Tenant Landlord With Withholding Tax

Description

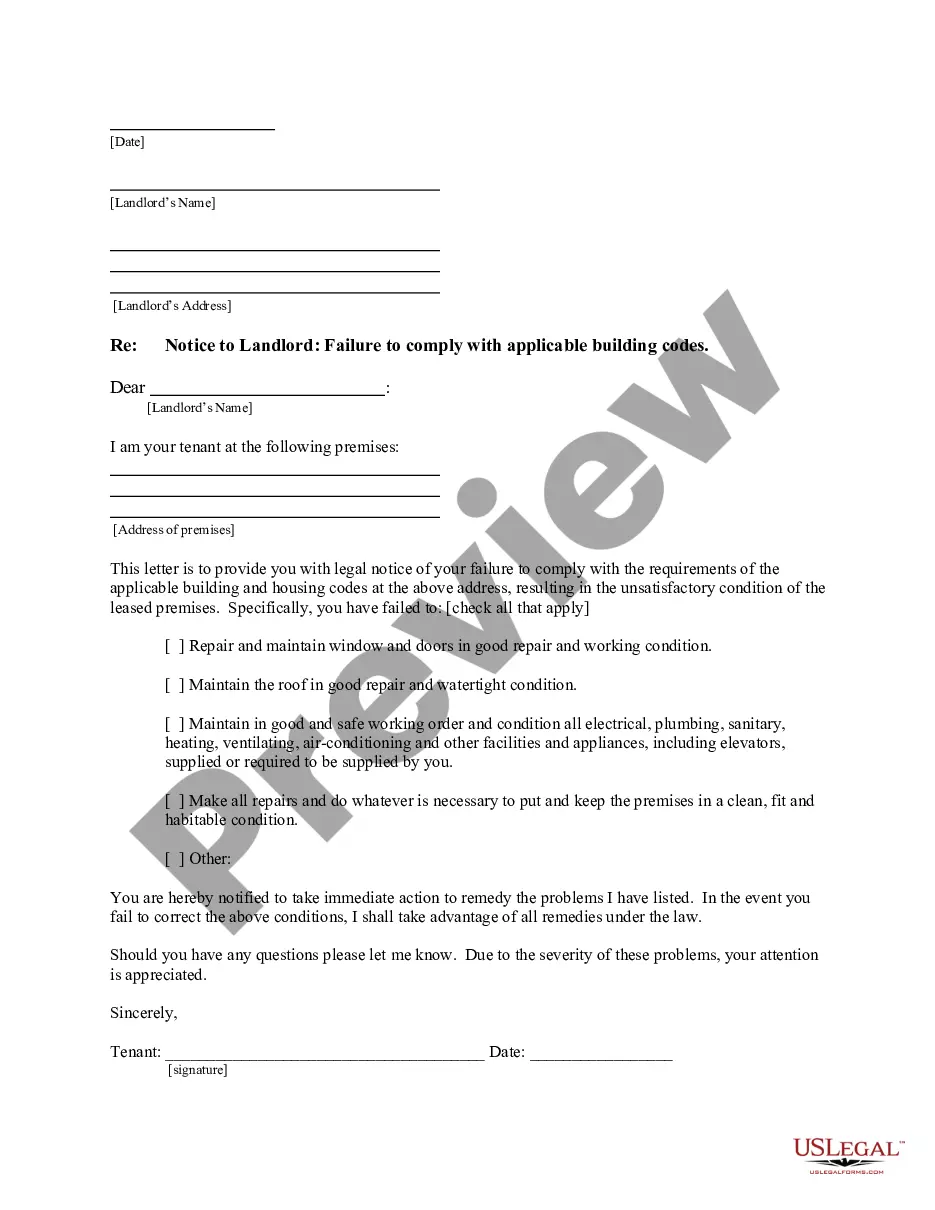

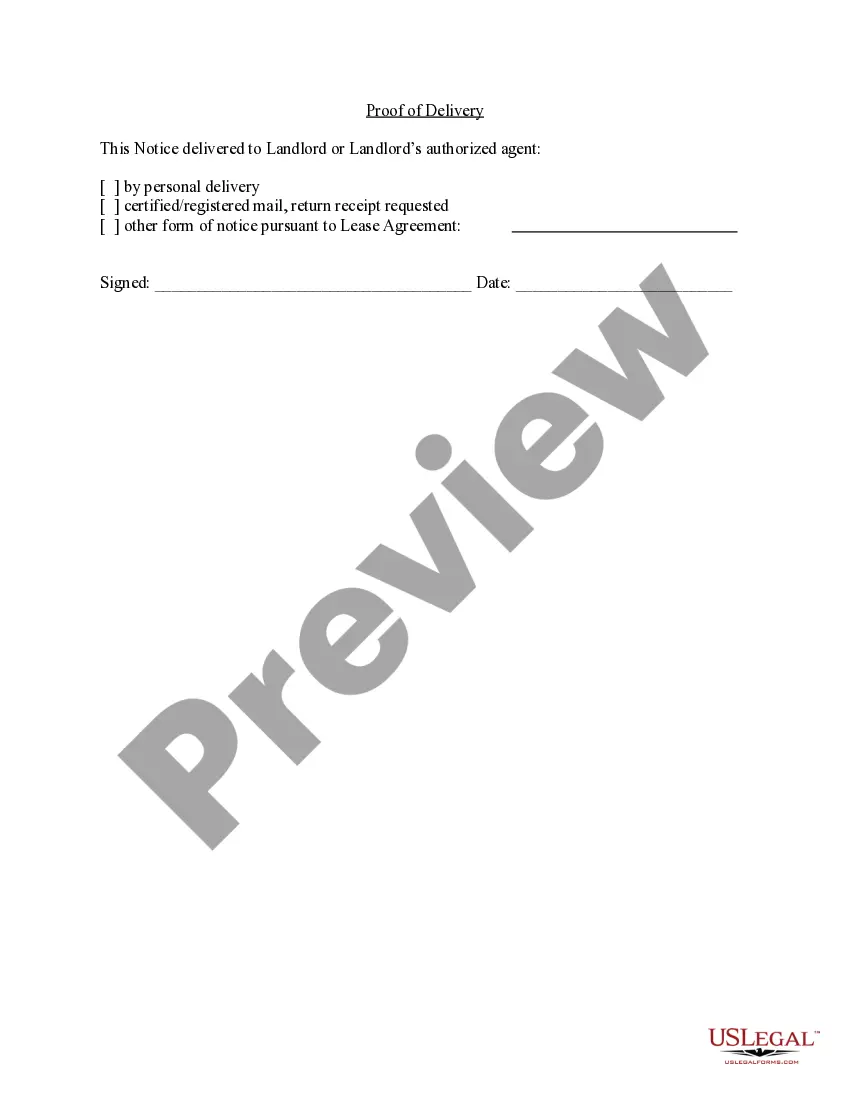

How to fill out North Carolina Letter From Tenant To Landlord For Failure Of Landlord To Comply With Building Codes Affecting Health And Safety Or Resulting In Untenantable Condition - Demand For Remedy?

- If you're a returning user, log in to your account and access your required document by clicking the Download button. Ensure your subscription is active; renew if necessary.

- If you're new, start by checking the Preview mode and form description to choose the template that aligns with your needs and complies with local jurisdiction.

- Use the Search tab above to locate any additional forms you might require based on your findings.

- Purchase the form by clicking on the Buy Now button, and select a suitable subscription plan. You must create an account for full access to the library.

- Complete your purchase by entering payment details via credit card or PayPal.

- Download your document and store it on your device, ensuring you can access it later in the My Forms section of your profile.

US Legal Forms not only provides a robust collection of over 85,000 easily fillable legal forms but also ensures users have access to premium expert assistance for document completion.

With this simple guide, you can confidently navigate the tenant-landlord landscape. Don't hesitate; start today to secure your legal peace of mind with US Legal Forms!

Form popularity

FAQ

In Virginia, tenants can withhold rent if the landlord fails to maintain essential services, such as heat or water, or if the property is uninhabitable. Additionally, if there are significant code violations, tenants have a right to withhold payment until repairs are made. It’s important to document these issues and communicate them to your landlord. Understanding your rights in the context of tenant landlord with withholding tax can empower you to take the appropriate action.

