Limited Liability Company For Dummies

Description

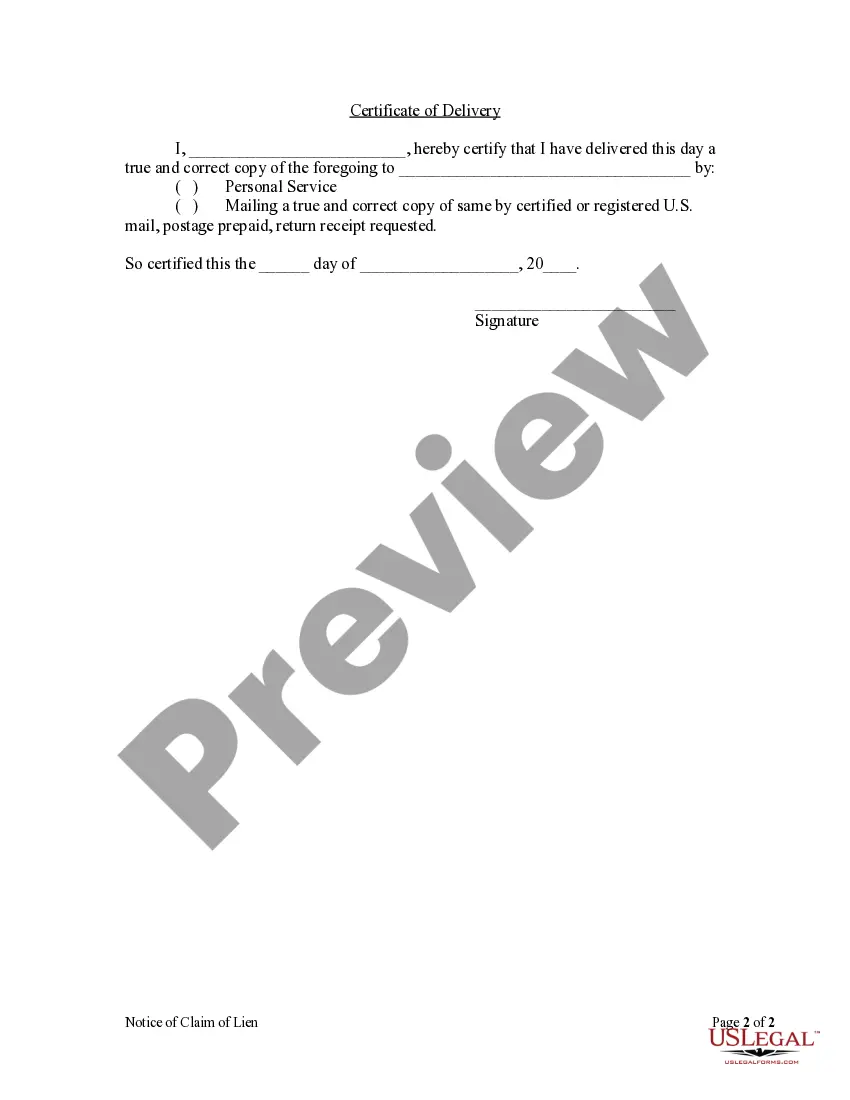

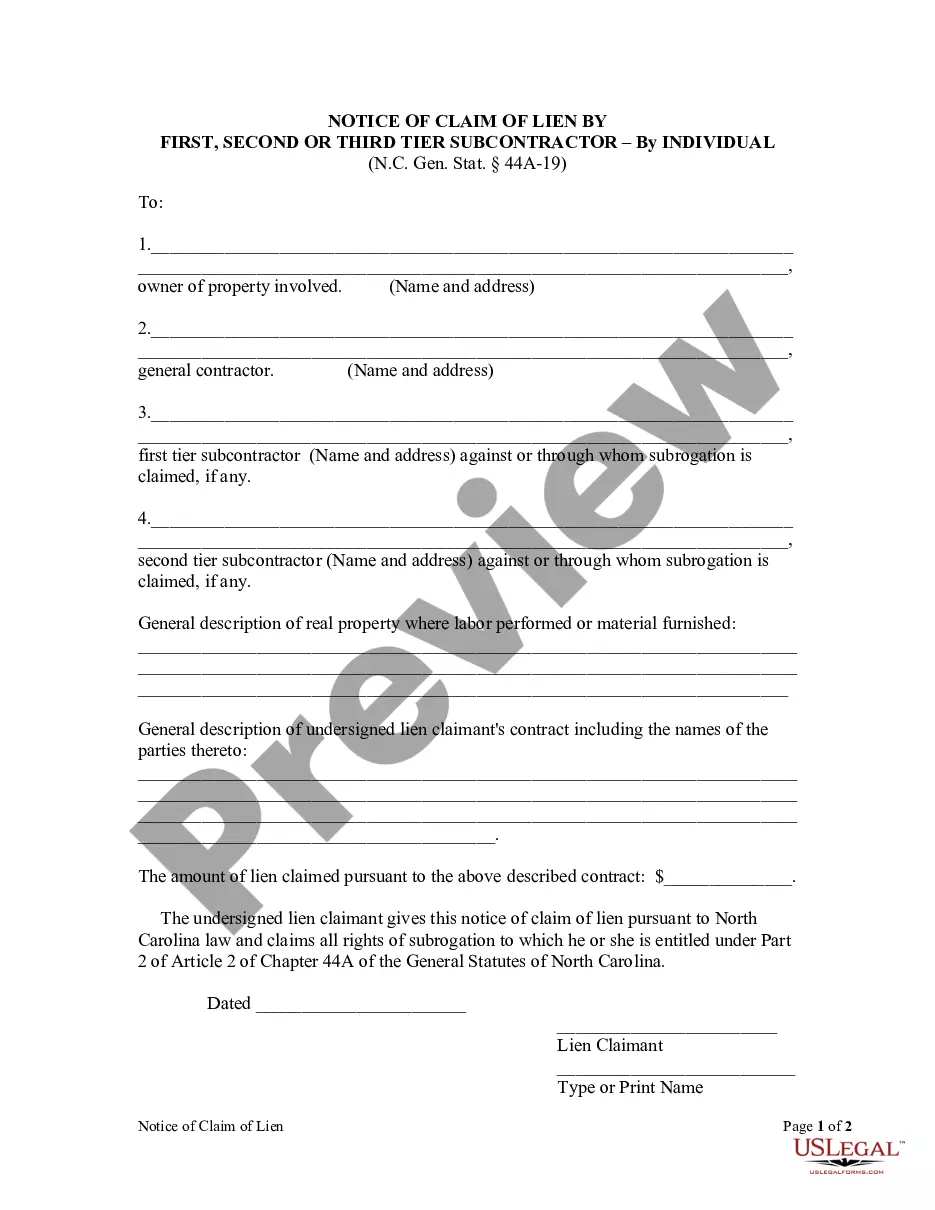

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

- Log in to your account if you're a returning user and click the Download button to save your form template. Ensure your subscription is active; renew if needed.

- If you are new to our service, start by exploring the Preview mode and form description to ensure you select the appropriate template for your local jurisdiction.

- Should you need a different template, utilize the Search tab at the top of the page to find the right one. Once confirmed, proceed to the next step.

- Purchase the desired document by clicking on the Buy Now button and selecting a suitable subscription plan, which requires you to register an account.

- Complete your purchase by entering your credit card details or using your PayPal account to finalize the transaction.

- Download the final document to your device. You can also access it later from the My Forms section of your profile for any future use.

By following these streamlined steps, you can effortlessly secure the legal documents needed to form your LLC. US Legal Forms not only provides a broad range of templates but also connects users with legal experts for additional support in completing your documents accurately.

Take the first step towards your LLC today with US Legal Forms and simplify your legal journey!

Form popularity

FAQ

The best filing status for an LLC often depends on how you plan to manage your business and its profits. Many single-member LLCs choose to file as sole proprietors, while multi-member LLCs often file as partnerships. Further, electing to be taxed as an S corporation can be beneficial in certain circumstances. Consider discussing your options with a tax advisor to select the most advantageous filing status for your Limited Liability Company.

The most effective way to file for an LLC is to gather all necessary documents and consult resources that simplify the steps. Using US Legal Forms can guide you through the requirements specific to your state, ensuring you meet all legal obligations without hassle. This approach helps clarify complex aspects and makes your experience smoother as you set up your Limited Liability Company.

An LLC typically files taxes as either a sole proprietorship or a corporation, depending on the number of members. For a single-member LLC, you’ll report income and expenses on your personal tax return using Schedule C. If you have multiple members, you’ll need to file Form 1065, and each member will report their share of the profits on their individual returns. Understanding this will help you manage your Limited Liability Company effectively.

