Limited Business

Description

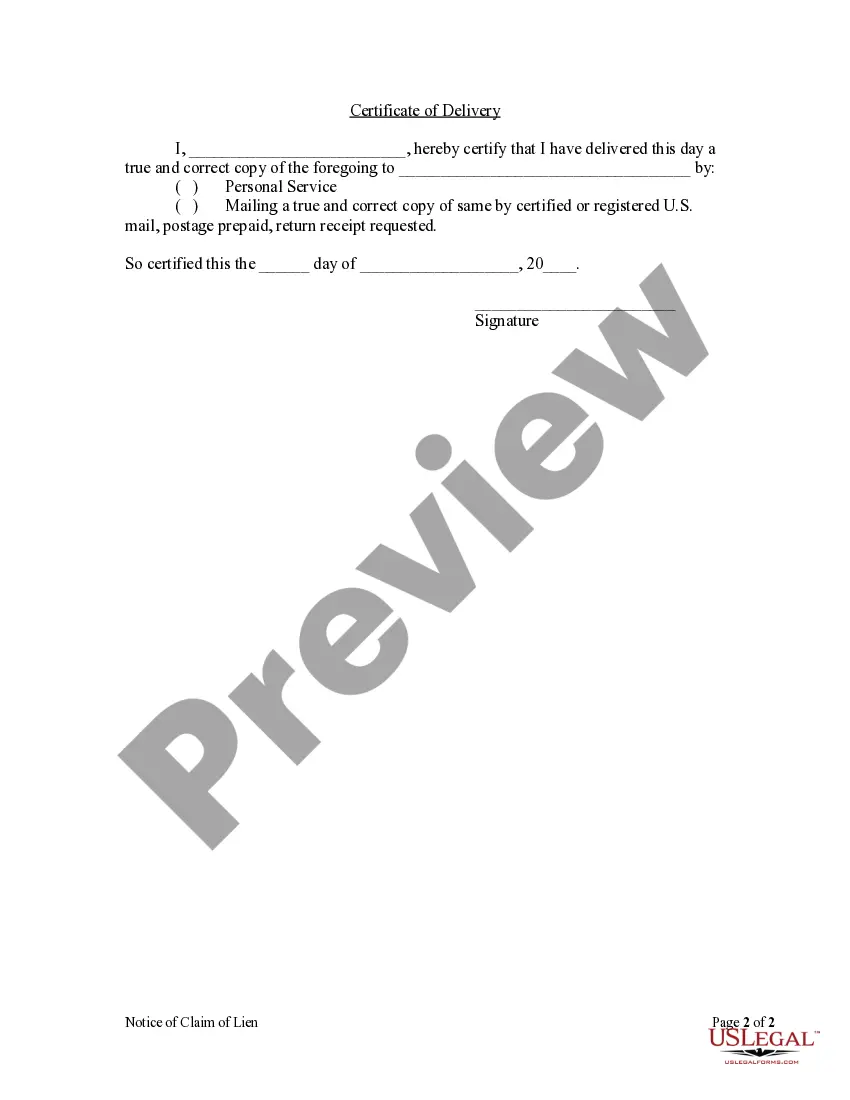

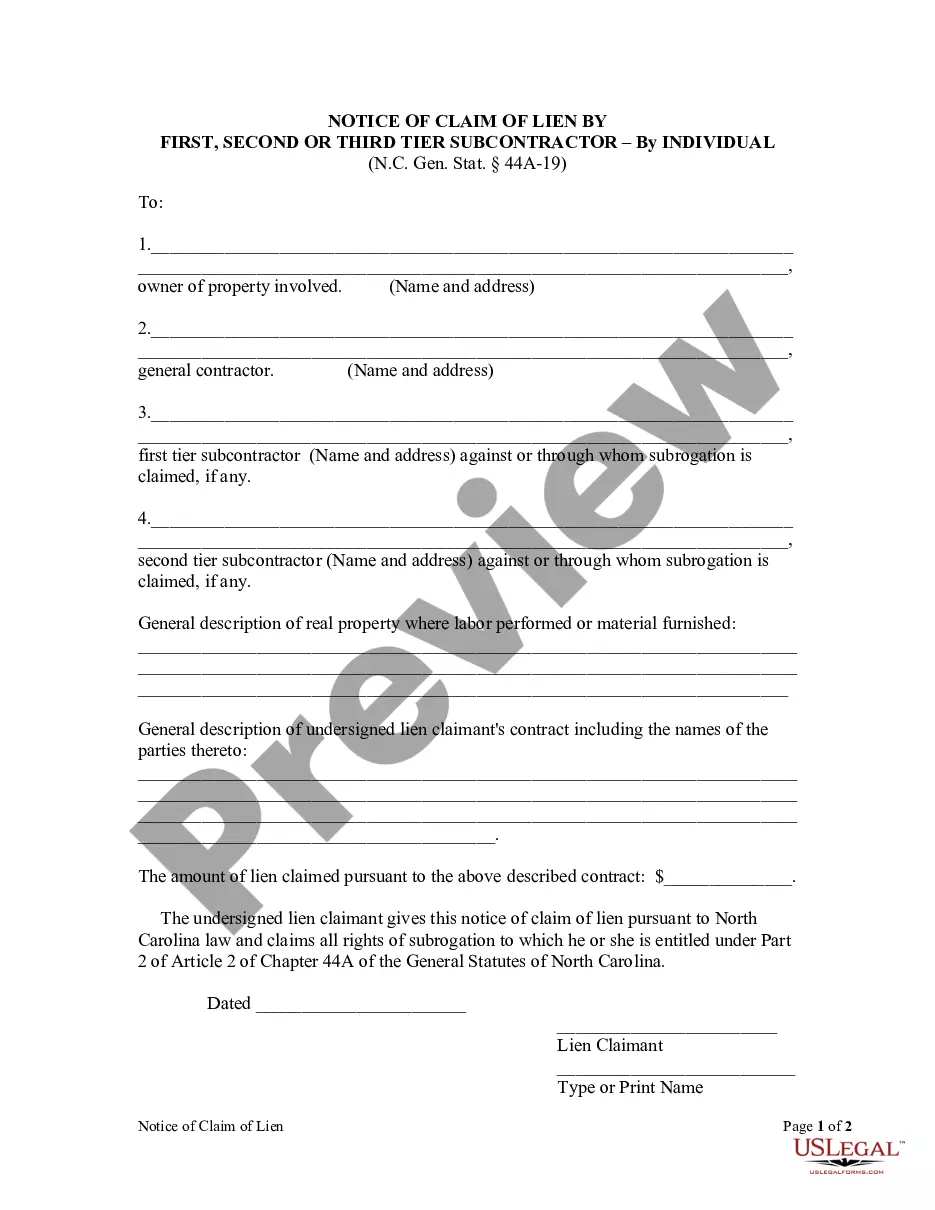

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

- If you are a returning user, log into your account and access your form library. Ensure your subscription is active; if not, renew it per your payment plan.

- For first-time users, start by reviewing the form descriptions in Preview mode to find the one that aligns with your requirements and local jurisdiction.

- If you need a different template, utilize the Search tab to explore other options until you find the correct form that fits your needs.

- Once you find the suitable document, click the Buy Now button and select your preferred subscription plan. You will need to create an account to access our extensive library.

- Complete your purchase by entering your credit card information or using your PayPal account to finalize the subscription.

- Download your selected form and save it on your device, allowing you to fill it out and access it later in the My Forms section.

Using US Legal Forms not only grants you access to a vast collection of over 85,000 legal documents, but it also connects you to experts for precise assistance. This ensures that your limited business remains compliant and efficient.

Ready to simplify your legal document process? Start your journey with US Legal Forms today and unlock the resources you need for your limited business!

Form popularity

FAQ

Deciding between an LTD and an LLC depends on your business goals and preferences. An LTD, or limited company, generally offers more structured requirements and oversight, while an LLC provides flexibility and fewer formalities. Each option has its own tax implications and liability protections, so evaluating your specific needs is crucial. To make an informed choice, consider using uslegalforms to access resources that guide you through the process.

Choosing a limited partnership over an LLC can provide unique advantages, particularly for investment purposes. A limited partnership allows for both general partners, who manage the business and assume liability, and limited partners, who contribute capital without taking on management responsibilities. This structure can facilitate investment opportunities while limiting personal liability, making it a strategic choice for certain types of limited business ventures.

Using 'limited' instead of LLC can lead to confusion, as they represent different legal structures. While both indicate limited liability, an LLC is a recognized business entity with distinct features like pass-through taxation and operational flexibility. It's advised to clearly define your business structure to communicate effectively with clients and partners. To establish a limited business, consider consulting uslegalforms for necessary documents.