Generally, you do not receive a tax return specifically for paying rent unless your state offers a rental tax credit or similar program. Many states have provisions to support renters, but the eligibility can vary widely. Exploring tenant landlord with withholding tax can inform you about potential credits you might not be aware of. Platforms like USLegalForms provide clarity on what programs or deductions might apply to your situation.

In Pennsylvania, you can deduct various expenses such as mortgage interest, property taxes, and certain rental expenses when filing your state taxes. Understanding these deductions within the context of tenant landlord with withholding tax can help you optimize your tax return. Additionally, USLegalForms offers resources to help you identify deductibles specific to Pennsylvania legislation, making the filing process easier.

You can claim rent as a deduction on your federal taxes if you qualify under certain conditions, especially for businesses and rental properties. Individuals who are renting their homes generally cannot, but specific states may allow deductions for certain expenses. Staying informed about tenant landlord with withholding tax is crucial to properly managing your finances. Consider using USLegalForms to track changes in tax laws that affect your deductions.

Whether you can claim rent on your state taxes depends on the specific state tax laws. Many states have provisions that allow you to claim a portion of your rent as a deduction or credit. Understanding these regulations through the lens of tenant landlord with withholding tax can help you maximize your benefits. Platforms like USLegalForms provide valuable information that can guide you through your state's requirements.