The best program to start an LLC typically provides step-by-step guidance and easy document creation. US Legal Forms offers a user-friendly platform that helps you navigate the process efficiently, saving you time and reducing potential errors. With resources specifically designed for beginners, this can be a great option for dummies looking to understand LLC formation.

To file for a Limited Liability Company (LLC), start by choosing a unique business name. Next, you should prepare your articles of organization and submit them to your state's business filing office. You may find it helpful to use a service like US Legal Forms, which simplifies the process and ensures you complete all necessary steps correctly.

The easiest limited liability company (LLC) to start is usually a single-member LLC. This type requires less paperwork and fewer formalities, making it accessible for a solo entrepreneur. With platforms like UsLegalForms, you can quickly complete the necessary documents without getting bogged down by legal jargon. Starting an LLC should be straightforward and clear, especially if you're following the limited liability company for dummies approach.

There is no specific income threshold that dictates when to start a limited liability company (LLC). However, it is wise to consider forming one once you begin earning consistent profits or if you foresee growth. Many experts recommend looking at your local laws or consulting a professional to assess your situation. An LLC can help protect your earnings as your business expands.

While a limited liability company (LLC) offers many benefits, there are some downsides to consider. First, forming an LLC may require more paperwork and fees than operating as a sole proprietorship. Additionally, some states impose annual fees and required filings that can increase costs over time. Balancing these factors is important when deciding if a limited liability company for dummies is the right choice for your business.

Limited liability means that as the owner of a limited liability company (LLC), you are not personally responsible for your business debts. Simply put, if your LLC faces financial trouble, your personal assets remain safe. This feature helps individuals take business risks without jeopardizing their personal finances. Thus, understanding limited liability is crucial for anyone considering a limited liability company for dummies.

Turning your side hustle into a limited liability company (LLC) can be beneficial when your business begins to gain traction. If you start generating significant income or you take on risks like purchasing inventory or hiring employees, consider forming an LLC. This structure protects your personal assets from business debts and liabilities. Using a service like UsLegalForms can simplify the process of setting up your LLC.