Limited Liability Company With One Member

Description

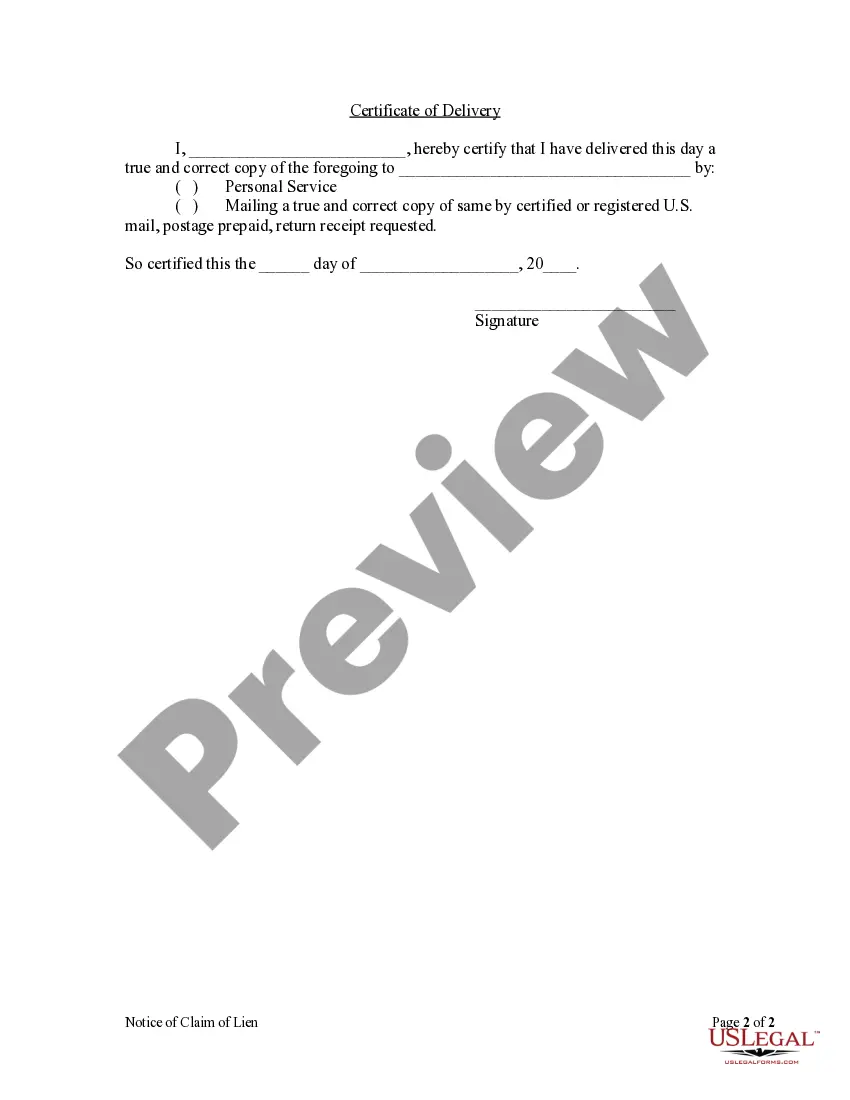

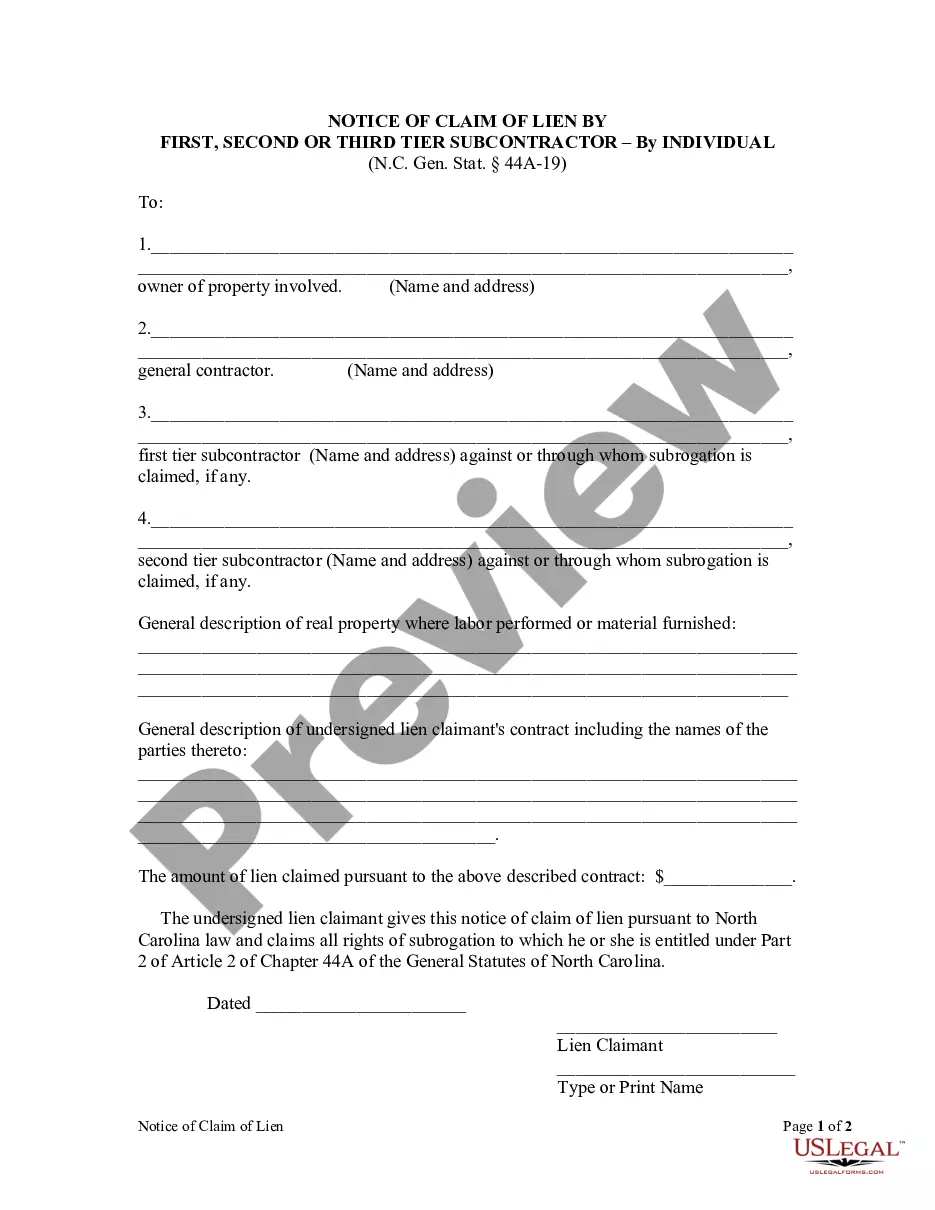

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

- Log in to your US Legal Forms account if you're an existing user; otherwise, register for a new account.

- Navigate to the Preview mode to review and confirm that you’ve selected the right form for your one-member LLC, ensuring it meets local regulations.

- Use the Search feature to locate additional templates if necessary, making sure you have exactly what you need.

- Choose your preferred subscription plan by clicking the Buy Now button to purchase the document.

- Provide payment information via credit card or PayPal to complete the subscription purchase.

- Download the template to your device, ensuring you can easily access and complete it later from the My Forms section.

Creating a limited liability company with one member through US Legal Forms is not just convenient but ensures you have the necessary legal framework to operate smoothly. Their extensive library of over 85,000 forms guarantees that you find exactly what you need.

Start your journey today by visiting US Legal Forms and empower yourself with the resources you need for effective legal documentation!

Form popularity

FAQ

Being a limited liability company with one member can be beneficial for many entrepreneurs. It provides personal asset protection, separating your business liabilities from your personal assets. Additionally, it offers flexibility in management and taxation, allowing you to choose how to handle profits. If you align your business goals with this structure, it can be a solid choice for your entrepreneurial journey.

A limited liability company with one member can write off various business expenses that are ordinary and necessary for operations. Common deductions include rent, utilities, salaries, and certain business-related travel expenses. Moreover, losses from your single-member LLC may offset personal income, offering potential tax benefits. Consulting a tax professional can help you maximize these write-offs effectively.

While a limited liability company with one member offers protection from personal liability, it has some disadvantages. For instance, you might face challenges in obtaining certain types of funding, as lenders may prefer businesses with multiple members. Additionally, in the event of legal issues, single-member LLCs can sometimes be pierced, exposing personal assets. Always weigh these factors before deciding your structure.

