Limited Liability Company For Rental Property

Description

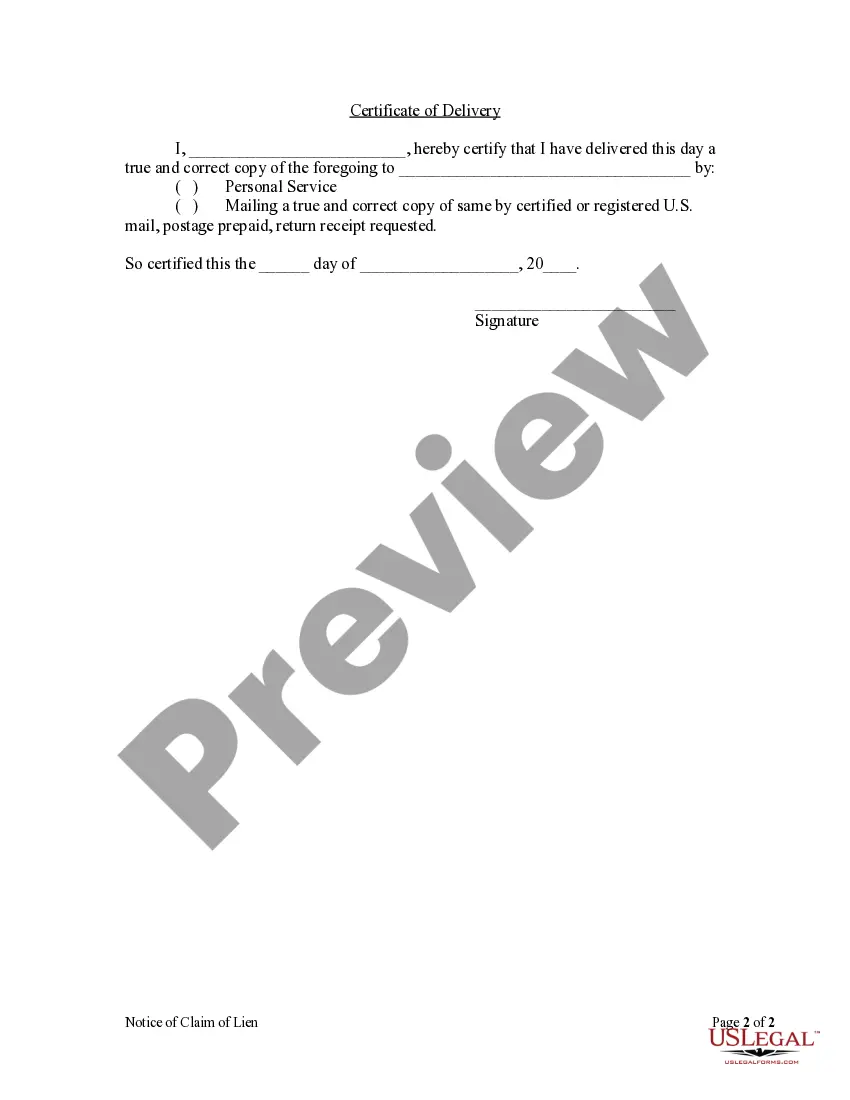

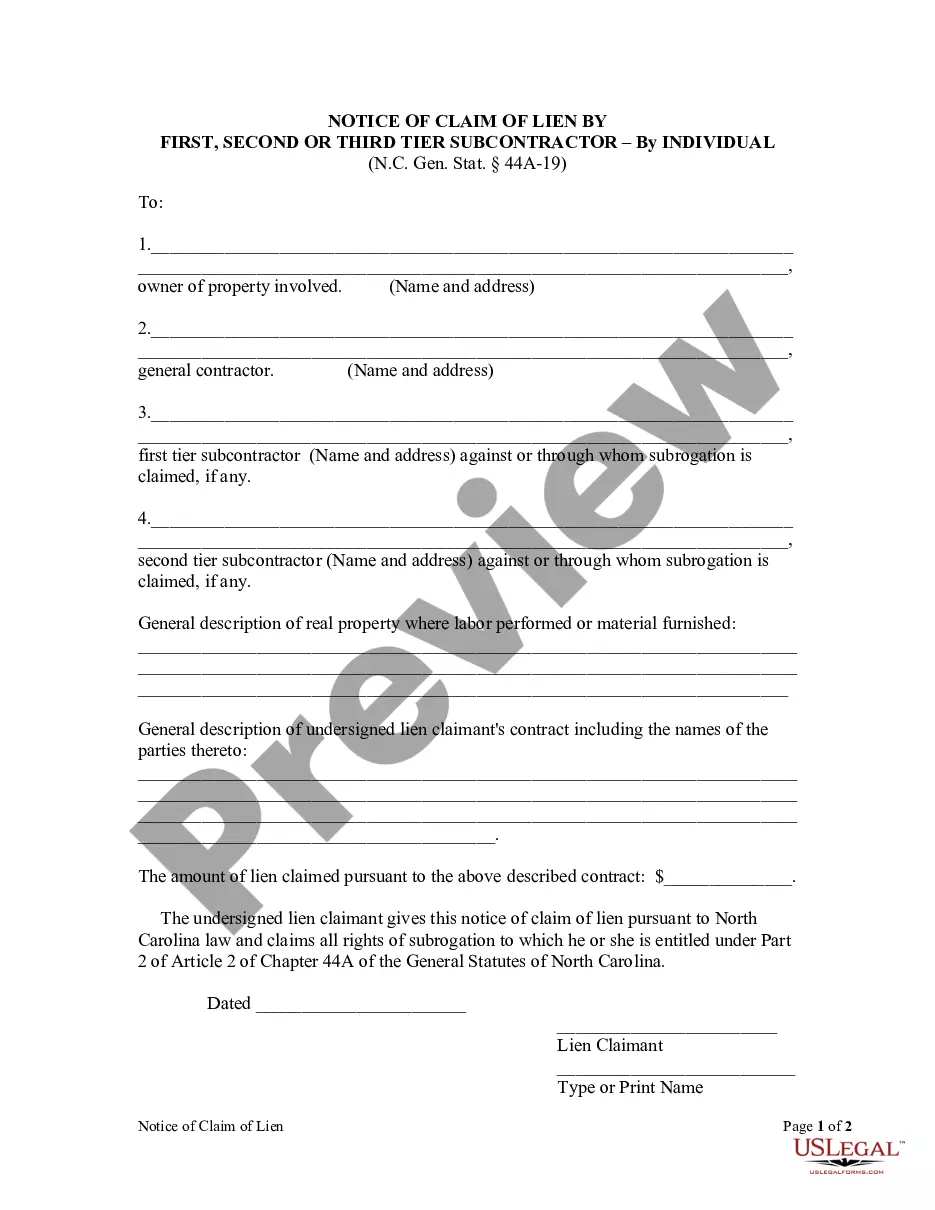

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

- Log in to your existing US Legal Forms account to access the necessary templates. Ensure your subscription is active.

- If you are a new user, start by browsing the Preview mode and reviewing the form descriptions to find the appropriate document for your state requirements.

- Use the Search feature if you need to locate alternative templates or forms until you find the one that perfectly meets your needs.

- Click the Buy Now button to select a subscription plan that suits you and create an account to unlock additional resources.

- Proceed to checkout by entering your payment information, such as credit card details or your PayPal account.

- Download your chosen form to your device, making it easy to complete and store it in the My Forms section of your profile for future use.

In conclusion, US Legal Forms empowers both individuals and attorneys to efficiently handle their legal documentation needs. With a vast collection of over 85,000 forms, you'll find the perfect template for your LLC.

Start your journey today and protect your rental property investments with US Legal Forms!

Form popularity

FAQ

An LLC needs to file taxes when it has income, regardless of the amount. The thresholds may vary based on the LLC’s structure and classification, but it’s important to report any rental earnings from your limited liability company for rental property. Even if your earnings are minimal, filing ensures compliance with tax regulations and keeps your LLC in good standing. To navigate these requirements efficiently, consider utilizing platforms like USLegalForms for assistance.

Rental income from a limited liability company for rental property is generally taxed as ordinary income at the federal level. This means that the profit you make from renting out your property is subject to income tax after deducting any allowable expenses. It's important to keep accurate records of all income and expenses related to your rental activities to properly file your taxes. Understanding these taxation rules can help you manage your rental investment more effectively.

To file taxes for a rental LLC, you'll need to report your rental income and expenses on the correct tax forms. Single-member LLCs typically use Schedule C attached to their personal tax return, while multi-member LLCs will file Form 1065 and issue K-1s to members. Remember to track all rental expenses, as these can significantly reduce your taxable income. Consulting a tax advisor familiar with LLCs can ensure you meet all obligations while optimizing your tax benefits.

