Irs Installment Payment Agreement Form

Description

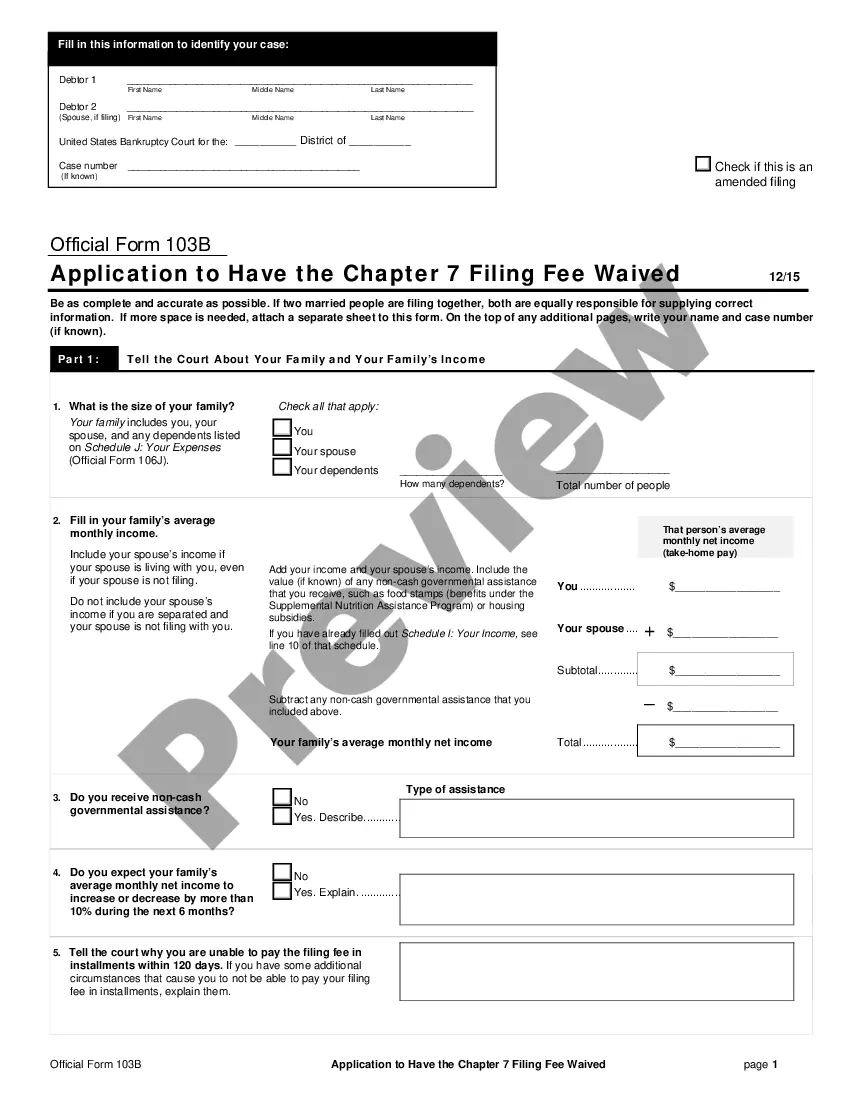

How to fill out North Carolina Installment Purchase And Security Agreement With Limited Warranties - Horse Equine Forms?