To get a limited liability company with one member, you need to select a unique name for your business and ensure it complies with state regulations. Next, file the necessary paperwork with your state's business filing office. Additionally, consider drafting an operating agreement that outlines the management structure of your limited liability company with one member. Using platforms like uslegalforms can simplify this process with step-by-step guidance.

To fill out a W-9 for a single member LLC, begin by entering your LLC's name as it appears on your formation documents. In the 'Business name' section, include your name if you are the sole member, and check the box for 'Individual/sole proprietor or single-member LLC' in the classification section. This is important for tax purposes, as it clarifies your status as a limited liability company with one member. If you have further questions, consider visiting US Legal Forms, where you can find resources and forms tailored to your needs.

An LLC with one person is commonly referred to as a single member LLC. This business structure allows you to enjoy the benefits of limited liability while maintaining full control over your business. As a limited liability company with one member, you can easily manage operations and minimize tax responsibilities. This arrangement provides flexibility while protecting your personal assets.

A single member LLC owner generally enjoys limited liability protection. This means that in most cases, your personal assets remain shielded from business debts and lawsuits against the limited liability company with one member. However, it is crucial to maintain proper separation between personal and business finances to uphold this protection. If you mingle these finances or engage in negligent activities, you may risk losing this shield.

A limited liability company with one member offers several tax advantages, including pass-through taxation. This means you avoid double taxation on business profits, paying taxes only at your individual tax rate. Moreover, you can deduct various business expenses, maximizing your potential savings.

Yes, the IRS recognizes a limited liability company with one member as a distinct business entity. For tax purposes, it is treated as a disregarded entity by default, meaning profits and losses pass through to your personal tax return. This recognition simplifies tax filings, making it an attractive option for individual business owners.

Yes, an LLC can consist of only one member. This type of structure is ideal for individuals who want to start a business independently. A limited liability company with one member grants you the same protections and benefits as multi-member LLCs while streamlining the management process.