A private limited company and an LLC share some similarities, but they are not the same. Both provide limited liability, protecting personal assets from business debts. However, a private limited company is usually more regulated and can have specific reporting obligations. On the other hand, an LLC provides greater flexibility in management and tax treatment, making it a popular choice for a limited business in many states.

A limited company, often referred to as a limited business, is a separate legal entity from its owners. This means that the company holds its own assets and liabilities, protecting the personal finances of its owners. To qualify, the company must be registered with the state, and its ownership must be limited to the amount unpaid on shares held by its members. Operating as a limited company enables you to conduct business while enjoying certain legal protections.

You can use 'limited' in certain contexts, but it is essential to understand the legal implications. 'Limited' generally refers to a type of company that limits the liability of its owners. However, an LLC, which stands for Limited Liability Company, is a specific legal entity that provides personal liability protection and tax benefits tailored for business owners. Therefore, while related, 'limited' is not a direct substitute for LLC.

In business terms, 'limited' stands for limited liability, which is a key benefit of this type of company structure. This designation protects the personal assets of owners from the company's liabilities. By forming a limited business, individuals can confidently pursue their entrepreneurial goals while safeguarding their personal wealth.

Businesses include 'limited' in their name to signify their limited liability status under the law. This status reassures customers and investors that the owners' personal finances are not at risk due to company debts. In turn, this can boost business reputation and trust.

Being a limited company means that your business is a separate legal entity from its owners. This separation provides significant legal protection, as the company itself is liable for debts. Thus, personal assets of the owners remain secure, allowing them to operate with greater peace of mind.

When a business has 'limited' in its name, it indicates that it is registered as a limited liability company or a corporation. This designation offers personal liability protection to its owners, meaning they are not personally responsible for the company’s debts. Choosing a limited structure can enhance credibility and attract investors.