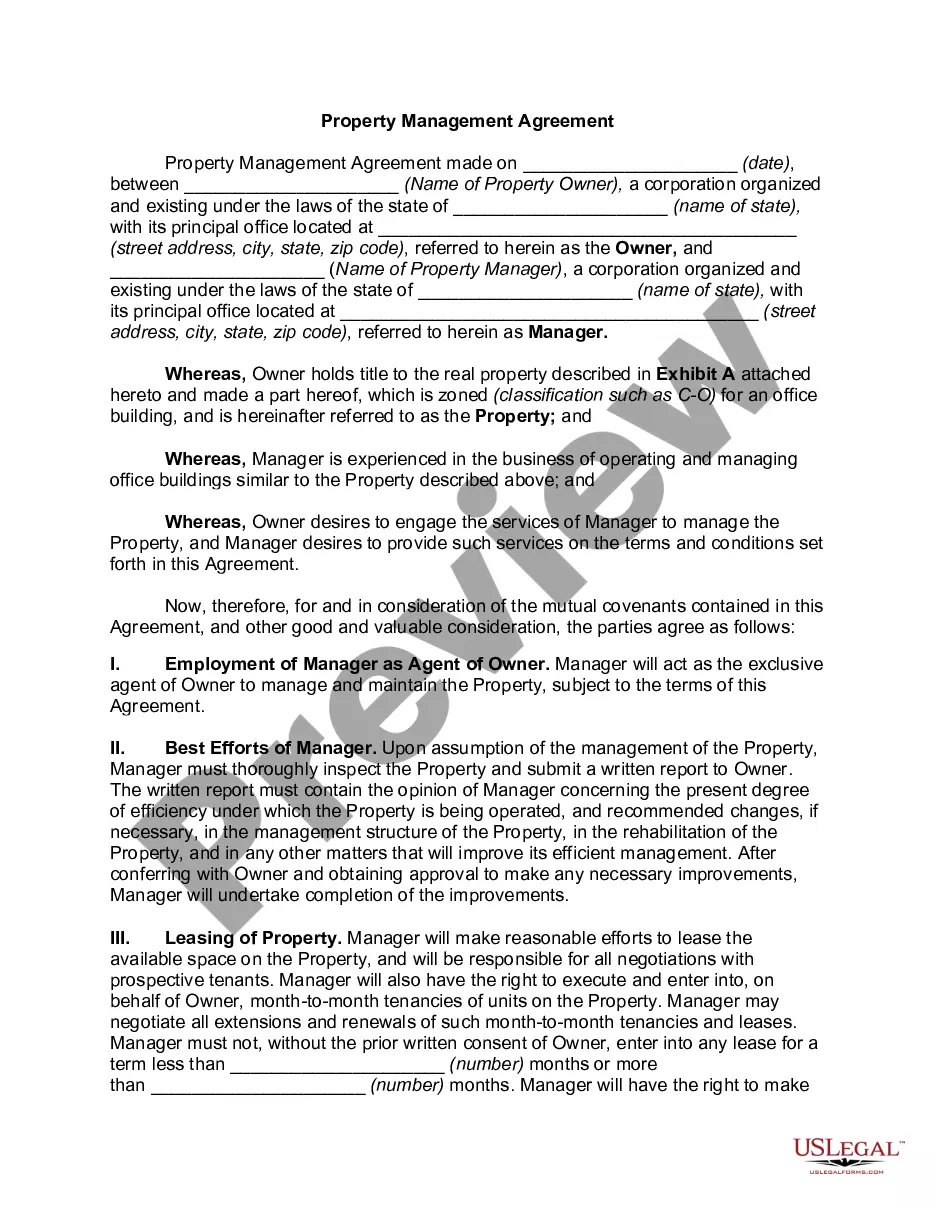

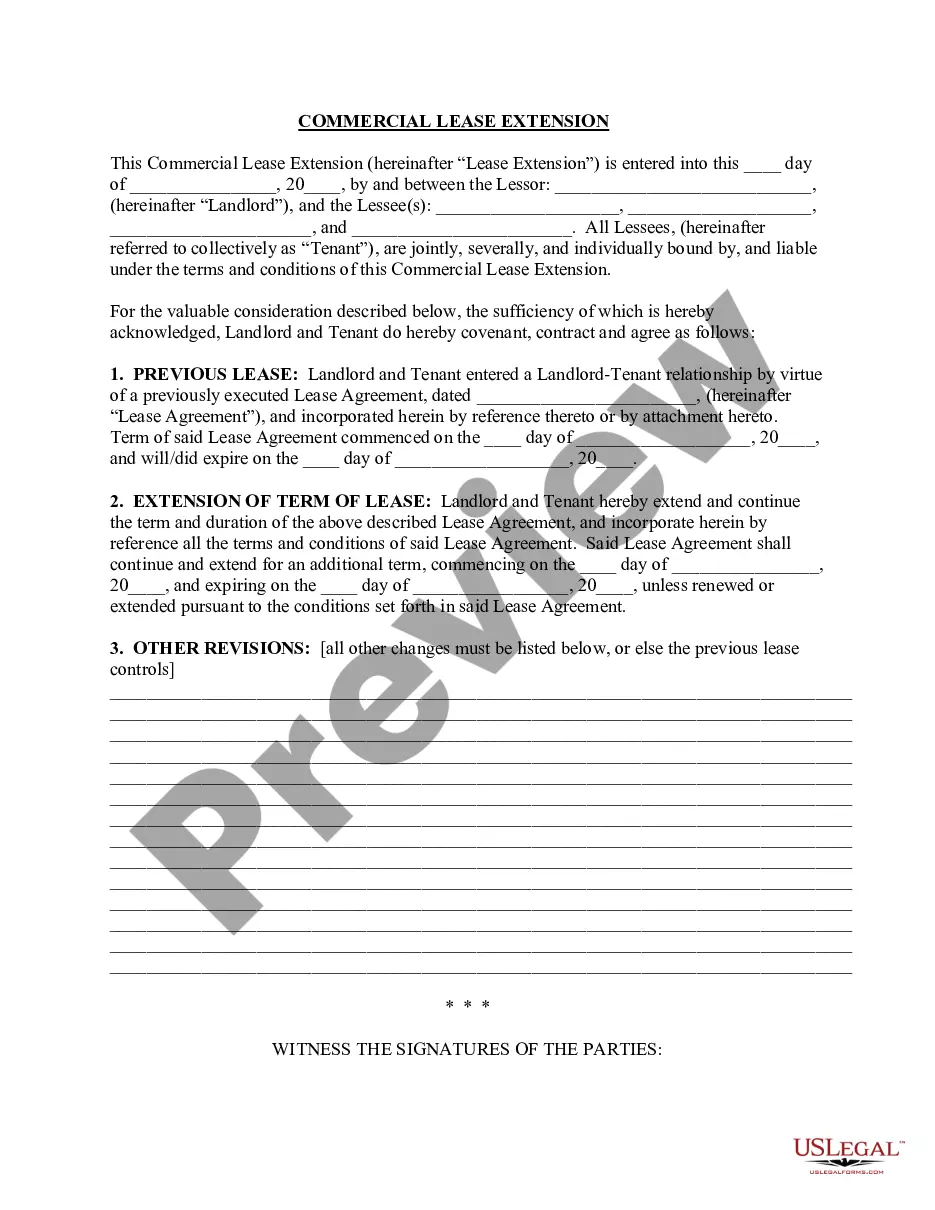

No matter if you handle documents frequently or need to present a legal document occasionally, it is vital to find a valuable resource where all the samples are interconnected and current.

The initial step you must take with an Irs Installment Payment Agreement Form is to ensure that it is its latest version, as this determines its eligibility for submission.

If you wish to streamline your search for the most recent document samples, seek them out on US Legal Forms.

Say goodbye to confusion while managing legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents featuring almost any document sample you may require.

- Search for the templates you need, assess their relevance promptly, and learn more about their application.

- With US Legal Forms, you gain access to approximately 85,000 document templates across diverse fields.

- Locate the Irs Installment Payment Agreement Form samples within a few clicks and keep them anytime in your account.

- A US Legal Forms account will provide you with easier access to all the samples you need with greater convenience and less hassle.

- Simply click Log In in the website header and navigate to the My documents section where all the necessary forms are at your disposal; you won’t need to spend time searching for the correct template or verifying its authenticity.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

Attach Form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you have already filed your return or you're filing this form in response to a notice, file Form 9465 by itself with the Internal Revenue Service Center using the address in the table below that applies to you.

You can make any desired changes by first logging into the Online Payment Agreement tool. On the first page, you can revise your current plan type, payment date, and amount. Then submit your changes. If your new monthly payment amount does not meet the requirements, you will be prompted to revise the payment amount.

Form 9465 is available in all versions of TaxAct® and can be electronically filed with your return. If you have already filed your return or you are filing this form in response to a notice from the IRS, Form 9465 may be paper filed by itself.

How do I apply for an installment agreement electronically or by mail? To request an installment agreement, the taxpayer must complete Form 9465. Form 9465 can be included electronically with an e-filed return or paper-filed.

You can make any desired changes by first logging into the Online Payment Agreement tool. On the first page, you can revise your current plan type, payment date, and amount. Then submit your changes. If your new monthly payment amount does not meet the requirements, you will be prompted to revise the payment amount.