Choosing the right type of LLC for rental property is crucial for liability protection and tax benefits. Most investors opt for a single-member LLC for simplicity, but multi-member LLCs can be beneficial if you plan to co-own the property with others. Additionally, it’s wise to use a series LLC if you have multiple rental properties, as this can provide better asset protection and easier management. Each structure has unique advantages, so consider your investment strategy carefully.

When dealing with a limited liability company for rental property, you typically do not file LLC and personal taxes together. Your LLC will need to file separate tax forms, depending on its tax classification. For instance, single-member LLCs are often treated as sole proprietorships, while multi-member LLCs may be treated as partnerships. It's essential to consult a tax professional to navigate the specific requirements for your situation.

Buying a house under a limited liability company for rental property presents both pros and cons. On the positive side, LLCs offer personal liability protection and potential tax benefits. However, they also come with added costs, such as formation expenses and ongoing maintenance fees. Moreover, obtaining financing for property owned by an LLC can sometimes be more challenging than for personal purchases.

Wealthy individuals often buy houses under a limited liability company for rental property to protect their assets. By doing so, they can separate personal finances from their investments, providing an extra layer of protection against lawsuits or creditors. Additionally, using an LLC often brings tax advantages and streamlines the estate planning process. This approach allows them to manage their real estate investments efficiently and securely.

The biggest disadvantage of a limited liability company for rental property is often the complexity of legal and tax requirements. Maintaining an LLC can require more detailed records and compliance practices, which can be overwhelming. Moreover, while LLCs protect personal assets, they do not shield you from all types of liability related to your rental activities. Thus, it’s essential to fully understand these risks.

The best type of limited liability company for rental property often depends on your specific investment strategy. Many investors prefer a single-member LLC, especially if they are the sole owner, for simplicity and ease of management. Alternatively, multi-member LLCs work well for partners or groups investing together. Each option provides liability protection and has its own tax implications, so consider your circumstances carefully.

The best business type for a rental property is often a limited liability company for rental property. This structure not only protects your personal assets but also allows for potential tax advantages. Additionally, an LLC can provide credibility to your rental business, making it easier to secure financing. Evaluating your long-term goals and consulting with experts can further inform your decision.