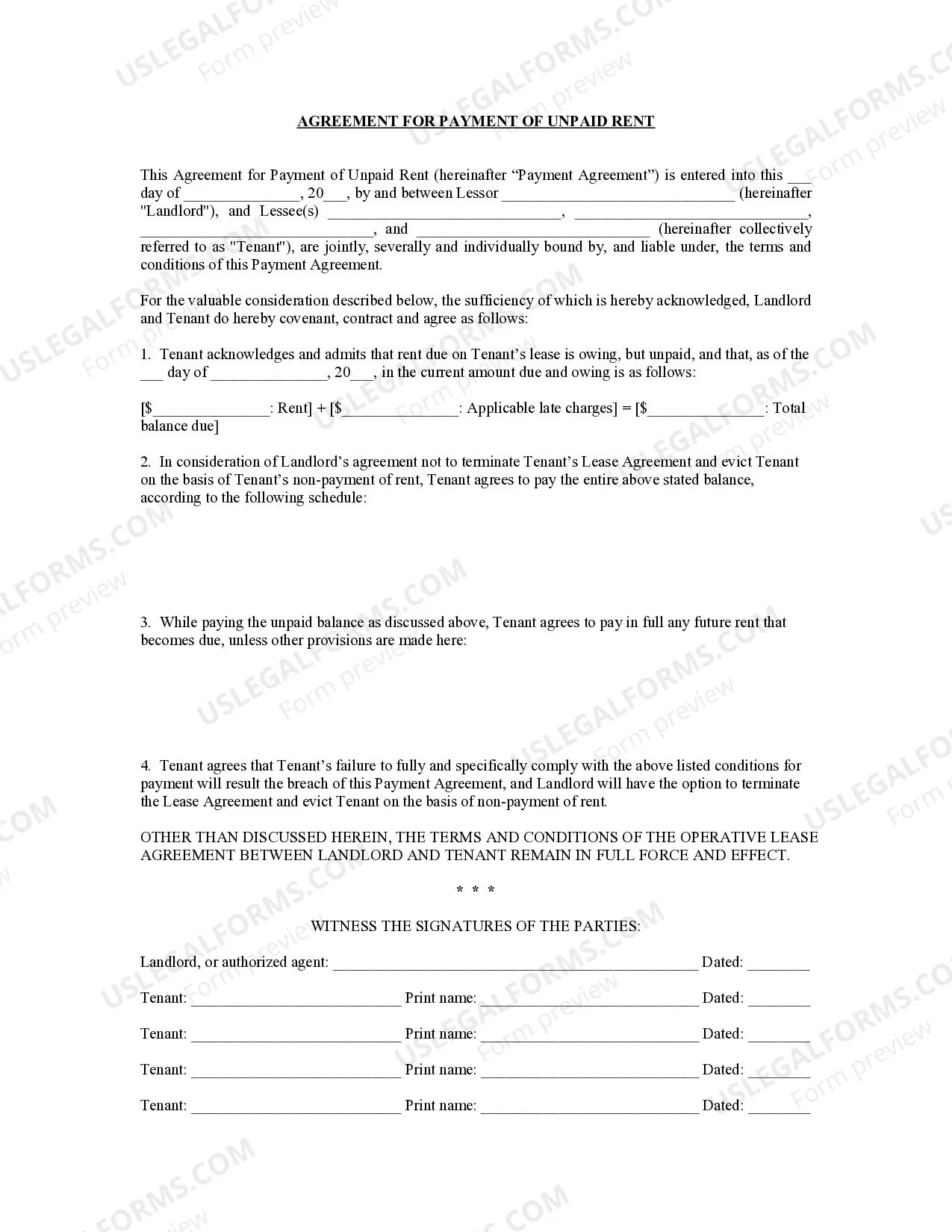

To claim unpaid rent from a tenant on your taxes, you will typically report it as income, even if you haven't received the payment. However, if the tenant later pays the rent, you will include this in your taxable income for the year it is received. Proper documentation of your rental agreements can ease the process, especially when considering tenant landlord with withholding tax. Resources such as USLegalForms can help you generate the necessary documents.

As a landlord, you can indeed receive tax breaks, particularly through deductions on various expenses related to property management. These might include mortgage interest, repairs, and maintenance costs, among others. Knowing how to navigate tenant landlord with withholding tax can significantly enhance your tax situation. Consider using platforms like USLegalForms to streamline the process and ensure you don't miss any potential deductions.

The best approach is honest communication with your landlord regarding your situation. Common reasons might include job loss, medical emergencies, or unexpected expenses. While these circumstances are understandable, be aware that they may not legally justify withholding rent without following the proper processes. Familiarizing yourself with tenant landlord with withholding tax can prepare you for conversations with your landlord and help you find a solution.

In Texas, tenants can withhold rent only under specific circumstances, such as if the property is uninhabitable or if the landlord fails to make necessary repairs. You must give proper notice to your landlord before withholding any rent to comply with state laws. Understanding tenant landlord with withholding tax in Texas is essential, and resources like US Legal Forms can provide helpful guidance to ensure you follow the correct procedures.

Yes, withholding rent can significantly affect your credit score. If the landlord reports the non-payment or sends your account to collections, this negative mark can linger on your credit report. When navigating tenant landlord with withholding tax issues, it's crucial to handle your finances responsibly to avoid long-term consequences. Consider using mediation to resolve disputes to protect your credit standing.