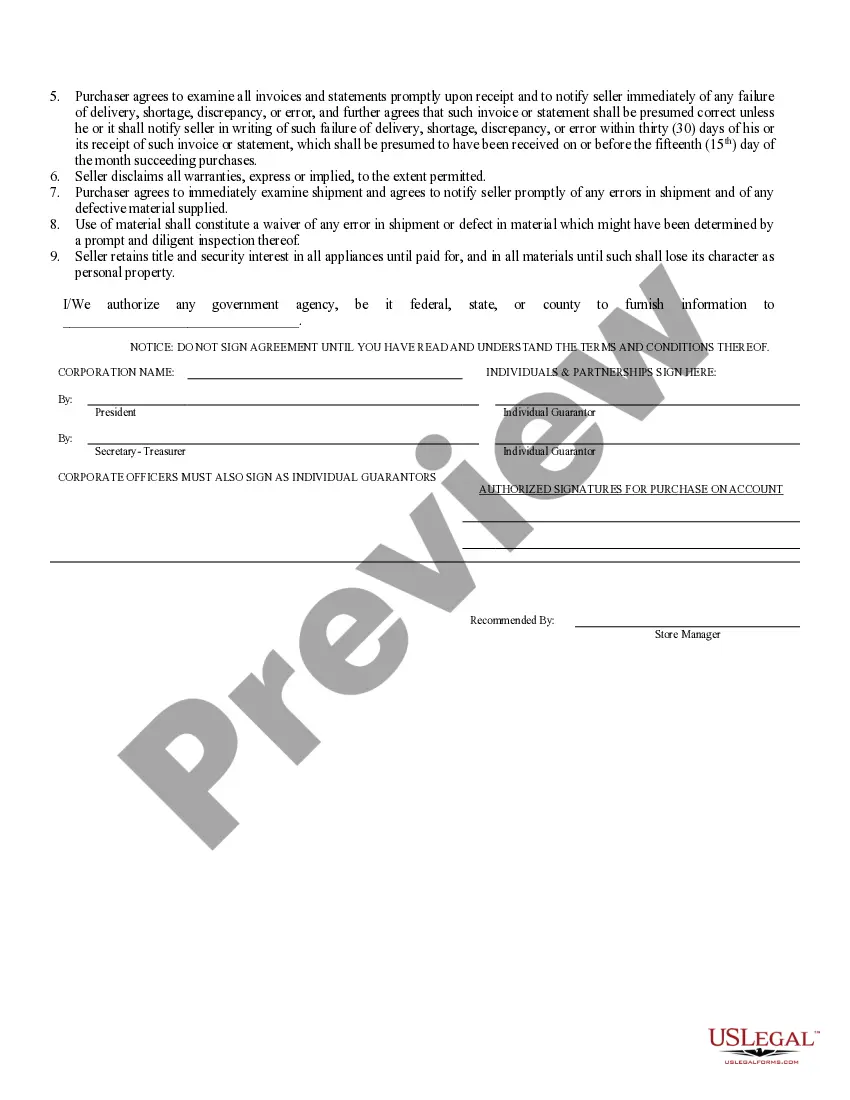

- Examine the page content closely to ensure it includes the sample you need.

- To do this, utilize the form description and preview options if available.

- Use the Search field above to look for another template if the current one doesn’t meet your needs.

- Click Buy Now next to the template title once you identify the right one.

- Choose the most suitable pricing plan and either create an account or sign in.

- Make payment for your subscription using a credit card or through PayPal to continue.

- Select the file format for your Credit Application Form For Car and save it to your device.

Form popularity

FAQ

Yes, filling out a credit application form for a car is an important step in the car buying process. This application allows lenders to assess your creditworthiness and determine the financing options available to you. By providing accurate information, you can streamline the approval process and secure a rate that fits your budget. It's advisable to complete this form ahead of time to better understand your financial position before visiting dealerships.

To get credit approval for a car, start by assessing your credit score and financial situation. Completing a credit application form for a car can simplify the process, allowing you to apply to multiple lenders simultaneously. Look for lenders that offer the best terms and ensure you have your documents ready for faster processing. Staying organized and understanding your budget will enhance your chances for successful approval.

Generally, a credit score of around 700 or higher is considered favorable for car financing. However, some lenders may approve loans for borrowers with lower scores. It's essential to understand your credit profile and use a credit application form for a car that matches your credit situation. This can help you find lenders willing to work with you.

The easiest car lender to get approved for usually offers flexible requirements and generous terms. Many online lenders have streamlined processes that enable quicker approvals. By using a credit application form for a car, you can find lenders that suit your financial situation. Researching and comparing options will help you identify a lender that meets your needs.

Yes, a credit application for a car typically results in a hard inquiry on your credit report. A hard inquiry occurs when a lender reviews your credit history to make a lending decision. While this process can temporarily impact your credit score, it is often necessary for financing a vehicle. Understanding this helps you anticipate changes in your credit score during your car-buying journey.

A credit application at a car dealership is specifically designed to assess your credit history when buying a vehicle. When you visit a dealership, they may request you to fill out this application to streamline your financing options. Providing a thorough credit application form for car helps the dealership tailor financing proposals that suit your needs and budget.

It is a convenient option that will add speed to your loan approval and car buying process. Contrary to the popular belief, there is no risk in filing this form online if you are doing so on a safe and well-protected website.

These seven steps will help get your credit ready to buy a car.Check Your Credit Report and Scores.Always Pay Your Bills on Time.Focus on Paying Down Credit Card Debt.Only Apply for Credit if You Really Need To.Dispute Inaccuracies on Your Credit Report.Save Up for a Down Payment.Ready, Set, Buy.

If you prefer a face-to-face experience, opt for a traditional brick-and-mortar bank. If you want fast funding and modern conveniences like mobile loan management, an online lender can make sense. No matter your preference, the best choice of lender is usually the one that offers the lowest interest rate.

Applying OnlineApplying for a loan online is convenient because it can be done quickly and from the comfort of your home. You can apply to many different lenders at once, making it easy to compare interest rates and financing options.